Halokas, a financial bookkeeping application that also helps MSME capital

Explanation regarding the Halokas application along with its features, services and benefits for MSME players.

There is a shift in people's shopping behavior from traditional to digital at this time triggering the emergence of competition between actors MSMEs. MSMEs are competing to develop their business into the digital realm to cover a wider market.

In the midst of this trend of business digitization, there are still several obstacles for MSMEs to develop and compete effectively online. Some of them are related to the lack of innovation, financial records which is still manual until modal minimal.

Even so, now there are various digital applications that help MSMEs to progress. One of which is financial accounting application Hello. Not only helping MSMEs with financial disability issues, this application also provides capital assistance.

The following is a further review regarding Halokas along with its features, services and benefits for MSME players. Read more.

What is Halokas?

Halokas is a platform business to business (B2B) targeting MSMEs as its target market. This platform is here as a solution for businesses to overcome digital business problems they face, namely digital bookkeeping and venture capital.

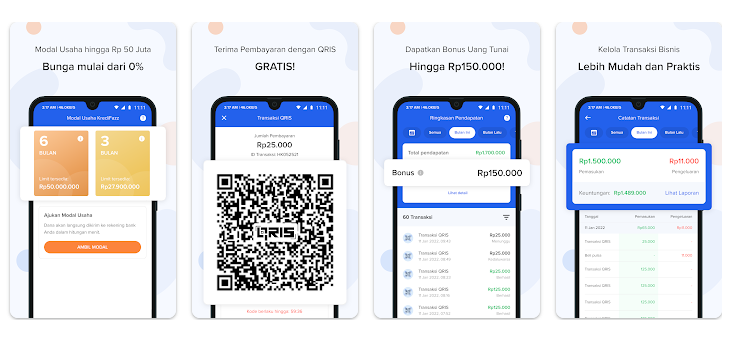

The Halokas platform allows businesses to receive Qris payments, record business finances automatically which can be downloaded in excel format and get business capital of up to IDR 50 million, interest starting from 0% and without collateral.

The Halokas application can be downloaded for free on the Google Play Store/App Store. Since its inception until now, this application has been downloaded approximately 100 thousand times.

Key Features of Halokas for Business

There are three main Halokas services that can be utilized by MSMEs to develop their digital business. Among them are:

Recording of Business Transactions

Halokas has a 'Business Recording' feature that helps MSME players record their business finances, starting from income and expenses, to accounts payable. This feature also allows QRIS transactions to be recorded automatically.

Business actors can also download business registration reports in a customized report format. In addition, this business record service has automatic due date and debt reminder features. That way, business actors will be assisted when managing payments and collection of business debts.

Accept Payment with QRIS

QRIS is a National QR code standard launched by Bank Indonesia to facilitate QR code payments in Indonesia. With the QRIS feature in the Halokas application, businesses can receive payments from e-wallet and mobile banking anything for free.

Simply by becoming a user of the Halokas application, businesses can immediately take advantage of the 'Accept Payments with QRIS' feature, without the need to make another registration. In addition, Halokas also bears MDR costs (Merchant Discount Rates) of 0.7% of the total payment and will return it in the form of a bonus.

For information, the QRIS obtained by business actors has an expiration date. QRIS created to accept customer payments will be valid for one hour. If within one hour the QRIS code has not been received,scan by the customer, then the business actor needs to create a new QRIS code.

Startup Capital

The business capital services offered by Halokas are referred to as 'KrediFazz Business Capital'. This facility is provided by Halokas as added value for Halokas users to develop the business of MSME players.

There is also a capital loan limit that can be used by business actors, which is up to IDR 50 million. KrediFazz Business Capital is said to offer loan interest starting from 0% and without collateral.

Advantages Offered by Halokas for MSMEs

Of the various features and services it has, Halokas offers advantages for MSMEs as users of the application. What are the promised benefits? Here are some of them:

- Halokas helps MSME players to be able to check profit and loss reports and monitor income/expenses, so that business profits and losses can be seen immediately.

- Make it easier for MSMEs to manage business debts, by setting the due date of accounts receivable and sending debt payment reminders easily.

- Make it easy for businesses to record business products and inventories, starting from product names, selling prices and product categories.

- Facilitate customers and business actors in making and receiving non-cash payments through QRIS, from all payment applications, both bank and non-bank, that are used by the public.

- By using QRIS Halokas, all types of transactions made will be exempt from the applicable admin fee (MDR).

- A business capital loan solution with an easy registration process. Business actors only need a KTP, selfie photo, and complete personal data.

- Loan interest starts from 0% without collateral.

- Disbursement of verified instant business capital loan funds can be disbursed directly to the business owner's account.

This is an explanation regarding Halokas along with its features, services and benefits for MSMEs.

Sign up for our

newsletter