Ajaib Group Now Owns 40% Shares of Bank Bumi Arta

Want to become the new controller of Bank Bumi Arta through the addition of share ownership

Ajaib Group through PT Takjub Finansial Teknologi (TFT) has again increased its share ownership in PT Bank Bumi Arta Tbk (IDX: BNBA) to 443,52 million shares or 16 percent of the total issued and fully paid capital.

Based on information disclosure on the Indonesia Stock Exchange (IDX), this share purchase transaction was carried out on April 8, 2022 with an exercise price of Rp1.345 per share.

Previous, Magic Group annexed 665,2 million shares or representing 24 percent of Bank Bumi Arta's shares in November 2021. With this addition, Ajaib now controls 1,10 billion shares or 40 percent of the total issued and fully paid capital.

The management of Ajaib Group revealed that it wants to become the new controlling shareholder of Bank Bumi Arta through this addition of share ownership.

Product expansion

In previous news, Director of Stock Brokerage Ajaib Sekuritas, Anna Lora, said that this acquisition will make it easier for Ajaib to develop more products in the future.

The company started introducing a new service called Magic Margin Trading in March. For your information, margin trading is a loan that is facilitated by a securities company to a client holding a securities account.

Margin Trading Magic allows users to redeem more shares by using borrowed funds from securities companies. Magic facilitates Margin Trading with 0% on broker fees and margin interest.

Currently, Ajaib's main business is an investment platform for stocks and mutual funds. As of December 2021, Magic's total investors have reached 1,4 million people. Of this figure, 96 percent are novice investors and 90 percent belong to the young age group.

Meanwhile, IDX data as of the end of 2021 noted that there were only 7,48 million retail investors in Indonesia. However, this figure grew significantly by 92,7 percent compared to the end of 2020 which was only around 3,88 million investors.

When referring to Robinhood's business model, this trading and investment platform applies zero commission on its services. Robinhood monetizes the business through a number of schemes, including margin trading, cash management fees, to Robinhood Gold.

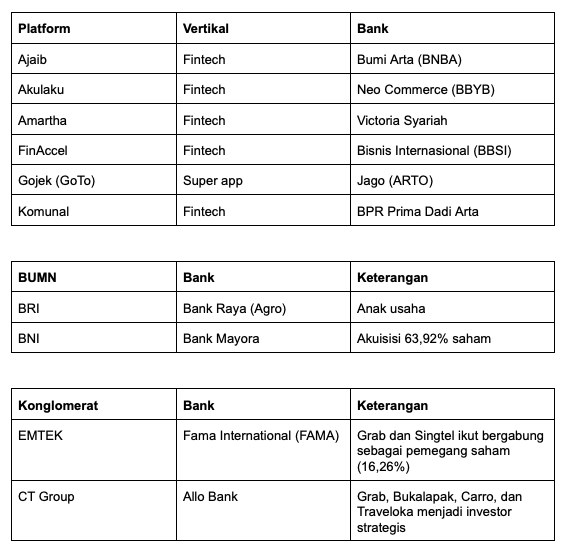

Fintech bank acquisition

Had been contacted separately, the Director of the Center of Economic and Law Studies (Celios) Bhima Yudhisthira mentioned a number of strong factors that underlie the actions of fintech startups to acquire banks.

More Coverage:

Bank acquisition will enable startup fintech to increase financial inclusion throughout Indonesia. One of them is through a business capital loan facility with a higher ceiling. In our notes, some startup fintech which acquired this bank focused on the MSME segment.

Another factor is that the acquired banks are small banks. They were annexed at a low price because they were unable to meet the minimum capital requirements set by the OJK. Moreover, the acquisition of a small bank makes it easier for companies to transform because the infrastructure and branch offices are small.

Sign up for our

newsletter