Standard Chartered and Bukalapak Present Digital Banking Services in the Near Future

Take advantage of Standard Chartered Bank's nexus banking-as-a-service (BaaS) platform

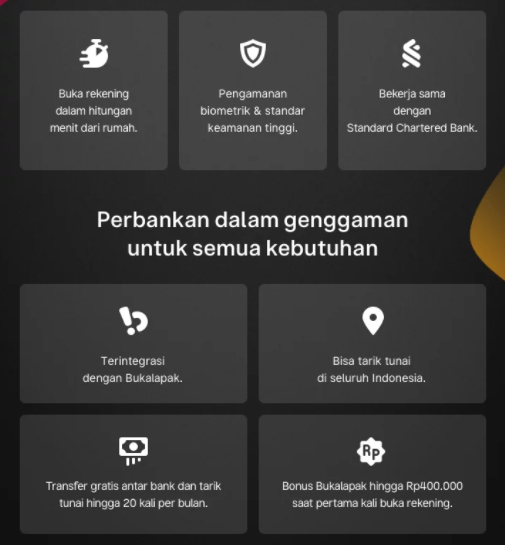

Standard Chartered Bank Indonesia and Bukalapak officially introduce the application digital banking which is planned to be released to the public in the near future. This product is a continuation of the strategic partnership the two signed in early 2021.

The partnership in question is to integrate services banking-as-a-service (BaaS) nexus owned by Standard Chartered Bank to the Bukalapak platform. There are two focus areas being targeted. First, presenting financial and e-commerce innovations through the Bukalapak ecosystem. Second, encouraging financial inclusion to 100 million users and 13,5 million SMEs in Bukalapak.

From the agreement, Bukalapak obtained an investment of $200 million or equivalent to 2,8 trillion rupiah from Standard Chartered Bank which will be used for expansion needs.

In his official statement, Standard Chartered's Cluster CEO Indonesia & ASEAN markets (Australia, Brunei, Philippines) Andrew Chia said Indonesia was the first country to launch Baas nexus services in the region. "Indonesia has a strategic position and is an important market for Standard Chartered," he said.

Meanwhile, President of BukaFinancial & Digital Victor Lesmana added, this collaboration will make it easier for Bukalapak to reach segments mass market and MSMEs throughout Indonesia. Likewise among underbanked and unbanked which has been considered difficult to access financial services.

"With customized technology and state-of-the-art security systems, we can bridge the financial literacy gap," said Victor.

Prior to this, Standard Chartered also cooperated with the platform beauty commerce Sociolla for similar cooperation. It implements nexus on Sociolla so that users can access financial services, such as opening new accounts. Based on the latest news, this service is targeted for commercial at the end of 2021.

Onboarding without face to face

Application digital banking it is targeted to be available on the Google Play Store and App Store in the near future. Currently, the company is still waiting for approval from Bank Indonesia (BI), but already has a license from the Financial Services Authority (OJK).

Then, this application also utilizes advanced automation with artificial intelligence (AI) technology in the Know Your Client (KYC) process, namely facial biometry recognition and e-KTP validation. That way, users can do fully digital onboarding without the need for face-to-face verification anywhere and anytime.

In addition, the company also implements industrial grade encryption (TLS1.2) to secure sensitive data and avoid data snooping attempts. To ensure valid customer identity validation before granting access to account holders and digital applications, users are provided with multi-factor authentication with soft tokens PINE.

BaaS through digital ecosystem

Synergy with this model is not the first in Indonesia. A number of other banks have collaborated with digital platforms to reach new customers. For example, BRI collaborates with Grab, Tokopedia with BRI Ceria, and Shopback with TMRW (UOB Bank).

More Coverage:

In fact, a number of banks already offer account opening services online, but mostly still through the app mobile banking. In recent years, the banking sector has begun to change the approach that has been done conventionally. This is one of the efforts to reach the segment unbanked having problems accessing the branch office.

As is well known, Bank-as-a-Service (BaaS) has now become one of the key strategies in the concept open banking. The model allows digital banks and third parties to connect with the banking system directly via an API. That way, both parties can build services on the provider's infrastructure while opening opportunities to develop products open banking other.

This model has also begun to be applied by many banks in the world because it is considered more efficient. In global spades, citing research firm reports Oliver Wyman, implementing BaaS can reach more new users and reduce customer acquisition costs from $100-$200 per customer to $5-$35.

Sign up for our

newsletter