Southeast Asia Digital Economy Growth Review 2022

Bain & Company Singapore Associate Partner Willy Chang explains interesting findings in "e-Conomy SEA 2022"

In report titled e-Conomy Southeast Asia 2022: Through the Waves, Towards a Sea of Opportunity released by Google, Temasek, and Bain & Company revealed, in the last 24 months the pandemic has disrupted businesses in various sectors. However, it has accelerated digital adoption in various sectors.

Another interesting thing that was also revealed by Bain & Company Singapore Associate Partner Willy Chang at the event Switch 2022 is, currently conditions have returned to normal, although the pandemic cannot be said to be over. In the future, moderation will also begin to appear consumer consumption.

Meanwhile, for investment activities, investors will be more stringent in providing funding and determining valuation. The impact is how companies must immediately think of the right path to profitability.

Digital service improvement

The report also revealed that in the last three years in Southeast Asia, internet users totaled 460 million people, an increase of 100 million compared to 2019. Then regarding digital business, several sectors experienced growth during the pandemic, including: e-commerce, food delivery, transportation, online grocery, online travel, and video on-demand.

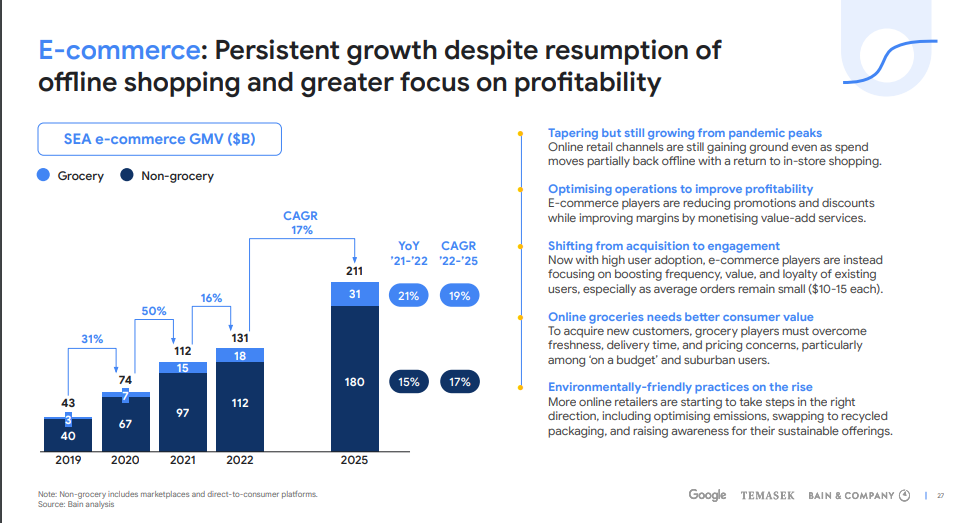

For service e-commerce, recorded to be the most profitable during the pandemic even today. In the future, it is predicted that it will continue to increase. For transportation (ride-hailing) quite the contrary, it is currently a bit difficult for him to recover. One of the reasons is the concept of working hybrid in the company is still being implemented. So only a few make orders.

The issue of rising fuel prices also makes it difficult for most of the driver-partners to operate later, causing some of them to change professions. However for service food delivery recorded to continue to increase. Judging from the massive number of requests at the beginning of the pandemic even today.

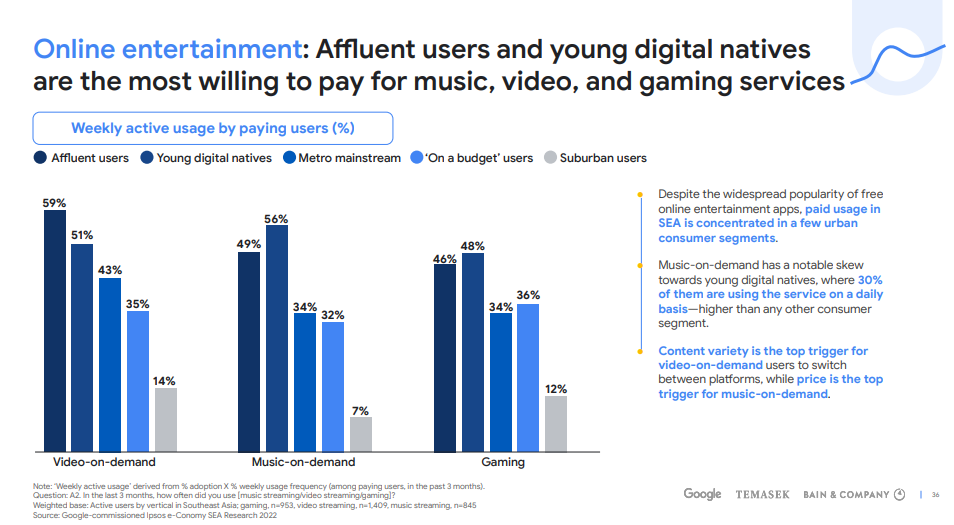

Another sector that will experience business changes during the pandemic is online media, in this case video on-demand and online gaming. For streaming Subscription music has experienced a decline in subscribers during the pandemic due to lack of activities Commute by most office workers.

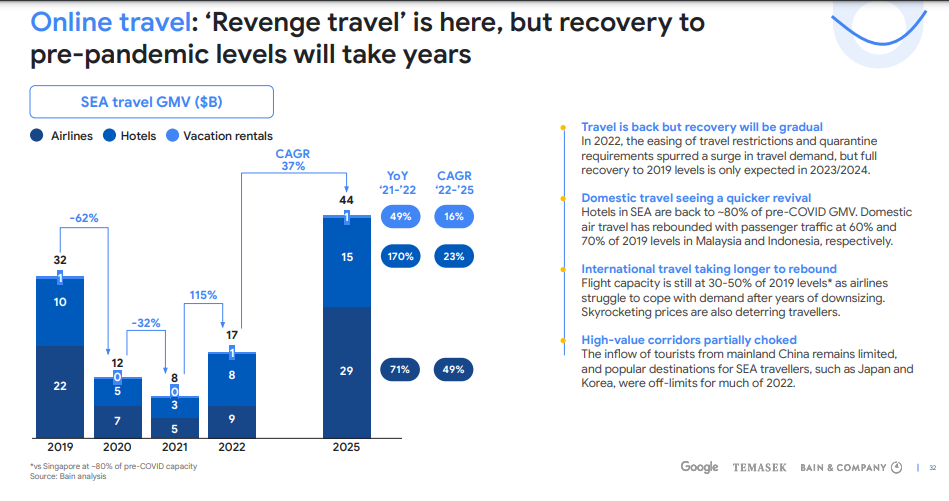

Specifically for online travel There have been many requests for purchasing airplane tickets with more and more countries reopening tourism activities. But on the other hand, there are still not many flight providers in several airlines. Coupled with the still high price of airline tickets today.

Financial services and investment opportunities

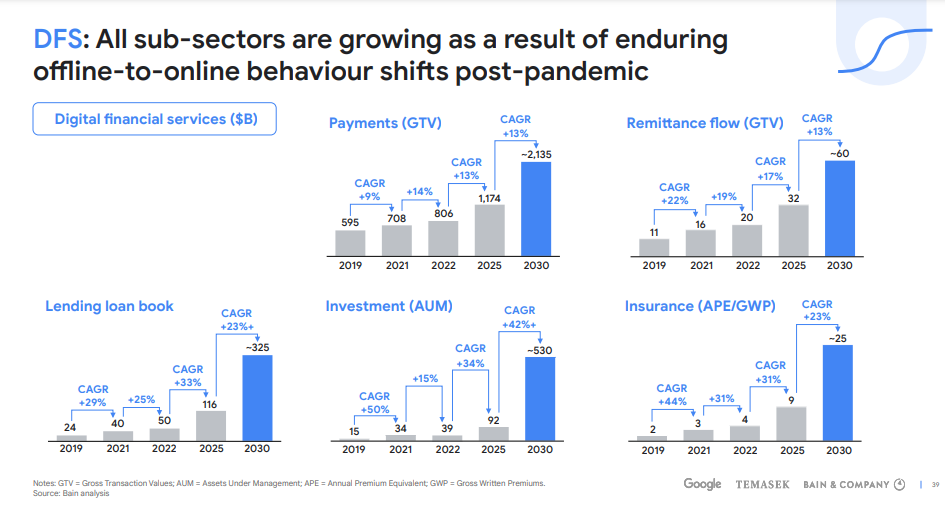

Gopay, ShopeePay, up to GrabPay has also experienced massive growth, even each one has release service paylater. Because on the other hand digital financial products such as to paylater continues to experience positive growth and is predicted to continue to increase.

The report also revealed, in the last three years there are several business models that fall into the category of having the opportunity to be successful in the sector fintech. Among others are pure play fintech, consumer tech platform, establish financial services player, establish consumer players, and digital bank.

In Indonesia alone for service Digital banks have started to emerge. This service has the opportunity to be successful, as seen from the large number of Indonesians who fall into the category of unbanked/underbanked about 81%. Other countries in Southeast Asia that also have potential for digital banking services are the Philippines and Vietnam.

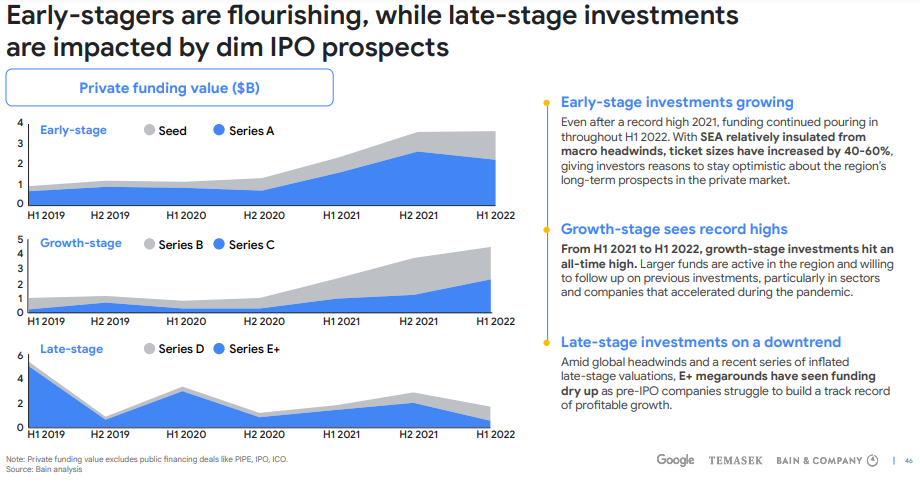

For investment, despite experiencing a fairly strong moment in H1 2022, most investors are more careful in terms of giving investments. Their current focus is more on how startups or companies they invest in can achieve profitability.

The report also revealed that investment for early-stage companies has increased.

More Coverage:

Meanwhile, for companies that are included in the advanced stage funding category, they are quite affected. One reason is that pre-IPO companies struggle to build a track record of profitable growth. On the other hand for growth stages starting from H12021-H12022 experienced a fairly high increase in investment.

Large amounts of funding have been disbursed in the region, even some investors are willing to be involved in the next funding, especially for companies that are accelerated during the pandemic. When it comes to valuations, most venture capitalists expect valuations to continue to decline; only a minority see a recovery in the near future.

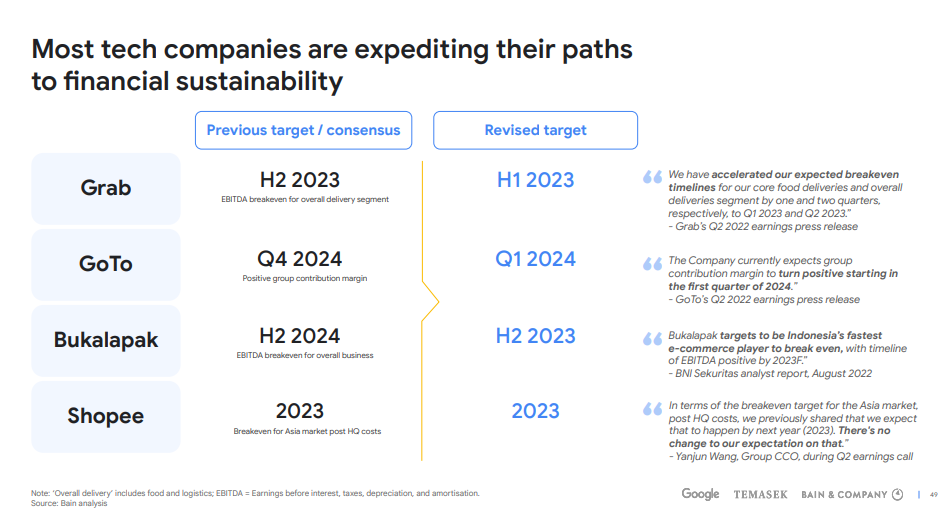

In the report also released several companies that will achieve the target to financial sustainability. Among others are Grab in H12023, GoTo in Q12024, Bukalapak in H22024, and Shopee in 2023.

Sign up for our

newsletter