2019 Indonesian Startups Book More Than 40 Trillion Rupiah Funding, Local Venture Investors "Exit" 14 Times

Preliminary overview of the “Startup Report 2019” data to be published in early 2020

It seems that it is not impossible if Indonesia can become digital archipelago leading the internet industry in Southeast Asia. The rapid growth of business and technology startups is starting to have a massive impact. Evidenced by many things, including investor confidence to invest.

Every year DailySocial published a research report entitled "Startup Report”, noting market dynamics and trends in the digital sector. Including for 2019, there will be special research that records interesting things in the industry. The latest report is planned to be released in early 2020.

As an initial overview, we try to present some interesting findings for the 2019 Startup Report, especially regarding funding. Of the 59 funds announced in nominal terms, the total obtained reached $2,8 billion or equivalent to 40,2 trillion Rupiah. Meanwhile, there are 44 other funding transactions whose nominal value has not been disclosed to the public.

Apart from that, there are some other interesting trends, here's a quick review:

The financial sector still attracts a lot of attention from investors

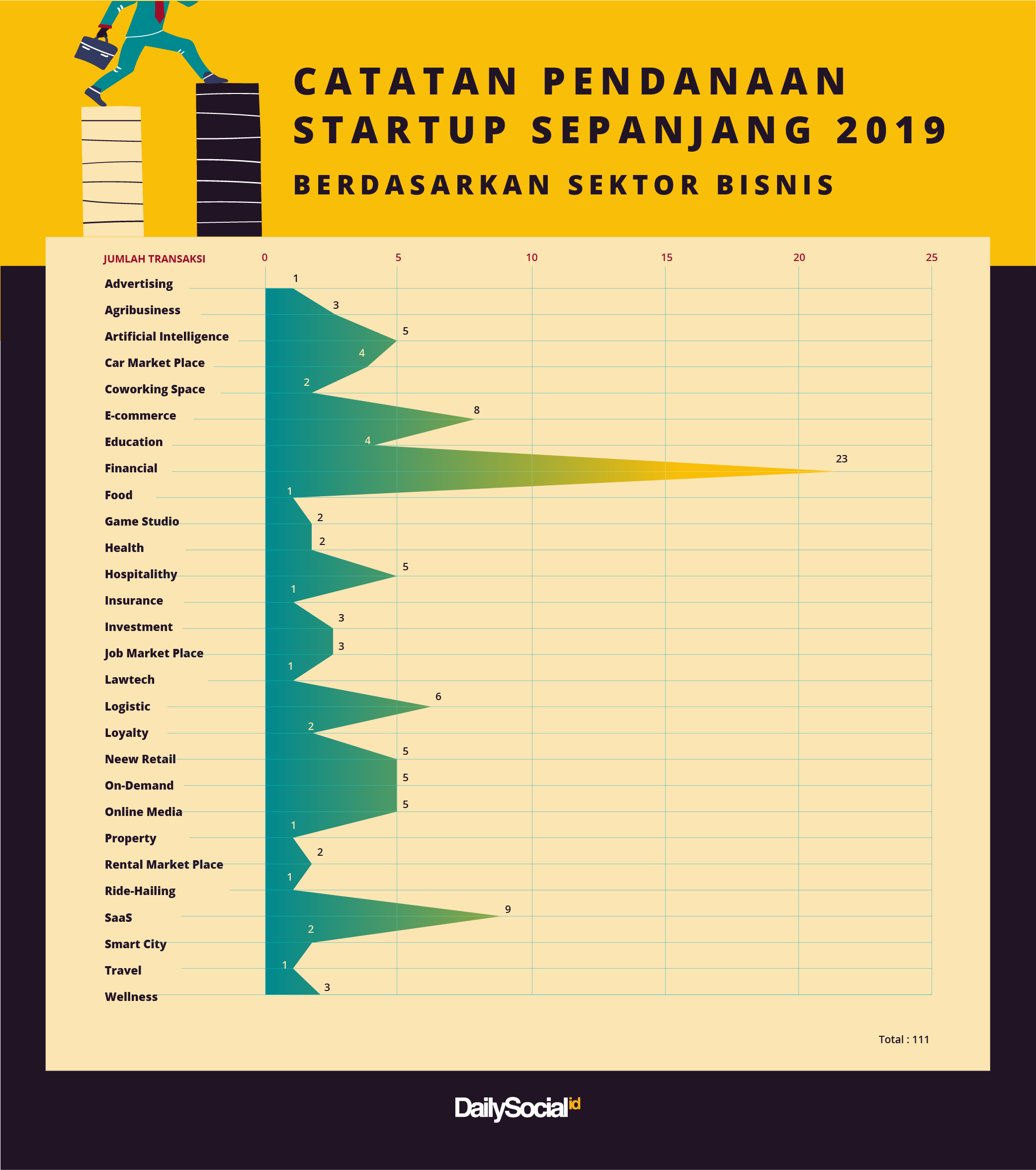

As of December 18, 2019, team DSResearch noted that there were 110 funding transactions announced by Indonesian startups and/or investors. Of this number, the financial sector received the largest portion with 23 transactions, followed by SaaS (9), E-commerce (8), and logistics (6).

This is in line with what was predicted in last year's report, that fintech will be more exhilarating. Many underlying factors, the first is market potential. among unbankable in the homeland still dominates, comes from the city tier one to three. Second, regulations that are increasingly open to business actors. Third, the community is easy to adapt to the digital approach.

Sector-specific research fintech has also been previously published via Fintech Report 2019.

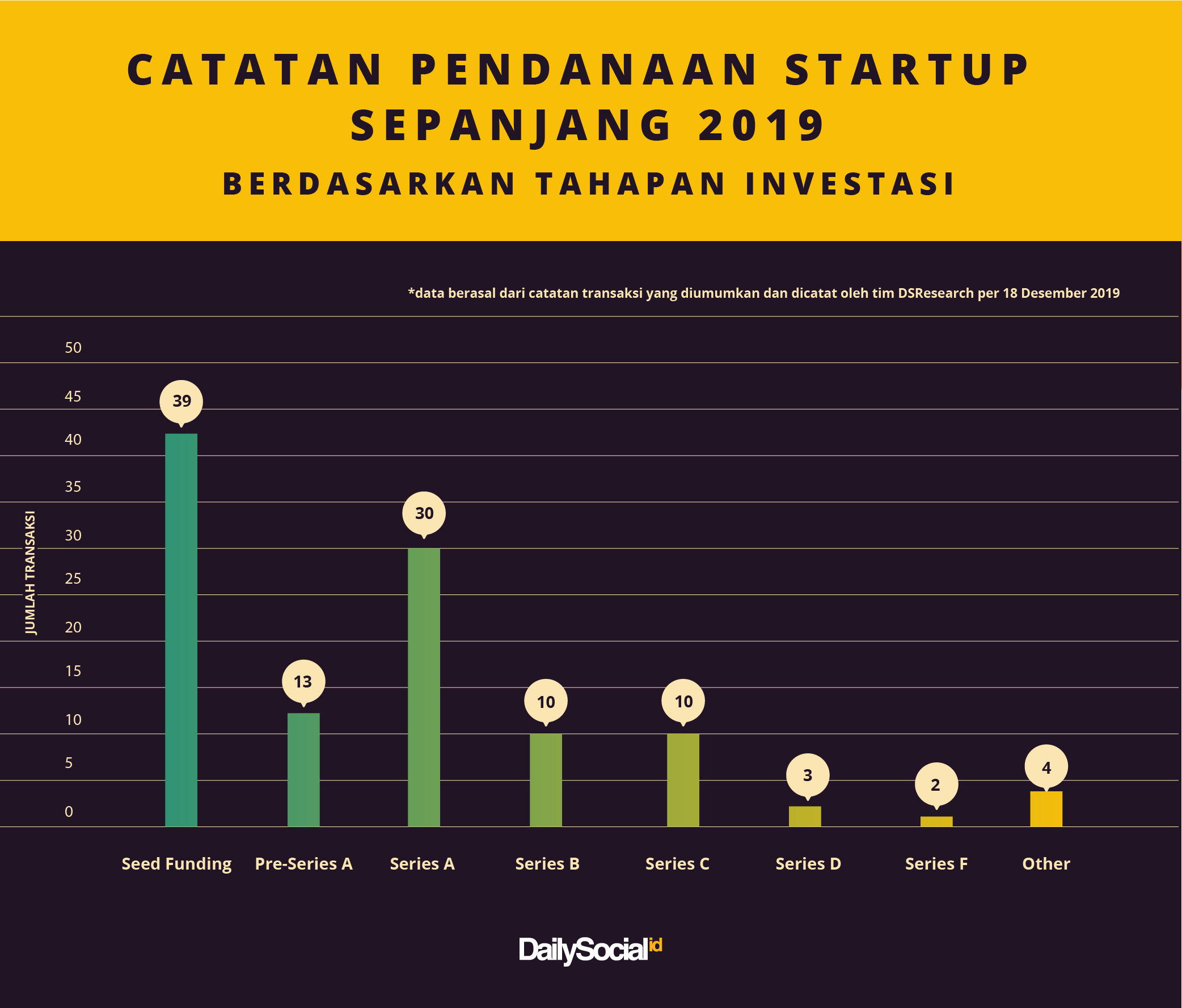

Funding for early-stage startups pours in

Initial funding (seed funding) still gets the largest portion, followed by series A funding. In general, the investment is disbursed by investors to new startups that have successfully validated their products to the market, thus generating traction. This year the categories are quite diverse, starting from startups that provide artificial intelligence-based services, investment platforms, health, and others.

In the advanced stages, Indonesian startups also still get quite a large amount for series B and above, there are 27 transactions that have been recorded. Financial sector and E-commerce each get 5 advanced transactions. Forwarded car marketplace and education 2 transactions each.

Gojek dominate the achievement of funding transactions

After the acquisition from the Cool Japan Fund, series F funding Gojek said to have reached $ 2 billion of the target of $ 3 billion, and will closed as of January 2020. This achievement, apart from strengthening the company to be local decacorn First, it is also the largest nominal funding transaction obtained by Indonesian startups.

Next Kredivo which received funding in two rounds, namely series C and debt funding. Mirae Asset-Naver Asia Growth Fund, Telkomsel Innovation Partners, MDI Ventures, Cathay Innovation, Partners for Growth are some of the investors involved.

Most transactions in the third quarter

More Coverage:

In the third quarter, July-September, there were around 36 funding transactions that took place. So the most when compared to the time period before and after. However, if you look at the nominal side, the quarter at the beginning and end of the year dominates. In that period startup unicorn and centaur announced its new funding acquisition.

14 exit through acquisitions and IPOs

This year there are 14 exit successfully listed by local venture capitalists. MDI Ventures leads the acquisition with 3 acquisition records and 2 IPOs. Some startups that have succeeded in bringing in investors exit are Whispir, Bridestory, Jualo, Female Daily, and so on.

- Disclosure: The data displayed is based on the findings of DSResearch from various transactions announced to the public as of December 18, 2019. There is a potential for data changes, in the form of increasing the number or nominal transactions, in future reports.

Sign up for our

newsletter