Indonesian Logistics Startup Shows Tremendous Traction, Earns Investment of 8,4 Trillion Rupiah Over the Last Three Years

Active local venture capitalists are at the forefront of providing support to Indonesian logistics startups

There are many supporting sectors in the growth of the digital economy in Indonesia. Logistics is one that has a crucial role in being the backbone of the business e-commerce, which accounts for the largest GMV in national digital economy.

According to data from the Association of Indonesian Express, Post and Logistics Delivery Service Companies (Asperindo), currently there are 561 logistics business listed, consists of various types of services, with the majority focusing on delivery services [fleet providers]. In reality, Indonesia's logistics needs have not been fully met – has not kept pace with the pace of business E-commerce that reaching ~14,8% CAGR between 2020-2023.

If you look at more specific issues, there are still many frictions in this business vertical. Take the example of how freight transport can increase effectiveness. So far, when a fleet departs to its destination carrying a full load of freight, it must return home to find an empty tub. Whereas. if it can be filled when going home and going, the operating costs incurred can be more effective.

Not to mention the classic businessman's problem, namely finding the right and cheapest logistics solution. Geographically, Indonesia presents unique challenges for logistics businesses – it is not uncommon for delivery processes to require more than one mode of transportation. Businesspeople have their own challenges in finding the right logistics partner, especially handling deliveries across regions.

These issues then gave birth to a breakthrough in the logistics industry in the form of technological innovation. Over the past three years, DailySocial observing a consistent growth trend of technology-based logistics companies, both those developed by local innovators and expanding overseas services to solve very specific problems.

Strong capital support

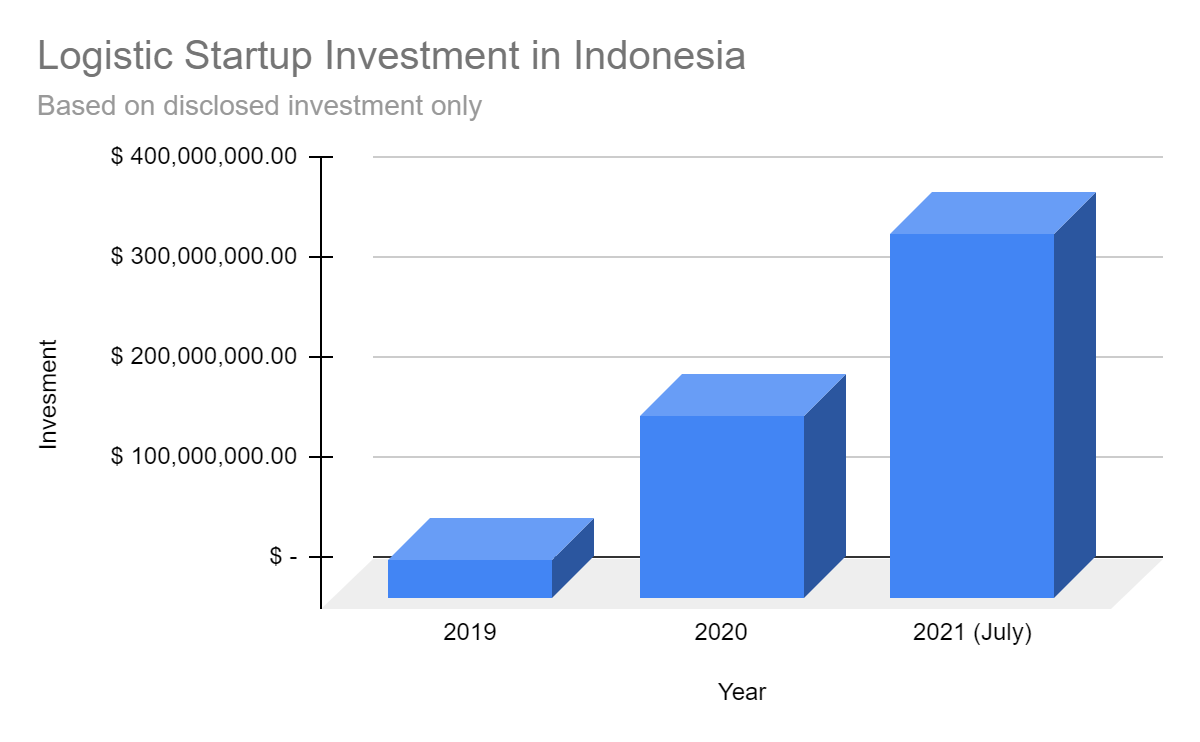

From the beginning of 2019 to July 2021, the research team DailySocial note there is around 16 announced funding transactions involving technology-based logistics companies. This investment succeeded in recording the total fund value $586 million (Rp. 8,38 trillion at today's exchange rate).

There are at least 4 logistics startups that have a valuation above $100 million, viz SiCepat, Waresix, Shipper, and GudangAda.

| Company | Round | Year |

| ASSA (parent of AnterAja) | Convertible Bonds | 2021 |

| Andalin | Series A | 2021 |

| Deliveree | Series A | 2017 |

| finfleet | Series A | 2019 |

| WarehouseAda | Series A | 2020 |

| Series B | 2021 | |

| Cargo Technologies | Seed Funding | 2019 |

| Series A | 2020 | |

| logically | Series A | 2020 |

| Uncle | Seed Funding | 2018 |

| Ritase | Series A | 2019 |

| Shipper | Seed Funding | 2019 |

| Series A | 2020 | |

| Series B | 2021 | |

| SiFast | Series B | 2021 |

| triplogic | Seed Funding | 2019 |

| Waresix | Seed Funding | 2018 |

| Pre-Series A | 2018 | |

| Series A | 2019 | |

| Series A+ | 2020 | |

| Series B | 2020 | |

| Webtrace | Seed Funding | 2020 |

This capital support is proof in itself for logistics technology players in Indonesia. So far local venture capitalists have been the most active invest in this vertical.

| Investor | Investment Round |

| East Ventures | 6 |

| AC Ventures | 5 |

| Insignia Ventures Partners | 4 |

Large market size

Managing Partner AC Ventures Adrian Li said, currently The logistics sector in Indonesia is estimated to be worth $275 billion, growing at ~16% CAGR between 2015-2020. The institution was involved in funding Shipper and Kargo -- including among the initial investors.

He argued, channel E-commerce is indeed an important aspect in the growth of the logistics industry. In particular, he said that there was a rapid increase in deliveries to tier-2 and 3 cities which required expanding logistics channels.

"Growth in consumption, trade and infrastructure development will drive logistics innovation to deliver more efficient and cost-effective solutions [...] We project this sector will make waves unicorn next. And we have strong confidence that this space will show substantial growth in the next decade," said Adrian.

On a separate occasion, Shipper Co-Founder & COO Budi Handoko said that four years ago when he initiated Shipper he saw the problems that almost all MSMEs face when trading online. online. Shipper is here to be a logistics and service aggregator application warehousing, helps business people carry out proper delivery management.

Alluding to the question investment in logistics businessBudi assesses that currently, apart from local investors, many global venture capitalists are also interested in investing in Indonesian startups. This is proven by Shipper by the involvement of a number of foreign investors at every stage of its funding. He emphasized that Indonesia's logistics problems are unique and local innovators have a strong position to solve this problem.

Logistics funding trends

Over the last three years, the investment value for logistics startups in Indonesia has also continued to experience rapid growth. Until July 2021, meaning it has only been 7 months, the value of funding disbursed by investors has almost doubled compared to funding throughout 2. From $2020 million to $182,9 million. Investor confidence in funding startups in late stage based on strong traction in this business.

It is hoped that this will be a good indication for the ecosystem and trigger innovation to solve various logistics problems in this country.

In fact, the pandemic has not dampened the business and product expansion of logistics startups in Indonesia. According to Budi, a pandemic actually happened turning point because logistics services increase along with the large number of shipping requests from services E-commerce.

More Coverage:

-

Header Image: Depositphotos.com

Sign up for our

newsletter

Premium

Premium