The Indonesian and Singaporean Startup Ecosystems Are Still the Main Concerns of Monk's Hill Ventures

Most of its investments focus on the fintech, logistics, and SaaS . sectors

Sebagai venture capital which focuses on Southeast Asia, Monk's Hill Ventures still sees Singapore, Indonesia and Vietnam as countries that have more potential in terms of startup performance and investment potential. However, given the current developments in other countries in Southeast Asia such as Thailand, Malaysia and the Philippines, it is unlikely that they will be eyeing these three countries in the future.

In session media briefings held by Monk's Hill Ventures (MHV) was revealed, some of the focus of which later became highlights throughout 2020. The investment plans, opportunities and sectors that MHV is eyeing for 2021 are also disclosed.

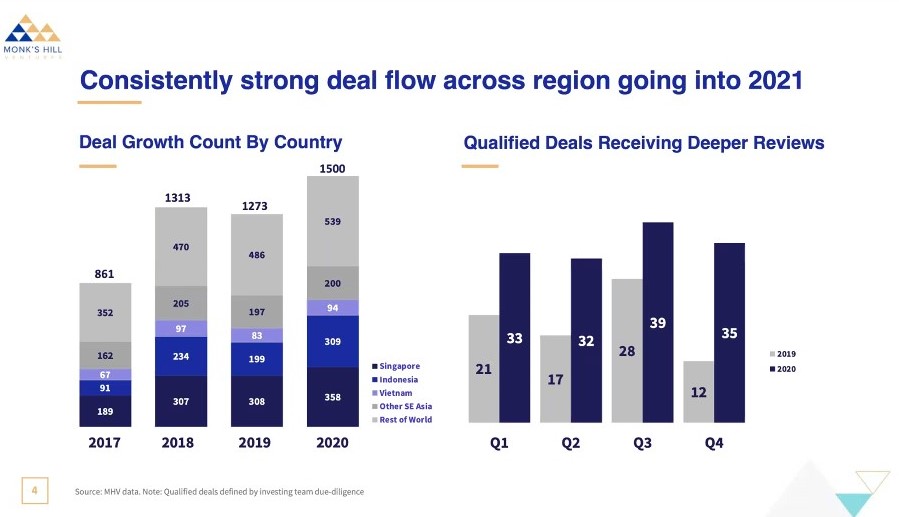

Indonesia and Singapore are the biggest investments

In a presentation delivered by Monk's Hill Ventures Managing Partner Kuo-Yi Lim, the biggest investments that have been made by MHV so far are Singapore and Indonesia.

Recorded since 2017MHV makes fairly regular investments, although the company claims that ideally only about 4-5 investments are given per year. But entering 2020 when the pandemic began to spread globally, they decided to postpone investment and pay more attention to the trends and movements of the sector which then experienced growth during the pandemic.

"Throughout 2020 the numbers show an up-and-down dynamic, looking heavier than the previous year," said Kuo-Yi Lim

He added that previously this condition had been predicted, because most venture capitalists postponed investment during the pandemic with uncertain market conditions. However, after looking at the dynamics of the existing sector, it turns out that 2020 is the right time to invest.

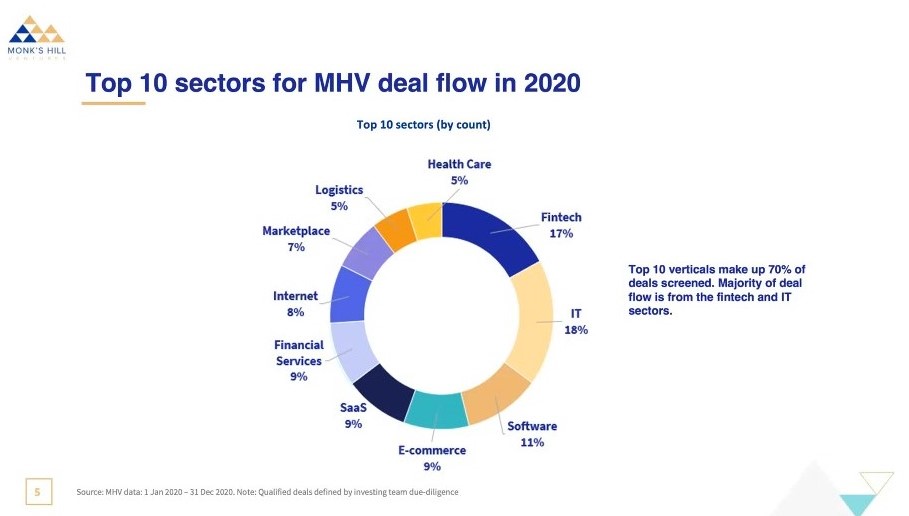

In the presentation, 10 sectors were also presented which MHV then glanced at. Among them are Fintech (17%), IT (18%), Software (11%), financial services (9%), marketplace (7%), logistics (5%), healthcare (5%), e-commerce services (9%), SaaS (9%) and Internet (8%). This sector was later the deal that was launched by MHV throughout 2020.

"From our records, it can be seen that many of the sectors we are looking at are fintech services, IT, especially those that offer infrastructure services such as for mobile devices to report the for service E-commerce. Logistics is also our investment choice. This data represents the sectors we looked at throughout 2020 and 2021."

In 2021, it turns out that there will be no significant changes for MHV in terms of which sector will be the focus. Specifically adjusting for preselected sectors, it doesn't see any appreciable changes in 2021.

"This can be seen from the large number of players entering this sector. Along with the large demand from the industry. For example healthcare and financial services, everything remains keyplayer. we will see the impact of these sectors," said Kuo-Yi Lim.

Current investment tips

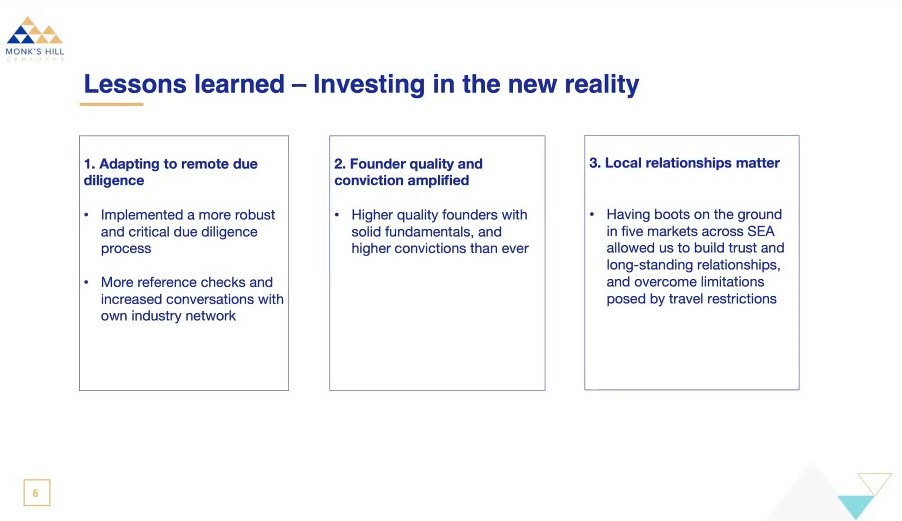

The most important lesson that MHV then took when investing during the pandemic and entering a new reality was, to be able to adapt to the work environment effectively. remotee. But on the other hand it is necessary to carry out the process due diligence more critical and of course more stringent. Capital Venture must also be able to carry out relevant checks, and always communicate with networks in related industries.

More Coverage:

Another important thing that later became a concern for MHV was to focus on the quality of the founders, especially those with the highest quality with solid fundamentals and higher conviction from the previous. And the last thing that became the concern of MHV was, it became important to be able to create good local relations. In this case, the 5 countries targeted in Southeast Asia.

"This has enabled us to build trust and long-term relationships, at the same time eliminating the limitations that occur due to travel restrictions," said Kuo-Yi Lim.

-

Header Image: Depositphotos.com

Sign up for our

newsletter