Indonesian Card Technology Provides School Digitalization Services

With more than 1000 schools and Islamic boarding schools that have adopted the service, TKI claims to have achieved profitability

Founded in 2019, Indonesian Card Technology (TKI) is a startup that focuses on providing digitalization solutions in the education sector. This Salatiga-based startup is a result pivot from a previous business founded in 2018 named SmartSchool.

Now TKI are focusing on school digitization services through the Smart School Platform. The features presented include Smart Student Cards (for payment transactions), Digital Billing, Face Attendance, and PPDB Online (new student registration). Not only for formal schools, TKI also targets that their services can be used among Islamic boarding schools.

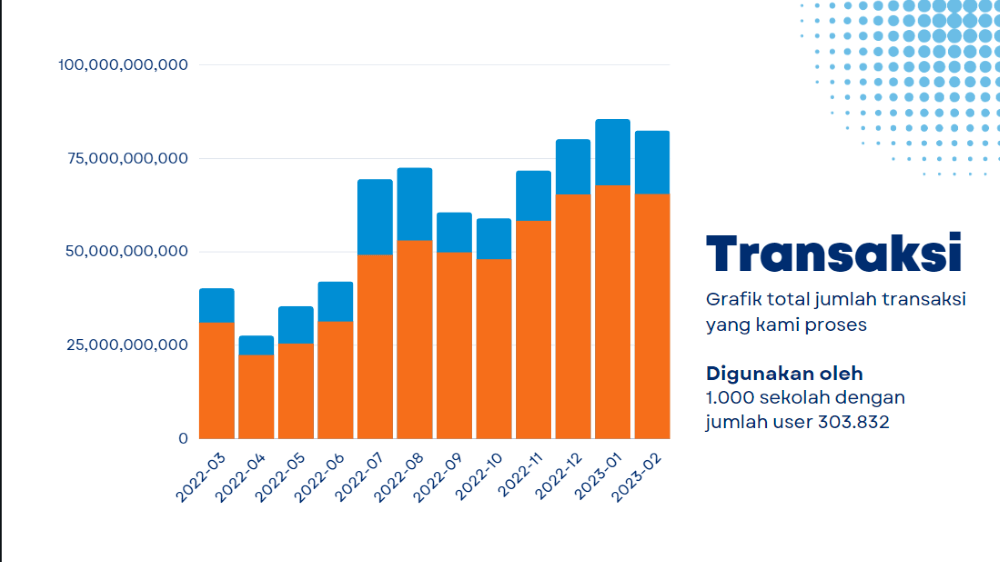

TKI is now used by more than 1000 agencies with more than 300 thousand users. On average, there are more than 500 transactions per day. With a solid business model, the company also claims to have reached a point of profitability. TKI is also supported by CTO Yudi Kurniawan, COO Wuntat Wiranto and CMO Agung Putro.

To DailySocial.id, Founder & CEO of TKI Arif Arinto conveyed the company's plan to expand its service area in 22 other cities, having previously succeeded in penetrating products in 34 provinces.

Fundraising plan

From the start, TKI ran the business in fashion bootstrapped and have never done a fundraiser. The company claims to have grown organically with the support of around 100 employees. However, to accelerate business growth, this year TKI plans to raise funds.

"Fundraising menjadi plan B us, the need for these funds to open support office in 22 cities in Indonesia, so sales and support we become more optimal in various provinces. Without fundraising, we also focus on multiplying support office gradually," said Arif.

The main reason why TKI was built started from the founder's concern regarding the habits or behavior of children when buying snacks at school. Cash, which is then given by parents, mostly buys unhealthy food, in the end children often get sick because of this.

An idea arose, what if the child's snacks use a card that is connected and can be arranged through the parent's application, so that the child can only spend his pocket money in a canteen that has collaborated with the school and has good healthy canteen standards.

"We have two main solutions, namely multifunctional student cards and the Education Development Contribution (SPP) payment system. The target educational institutions we are targeting include Islamic boarding schools, private schools and public schools," said Arif.

In particular, TKI presents a transaction or payment system that is closed loops. Funds from parents are stored and managed in the school's account. Schools can then open an account at the bank, and register for a Virtual Account (VA) service top up or fill in the balance that will be used for child transactions and various other payments.

Expand partnerships with banks

At present, the products presented by TKI have been used in almost all provinces in Indonesia. TKI has also established strategic partnerships with 10 partner banks to sell products and solutions. Among them are BSI, BNI, BRI, Danamon, BTN Syariah, Muamalat, Bank DKI, Bank Jabar Syariah, Bank Jatim Syariah, and NTB Syariah.

"We focus on digital payment systems to e-money for children under 17 years old who cannot do Know Your Customer (KYC). Our dreams can present a solution e-money for kids such as the Greenlight platform in the US and GoHenry in the UK," said Arif.

The monetization strategy implemented is to apply fees, namely a registration fee of IDR 10.000 per new student and a card purchase fee of IDR 20.000 per RFID/NFC card that has been printed as a student card as well. TKI also get fee of fees top up VA

"So far, deposit money has been recorded manually and is very inconvenient, especially for Islamic boarding schools with many students. Our solution includes closed loops which can run without permission from BI, in accordance with PBI rules, e-money closed loop with floating funds under Rp. 1 billion can run without permission first," said Arif.

Sign up for our

newsletter