An Easy Way to Prepare a Trial Balance for Beginners, See the Steps

Trial balance is one part of the process of accounting reports. To get balanced balance results, it is necessary to be careful in entering balance and account numbers. Here are tips on how to compile an easy trial balance for beginners.

Trial balance is an accounting activity in keeping records including expense reports, sales, transactions, accounts payable and so on. The trial balance presents calculations regarding the company's assets, liabilities, income, equity, expenses, losses and profits and lists the final balance in the accounting ledger.

In simple terms, the trial balance is a report that contains all transactions and assets owned by the company in the accounting ledger. The function of the trial balance is so that each company's expenses and income have a clear track record, the balance sheet is also used to complete the profit and loss report.

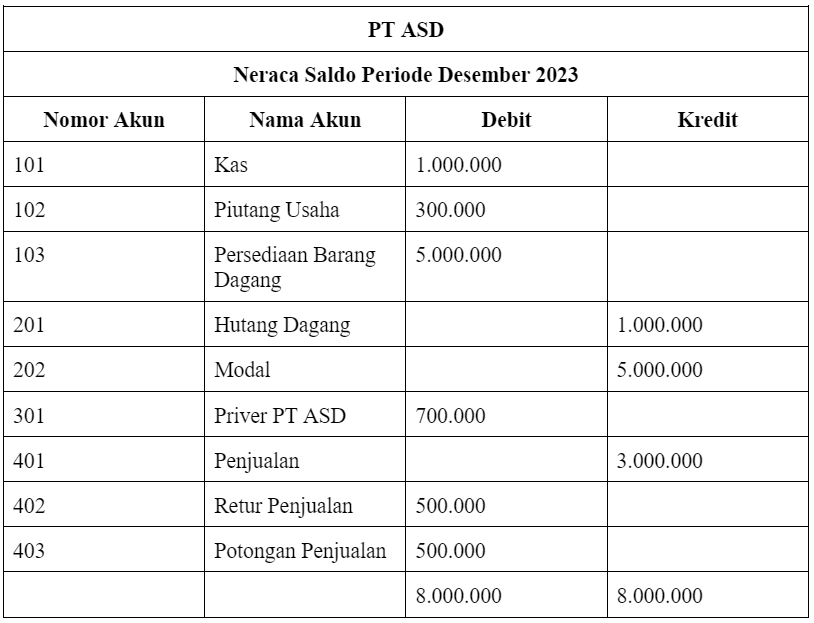

The following is an example of how a trial balance will appear in report form:

The results of the Debit and Credit calculations must be the same, because if the totals are the same, the report will be stated Libra or an adjusted trial balance. The results of the trial balance are used to show that debits and credits are equal and evidence is provided regarding the value of the balances.

If the credit and debit columns are not the same, the trial balance is not declared Libra. It is necessary to look again at the account statements and numbers on the trial balance, because there are bound to be problems in the calculation process.

The following methods can be used to look for errors in trial balance calculations:

- If there is an error in the difference of 10,100 or 1.000, then add up the trial balance column again because errors like this usually arise due to an incorrect addition. If after checking there are still errors, recalculate the entire balance in the account.

- If the difference can be divided by 2, it usually occurs because the wrong number is entered, where the debit is deducted.posts in the credit column and vice versa.

- If the difference is divisible by 9, then check the account balance again in the general ledger for a balance transfer error. Usually the most common errors are transposition (occurs when the numbers are entered upside down, for example 54.000 becomes 45.000) and slide (a number that is tucked away is lost).

- If an error occurs that is not divisible by 2 or 9, it is necessary to check the general ledger for the same number of errors before moving it to the trial balance. If the error is still not found, check the move journal for an incorrect move.

Sometimes a calculation error will not cause a trial balance to be unbalanced, but may be discovered when preparing a trial balance or focused on an unusual balance in an account.

More Coverage:

If an error that occurs in the trial balance is not found in the method previously described, the report must be traced back from the last step to the journal transfer.

Hopefully the explanation that has been given along with an example of the calculation can help you in preparing a balance sheet.

Sign up for our

newsletter