Bukalapak Financial Performance Third Quarter 2021

Striving to reduce net loss and EBITDA through efficiency improvements

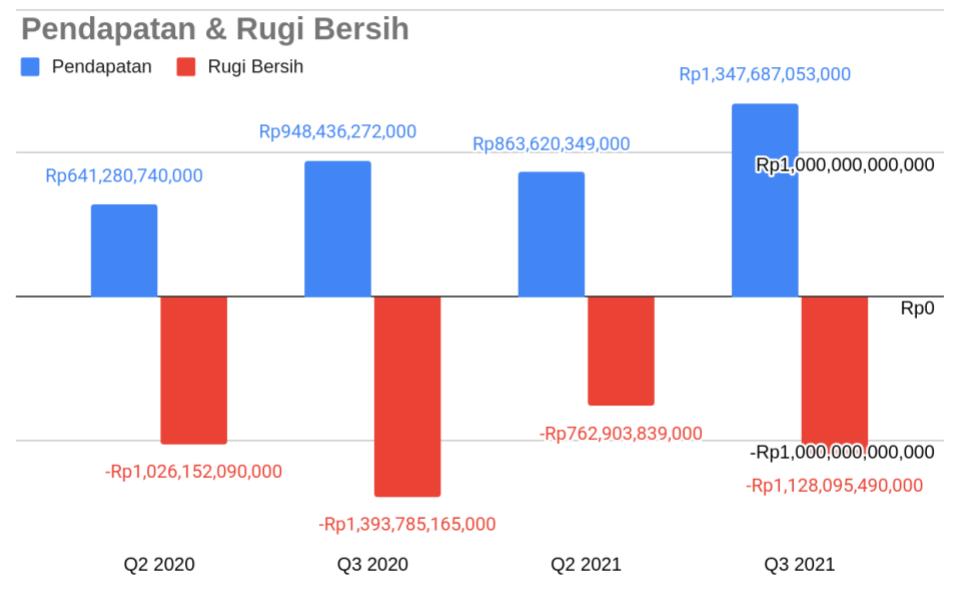

PT Bukalapak Tbk (IDX: BUKA) announced its financial performance in the third quarter of 2021. The company reported a total revenue of Rp1,34 trillion, which was triggered by the significant growth of Mitra Bukalapak's revenue.

In its financial statements, Bukalapak posted a total revenue growth of 42% throughout the nine months of 2021, compared to the same period last year which amounted to Rp948,4 billion.

Of this total, Marketplace services still dominate by contributing Rp780,4 billion in revenue, up 5,1% year-on-year (YoY). Meanwhile, revenue from Bukalapak partners skyrocketed by 322% to Rp496,7 billion from the previous Rp117,4 billion.

Meanwhile, BukaPengadaan service experienced a 20% decrease in revenue to Rp. 70,5 billion from the same period last year which was Rp. 88,9 billion.

Furthermore, in an official statement, Bukalapak reported that the Total Processing Value (TPV) in the third quarter increased by 51% to Rp. 87,9 trillion. From this figure, the TPV of Mitra Bukalapak shot up 179% to Rp40 trillion compared to the same period in 2020.

This growth was triggered by an increase in the number of transactions by 25%, of which 73% of TPV was contributed from areas outside the first-tier cities. "In those areas, penetration all-commerce as well as the digitization of traditional stalls and retail stores showing strong growth," explained Bukalapak.

Then, Bukalapak's Average Transaction Value (ATV) also increased by 21% throughout the nine months of 2021. ATV from Bukalapak Partners recorded a growth of 63%, due to the variety of products and services offered to Partners that continues to grow.

Suppress loss

Bukalapak showed an effort to keep its losses down while continuing to drive efficiency in the third quarter. Company operating loss of IDR 1,2 trillion or down from the same period last year which amounted to Rp1,4 trillion.

Meanwhile, its net loss shrank to 19% or Rp1,1 trillion compared to the third quarter of last year of Rp1,4 trillion. The company also reduced its EBITDA loss to 15%, where its ratio to TPV improved to 1,2% from 2,2% in the third quarter of 2020.

In total, contribution margin Bukalapak after selling and marketing expenses on TPV increased from -0,4% to -0,2%. Contribution margin from Marketplace after selling and marketing expenses increased from -0,1% to 0,01%. Then, the contribution margin from Partners after selling and marketing expenses also improved from -0,3% to -0,2%.

Currently, Bukalapak's cash position is recorded at IDR 23,6 trillion as of the end of September 2021.

Main mover

With the above performance achievements, Mitra Bukalapak is the main driver of Bukalapak's growth. As of the end of September 2021, the number of registered Partners reached 10,4 million from the position at the end of December 2020 which was 6,9 million. The company said it would continue to focus on a strong and sustainable growth strategy, by continuing to manage both operational costs,

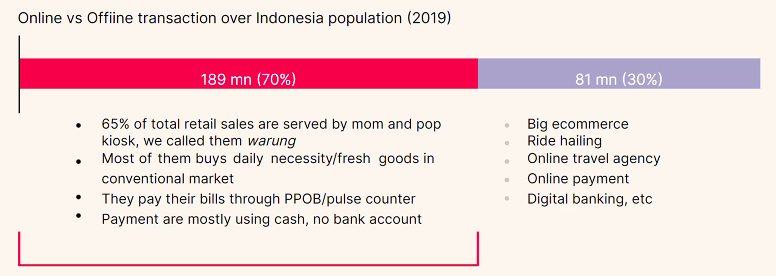

In previous interview, CEO of Buka Mitra Indonesia, Howard Gani, said that his party was in the process of strengthening the Partner network throughout Indonesia, especially outside the first-tier cities. He assessed that there are still many stalls and MSME segments in Indonesia that have not been touched by technology and digital access. This is different from other services whose digitization is already strong, such as online shopping, transportation and travel, to payments.

More Coverage:

"We want to optimize the spread of technology in these cities by introducing the benefits of technology through individual stalls and agents," Howard said some time ago.

The company even launched BookPartner app which aims to help SMEs develop their business scale. A number of features offered include digital bookkeeping and debt recording.

Based on the results of a Nielsen survey of 1.800 stalls and 1.200 credit kiosks, Mitra Bukalapak is recorded as leading the O2O market with a penetration of 42% compared to O2O players who have 2,5 times more users in this survey.

Bukalapak partners are also called mastering categories Grocery/groceries by 55% and virtual product penetration 52%. Currently, Mitra Bukalapak has various product categories, ranging from physical, virtual, financial products, to products for daily needs.

Sign up for our

newsletter