Bank Jago Officially Launches Digital Finance Application, Focusing on the Center of Life

Summarizing our initial impressions of using the Jago Bank application

After almost a year of changing identities, PT Bank Jago Tbk (ARTO) finally officially introduced the Jago app (Jago app) to the public. This app provides life-focused digital financial services (life-centricity) with an approach to ecosystem collaboration.

"To present innovative and collaborative solutions, we work closely with the ecosystem. We hope this application can provide financial access to the wider community and accelerate financial inclusion. There are still many segments that we want to reach in Indonesia," said Bank Jago President Director Kharim Indra Gupta Siregar was met at the Jago application launch event in Jakarta.

Currently, the new Jago application provides several financial services, such as transfers, bill payments, and payments top upe-wallet. In the future, the company will add more services to target segments digitally savvy and mass market in the middle class, both individuals and entrepreneurs.

Including one of the initiatives of its strategic partnership with Gojek, which is a service that allows millions of customers to open Bank Jago accounts directly through the platform ride hailing the. "Regarding [the partnership with Gojek], our team is still working on the integration process," added Kharim.

Try the Jago app

Bank Jago claims to be a fully technology-based digital bank (tech-based banks). Kharim also emphasized that Bank Jago's technology and innovation were also entirely developed by an internal team. Therefore, DailySocial had the opportunity to try out some of the innovative features of the Jago application.

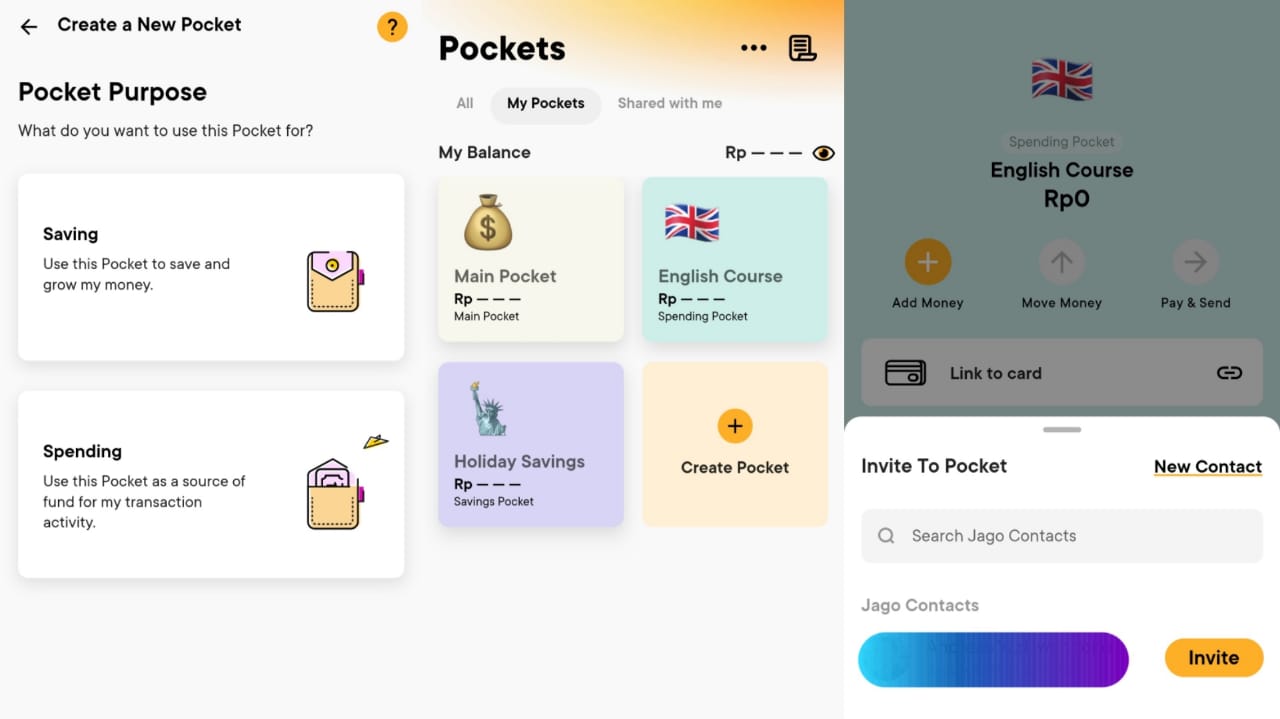

First impression, process Account creation is very fast, e-KYC checking only lasts less than 30 seconds via video calls. We then tried the "Pockets" or "Pockets" feature which allows customers to allocate money for different purposes in a simple way. As seen in the image below, the Pockets feature can be personalized, both with its name, color, and profile photo.

Pockets have two categories, namely "Savings/Savings" and "Spendings/Pay". Users can add Savings Bags with various transfer methods, including: digital banking (TMRW, Digibank, Jenius), mobile banking (BCA, Mandiri, CIMB, BRI), SMS banking, internet banking (BCA, Mandiri, BNI, CIMB), ATM (BCA, Mandiri, BNI, BRI, Permata, CIMB), and Jago Branch.

However, it should be noted that money deposited in the Savings Pocket cannot be transferred to an external account thereby reducing the potential for unnecessary expenses. For transfer, the user must transfer the money to the Pay Pocket. If it is changed to Paid Pocket, the user can make transactions and interest is charged to 0,5% pa While changing to Savings Bag will activate 3,5% pa interest

Interestingly, users can invite other account holder users (collaborators) to collaborate to save. User can authorize collaborators to "see" or "use" the money in the pocket. There is limit set daily.

According to Kharim, the feature of collaborative financial management is not yet owned by banks in Indonesia. This feature was also developed by research conducted by the company. According to him, there are many use case financial services that can be explored in the future.

In addition, it says that this feature has gone through a process risk management remember use case-The savings are still relatively new and have the potential to be called term savings if they are stored for a long time. "This is one of the challenges for the team treasure at Bank Jago. In this case, we simulate what market the funds will be played in, so we have made adjustments in providing services," he said.

Meanwhile, Director of Digital Banking Bank Jago Peter van Nieuwenhuizen added that collaborative features are very possible to be implemented in financial services. The reason is that people in Southeast Asia are thick with a culture of collaboration, especially Indonesia, which is known to be active in socializing.

"The new [features] we are developing are a new model for banking so it will take 1-2 years to see how do you do with 'Pockets' or how to figure out what works best," said Peter.

Another interesting feature introduced by Bank Jago is bill payment with a variable value, for example post-paid. Through this feature, users can make payments automatically or through a reminder to confirm the bill value is not fixed.

Flashback to Bank Jago's journey

Bank Jago officially changed its name from Bank Artos in June 2020. The change of identity is an effort to massively transform Bank Jago into a post-acquisition digital bank by an investor group led by Jerry Ng through PT Metamorfosis Ekosistem Indonesia (MEI) and Patrick Waluyo through Wealth Track Technology Limited (WTT).

Gojek GROUP, through its subsidiary GoPay (PT Dompet Anak Karya Bangsa), is also a 22% shareholder. Then, in early March, the Singapore government-owned investment agency, Government of Singapore Investment Corporation Private Limited (GIC) also annexed Bank Jago's shares.

Thus, the composition of Bank Jago's shareholders consists of PT Metamorfosis Ekosistem Indonesia (29,81%), Wealth Track Technology Limited (11,69%), PT Dompet Karya Anak Bangsa (21,40%), GIC Private Limited (9,12, 27,99%), and the public (XNUMX%).

Previously, senior banker and founder of Bank Jago Jerry Ng said that: collaboration This can be a key strategy to accelerate digital bank business growth. He gave an example, digital banks in China and South Korea are oriented towards ecosystem collaboration so that they can pursue growth through products with a wider spectrum.

This also answers various strategic partnership actions from various verticals that have been carried out by Bank Jago since 2020. This inorganic strategy can accelerate growth. Currently new Gojek being a strategic partner. That is, this partnership includes opening an account ( ) in the app Gojek directly, without the need for the Bank Jago application.

| Ecosystem | Vertical | Partnership |

| Gojek GROUP | Ride-hailing | Strategic partnerships, shareholders |

| Akulaku | lending | Loan channeling scheme (Rp 100 billion) |

| Acceleration | lending | Loan channeling scheme (Rp 50 billion) |

| Smart Credit | lending | unknown |

| logically | E-logistics | unknown |

More Coverage:

"We have to create a unique value proposition. What we do is combine the two because they both have advantages. Bank is no longer the center of ecosystem, but part of the ecosystem. If we position ourselves properly, we will have a strategic role because whatever consumers do, in the end is payment,” said Jerry.

Other digital banks

The digital bank competition map in Indonesia will be even stronger this year. After Neo Commerce Bank and Bank Jago officially introduced application-based digital services, several other banks are anticipating its realization into digital banks. In our records, there are still a number of names, ranging from Digital Bank BCA, SeaBank, and KB Bukopin.

Bank Agro, which is applying for a license to become a digital bank to the OJK, has also just appointed Kaspar Situmorang as President Director through the Annual General Meeting of Shareholders (Annual GMS). Kaspar was previously the Executive Vice President of the Digital Center of Excellence, one of the digital transformation divisions at BRI's parent company.

To DailySocial Last year, BRI Director of Digital, Information Technology, and Operations Indra Utoyo said, BRI Agro has a great opportunity to be converted into a digital bank because it has launched platform digital lending betel nut (Quiet Borrow) who became test cases early to market.

Meanwhile, SeaBank, which has changed its identity from Bank Kesejahteraan Ekonomi (BKE), is reportedly exploring the potential of acquiring another bank to strengthen its capital structure. That way, SeaBank can get a digital bank license. SeaBank is still listed as a Commercial Bank for Business Activities (BUKU) II with a core capital of IDR 1,3 trillion as of September 2020 and total assets as of December 2020 of IDR 3,6 trillion.

Sign up for our

newsletter