GoPay is now available as a payment method in the Apple Ecosystem

OVO and LinkAja are two e-money platforms that are not yet available on any operating system

GoPay inaugurated its presence as a payment method for Apple services in Indonesia, be it the App Store, Apple Music, Apple Arcade, Apple TV app, iTunes Store, iCloud storage, and others. GoPay is a platform e-money second local partner with Apple after DANA since the beginning of last year.

In an official statement, GoPay CMO Fibriyani Elastria said, during the period of activity restrictions and working from home, the demand for games and entertainment options in the community also increased. The company wants all users to be able to use GoPay as a secure payment method.

"As a trusted and leading payment service, we are very pleased to be able to present GoPay as a payment method for Apple services," he said, Monday (6/9).

Apple's competitor, namely Android (Google Play) is much more expansive in working with the platform e-money local. As of now, we have collaborated with DANA, DOKU, GoPay, and ShopeePay.

OVO and LinkAja are the two platforms that are not yet present on the two operating systems.

Each platform e-money competing to increase its utility by being present in various applications mobile devices key to getting closer to the users. Moreover, during a pandemic, activities on online platforms tend to increase to meet daily needs.

Apps like entertainment (streaming movies, music, games), daily shopping, education, E-commerce, health, investment, and others become soft fields for platforms e-money enter because it requires a payment platform to accommodate all transactions in it.

Previously, GoPay has also been used to pay subscription fees on Netflix. The company is a pioneer, because so far Netflix has only provided payment options by credit and debit cards.

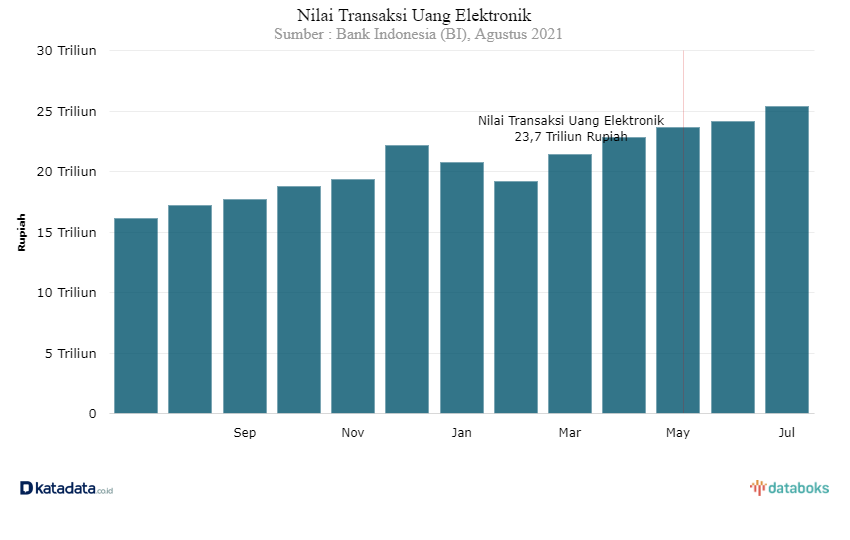

Bank Indonesia recorded transactions with electronic money reaching Rp. 25,4 trillion in July 2021. This number increased by Rp. 16 trillion YOY. Meanwhile, in terms of transaction volume, there were 415,2 million transactions.

The increasing trend is predicted to continue, considering that e-money players can become a bridge to bring people together with banking services.

According to the e-Conomy SEA 2019 research, Indonesia is the country with the largest population unbanked largest in ASEAN, which is as many as 92 million people. While for unbanked 47 million people, and the rest are banked as many as 42 million people.

The same report states that the e-commerce market in ASEAN is predicted to grow from $38,2 billion in 2019 to $153 billion in 2025. The majority will be contributed by Indonesia whose value is estimated to increase from $21 billion to $82 billion.

Sign up for our

newsletter