YCAB Ventures Talks About First Steps to Enter the Startup Ecosystem and Impact Investment Landscape

DailySocial talks with YCAB Ventures Head of Impact Investments Adelle Odelia Tanuri

The Ministry of Cooperatives and SMEs reports that there are 64,19 million MSMEs in Indonesia, of which more than 50% of them are run by womenn. This data shows that there is tremendous potential to boost the economy through women's entrepreneurship.

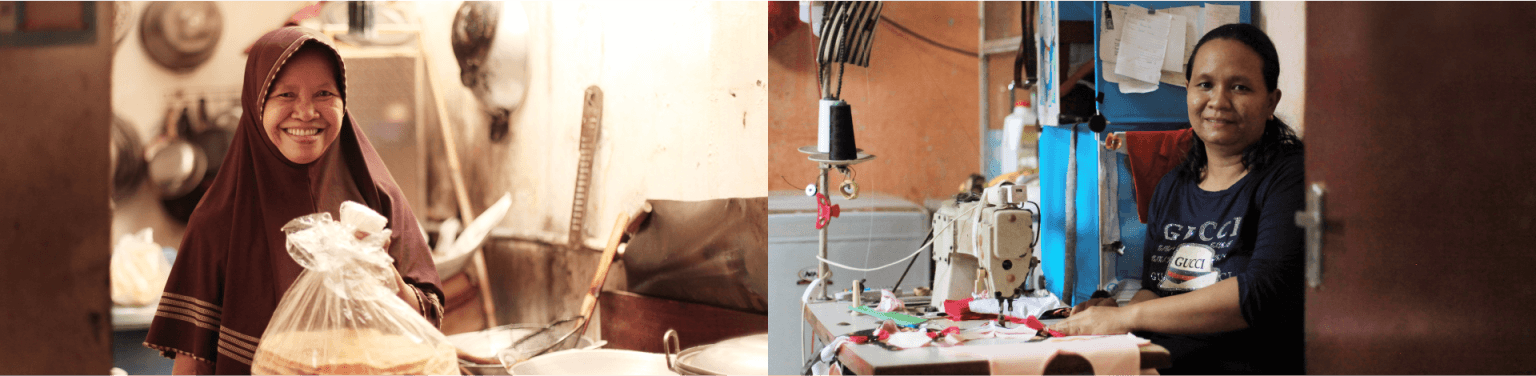

These potentials are worked out by an extension of the Cinta Anak Bangsa Foundation (YCAB), through YCAB Ventures, by channeling the schema microfinance to mothers of business owners over the last ten years.

However, increasing women's empowerment is not enough to help with entrepreneurial capital alone. Therefore, since the last year, YCAB Ventures has started to be involved in the Indonesian startup ecosystem.

Adelle Odelia Tanuri leads the Indonesia Women Empowerment Fund (IWEF), a managed fund that provides investment to startups that offer technology-based products/services, and is led/managed by a team that has a gender balance of men and women.

Regarding Adelle, she has long been involved in various activities and efforts to empower women. Adelle is one of the Co-founders and Directors of Girls' Secrets, an online women's community that focuses on mental health, rights and leadership for teenage girls.

On this occasion, DailySocial chatted with Adelle as Head of Impact Investments YCAB Ventures in starting its steps in the startup ecosystem, talked about the investment landscape, and its mission to open up opportunities for female founder in Indonesia.

About YCAB Ventures

The Cinta Anak Bangsa Foundation (YCAB) is a non-profit organization that was founded in 1999 and focuses on the sustainable development of young people to become social enterprise.

Since 2010, YCAB began to expand its extension by establishing YCAB Ventures to be involved in alleviating poverty and inequality in Indonesia. One of the programs is to provide business financing (microfinance) to women.

Adelle believes that breaking the chain of poverty can be done by empowering women and providing access to financial services that have not been inclusive so far. For example, giving microfinancing to mothers who own small food businesses at home.

As of December 31 2020, YCAB Ventures has disbursed 592.825 productive loans with a value of IDR 1,2 trillion since 2010. YCAB Ventures has also invested a total of IDR 22,8 trillion in ten social enterprise, including GSI Lab, Krakakoa, and EVOS Esports.

"empowerment women can improve livelihoods as a family, and they can make sure their children [can] go to school. During this trip, we saw there different angles and opportunities to invest in the startup ecosystem," he said.

Therefore, YCAB Ventures decided to invest in startups since 2021 because it was triggered by a number of factors, such as the growth of the digital economy, the investment climate, and the persistence of inequality among women. YCAB Ventures also wants to focus on development female founder startups in Indonesia.

"YCAB Ventures cannot reach everyone alone. We may have reached hundreds of thousands of MSMEs, but we can reach even more by investing in startups. That way we can push impact wider," he said.

IWEF and the investment thesis

YCAB Ventures took its initial steps by forming the Indonesia Women Empowerment Fund (IWEF) with Moonshot Ventures. IWEF is a managed fund that aims to encourage an impact on women's empowerment in the Indonesian startup industry.

"We saw timing and the momentum is right now to be able to [push] impact. So we don't just focus on low income only, but also female founder which has products that serve and empower women," he said.

In general, YCAB Ventures has three main investment theses. First, the party is looking for startups in the impact category (impact) that doesn't just focus on financial returns, but also have metrics to measure impact, not just claims.

Second, IWEF invests in startups growthhacks technology-based to solve various problems among women. Third, the party uses Gender Lens Investing criteria to invest in women. According to Adelle, integration and analysis of gender can be used to make investment decisions.

Quoting coil, Gender Lens Investing (GLI) refers to the actions and processes carried out by investors by paying attention to the benefits of investing for women. In short, GLI can create change in the business realm to advance gender equality. In Indonesia, a number of investors and companies have used this model. According to Intellecap Indonesia data, as many as 95% of GLI investors focus on businesses led by women.

Adelle assesses the GLI concept to see whether gender factors contribute to the absence of investment in a startup. Likewise with the Gender Lens Team factor, to see gender equality in startup teams. According to him, GLI also has the potential to become “the next big thing” in Indonesia is in line with the increasing involvement of many parties to empower women in economic activities.

"We invest in startups that have female co-founders because they areunderestimating and undervalued by a number of factors, such as social [construction] and gender bias. We also look at products consumer for women it is very big in Indonesia, and women make it purchasing decisions," he explained.

Citing research reports Kauffman Foundation in 2013, Adelle said that private technology companies led by women, were proving more capital-efficient, achieve a 35% higher Return on Investment (ROI), and--when backed by VC--pocket 12% higher revenue than startups run by men.

In addition to the criteria above, IWEF targets investment in startups in pre seed and seed (early stage). He also emphasized the importance of quality founder, such as the desire to adapt, product execution, and leadership.

Apart from this collaboration, YCAB Ventures is also open to partnerships with other VCs, especially local ones, as long as they have the same vision and mission and deeper expertise in women's empowerment and impact.

Impact incentives

There are many questions regarding startup efforts to achieve impact and return continuously. Adelle assesses that these two things can be possible to run simultaneously if the startup has aspects of leadership and a business model that are closely related to each other impact.

"We are looking for a business model where impact and financial returns can grow together. And this can happen if foundr have leadership and prioritize impact, that's the most important thing," said Adelle.

At YCAB Ventures, Adelle applies several impact measurement methods. First, it adopts the standardization of metrics used by the non-profit organization Global Impact Investing Network (GIIN) to help startups find the right metrics.

"Sometimes it gets really complicated [talking about impact] and you can claim to have it impact. Is opening a job included impact? Everyone has their own definition. However, we always recommend GIIN as a reference to measure this," he said.

Second, his party is also trying out concepts impact incentives which is often used in the VC industry. Adelle gave an example, if you invest in a startup and earn financial returns exceed hurdle rate, for example 7%, VC can give profit sharing to investors, general partner, or limited partners.

At IWEF, they implement impact incentives with model impact-linked carry to fund managers which focus on impactful investment. It means, fund managers can get incentives in the form of profit sharing if successful in achieving impact which is aimed.

"Currently, impact-linked carry not yet [widely implemented] in Indonesia. Hopefully IWEF can be the first to bring this model to measure and impact track because both are expensive. To be able to get incentives, like it or not, you have to trackimpact."

Roadmap 2022

IWEF has a fund management target of ten years, where currently it has only raised $2 million from LP Investing in Women for the first phase. Meanwhile, the remaining $8 million will be collected by the scheme blended finance, open to local and foreign investors.

While collecting funds, IWEF is targeting investment in as many as 20-40 startups in Indonesia in the next three to five years. As of December 2021, IWEF has provided investment to 11 startups in Indonesia, including Eateroo (F&B), Binar Academy (edtech), and TransTRACK.ID (logitech).

"Ticket sizes investments range from $15.000 to $200.000, but the size depends on what we believe and according to our investment mission. And this investment can be gradual depending on the trend. So we can top up," he said.

YCAB Ventures is not fixated on a particular vertical or is agnostic, as long as it meets the criteria outlined in the investment thesis above. However, Adelle sees that edtech and fintech are some of the verticals that will become big trends after ride hailing and E-commerce.

According to him, education is still one of the things concern great contribution to breaking the cycle of poverty. Even though there are currently many edtech players in Indonesia, he believes there is still room for growth and opportunities that can be explored to overcome problems in the Indonesian education industry.

Likewise, financial inclusion in Indonesia is limited to certain groups unbanked and underbanked. The increasing adoption of digital finance during the Covid-19 pandemic proves that the potential of fintech services can be explored further.

No less important, Adelle also highlighted the inequality of the startup ecosystem, which so far has been mostly concentrated in Jakarta and its surroundings.

"One of the main challenges in the startup industry is a lot of tech-based services centered in Jakarta. But, we saw a lot entrepreneur in tiers 2 and 3 which have not been explored well and could actually be the future,"

Business assistance

Adelle believes that as we get here, startups are becoming more selective in looking for investors. They are no longer just looking for sources of capital, but also networking and mentoring which can help him develop his business. At YCAB Ventures, Adelle was involved in providing business assistance (mentoring) to founders with minimal experience.

They focus on honing their skills founder di early stage, such as business, marketing, and leadership, can be done through IWEF team communication and portfolios. And through the special She Disrupts Indonesia program which provides sessions mentoring and training. YCAB Ventures also offers a strong network of connections in the government and private sectors.

"Specifically female founder, why they don't get as much investment male founder? This could be due to a number of factors, for example low self-confidence, no experience, and low financial literacy. For us, [women's empowerment] is not just providing capital, but honing business and business skills networking."

Sign up for our

newsletter

Premium

Premium