Startup Mission "Lending" DanaBijak Channeling Loans to Micro Customers

Will launch applications and increase service coverage for loan disbursement of $2 million (approximately IDR 28 billion) per month this year

There is still a large potential for the Indonesian people who have not been served and cannot get loans from banks, which is a business opportunity for them DanaBijak. Startups lending This focus focuses on micro loans, because the company believes there is a niche that the community really needs more than having to go through KTA.

"Many Indonesians only need small loans for their daily needs such as paying for electricity, business capital, education, or traveling. This is where the Wise Fund is here as a solution for the Indonesian people in solving their financial problems," said the CEO. DanaBijak Markus Prommik to DailySocial.

DanaBijak, continued Markus, has differentiation compared to players on balance sheet lending others, including the point system (Poin Wisdom) that will allow customers to get lower interest rates, higher loan limits (up to IDR 10 million), and longer tenors (up to 90 days).

The company also applies a faster payment system, lower interest rates. This means that if the customer pays the loan faster than the tenor, the remaining interest does not need to be paid. For example, the loan tenor is 30 days but if on the 20th day the customer has paid the loan, interest in the remaining days does not need to be paid.

Wise Points is a system reward provided by the company for customers who frequently apply for loans and have a good credit history. Not only that, customers who use referral codes, provide reviews about the company on social media, and participate in education will earn additional points.

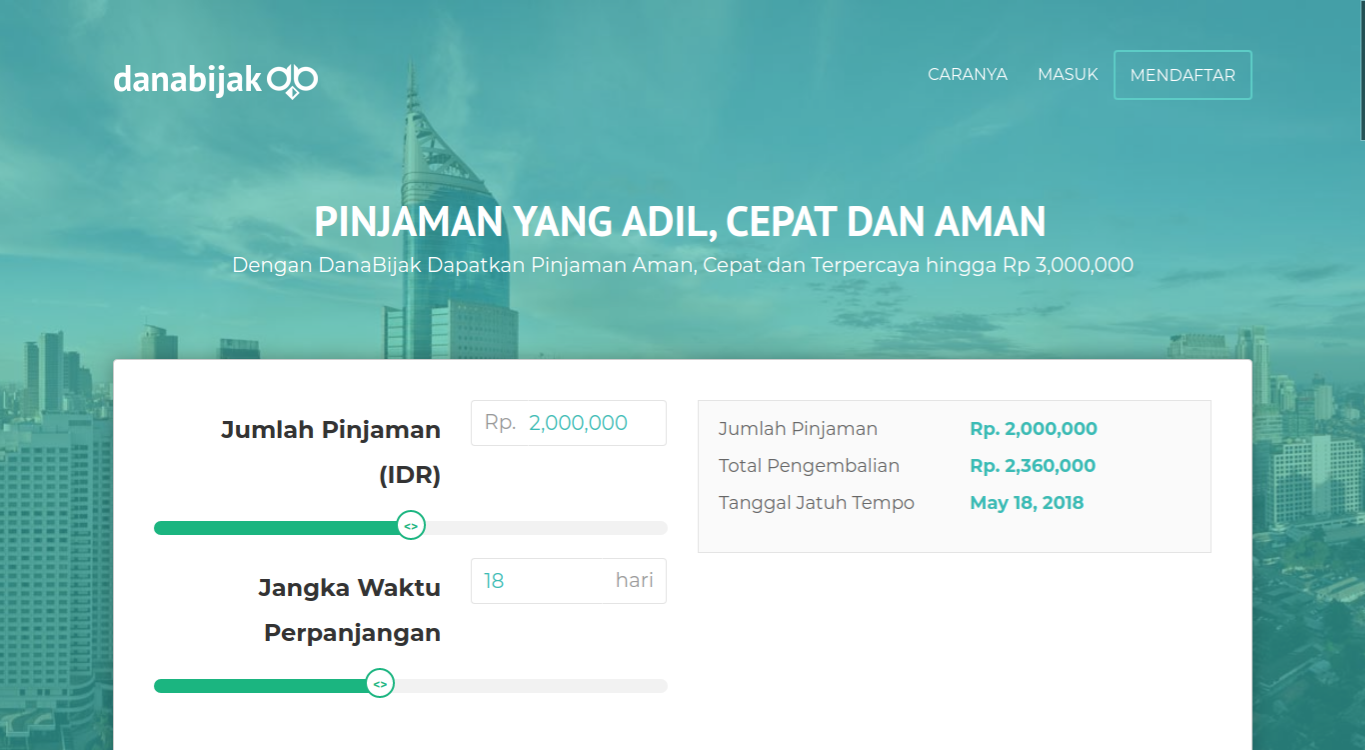

Mark gave an example, for customers who are borrowing for the first time at DanaBijak, the maximum loan limit is IDR 3 million, interest is 1% per day, and the maximum tenor is 30 days. However, with the Points of Wisdom system, customers can borrow up to IDR 10 million, interest is 0,4% per day, and the maximum tenor is 30 days.

"DanaBijak aims to provide financial education to solve financial issues faced by customers every day. For that our next plan is to make offline workshops for customers and potential customers."

Unfortunately, he was reluctant to reveal in more detail about the source of funds used by the company to distribute its financing. Markus only mentioned the majority of sources of funds DanaBijak still comes from individual investors from abroad and institutions.

"Nevertheless, we are currently focusing on finding Actioncalendar from Indonesia."

Two-way risk management

In providing loans, the company performs verification automated by system combined with manual verification. Every loan that passes verification by system will enter the Wisdom Fund team for further data checking to ensure all information entered is correct and valid.

"This method is done to help customers build creditworthiness so they can get lower interest rates, higher limits, and longer tenors."

He continued, the credit scoring system is also based on smartdata. More than 85% customers DanaBijak accessing its services via their smartphones, that is DanaBijak can analyze each digital footprints consumer.

This step is claimed to be ahead of other financial institutions, such as banks and finance companies, which still focus on paper documents and credit points traditional ones.

"Allows us to make better credit decisions and helps millions of Indonesians build creditworthiness. Our technology team continuously strives to improve algorithms credit scoring by supervising it with a team of credit analysts."

Loan applications can be made via site access DanaBijak by filling out the form online. Customer must be over 21 years old, Indonesian citizen, minimum income of IDR 2,5 million, and have a verified bank account.

The purpose of the loan can be directed to the need to cover unexpected costs, such as motorcycle repairs, education costs, and other daily needs.

With the implementation of such management, the company is sure to continue to expand to various regions throughout Indonesia. Since its establishment in December 2016 until now, Dana Wisdom has disbursed around Rp35 billion with a total of 25 thousand customers who have received loans.

When viewed from yoy April 2017-2018, the increase reached 15 times with the realization of $500 thousand (around IDR 7 billion) from the previous US$ 40 thousand (around IDR 560 million). Service scope DanaBijak while these are still scattered in Greater Jakarta, Bandung, and Surabaya.

Future plan

The company plans to add other locations in Semarang, Yogyakarta, Makassar, and Bali. Not only that, they will launch the application native to facilitate the acquisition of new customers, get more information related to Wisdom Points, and help scoring models to be better in the middle of this year

All of these plans are expected to help the company's ambitions to target a loan disbursement of $2 million per month (approximately IDR 28 billion).

Not only that, participation DanaBijak as one of the graduates of the second batch of Plug and Play with Gan Kapital (GK-PnP), can be a trigger factor top of mind for prospective customers who need a loan.

"In addition, we can be one of the media for Indonesian people to get financial education," concluded Markus.

Sign up for our

newsletter