What You Need to Know about GoTo's IPO (Part I)

Exploring GoTo plans after IPO, shareholders, financial performance, and growth metrics

Monday (11/4), a combined entity of Gojek and Tokopedia officially took the floor on the Indonesia Stock Exchange. Using the trade code "GOTO", the company lists approximately 1,184 trillion shares. The shares released to the public (Series A) were 40,6 billion shares with an offering price of IDR 338 per share.

PT GoTo Gojek Tokopedia Tbk. listed on the main board, in its initial listing one week ago, the value of its shares had increased by 23%, making the company's market capitalization more than Rp466 trillion; at the same time pushed to the big 3.

Agenda after IPO

GoTo submitted a registration statement in connection with the initial public offering of shares to OJK since December 21, 2021. At least 13,7 trillion Rupiah has been collected from the share offering. Through this corporate action, a number of agendas prepared by GoTo after being successfully listed on the IDX.

Strengthening the User Ecosystem

In the previously published prospectus book, GoTo currently accommodates more than 55 million users who transact on the platform every year. This includes more than 14 million merchants and 2,5 million driver partners; with the main business around services on-demand, e-commerce, and fintech.

One of the allocations of funds obtained from the IPO, GoTo will encourage growth in the number of consumers and use of services, including through the synergy of the ecosystem owned by Gojek, Tokopedia, and its subsidiaries.

Quoting RedSeer research results, market value on-demand in Indonesia it has reached $5,4 billion in 2020 and is expected to grow to $18 billion in 2025. Temporary E-commerce for physical goods the value was $44,6 billion in 2020 and is projected to grow to $137 billion in 2025. And fintech is projected to have touched $17,8 billion in 2020 and will reach $70,1 billion in 2025.

Strengthening Loyalty Programs

Still related to efforts to strengthen the user ecosystem, loyalty programs and reward will be synergized to create a connected experience between platforms within GoTo. As previously known, Gopay has started to become the main payment option on Tokopedia, and Gopay Coins are also used as the system reward in the applications.

Not only for end consumers, value added for partners is also a priority. This includes expanding financial services that will be integrated across platforms. Even though the real plan has not been conveyed to the public, it is known that GoTo Finance has a product ecosystem fintech which is quite complete, starting from e-money, lending, to digital banking.

Strategy Strengthening Hyperlocal

It cannot be denied that the businesses managed by GoTo and its subsidiaries have not served the Indonesian people as a whole, especially when talking about tier-2 and 3 cities. Currently the service Gojek has only reached approximately 200 cities out of a total of 514 districts/cities in Indonesia. Including through partnership programs.

GoTo's presence in second and third tier cities will actually also increase the overall visibility of the service, for example enabling the GoSend instant delivery service to be available to more Tokopedia users. Or the adoption of GoMerchant which is increasingly expanding to MSME partners who have not been reached before, has an impact on the adoption of other supporting platforms such as payments to POS.

Strengthening Strategic Investment

The investment in question is aimed at increasing growth potential in GoTo's operational areas, both in Indonesia and other Southeast Asian countries. GoTo will also continue the venture strategy that has been carried out, including carrying out M&A and funding into strategic businesses, especially through Go-Ventures.

The transition to an environmentally friendly business is also on the agenda. Including preparing infrastructure such as electric vehicles and supporting components.

The detailed allocation of funds from the initial public offering of shares is as follows:

| Percentage of Funds | Allocation |

| 30% | Issuer |

| 30% | Tokopedia |

| 25% | Gopay |

| 5% | GoFinance |

| 5% | Gojek Singapore |

| 5% | Gojek Vietnam |

Board of director

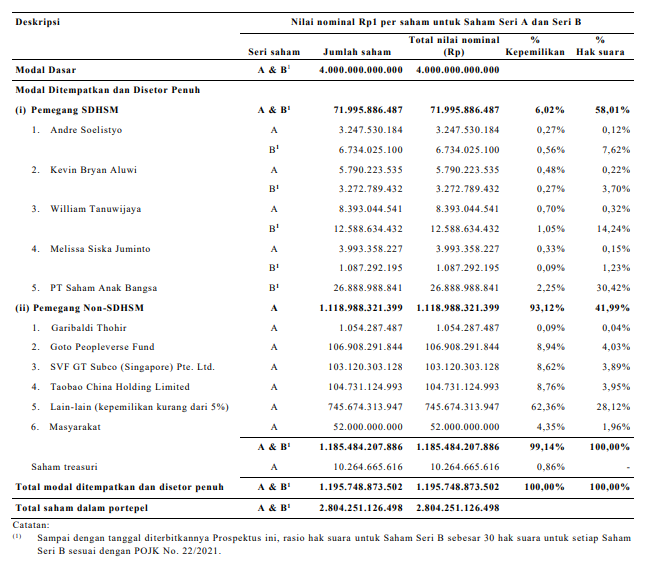

Issuer GoTo offers Series A shares to the public, all of which are new shares issued from its portfolio. There are 2 types of distribution, namely Series A and B, although the ownership is the same, Series B shares have greater voting rights, aka shares with multiple voting rights (SDHSM).

A number of GoTo officials, from Tokopedia executives and Gojek, enter the SDHSM list. Overall, they have the majority of voting rights on strategic decisions that will be made by the company in the future.

This scheme can be seen as a strategic step to ensure GoTo continues to be in the corridor The roadmap its growth. With growth style startup, GoTo is indeed targeted to have growth significantly agile – including by making business changes quickly in accordance with market demands and competition. The existence of large voting rights in the executive ranks minimizes obstacles to having the same voting process to decide on urgent matters.

After being listed on the IDX, the composition of share ownership in the company is as follows:

On the SDHSM list there is PT Shares Anak Bangsa. It is known that there are a number of strategic investors who have supported it Gojek from previous equity funding. This includes Temasek, Google, Telkomsel, KKR, Astra International, Taobao, Tencent, and a number of others. As is known, since raising further funding (Series B and above), more global investors have participated in funding Gojek and Tokopedia.

In accordance with POJK 22/2021, Series B shareholders are prohibited from transferring part or all of their ownership for 2 years from the effective date.

Financial Statements

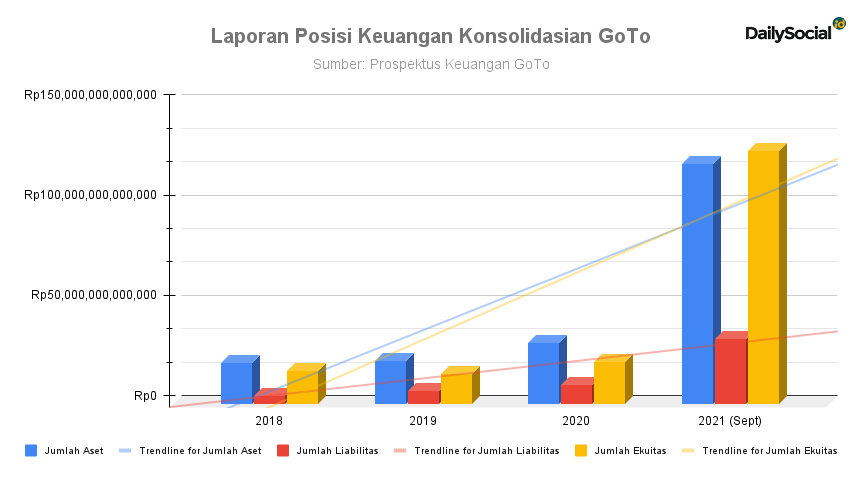

Consistently, GoTo has an increasing number of assets, liabilities and equity. In the published report, in 2021 as of September the increase in number is quite significant, because the company's consolidated financial position report as of July 31 2021 has reflects the acquisition of PT Tokopedia.

The condition of the financial statements shows that GoTo currently has sufficient resources to carry out business expansion and innovation - in terms of the amount of equity it owns. The size of this equity funding is also supported by previous investments which have led the company to become the first Decacorn in Indonesia after successful Series F funding.

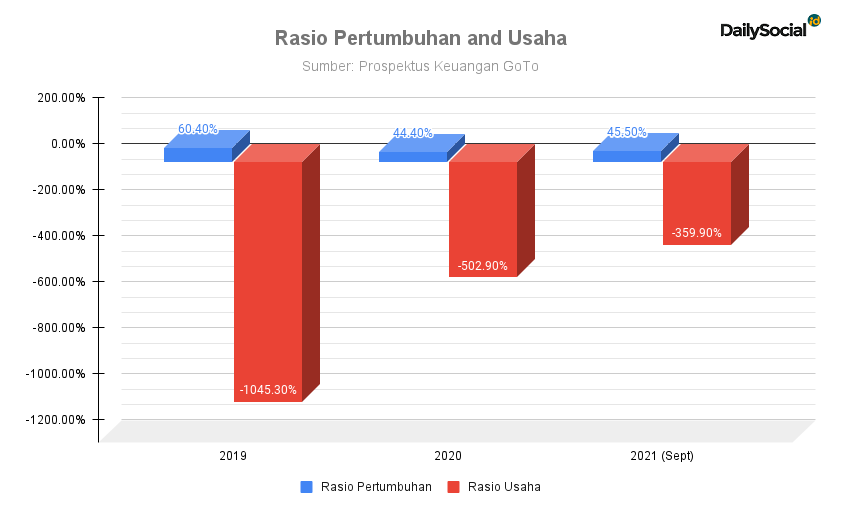

Meanwhile, a look at the growth and business ratio shows that currently GoTo is still in a "loss" position. Some observers say that this condition is quite normal for startups that are still in the phase of pursuing growth. Digital platforms require large capital as compensation for user acquisition. In reality, this includes discounts, free shipping, and various benefits others provided to users.

Since its inception, players like Gojek, Tokopedia, even unicorn others are identical to “burn money” strategy. However, please note that this approach also has a period that is expected to return the company's position to the BEP point – when the monetization model is fully run from the user base throughout the business ecosystem.]

Indeed, when compared with other TBK companies that have been listed previously, this concept will be different. Companies in general put forward revenue as a metric to show its business growth and performance. The more profitable it is, the better it will be considered - even by retail investors who hold the shares.

Business metrics

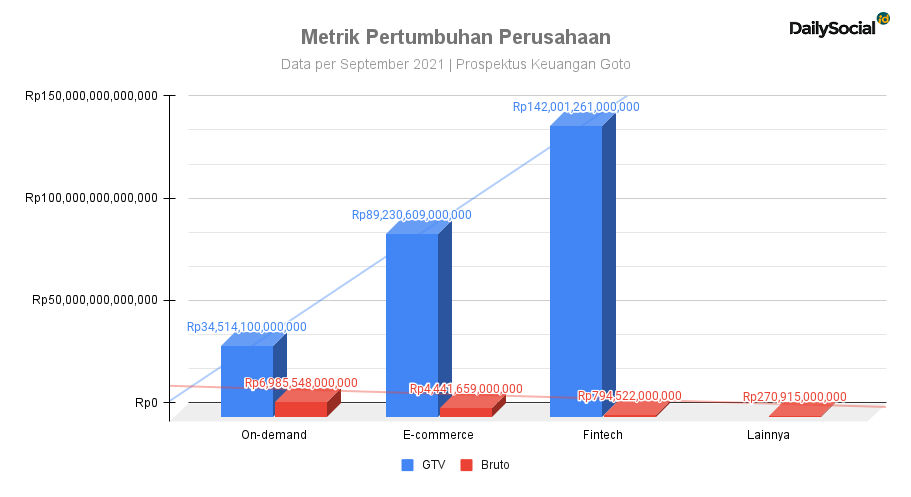

To measure its business growth, the company has a number of metrics starting from gross transaction value (GTV/Gross Transaction Value), number of orders, number of annual transacting users (ATU/Annual Transacting User), and gross revenue. GTV is defined as gross transaction value, an operational measurement that reflects the number (not value) of transactions, products, payments that occur in a particular business segment. Meanwhile, gross income represents the total Rupiah value attributable to the company from each transaction.

Under these conditions, the company claims to now be a service provider on-demand number 1 in Indonesia for mobility services, food delivery and logistics. Number 1 also for E-commerce in physical and digital products. And number 1 for products fintech consumer payment based and POS based cloud.

Potency on-demand, e-commerce, and fintech it is still very big in Indonesia. Meanwhile, GoTo places the platform in the C2C, B2C and B2B segments - by making MSMEs one of the main market shares. The market size is now expanding with regional expansion ambitions. The biggest challenge is indeed the increasingly fierce market competition - with Grab, Shopee, Akulaku, and others. The plus point of GoTo is that they have a business unit that is complete enough to handle all business lines previously established or the results of their acquisition of other startups.

Sign up for our

newsletter

Premium

Premium