Venture Capital Company Risk Management Strategy

Learn from Softbank's mistakes against their flagship portfolio

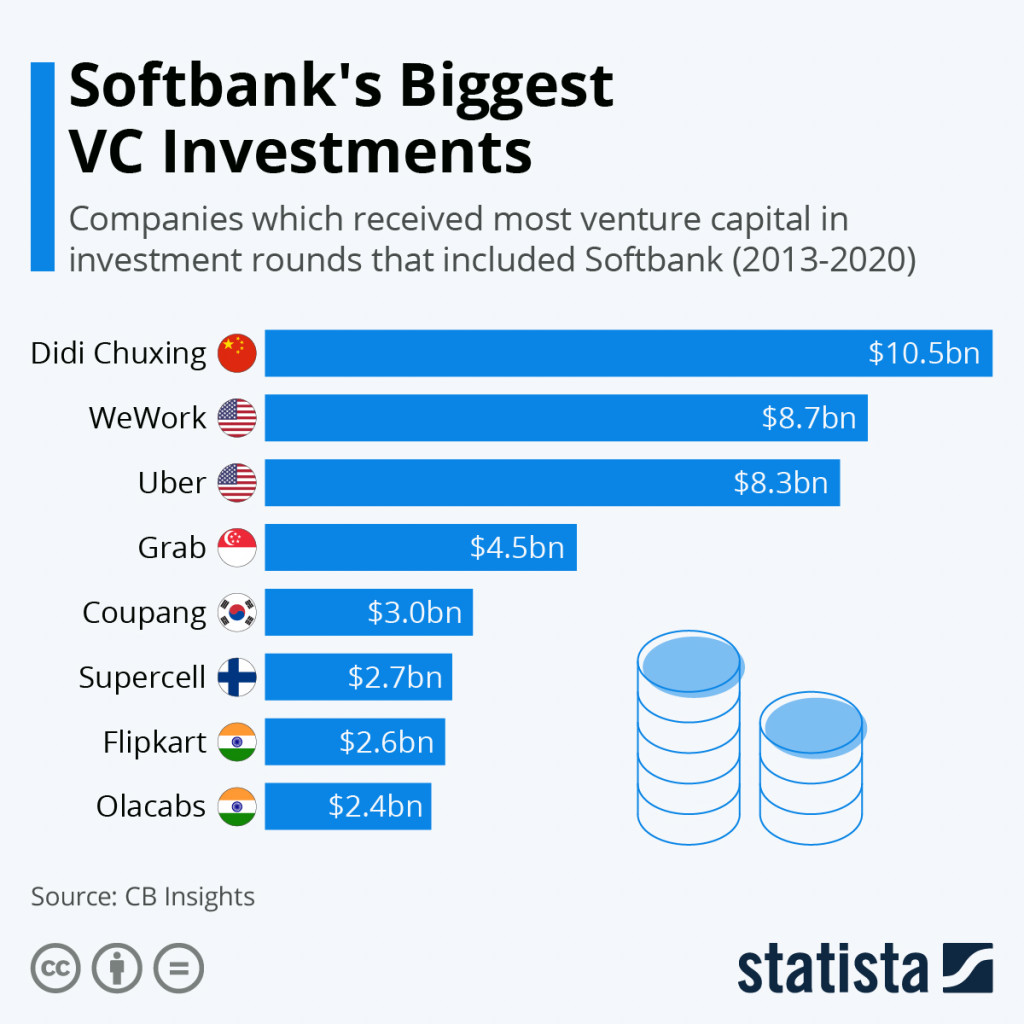

Japanese digital conglomerate Softbank, through its investment vehicle, Vision Fund, all year 2013-2020 has invested nearly $10,5 billion in funding for the company ride hailing Didi Chuxing, WeWork ($8,7 billion), Uber ($8,3 billion), and Grab ($4,5 billion).

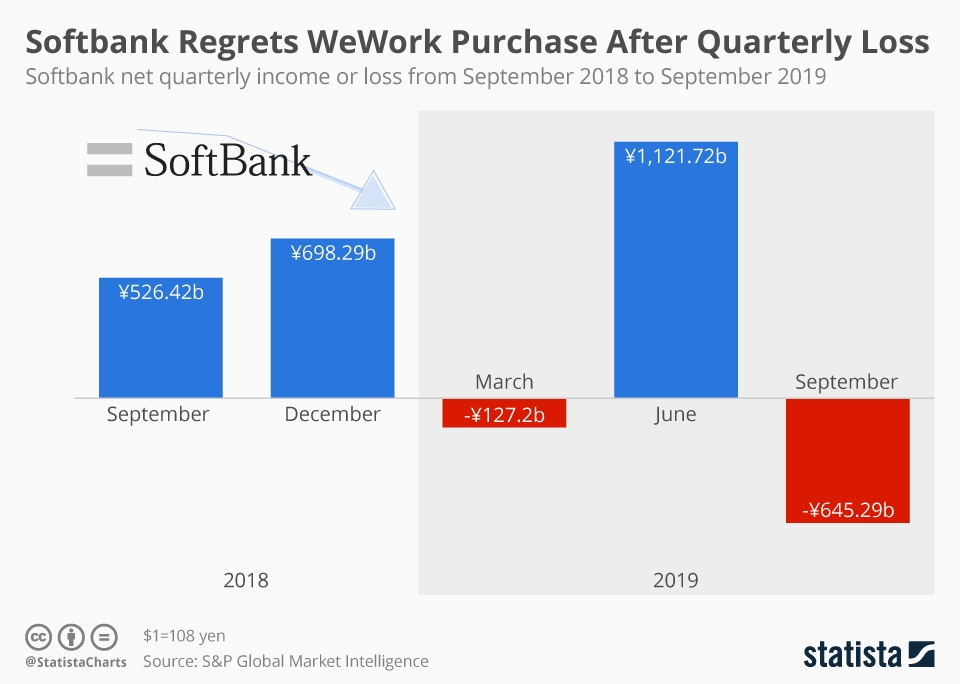

These popular names have managed to achieve giant valuations by putting forward the concept of growth and massive expansion. However, the "commotion" that hit WeWork in 2019, had a negative impact on Softbank as the biggest supporter.

Softbank recorded net loss of $6,4 billion, the majority due to the impact of WeWork's devaluation.

What happened to Softbank became wake up call for investors globally. Don't just change focus and start abandoning the concept growth at all costs, most venture capital companies are also starting to focus on startups that are truly technology-based.

According to Prasetia Dwidharma CEO Arya Setiadharma, every investor who relies on portfolio diversification needs to be disciplined in terms of investment allocation.

"If that [investment] money came from the Vision Fund [which has a total fund of] $100 billion, then I would say the investment in WeWork has massive exposure to that fund. Softbank is playing in the 'big leagues,' so it's certainly a much more public failure." Arya said.

Venture capital firms like Softbank once had huge profits with Alibaba, but “failed” with WeWork. For this reason, this time we discuss how investors can mitigate risks so they can still run their business and invest healthily.

Risk management

Capital Venture (VC) invests in one of the riskiest asset classes, namely startups. According to Shikhar Ghosh, Harvard Business School Professor, in the last 10 years 70% of startups failed. All startup failures stem from decisions the company makes.

Ideally, assessments and scenarios risk mitigation carried out from pre-investment to the investment stage to determine success. That's why VCs usually do due diligence (due diligence) in depth before funds are awarded.

"There is no guarantee that any investment will be successful return, but if we walk together with startups with vision and values that are in line and produce products or services that can make people happy and helpful, this is already a great pleasure. Financial returns "That's the bonus," said UMG Idealab Managing Partner Kiwi Aliwarga.

Kiwi added, every venture capital has a unique vision and way of making investments. UMG Idealab claims to invest by sight alignment vision and values from the founders and co-founders.

On the other hand, Indogen Capital tries to focus on three main foundations, namely unit economics, trendsand exit market. For trends, adjustments must be made to adapt to recent changes in the market. While assessing economic units and exit market always done consistently since day one.

"economic unit very important to identify path to profitability from a startup. From here we can also assess whether the startup has the potential to achieve success long-term competitive advantage or not," said Indogen Capital Managing Partner Chandra Firmanto.

Abandonment concept growth at all costs

What happened with Softbank and WeWork has changed the perception that most VCs focus on growth. Even though this method is successful in acquiring more customers quickly, the long process and large cost requirements make it difficult for startups to make a profit.

Relevance growth at all costs also questioned by most VCs today. Nowadays, capital is no longer a rare item. as a result growth stories is no longer attractive, compared to 10 years ago when VC funding was still relatively rare.

"In the future, companies that can demonstrate their capabilities will become companies that sustainable in the long term is what will be attractive to most investors," Chandra said.

Kiwi expressed the same thing. Although don't believe in the concept growth at all costs, but there are always limits to growth.

"Our first focus is not about profit, but how much we can help other people or other companies and provide satisfaction. I believe profit will follow if we deliver smiles first to users and customers," said Kiwi.

According to Arya, despite the concept growth at all costs does not have a positive effect on startups and VCs, but the concept does hyper growth still relevant enough to apply, as long as growth can create barriers to entry (entry barriers).

Example entry barriers are the “switching costs” a customer must incur to switch to a competitor's product or service. Nonetheless, this overgrowth must be reasonable in terms of costs.

"For example if a startup spends $1 to acquire 1 potential customer, that customer better have a long-term value of more than $1. That value is not necessarily [about] how much the customer will pay the company, but it could be how much other people are willing to pay to have access to customers, for example by utilizing Google Ads," said Arya.

Support all portfolios

After admit mistake When investing in WeWork, one important lesson that Masayoshi Son learned was not to focus too much on one startup.

If a VC has a portfolio that has the potential and opportunity to grow quickly and positively, try to balance the focus and pay attention to investments in other portfolios. Make the success of one of your portfolios a success success story, but don't make this startup the main startup to invest in.

"What VCs need to pay attention to to avoid this problem is stay true to your beliefs , sacrifice for your cause and go the extra mile. If startup founders are not willing to sacrifice their beliefs and vision, there is no reason for VC to invest," said Kiwi.

In conditions like these, VC portfolios need not only strategic support but also moral support. VCs should help them focus on surviving and being relevant, as well as for long term goals.

"Strategically, we provide input to the portfolio for course correct direction rather than the company [failing] first. After that, we also focus on helping from an operational perspective. In terms of moral assistance, we try as much as possible to always accessible "to all founders by communicating [constantly]," said Chandra.

Sign up for our

newsletter

Premium

Premium