Bindcover's Efforts to Streamline Insurance Business Processes for Companies

Bindcover became the first Insurance Broker Marketplace platform registered in the OJK IKD; already received pre-seed funding from Loyal Ventures

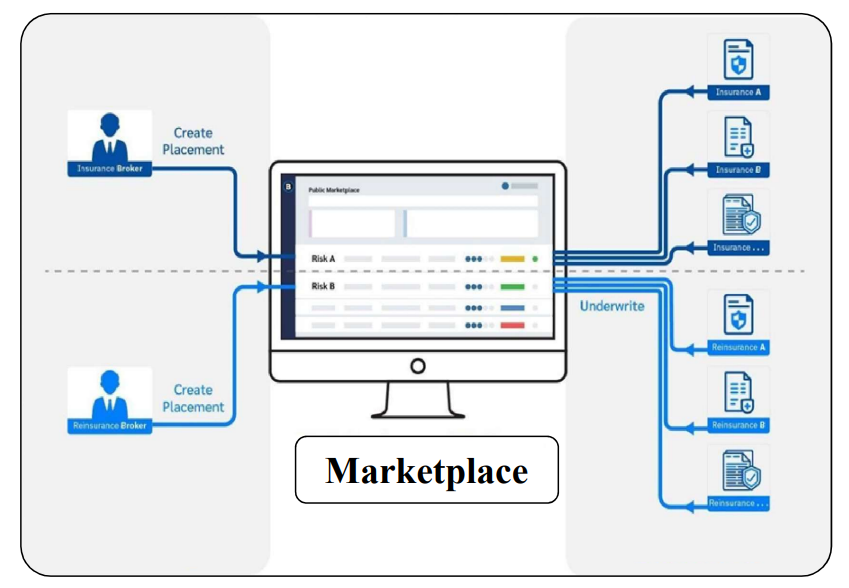

Bindcover is a platform insurtech which tries to make it easy for brokers and insurance companies to be able to connect with each other.

The inspiration came when Victor Roy as Founder & CEO bindcover came to visit London in 2018. There was Lloyd's, which is a market biggest insurance/risk in the world -- the concept is similar to the stock exchange, only focused on insurance prospects. It brings together insurance brokers/brokers and insurance companies. From there Lloyd's was able to accommodate a variety of unique insurance needs, from insurance for the Titanic to today's electric vehicle products such as Tesla.

However, when exploring the business process, Victor saw the potential for digitization that could provide efficiency. When the company wants to do placement, there are a lot of documents to prepare and carry -- meet in person face to face. The process is still considered manual, computerization is only carried out at the recording stage.

When he returned to Indonesia, he came up with the idea for a digital version of Lloyd's to become a forum for brokers and companies to run their business. Even in the local market, based on Victor's experience in the insurance industry since 2004, he sees that when a big business (famous for fire insurance) wants an insurance product, the process cannot be as easy as finding car or life insurance. For example, for insurance that is able tocover fire accident coverage in a factory -- the risk is unique and insurance companies usually have to do custom calculations to accommodate them.

"For example, there are people who own a furniture factory, when they want to get fire insurance products, usually the first issue they face is they are confused about who to contact, when they come to the insurance company's website sometimes they cannot be contacted for intense discussions, not even a few have difficulty finding out which company is the right one. "I want to provide this insurance product because wood is a high risk. Even when you get it, sometimes the price calculation is also not transparent - it is difficult to find comparisons, because the risks are unique," explained Victor.

He continued, "Once you get a broker or agent, there are usually a lot of documents that must be prepared, starting from the legality of the PT, the size of the building, production etc. And when the filing is complete, getting the price can usually take months. That's what point breadThe thing is, data entry is difficult, finding data is difficult, negotiations are complex, prices are not transparent, so the capacity is lacking."

"And point bread The most important thing is actually during the claim process. Because if we look at the website, insurance products are competing to be the cheapest, even though the most important thing is how they handle claims,” he added.

Solutions presented by Bindcover

Currently Bindcover is listed in Digital Finance Innovation at OJK for the Insurance Broker Marketplace cluster. As defined by OJK, the Insurance Broker Marketpalce is a shared platform that is closed and is intended for the community of insurance-licensed business entities; ranging from insurance/reinsurance brokers and insurance/reinsurance companies.

Within the Bindcover web platform, there are many brokers and companies that can sign up. Brokers can upload various prospect clients with unique risks in them, then insurance companies can see and weigh to facilitate these needs. All administrative processes are recorded and documented on the platform -- both from the side of the broker who uploads the client data or the company that manages the transaction. The ultimate goal, Bindcover wants to be a "one" service pintu".

Another feature that is also provided allows brokers and insurance companies to negotiate on the platform. This is considered by Viktor to be an important aspect because it is related to compliance -- the insurance business is one that is tightly regulated. The communication presented was thorough. For example, a broker who uploads a risk profile on the platform can know which companies downloaded the data and when, so that they can do follow-up Furthermore. Usually, by email or telephone, the recording is less structured.

Bindcover is also developing AI-based technology to provide supporting data in the risk assessment process of a business. For example, by doing crawling relevant data from the internet related to certain businesses that will become insurance clients. However, for now, risk management is still manual, both data recording and analysis -- especially for risks with large values.

Already got funding pre seed

Currently Bindcover's business model is B2B. Victor further said, they have two revenue streams which is executed. First, charge per policy with a value that depends on the premium that has been successfully paid.underwriting. For policies worth under 2 million, Bindcover does not charge a fee.

While the second model, there is sharing fees from brokers who get inquiry clients of Bindcover. It is undeniable, with the existence of digital services, several companies are also trying to order their needs through Bindcover. However, because it is not a broker (does not have a broker license), what is usually done is to continue inquiry to partners registered on its platform.

"Our PT was established at the end of 2018. A year after that we were still looking for forms and developing the platform, until in February 2020 we received an IKD permit from the OJK. Unfortunately, after being ready to operate, we were faced with a pandemic. However, in July 2020 soft launch still held. After one year running, the numbers are not bad, until the end of July 2021 there are 18 brokerage firms that have entered Bindcover out of a total of 159; then there are 22 insurance companies from 70 general insurance company existing in Indonesia. From a business perspective, the increase is also up to 100%," said Victor.

Bindcover has also received funding pre seed in July 2021 from Canada-based Loyal Ventures. At the beginning of 2022, the company also began to raise funds to accelerate the business it is working on.

More Coverage:

"Besides, this year we want to confirm to the regulator a more advanced form firm of this business model, in order to have viewpoint which is clearer. Because 2022 we plan to expand partnerships to B2B2C, one of which is by entering the financial ecosystem in collaboration with banks. In addition, we will also collaborate with startups that have an MSME user base," added Victor.

Great to play in the business segment

At the moment insrutech others are competing to win the consumer market by presenting products micro insurance or agency digitization, Bindcover chose to focus on the business segment. Victor has strong reasons for this.

"Currently our average GDP is $4000 per year, from the existing income there is no need to have insurance. It is rare for people to buy insurance without being forced. Apart from the income, financial literacy related to insurance is still very low, if I'm not mistaken in the range of 14%. This is difficult for me, especially if you want to enter a more micro market in the region. Maybe the momentum is in a few years. Meanwhile for the business segment, the basic need for protection will exist; with stable purchasing power as well," he said.

Victor also tries to see from the needs of the global market, this platform has the potential to be brought to the regional arena. The reason is that currently there are only 70 insurance companies and 5 reinsurance companies in Indonesia. When the capacity is lacking, players from outside can enter Indonesia. This will be Bindcover's next focus, developing reinsurance -- currently exploring its licensing. Dancing to several countries has also opened access, for example Japan, Australia, and the United States, which will make it easier for you to expand your business.

Sign up for our

newsletter