Trend of Slowing Indonesian Startup Investment Climate in Semester II 2020

Funding in the first semester of 2020 increased compared to the same period in 2019, but not significantly

The Covid-19 pandemic is not over, the economy has not recovered either. Indonesia could enter a period of recession if the economy still recorded negative growth in the third quarter of 2020.

All sectors of business and industry are currently experiencing difficult times due to the pandemic. However, there are also those who see this situation as a momentum to accelerate the role of digitization. This is also one of the maneuvers against changes in market and consumer behavior in the midst of a pandemic.

How was the achievement of startup funding transactions in Indonesia in the first semester of 2020 and what are the next trends at the end of 2020?

Funding in semester I 2020

As reported Nikkei, the investment trend in Southeast Asia actually jumped in the second quarter of 2020 (April-June period). The pandemic has become a momentum for e-commerce and fintech businesses to gain major service traction in line with government policies to implement social restrictions and Work From Home (WFH).

According to data DealStreetAsia, Indonesia contributed the most transactions in that period with 45,8 percent compared to other countries in the Southeast Asian region. The second and third largest were Singapore (33,2%) and Vietnam (7,9%).

In the first semester of 2020, DailySocial recorded as many as 52 Indonesian startup funding transactions announced. When compared to the same period last year, there was an increase from 50 funding transactions, but it was not significant.

The number of these transactions could actually be greater than the same period last year. It's just that the pandemic has also resulted in a number of funding deals being pushed back from their original targets.

Example paxel initially targeted to be able to pocket new funding in the second quarter of 2020. However, this plan had to be postponed in the third quarter of 2020. Meanwhile, Mbiz admitted that it was difficult to find new investors because of this situation. Even companies in the e-procurement this should revise the fundraising target.

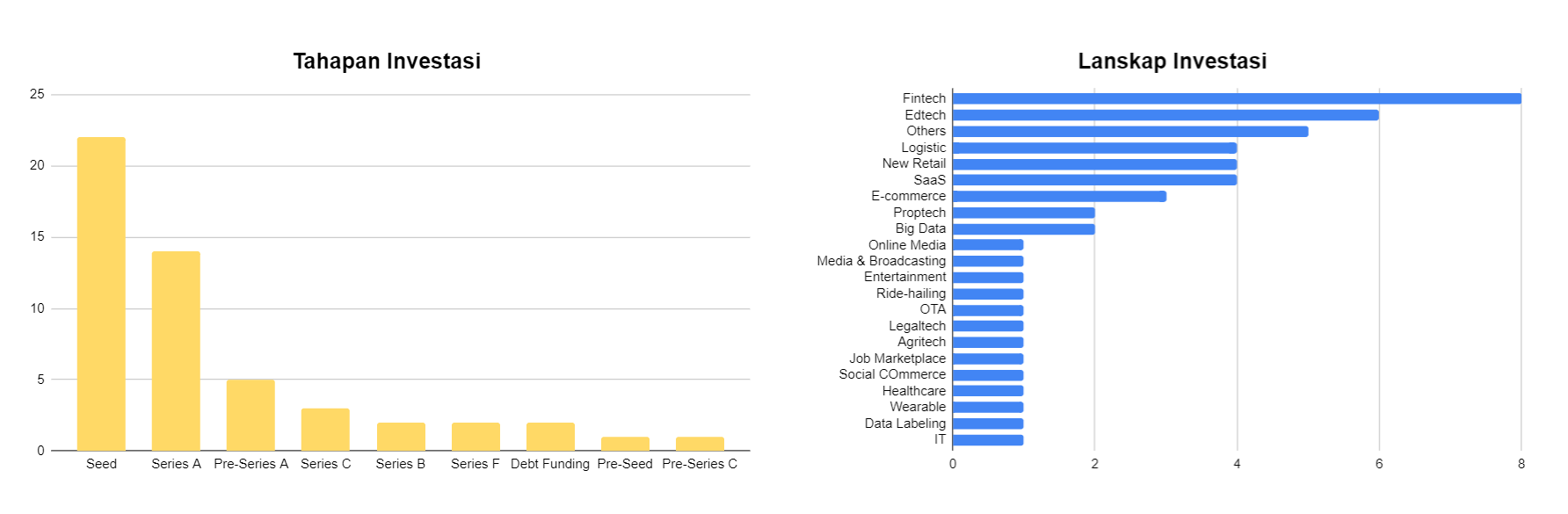

In terms of stages, beginner startups (seed) still dominates funding transactions. Meanwhile, fintech and edtech startups were the business verticals that received the most investment injections in the first semester of 2020.

Is the investment trend in the third quarter starting to slow down?

The third quarter of 2020 is not over yet. However, based on the summarized data DailySocial, the investment trend in this quarter is quite slow.

In the period from July to present (year-to-date), there are 19 startup funding transactions in Indonesia. As an illustration, in the third quarter of 2019 there were 30 funding transactions announced as summarized in Startup Report 2019.

Some of them come from startups unicorn and the next stage, namely Traveloka with the acquisition of funds of Rp. 3,6 trillion and Sociolla amounting to Rp. 841 billion.

Traveloka's own valuation is estimated to drop to $2,75 billion (nearly Rp40 trillion) in order to obtain this fresh injection of funds. Action down round This had to be taken because the company's business was hit by Covid-19, resulting in a decline in services.

Furthermore, investment gains for the July to early September period are still dominated by several business verticals that have benefited from the current situation, for example beautytech, e-commerce, logistics, and fintech.

| Startups | Business Vertical | Funding |

| Sociolla | Beautytech | Series e |

| Payfazz | Fintech | Series B |

| TiinTiin | E-commerce | Seed |

| SYCA | Beautytech | Seed |

| Kiddo | edtech | Seed |

| Traveloka | OTA | SeriesUnknown |

| let's connect | Fintech | Pre-Series B |

| Wahyoo | Social enterprise | Series A |

| CrediBook | Fintech | Seed |

| eFisheries | Aquatech | Series B |

| IUIGA | E-commerce | SeriesUnknown |

| Cash book | SaaS | Pre-Series A |

| Others | Series A | |

| SIRCLO | Ecommerce Enabler | Series B |

| PasarPolis | Insurtech | Series B |

| PropertyGuru Group | Proptech | SeriesUnknown |

| Webtrace | Logistics | Seed |

| CredoLab | Fintech | Series A |

Digital acceleration fuels investment climate optimism

Contacted separately, MDI Ventures Managing Partner Kenneth Li revealed that startup funding trends in the fourth quarter of 2020 are predicted to remain slower than the previous year. This is because the pandemic situation is still continuing and the economy has not yet recovered.

Based on data from the Central Statistics Agency (BPS) Indonesia's economic growth in the second quarter of 2020 was minus 5,32 percent (year-on-year). This growth is the worst since the 1998 crisis in Indonesia. Not to mention, Jakarta has again implemented large-scale social restrictions (PSBB) volume two starting in the third week of September.

Nevertheless, Kenneth admitted that he is optimistic about the investment trend going forward, considering that there are many startup business verticals that are actually positively affected by this condition. This is mainly related to the acceleration of digital capabilities to be faster and urgent.

He also sees that the future could be a momentum consolidation through mergers and acquisitions (M&A) for the startup industry. "This is because at the same time evaluating whether the founder The startup has the ability to survive. There are many ways to survive, it can be through raising new funding, pivot, and consolidation," he told DailySocial.

Previously, a giant VC firm Sequoia Capital has warned that the spread of COVID-19 will have a turbulent effect on the business and investment climate in the world's startup industry. Sequoia even called Covid-19 "The Black Swan in 2020".

Sequoia warned the entire startup ecosystem and its derivatives to rethink some aspects of its business this time of year. “While it is possible that your business will not be directly affected by this case, you need to anticipate that consumers may change spending habits them,” according to Sequoia.

Sign up for our

newsletter