Tokopedia Starts Rolling Out Virtual Credit Card "Ovo PayLater"

Only available for Tokopedia users who live in Greater Jakarta, Bandung, and Surabaya

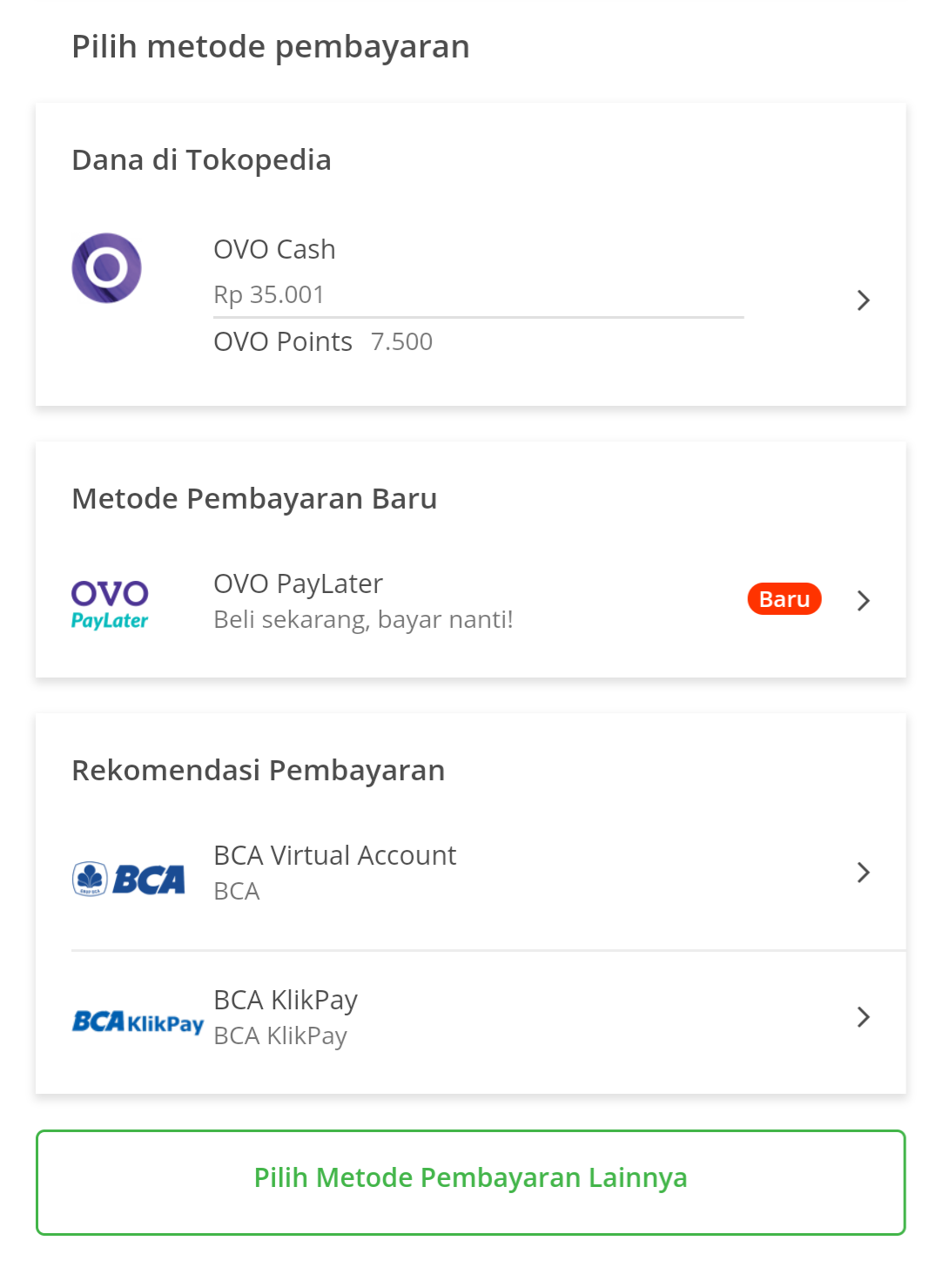

Tokopedia is further expanding its partnership with Ovo to improve services to its users by releasing Ovo PayLater, a virtual credit card for payment transactions on Tokopedia.

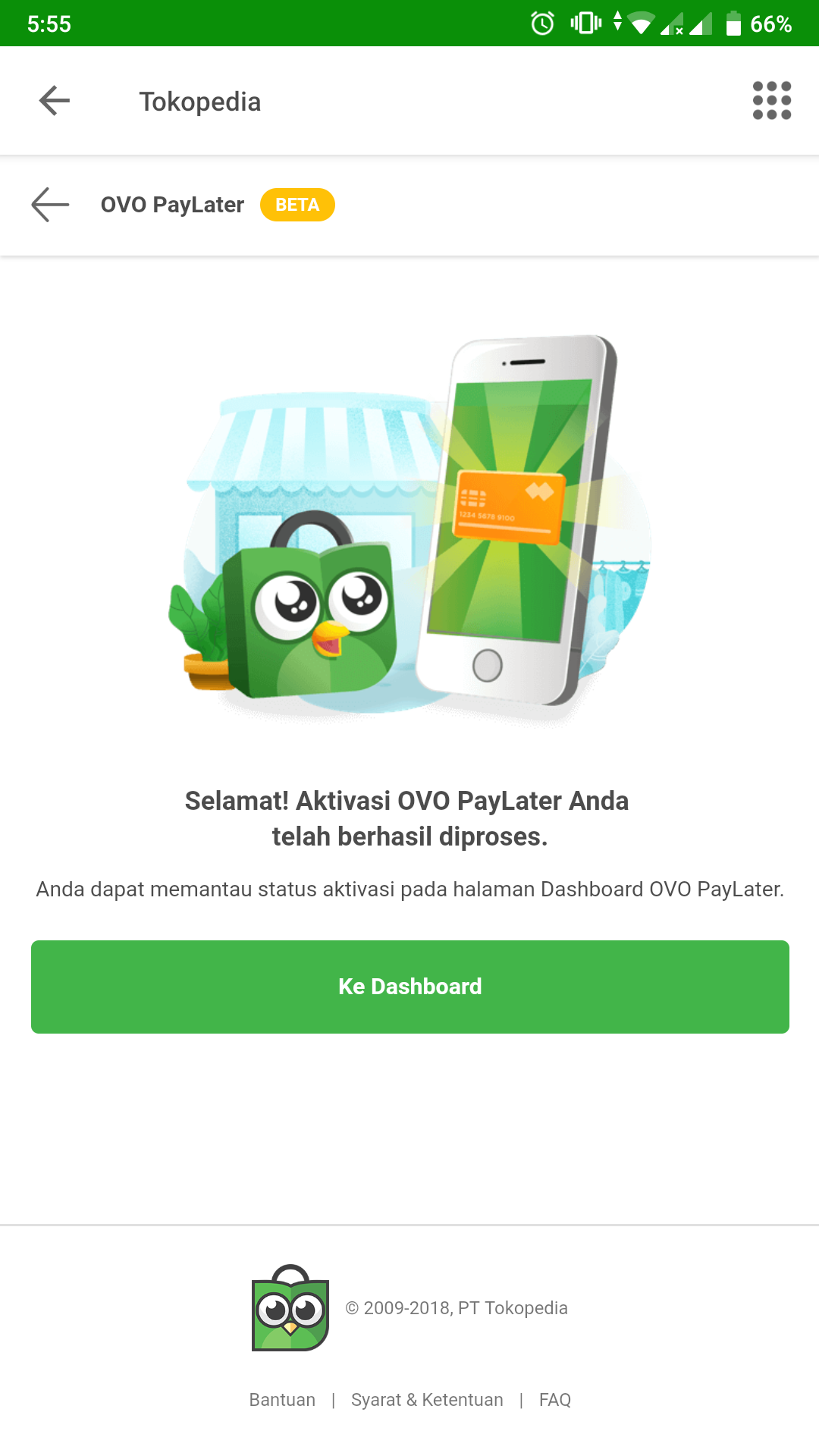

According to monitoring DailySocial, since it was first released in early January 2019, not all users have received this facility. Party Tokopedia was not ready to give an official statement regarding this matter.

Judging from the explanation in the site, Ovo PayLater is the latest payment method in the form of a credit limit to pay for transactions on the Tokopedia site or application only. The credit limit provided by Ovo PayLater comes from: Taralite, startups .

However, this credit limit cannot be used for credit installment payments, credit card bills, gift cards, e-money, donations, zakat, mutual funds and gold. To apply for this facility, users only need to verify by uploading their ID card and taking a selfie with the ID card. The results of the submission will be notified within 1x24 hours.

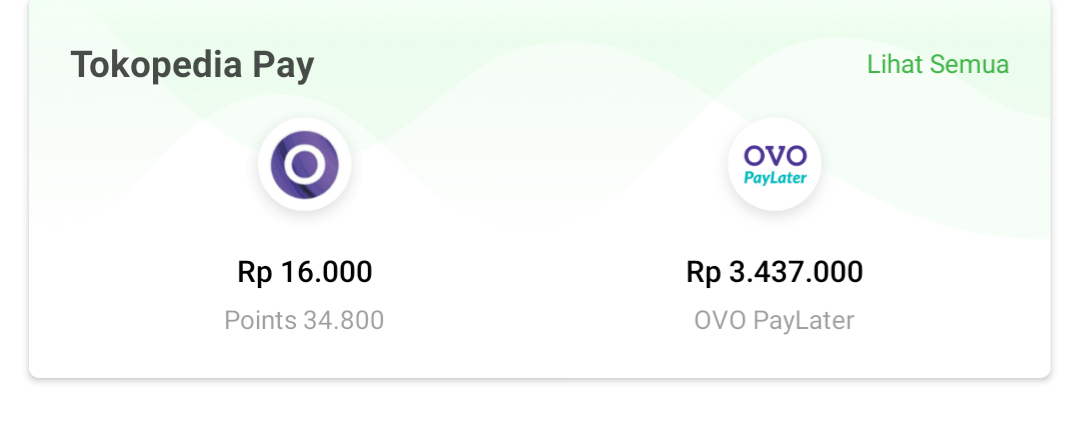

Once the application is accepted, the user will get a credit limit and use it for a minimum transaction of IDR 10. There is a 5% service fee for users every time they make a transaction using Ovo PayLater.

Billing will be submitted on the 27th of each month. Users can choose to pay in full or in part. This concept is very familiar when transacting with credit cards in general. If there is a late payment, the user will be charged 0,1% interest per day.

Ovo PayLater can only be enjoyed by Tokopedia users who live in Greater Jakarta, Bandung, and Surabaya with a minimum account age of four months.

Taralite himself, before becoming a partner for Ovo PayLater, also partnered with technology companies such as Tokopedia, Lazada, Doku, Hacktiv8, and Jurnal. However, the services provided are more directed towards the development of productive businesses.

In the opportunity previously, Ovo CPO Albert Lucius has explained this year Ovo will expand financial services, ranging from insurance, online installments without a credit card, and online loans. All of these services will be available in parallel in the first quarter of 2019.

In other words, there are already two partnerships that Ovo has announced, namely with Taralite for online installments without a credit card, and Do-It for online loans.

Sign up for our

newsletter