Tiket.com Collaborates with Indodana to Release Paylater Features

Can only be used by users in the Greater Jakarta, Bandung, and Surabaya areas

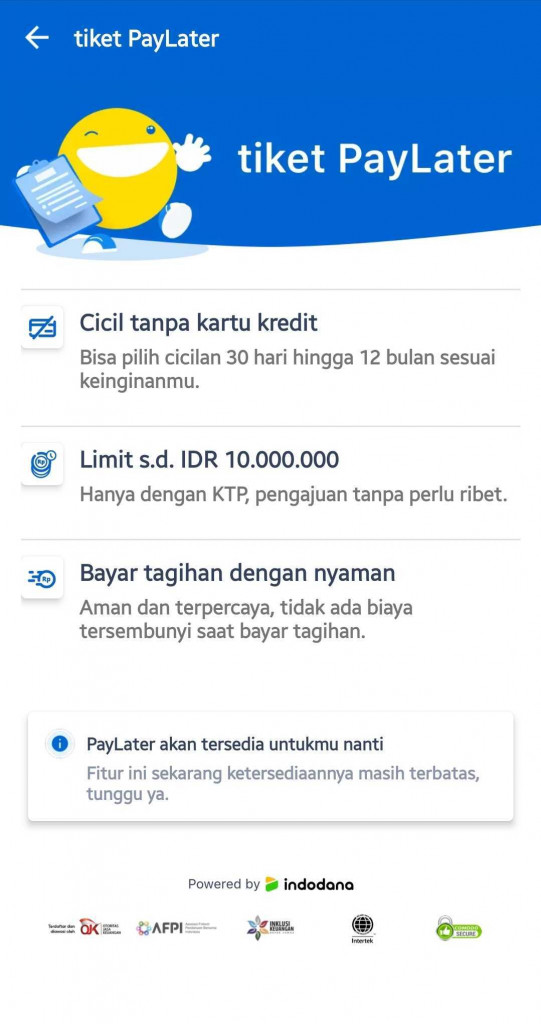

Tiket.com finally launches the product paylater, allows users to get installment facilities without a credit card limit of up to 10 million rupiah with a tenor of up to 12 months. In the latest update of the app, it was announced that this feature has only been rolled out on a limited basis.

In financing, Tiket.com cooperates with the platform p2p loans Indodana. Previously, it was known that Indodana was part of Cermati. While Cermati and Tiket.com are under under the same investor.

The plan to launch Paylater Tickets has actually been circulating since the beginning of 2019. As quoted DatawordAt that time, the Co-Founder & CMO of Tiket.com Gaery Undarsa said the feature was being finalized and planned to be launched in the second quarter of 2019. He also said, Kredivo chosen as partner fintech providing funding. But in the end, the plan to realize the feature was delayed and the cooperation between the two companies was not continued.

Quoted from Tiket.com official page, service paylater This can only be used by users who are domiciled in the Greater Jakarta, Bandung, and Surabaya areas. The submission verification process will be carried out quickly, between 15 minutes or a maximum of 1 working day. Paylater tickets can be used to pay for all product variants in the Tiket.com application, except Pay at Hotel services.

Indodana focuses on working on products paylater

Currently, Indodana has registered and licensed status from the OJK. Some time ago DailySocial had the opportunity to interview Ronny Wijaya as the President Director of Indodana.

He said, "We are currently focusing on developing the product paylater to provide convenience for people to shop now and pay later. To do this, Indodana has collaborated with online merchant and also players e-money."

Last month, Bukalapak and Indodana also just released "Pay Tempo" feature, solution paylater for partners to develop their businesses.

According to the company's internal statistics, the Indodana application has been downloaded by more than 3 million users throughout Indonesia. So far they have disbursed around 1 trillion Rupiah for 30 thousand customers, both for personal and SME borrowers.

Paylater the other

Previously several platforms were rolled out service paylater. Mostly partnered with fintech, although some have started to cooperate with banks to provide financing. Interestingly, several platforms are starting to be established fintechitself to accommodate these needs – with various business schemes, through subsidiaries or acquisition processes.

For example, Findaya is devoted to supporting loan/capital services in Gojek. Then Caturnusa started facilitating services specifically paylater on Traveloka. Then there is Lentera Dana Nusantara which is specifically affiliated with Shopee's financial services.

More Coverage:

Product availability paylater on various platforms, it is suspected that users' needs for credit services amidst stagnant credit card penetration. BI statistics as of November 2019 explained that the number of credit cards in circulation was 17,38 million units, a slight increase of 0,65% on an average basis year on year.

-

Disclosure: Both Cermati and Tiket.com are still affiliated with DailySocial under the umbrella of GDP Venture and Djarum Group

Sign up for our

newsletter