Leveraging the Potential Behind Indonesia's Billing Sector

Technological innovation support has a very big role in service development

The financial technology (fintech) ecosystem in Indonesia is experiencing very rapid development. Innovations in the financial services sector driven by the development of fintech in Indonesia are able to encourage financial inclusion, increase literacy of the Indonesian people, and have a positive impact on the economic situation triggered by the growth in the volume and value of spending transactions.

The growth in transaction volume and value was also experienced by the bill payment industry sector. As one of the most common types of transactions carried out by the public, the bill payment sector is an industry with enormous potential.

The Potential Behind the Billing Sector

The magnitude of the potential in this sector is influenced by two things. First, the very large number of customers, which includes almost the entire population of productive age and adult age in Indonesia, which will reach more than 200 million people in 2020. This demographic segment has the need to pay various types of bills, ranging from electricity bills, BPJS contributions. health, credit, internet data packages, education fees, rental and maintenance costs for houses or apartments, and so on.

Second, most bill payments are recurring types of transactions. Different from several other product categories, which can only be purchased once every few years, bills such as electricity and water are mandatory needs that must be paid every month. Other non-essential bills, such as cable TV and other entertainment services, also tend to have a fairly long subscription period, so the potential for recurring transactions is very high.

This is also supported by the results of internal research conducted by let's connect, an Open Billing Payment Network provider company (Open Bill Network) which has more than 3.000 billing products and digital products from 25 categories in its network. Through data taken from the National Socio-Economic Survey (SUSENAS) in March 2020, Ayoconnect found that recurring bill payments (recurring bill payments) contributes to 80% of Indonesia's monthly non-food expenditure. These recurring bill payments consist of housing costs, utility payments such as water, electricity, and gas, education, health, insurance, taxes, telecommunications, and so on.

Digital Technology Support for Bill Payment Services

In the past, paying bills was something that often took up a lot of time and effort, even costs. This is due to the limited bill payment methods and channels and the absence of data integration, resulting in snaking queues at various locations. Advances in technology and the internet provide extraordinary breakthroughs that make various types of bills can be paid anytime and anywhere.

In addition, the Indonesian population also has a fairly high level of internet adoption and digital solutions. Based on a survey by the Association of Indonesian Internet Service Providers in 2020, the penetration of internet users in Indonesia has reached more than 196 million people or equivalent to 73,7% of the total population. In another report released by Katadata in the same year, two out of three Indonesians from Generation Y have used financial services in a combination of conventional banks, digital wallets, and internet banking.

Supporting this data, research conducted by Jakpat from April to June stated that digital wallets are the most preferred payment method by internet users aged 25-35 years. A total of 76% of respondents are also noted to use digital wallets to top-up credit and data packages, and 41% of respondents use digital wallets to pay utility bills.

These findings indicate that technological innovation support has a very large role in the development of transaction payment services, including billing transactions.

Integration Through API As Bill Payment Industry Solution

The many types and numbers of billing transactions that exist also present challenges for billing providers, consumer platforms, and financial institutions. One of the problems in the bill payment ecosystem in Indonesia today is the lack of integration, digitization, and automation between billing companies and companies that provide bill payment services. Performing integration via API (application programming interface) can be a solution to overcome these problems.

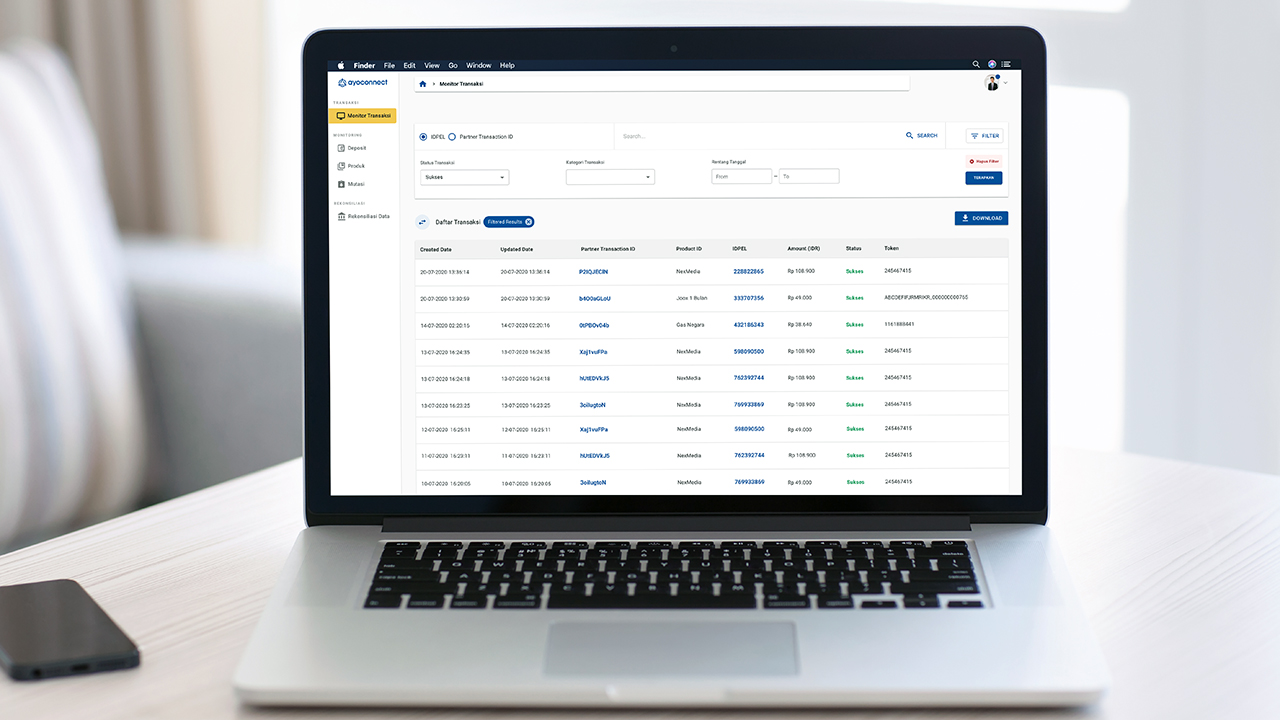

"The Ayoconnect network provides technology-based solutions that integrate various billing products and digital products in one API," explained Ayoconnect COO, Chiragh Kirpalani.

Ayoconnect API allows billing companies -- such as telecommunications companies, apartment managers, educational institutions, insurance companies, and so on -- to expand their payment points quickly and easily. On the other hand, companies that have direct contact with customers, such as e-commerce, banks, retail stores, and other fintech applications, can provide customers with access to 3.000 billing products from 25 categories instantly.

"With a network of billing products and digital products that are integrated and equipped with automation features, the Ayoconnect solution benefits business actors while increasing the convenience of consumer transactions," said Chiragh.

The development of the fintech ecosystem in Indonesia is also part of the growth of the startup ecosystem and technology business in Indonesia. As an information media as well as an innovation company, DailySocial.id always tries to present accurate research data and references regarding the development of the industry.

Supported by Ayoconnect, DailySocial.id has published research results on the development of the fintech ecosystem in Indonesia in a report entitled Fintech Report 2020 which can be downloaded at dly. social/fintechreport2020.

Sign up for our

newsletter