Estimating the Growth of Banking and Fintech Applications Behind Accelerated Digital Transformation

The pandemic is one of the driving factors for acceleration to open up new opportunities

The pandemic period has proven to be a factor in accelerating digital transformation in various fields, including the financial and banking sectors. This makes increasing the use of mobile applications in this sector inevitable. The limited direct interaction with consumers is a new opportunity that is used by service providers.

Although over the past few years the financial and banking sectors have been disrupted by the presence of various new digital innovations, this pandemic period is precisely the catalyst for accelerating the transformation of these sector players in providing access to their products and services.

The factors also come from various directions. Starting from increasing transactions E-commerce, consumer acceptance of digital products, increased investment in technology infrastructure by large banks, and increased consumer relevance for groups born in the digital era. Through this article, we will provide information regarding the increasing use of banking and fintech applications globally, which is summarized from: Adjust's Mobile Finance Report 2020.

Increased Use of Applications for Banking Activities

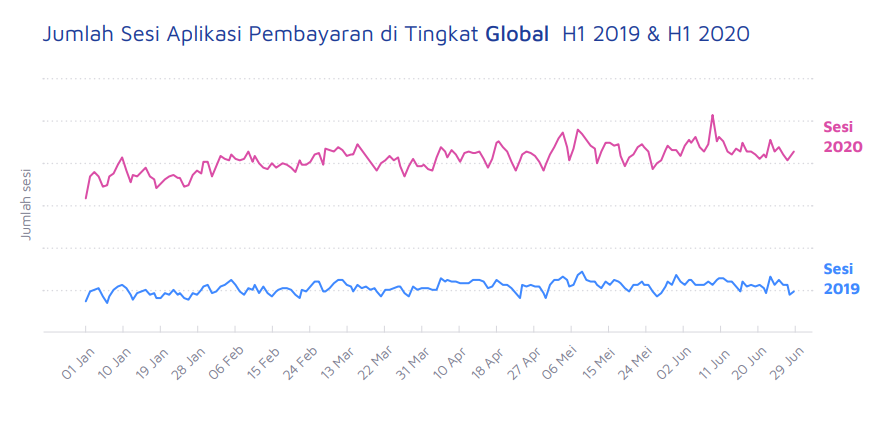

The impact of the pandemic on the activity of using banking applications cannot be underestimated. Restricted physical transaction activities make many customers do banking activities from home. This can be seen from the rapid increase in the number of sessions in banking applications during the first half of 2020. Compared to the same period in the previous year, there was a 26% increase in sessions globally. The two countries that showed the most significant improvement were Japan and Turkey, where there was a 133% and 119% increase in sessions by customers in those two countries.

The impact of the pandemic on the activity of using banking applications cannot be underestimated. Restricted physical transaction activities make many customers do banking activities from home. This can be seen from the rapid increase in the number of sessions in banking applications during the first half of 2020. Compared to the same period in the previous year, there was a 26% increase in sessions globally. The two countries that showed the most significant improvement were Japan and Turkey, where there was a 133% and 119% increase in sessions by customers in those two countries.

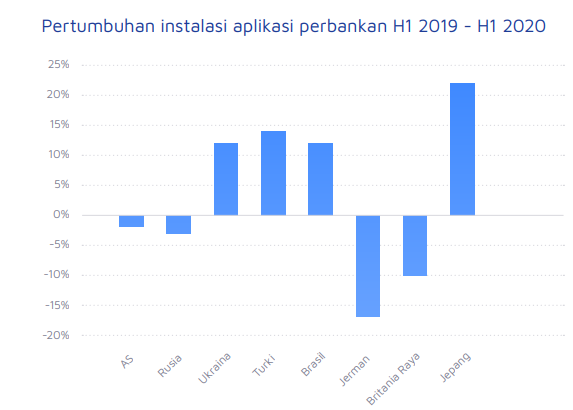

In addition to an increase in usage sessions, the pandemic has also encouraged a growth in the number of downloads for banking applications, especially in developing countries. Compared to developed countries, the number of users who do not have a bank account makes the number of banking application installations in developing countries increase rapidly.

From this data, it can be seen that digital banking services are increasingly in demand and needed by customers due to the limitations that occur during this pandemic. In addition to the increasing number of downloads, users are also spending more time using banking applications.

The Payment and Investment Categories Experience Growth

In addition to the banking sector, rapid growth has also been experienced by technology-based financial service providers fintech. This growth is especially experienced by payment and investment platforms. Based on Adjust's data, we see a 49% increase in sessions in payment applications in the first half of this year compared to the first half of last year. The largest growth was achieved by Japan (75%) and Germany (45%).

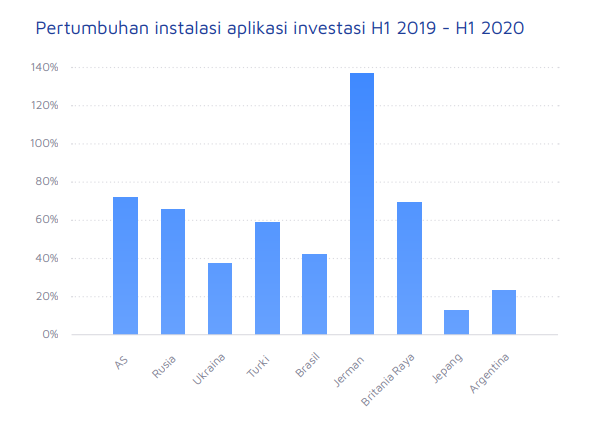

Category fintech Another thing that also experienced an increase was the investment platform. Compared to other financial application categories, the investment category shows a fairly good performance. According to Adjust's data, there has been a tremendous growth in the number of installations as well as a fairly rapid increase in app usage sessions. There was an 88,14% growth in the average number of sessions per day in the first half of the year.

In general, when comparing the performance of this half year with 2020, the number of sessions at the global level for banking applications and payment applications has increased by 26%. Although all countries experienced growth, there were several countries that stood out, such as Japan, which experienced an increase of 142% and Germany, which grew by 40%.

The growth data above can be used as benchmarking for financial industry players, especially in paying attention to the important attributions needed as the basis for future marketing strategies. This growth can also show new potentials related to financial and banking services that are carried out digitally to consumers.

You can also find out more about this report on the growth of banking and financial services applications through Adjust's Mobile Finance Report 2020 which can be downloaded via the following link.

Disclosure: This article is sponsored content endorsed by Adjust.

Sign up for our

newsletter