The Future of "Impact Investment" in Indonesia

Slowly but surely, "impact investment" is growing

How many startups and investors in Indonesia are using environmental, social, and environmental approaches? governance (ESG) or impact investing (impact investing) in running the business? The answer is certainly not much. There are many factors that cause this. However, recently the existence of digital economic entities that pay attention to this aspect has begun to emerge.

Of course, the situation in Indonesia is not as far as developed countries that already have regulations that "force" more players to make impactful investments. In addition to the digital ecosystem here which is still in its early stages, there are a number of factors that make impact investment still limited.

Piotr Jakubowski founded breath with a focus on raising public awareness of the importance of clean air. breather allows individuals or corporations to participate as sponsors in providing air quality sensors.

The challenge, according to Piotr, is that often environmental impact initiatives like the one he created through Breath are associated as a company's charity or CSR program. Not yet the main goal of an entity.

"The future of this category is clear. Science has confirmed the seriousness of a number of environmental issues which could result in the growth of profit-oriented business models that will focus on avoiding damage to our planet," explained Piotr.

Crowde also maintains the importance of environmentally sound business. Head of Impact Investment Afifa Urfani said that the urgency of upholding sustainability values is not only for necessity Branding companies that are momentary in nature, but also for long-term interests.

Afifa gave an example of how Crowde, which focuses on credit in the agricultural sector, is also implementing reasonable restrictions on the use of chemicals, analyzing the impact of climate change on agriculture, mitigating risks related to climate change such as the impact of prolonged drought on capital, and establishing green scoring to assess the capital of a sustainable plan.

"For example, if we invest a certain amount of money in a conventional business. Indeed, the income will be large and almost always instant, but investing in a sustainable business that looks difficult in the future can actually result in costs maintenance which was low after that," said Afifa.

From an investor's perspective, belief in the importance of impact investing can determine the sustainability of a company in terms of resources and finances. This belief is held by ANGIN.

Benedikta Atika, Impact Investment Lead at ANGIN, acknowledged that the growth of impact investment in Indonesia may lag around 5-10 years behind countries with more mature markets. However, because of this, there appears to be huge growth space for impact investment in Indonesia.

In coverage private investment In the early stages, Atika saw that many digital economy players in the country were starting to look at the environmental impact on the businesses they run. The growth of the sustainable agriculture sector, waste management, circular economy, represents a positive movement of impact investment.

"Apart from that, we also observed that several VCs who previously did not specifically pay attention to environmental impacts, are now starting to have exposure to them by having special teams related to impact investing or ESG (Environment, Social, and Governance) investment. Even too launching fund new to this approach," added Atika.

Comprehensive awareness

Even though it is called impact investment, awareness of the importance of this must start from the business people. Crowde and breath represent this by implementing sustainable values into their business model.

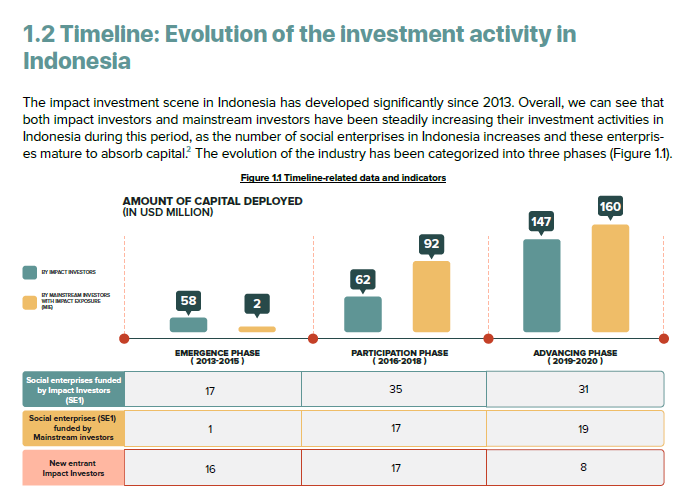

According to Atika, aligning perceptions about investment opportunities with the sustainability mission of business entities is a challenge they face. Based on reports Investing in Impact in Indonesia 2020, there is indeed a gap in the perceptions of both parties. One is very focused on how big an impact their solutions can provide, the other is prioritizing the scalability of solutions that can reach a wider market in the hope of bringing greater financial benefits.

Atika believes that as long as the business model and strategy implemented by the startup is sustainable, investor trust will come.

"In fact, commitment to the environment must come from the startup itself and embedded in the business model, not as a "mandate" from investors. "This commitment will then be reflected in the business strategy and its implementation," said Atika.

Crowde has at least practiced that. They have won the trust of a number of investors. This trust was gained because their entire team had equal awareness of the importance of the impact of their business on the agricultural environment.`

Crowde is one of the few startups that prepares environmental impact reports for the businesses they run. The distribution of knowledge and awareness is not only held by company officials, but also all employees.

"Such as approving a draft budget for farmers' costs for capital using certain chemicals that exceed dosages, will not reach the ears of the CEO. This requires awareness not only from agents in the field, but also supervisor at HQ," explained Afifa.

The pandemic accelerated the process

Market tastes can determine investment tastes. Shifts in societal behavior will influence business actors regarding sustainability issues. We can take the example of the increasing public enthusiasm for clean energy products which were finally captured by startups newenergy. However, it usually takes a long time to shift human behavior until it becomes a new habit.

The pandemic accelerated this process. Piotr said that public awareness of clean air has begun to increase rapidly since the Covid-19 outbreak took place. A study from Harvard University shows that there is a higher death rate due to Covid-19 in areas with more concentrated PM2,5 pollution.

Afifa also sees something similar in the agricultural sector. When the pandemic hit the global economy, investment in the food sector emerged as a major highlight. Increasing productivity has always been the main focus of the food sector without, almost without mentioning sustainable aspects. In fact, according to Afifa, there are quite a lot of incentives from the government and private sector that encourage investment in startups that address sustainable issues as stated in the SDGs.

"Before the pandemic, investment in the agricultural sector was considered a 'futuristic' concept intended for future generations - which is clearly a wrong conception. However, with the hard blow during the pandemic, investment in the food sector has finally become the main focus for economic growth, not only inclusively but massively," added Afifa.

Growing awareness in the digital economic ecosystem also requires a long-term approach. Atika believes that people often only rely on financial reports as a reference for business expenses. However, health, welfare and access can also be counted as non-financial burdens.

These indicators should be used to measure whether their business can make a better contribution to the environment. No less important, according to him, pursuing sustainable values can still go hand in hand with the financial targets of a business entity.

"Again, reflect on the mission and vision of the organization about what approach is the most feasible to take, both in terms of solutions, value chain, as well as business processes," concluded Atika.

Sign up for our

newsletter

Premium

Premium