The Future of Digital Banking in Indonesia

Banking in Indonesia is already at the point of changing and embracing the arrival of innovation from the digital world

Innovation in the world of technology that continues to grow rapidly has proven to have brought many changes in society. Finance is one sector that feels the impact of these innovations and now the term fintech (financial technology) slowly began to sound wider. Then what about the fate of financial institutions that first appeared like banks in the midst of this innovation?

Together with Indonesian Loan launch a few days ago, a forum initiated by Borrowing with Veryfund called the Indonesia Fintech Forum was also held. The topic that was brought was "The Future of Digital Banking in Indonesia". It's interesting, consideringfintech start crawling up slowly in Indonesia today.

Indonesia's current banking landscape

Innovation. That is the most important element needed by the banking world today in Indonesia, even the world. Admit it, financial products that are born from the belly of banking today are not so "attractive". This cannot be separated from the condition of the banking system itself, which is in a position as a corporation.

“I believe before talking about innovation you must know the landscape from where you will play the innovation. [..] What is the current market condition and what will be the market condition in the future,” stressed Maybank Indonesia Chief Strategy Officer Charles Budiman at @america.

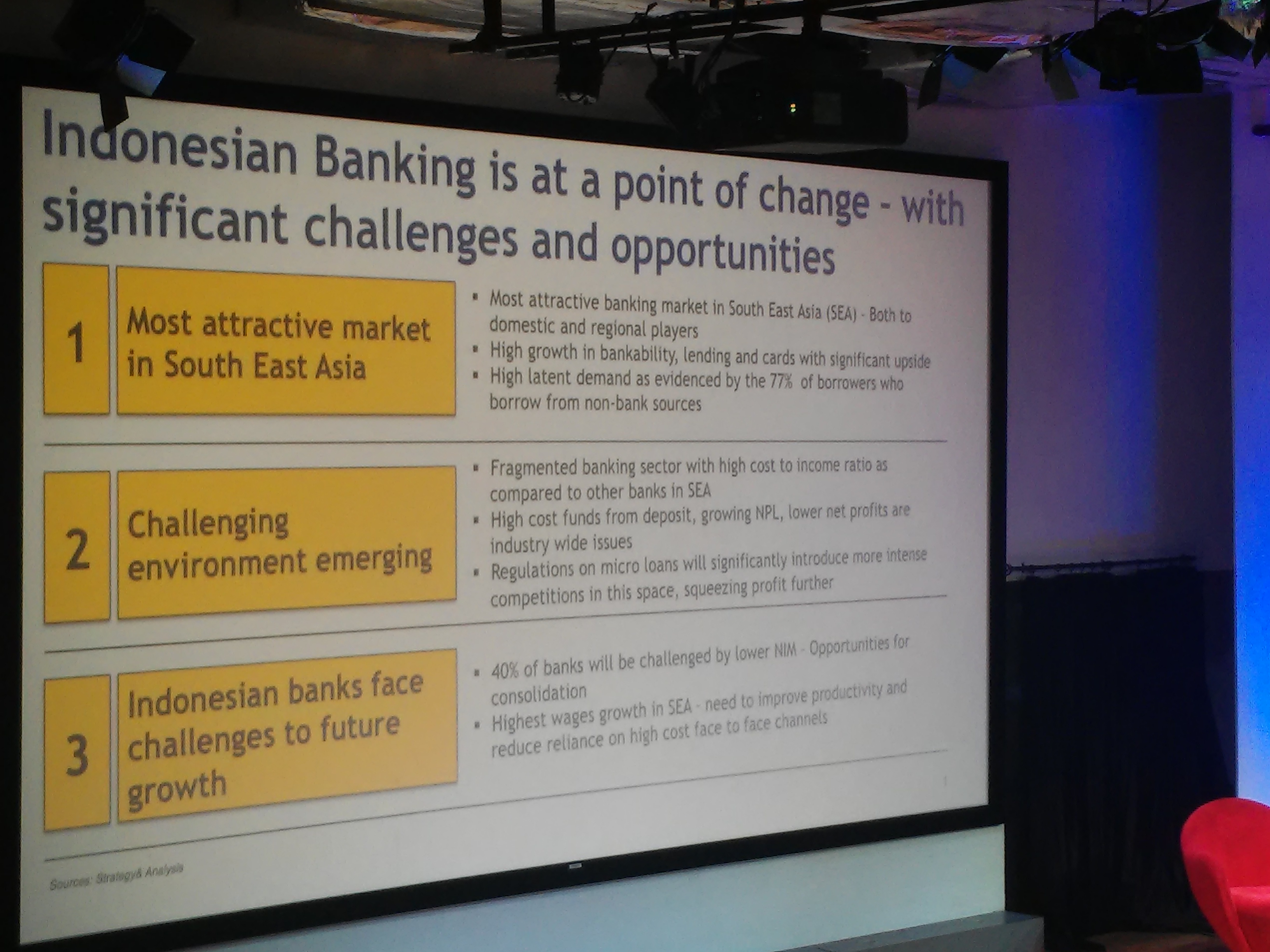

Broadly speaking, according to Charles, the banking landscape in Indonesia can be grouped into three main things. From Indonesia's position in Southeast Asia, the challenges are in the form of emerging environments, and also how banks in Indonesia can grow in the future, especially in welcoming the ASEAN Economic Community (AEC).

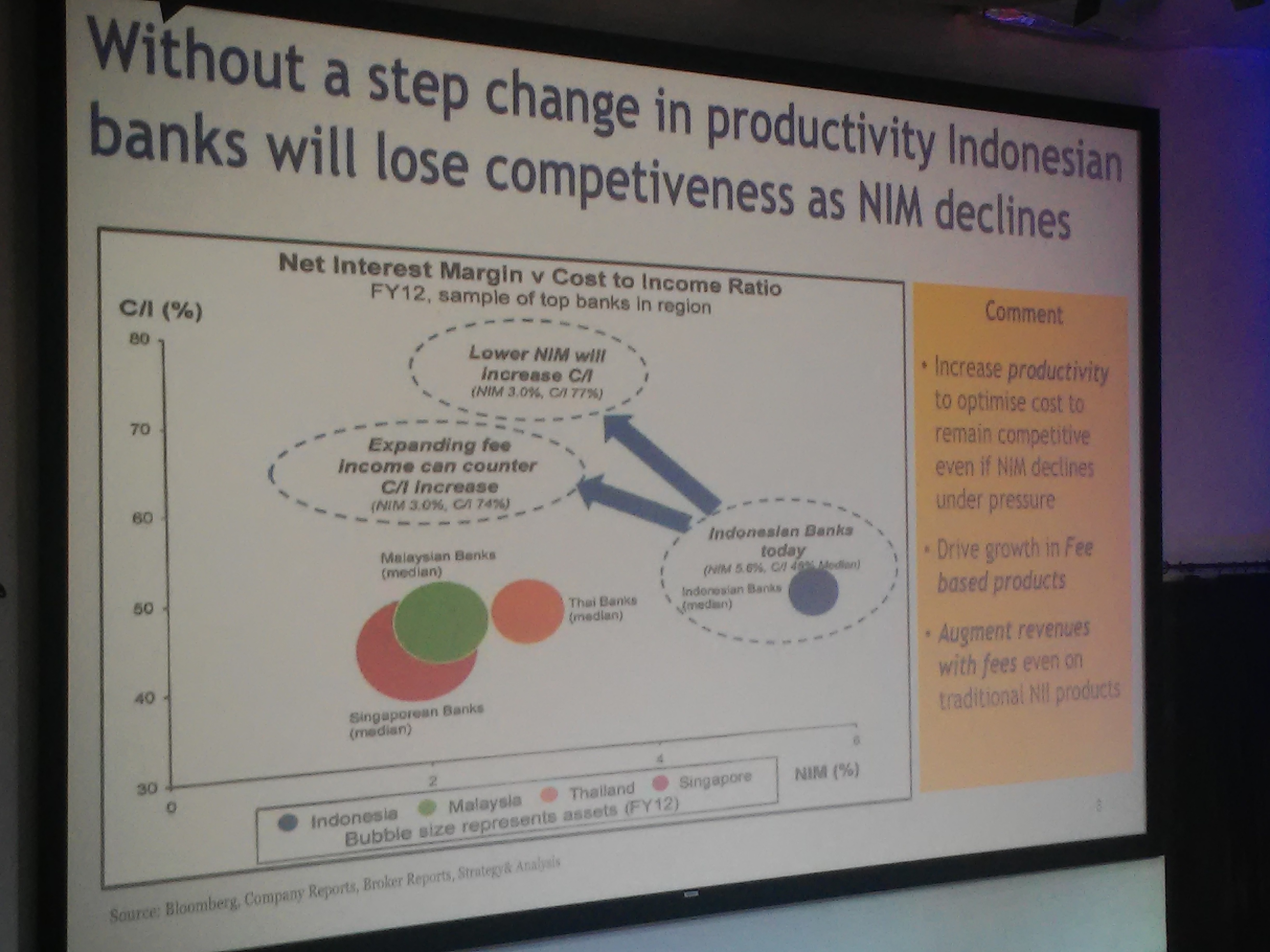

Charles said, “Currently the condition of the Net Interset Margin [NIM] of Indonesian banks is relatively high when compared to other banks in the Southeast Asia region. [..] But without a change in terms of productivity, banks in Indonesia will lose their competitive [side] with a decreasing NIM value but [value] Cost to Income Ratio increase. [..] This will be bad news for us [Indonesian banking industry players].”

Collaborating together with digital world innovation in finance

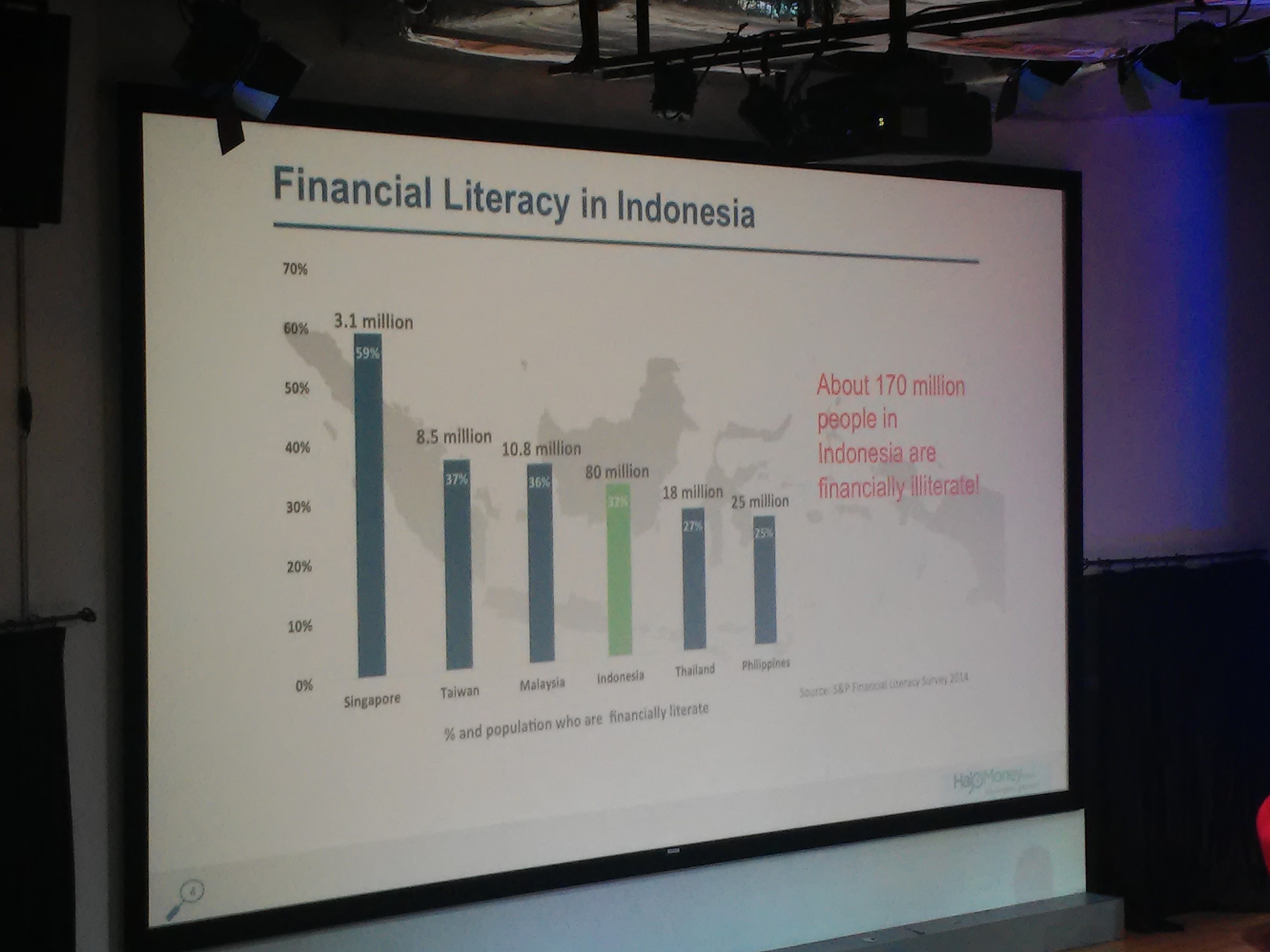

Indonesia as a developing country does have many challenges to solve in various sectors, including in the financial industry. Indonesia is currently still listed as a country with a fairly low level of financial literacy, only 32 percent.

This year is indeed not the year that fintech gets the spotlight, such as the e-commerce industry that has begun to mature or applications made by the nation's children. Even so, there are actually several digital startups that have started to surface in Indonesia's digital ecosystem. Even the emergence of these various fintech startups can make banks afraid of losing market share they.

Even so, change can never be done alone. The role of various stakeholders is needed to collaborate together in growing the ecosystem. Especially in the financial industry that is already well established with all the regulations that cannot be swayed arbitrarily.

Deputy Director of Bank Indonesia's Electronification and Financial Inclusion Program Ricky Satria said, “We need 'Fintegration'. Fintech collaborates with banks to overcome all challenges in this business [finance and banking].”

“You might be able to come alone [to play in the industry as a startup fintech]. But, you also need in-depth management [knowledge], consumer protection, and how to run [financial] management to grow the business,” said Ricky.

Sign up for our

newsletter