Crypto Industry Grows Rapidly, Generates 246,45 Billion Rupiah in Taxes

The imposition of taxes on crypto transactions in Indonesia has taken effect since 1 May 2022

The government's awareness of the rapid growth of the crypto industry in Indonesia has driven the policy of imposing taxes on crypto transactions. In accordance with Minister of Finance Regulation (PMK) Number 68/PMK.03/2022 concerning VAT PPh, the government views crypto assets as a commodity that meets the criteria as a VAT object. These provisions come into effect on May 1, 2022.

Based on the Final Publication of APBN KiTa January 2023 Edition, tax on Crypto transactions when referring to PMK 68/2022 Article 19, is subject to Income Tax Article 22 to Sellers of Crypto assets, PMSE Organizers, and Miners of Crypto Assets (miner). Meanwhile, the subject of Crypto VAT or those subject to VAT on Crypto asset transactions are Buyers of Crypto assets and Sellers of Crypto assets.

When translated per type of tax, Crypto Tax is the result of the receipt of Income Tax Article 22 on Crypto Asset Transactions through PMSE DN Operators, as well as self-depositing of DN VAT on Collection by Non-Treasurers.

Not long ago, Indonesian Deputy Minister of Trade Jerry Sambuaga revealed that the accumulated crypto tax as of December 2022 reached IDR 246,45 billion. In detail, the total income from PPh tax was IDR 117,44 billion and VAT was IDR 129,01 billion.

This figure represents 53,55% of the total tax on crypto transactions and Fintech P2P Lending tax which is worth IDR 456,49 billion. "The contribution of crypto transactions to the country, compared to other countries, such as South Korea and India, is proportional," he added.

Chairwoman of the Indonesian Blockchain Association (ABI) Asih Karnengsih also said, "Even though the crypto tax was only implemented on May 1 2022, it can already reach IDR 246,45 in December 2022. The Indonesian Blockchain Association and other Crypto players believe that the development of the crypto sector will continue to grow in line with developments in regulations and public interest."

Use of crypto tokens in Indonesia

Entering 2022, the crypto market is said to be experiencing a period bear market. Referring to the Investopedia site, bear market is the condition in which the value cryptocurrency has fallen at least 20% and continues to fall. For example when it happens cryptocurrency crash In 2017, investors saw Bitcoin fall from US$20 thousand to US$3.200 in a few days.

This condition also has an impact on the number of crypto transactions in Indonesia which has decreased and is only worth IDR 266,9 trillion. This figure decreased 68,9% from the previous year at IDR 858,76 trillion. Regarding this, Jerry said, "The contribution of crypto transactions to the country, compared to other countries, such as South Korea and India, we are proportional."

Nevertheless, crypto platform users who have passed the stage know your customer (KYC) is said to have increased to 16,3 million users. In fact, the number of crypto users in this country continues to increase, from only 11,2 million users in 2021, increasing by 48,7% in November 2022 to 16,55 million users.

Apart from that, Jerry also sees export potential in tokens issued by local projects. He said there were 10 local tokens out of 383 tokens that had been approved by Bappebti. The local tokens in question include Toko Token (TKO), LDX Token, Zipmex Token (ZMT), NanoByte (NBT), TadPole (TAD), ASIX Token (ASIX), Leslar, Pintu (PTU), Vexanium (VEX), and Tokenomy (TEN).

According to Jerry, the concept of crypto assets and blockchain will have a broad influence and change the pattern of trading economic regulation to be based on market authority and community. One thing that is of concern is the need for the presence of an institution that regulates and supervises the crypto industry regarding consumer protection.

Asih added, "We recently held an audience with the OJK and also conveyed the potential of establishing a Crypto Exchange which could help monitor trading and innovation in crypto assets in the future. We hope that in the future, the inauguration of this Crypto Exchange can help the Crypto industry in Indonesia and develop Blockchain technology as a whole.”

More Coverage:

The Ministry of Trade and CoFTRA are also said to immediately realize this by hastening the launch of the crypto exchange which is targeted to be released before June 2023. The Indonesian Crypto Exchange will act as a "regulator" in the crypto industry with the aim of preventing certain parties from monopolizing the market.

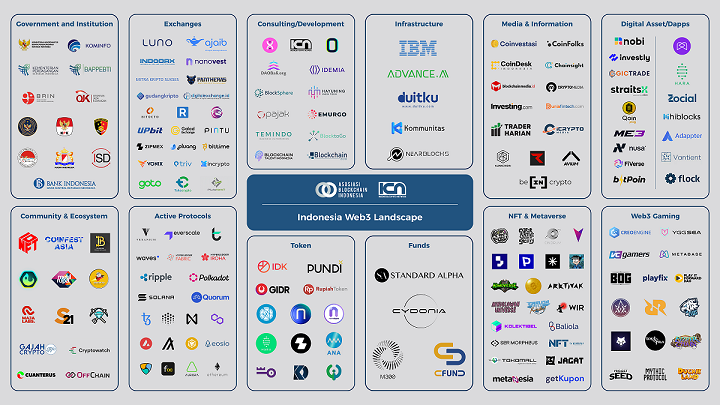

The "Indonesia Web3 Landscape and Crypto Outlook 2022" report released by the Indonesian Blockchain Association (ABI) and Indonesia Crypto Network (ICN) shows that there are 569 companies or startup registered in the system Online Single Submission (OSS) which is included in the category of "Blockchain Technology Development Activities" with the Standard Classification of Industrial Business Fields (KBLI) 62014.

Sign up for our

newsletter