A Year's Flashback of Tech Startups Starting to Take the Floor on the Indonesia Stock Exchange

Dive into the journey of three technology companies that have "go public" in the capital market

The journey when starting a company does need ups and downs, it must be colorful because it doesn't always run smoothly. Some take years and some quickly skyrocket. The lesson that is definitely needed is that building a company requires the best talent, products that consumers need, proper marketing, and of course strong capital.

Listed as a public company (tbk) on the stock exchange, go public or also known as IPO (Initial Public Offering) is one of the ways get capital. Companies generally look at this potential because it is easy to get additional fresh funds in a relatively fast time.

The option to add fresh funds is also varied, it can be in debt by issuing debt securities or issuing new shares in the form of rights issue. The performance of a flashy public company, of course, will attract public investors to invest. Just check the list of companies listed in blue chip stocks, such as BCA, BRI, Bank Mandiri, Telkom, Astra International, Unilever, Indofood, HM Sampoerna, and others.

Stock blue chips are stocks that are at the top with large market capitalization numbers. Generally they are long listed, have stable performance, large assets, and are widely recognized as market leaders in their sector.

To make the stock market more vibrant, the Indonesia Stock Exchange (IDX) and OJK are active in encouraging companies to list their shares, including startups or those classified as technology companies. Every move is taken to attract startup founders interested in being listed as a public company, until the latest effort is a plan to create a company acceleration board.

Since startups boomed in Indonesia, including the emergence of four technology companies that obtained unicorn status, there have only been three (following Passpod at the end of the year) which already on the floor. They are kiosk, MCASH, and NFC have been listed on the development board. The last two companies are members of the Kresna Graha Investama group.

Kioson is capitalizing on the momentum as the first technology company to take the floor. Its shares have been trading since 5 October 2017. MCASH followed less than a month later, on 1 November 2017, then NFC on July 12, 2018.

According to Indef economist Bhima Yudhistira, the lack of interest in startups is related to complicated and expensive requirements, including valuation and audit fees. Basically startups avoid excessive financial disclosure. There are concerns that the public or competitors can find out the contents of the startup kitchen, both from the financial condition and management strategy.

"They also want investor intervention to be limited, for example, the question of operational management is left to the management chosen by the founder. If the company is public, after the IPO, the directors must be chosen by the public. founder so it's reduced," said Bhima to DailySocial.

"Until the valuation reaches a certain level, only [startup] can think of an IPO," he continued.

IPO is not synonymous with exit strategy

Often IPOs are associated with exit strategy create startups. Apart from the IPO, exit strategy Another common practice is mergers & acquisitions (M&A), selling companies, becoming "cash cow", or the worst is liquidated and closed.

Many examples have occurred in Indonesia of exit strategy this. Quite well known are the merger between Berniaga.com and Tokobagus to become OLX Indonesia, the acquisition of Tiket.com by Blibli, or the acquisition of Lazada by Alibaba.

Bhima believes that the IPO is exit strategy for the founder to sell part of his shareholding, while the Co-Founder & Managing Partner of East Ventures Willson Cuaca take it not as a start, not really exit, but milestone startup

Not the beginning because the IPO occurred after the company had been operating for a long time. No exit also because IPOs are only one way of raising funds. After the IPO, the company will continue to grow to become bigger.

"Different pre-IPO and post-IPO for companies only in shareholders-his. If pre-IPO owner private, whereas post-IPO is public. Meanwhile, for investors, the IPO provides liquidity options to investors," explained Willson.

For the three companies that have IPOs, this corporate action is considered the first step to become bigger. For Kioson Co-Founder and CEO Jasin Halim, IPO is a strategy that never crossed his mind from the start when he first started the company in 2015.

Kioson initially obtained funding from Mitra Communication Nusantara (MKNT) in the middle of last year for the Pre-Series A stage. The company also met with investors to start raising funds from VC, PE, to corporates. No one is matched because there are several incompatibility, one of which is the calculation of the valuation.

After MKNT came in, then Kioson was helped by their network to learn whether the IPO was possible for startups, whether there were rules that hindered it, and so on.

“Because you could say, at that time we were in a position to find fresh funds in a short time. Meanwhile, going through VC is fast and out of our control. Incidentally, there is a fitting momentum, there are no startups that have IPOs, regulators are starting to aggressively encourage startups, the government is pushing for e-commerce. It was a very important moment,” said Jasin.

Managing Director of Kresna Graha Investama (KREN) Suryandy Jahja agrees with Willson's opinion. Jahja saw the IPO was milestone for greater growth opportunities. Therefore, KREN is quite active in encouraging its subsidiaries to be listed on the stock exchange.

KREN routinely conducts review whichever is deemed ready. If there is, it will be pushed immediately. Other considerations are also seen from various metrics. Is it fundamentally ready for an IPO, ready for expansion, and last but not least there is a desire to grow with a good profile.

Once registered, there are responsibilities to institutional and retail investors. They must always be transparent and uphold good corporate governance (good corporate governance / GCG). These two things are sometimes forgotten and ignored by startup actors.

“KREN is not reckless in encouraging its subsidiaries to listed. Only those who are ready and in the near future already profitable so that they have funding the strong one. Every three months we always check their performance,” said Jahja.

“So we think the IPO is the first step for the company to start growing. We believe that the company can grow faster because there are fresh funds from the IPO that can be used immediately. If it's a good company but doesn't have the money to expand, it's time to ask Kresna," added Jahja, who is also a Director at MCASH and President Commissioner at NFC.

Post IPO journey

Today Kioson marks its first year listed as a public company. Just to recall, Kioson released 150 million shares or about 23,07 percent of the total issued and fully paid capital after the IPO. The price of Kioson's shares was offered at Rp. 300 shares and fresh funds of Rp. 45 billion were obtained. In early October, Kioson's market capitalization was already above Rp2 trillion.

Jasin said, since the IPO, what has been most felt is Kioson's visibility has increased digital startup first successful IPO. These profits are used to partner with many parties so that the company's performance continues to improve.

Looking at the financial statements in Q2 2018, Kioson earned a net profit of IDR 4,8 billion. Net sales of Rp1,27 trillion from the same period in the previous year of Rp47,7 billion. The increase was in line with the company's total assets to Rp263,9 billion, an increase of 5,69%.

The largest sales contribution was from digital products of Rp1,27 trillion, followed by e-commerce products of Rp5,38 billion. However, the cost of goods sold also increased by Rp1,25 trillion from the previous Rp45,75 billion.

"That's why we continue to improve Kioson's business performance, because this is something that must be considered because it holds a mandate from the public to improve the company," said Jasin.

The Company is increasingly varied in presenting its products. The last one is an OTA service that the public can buy through Kioson agents and do top up electronic money products.

"Vertical and horizontally we will continue to present various products for the public and make it more attractive for agents. We want to be the most complete one at an affordable price.”

Meanwhile, MCASH sold 25% of its new shares or equivalent to 216,98 million shares to the public from its fully paid up capital. At that time the shares were sold for Rp. 1.385 per share. As a result, the fresh funds received were more than Rp. 300 billion. MCASH's capitalization has now crossed the Rp3 trillion mark.

“MCASH since listed last year grew by an exponential percentage, well above projections. Revenue grows many times, good profit. Just after listed, the company is much stronger and good. We can get a lot of business opportunities, many people know us, even though before listed there is no such opportunity,” said Jahja.

Based on the performance of the first semester of 2018, the company's net profit shot up to Rp45,05 billion, even though in the same period last year it was only Rp.3,79 billion. Revenue became Rp1,83 trillion from the previous Rp474,86 billion. Meanwhile, assets grew to Rp745,1 billion from the end of 2017 of Rp568,4 billion.

MCASH distribution is spread over hundreds of points through four main sales channels: digital kiosks, networks Wholesale, cashier, and app/chatbot. Digital kiosks managed to penetrate 1.700 units spread across various points, while digital agents also rose to 36 thousand people.

MCASH sells various digital content, ranging from game vouchers, restaurants, credit & data packages, and more. It is claimed that MCASH's daily transactions in June 2018 were around 340 thousand, even reaching 505 transactions.

For NFC, even though it's just on the floor, the company publishes its performance as of the first quarter of 2018. Revenue grew 15,8 times to Rp265,24 billion on an annual basis. year on year, while net income was recorded at Rp2,54 billion. Assets grew 233,6% on a basis year-on-year to Rp. 77,15 billion.

NFC offers prices on day one listed for IDR 1.850 per share. As many as 25% of the new shares were released from the total shares or the equivalent of 166,67 million shares. From there, NFC pocketed IPO funds of IDR 308,33 billion. Since listed on 12 July 2018, NFC's market capitalization is now at Rp1,6 trillion.

NFC is engaged in the digital business with two main business lines, namely telephone credit exchange, which is a digital pulse marketplace platform, and TV streaming service Oona with Telkom.

Jahja said, “Many things have happened and will continue to happen in the future. Each director is required to continue to innovate, collaborate, and focus on results. This will continue after the IPO.”

Getting fresh funds from the public in an instant must be paid with no less big responsibility. One of the responsibilities, as stated by Jahja, is to always be transparent and uphold good corporate governance.

Every three months a public company must hold a public expose to announce performance, use the services of auditors and consultants for financial reports, and disseminate information to the public to ensure that all parties receive the same information.

“Have access funding What is clear is that bookkeeping can be seen regularly, on the international radar, and every thing we do the public must know because it is obligatory to be transparent. The negatives, in my opinion, are almost non-existent, they just have to be more bothered because they have to tell the public. But it doesn't matter," said Jahja.

The three companies declined to disclose the immediate plans for when the corporate action would be held. The reason is because they want to prevent market speculation.

"MCASH and NFC have no plans at all to rights issue or other. We still have a lot of cash," said Jahja.

Jasin added, "We can't discuss it right now. Besides, we don't want to give any information."

Technology company stock movement

It's a shame if we haven't discussed the stock movements of these three technology companies, although it can't be said to be fair because we can't raise them from a fundamental point of view. Because generally it takes at least two years since listed to see the full performance.

Fundamental analysis is intended so that we know whether the company is profitable and worth buying shares. However, it is still possible to briefly discuss the technical analysis side.

The purpose of studying technical analysis is to determine when to enter or exit the market. Panin Sekuritas Technical Analyst William Hartanto helped explain the current and future prospects of the three shares of the three companies.

First, the movement of Kioson shares tends to decline, trading volume is almost non-existent this month. This shows that the company's shares are currently illiquid.

On the other hand, MCASH has the potential to strengthen technically. "MCASH is still good technically," he explained.

Lastly for NFC there is a downward trend. This drop is considered normal because of the new NFC listed and the rise at the beginning listing very "wild".

"So at this time the price has just adjusted to the actual conditions, there is indeed a fundamental element [causing stock prices to fall]. But it's not because the fundamentals are bad, the price is just adjusting."

Bhima agrees with William's opinion. Kioson's stock is highly volatile in the shape of an inverted U-curve.

"This is indeed the hallmark of startup stocks that are listing on the stock exchange. Likewise, NFC from its peak of 3.100 (13/7), after the IPO is now only valued at 2.650 (24/9). There is a significant correction, “explained Bhima.

According to Bhima, MCASH is considered to have good stock increase potential because of the business solutions it offers. The company develops digital kiosks and offers a variety of digital products, such as top up, OTA, and digital vouchers.

“Startup businesses that are related to fintech are generally more lucrative because they turn over profits faster than other types of business.”

Drive passion through the acceleration board

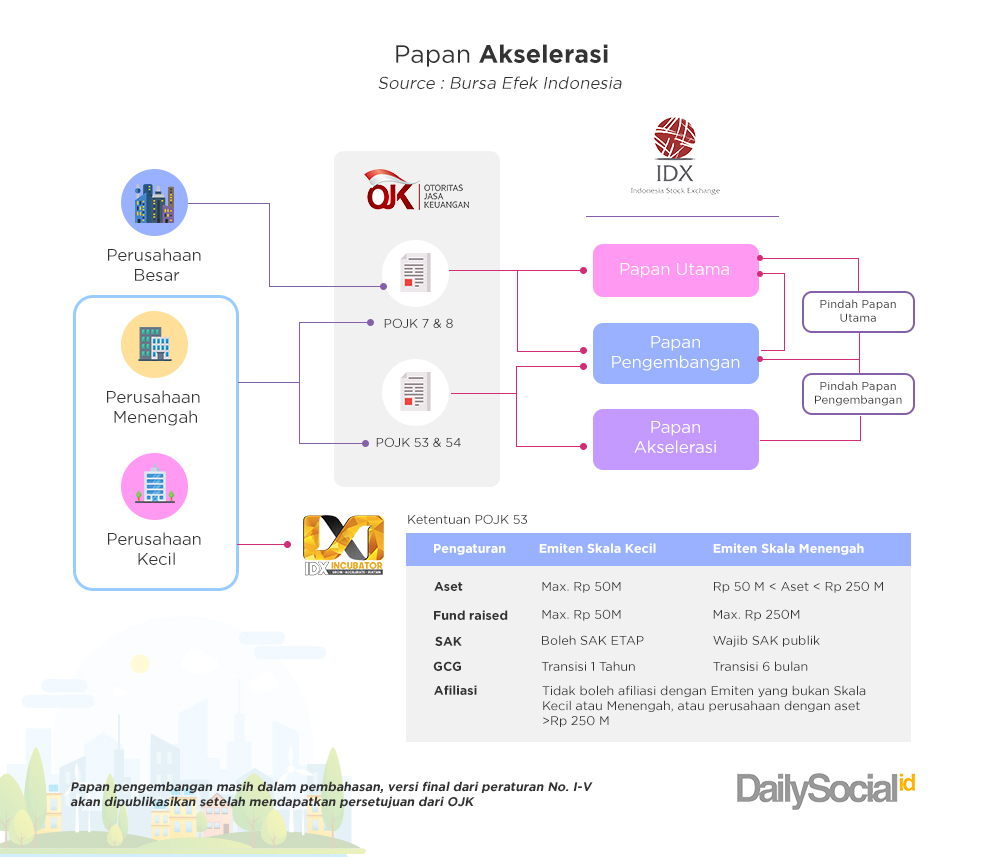

OJK and IDX continue to encourage the capital market to be more attractive to investors. IDX revised the acceleration board rules to make it easier for MSMEs and digital startups to be listed on the exchange. This initiation is the fruit of POJK No. 53 and 54, which were published last year, include the regulation on maximum assets (net tangible assets).

The acceleration board is a recording board specifically designed for MSMEs and digital startups based on different criteria than companies in general. IDX had previously made regulations regarding the acceleration board, but now it has been revised taking into account many inputs from various parties stakeholder.

IDX Director of Corporate Valuation I Gede Nyoman Yetna said the revision had been submitted to the OJK. It is hoped that this board can be implemented before closing this year. According to the latest revision, the IDX has cut many regulations which are considered convoluted and time-consuming.

One of them is the Statement of Financial Accounting Standards (PSAK). For the acceleration board, the guide used is PSAK for Entities Without Public Accountability (ETAP) which is simpler in nature. While companies on the main board and development use general PSAK.

On the development board, the requirements for the GCG standard are also thick. Must include the number of directors, commissioners, and other devices. This is not in accordance with the characteristics of digital startups.

“Startups are beginners, so their characteristics are to think about the business first, how to validate it? market and defend the idea. Boro-boro in the early stages already think company life. So what is taken is PSAK ETAP," said Nyoman.

Next in terms of operating profit obtained. Previously for the development board, the company was required to earn a profit in the second year. On the acceleration board it is decided the period required to reach the profit condition is six years after being registered.

Requirements for listed the acceleration board is also determined based on the amount of assets, only for this metric IDX proposes to use total assets, not from net tangible assets. This consideration was taken because startups generally have more intangible assets (intangible assets) rather than physical assets.

“Back then, we were still trying to build an ecosystem for companies that established first for listed. Now digital startups that we see in the future will be the driving force of the country's economy. That's why now we use the jargon 'Capital Market for All'."

In addition to providing convenience for startups, you can listed, not to forget the new regulations to provide protection for investors. Notification to investors prior to holding an IPO must state that this share offering is adjusted to POJK No. 53 and 54 in 2017 and listed on the acceleration board. This indicates that the company is an MSME and digital startup.

Next there will be a code ticker which will be embedded in the prospective registered company. Generally code ticker consists of four letters. The two steps are expected to be a sign of investor protection, as well as ensuring that the shares traded remain liquid.

"We will also change the paradigm for investors to understand that these characteristics are different from companies in general listed on the main board and development. The way to look at the outlook is not in terms of fundamentals, but from expectations of future prospects."

Nyoman hopes that this acceleration board will make it easier to find fresh funding options for SMEs and digital startups from the capital market. They also do not rule out the potential to attract technology companies that already have unicorn status to realize the IPO step.

"Of course even small ones [SMEs] can [via the acceleration board], let alone Go-Jek [for IPO]."

Willson appreciates the IDX plan. He said, if this is successful, Indonesia will be much more progressive than other countries in Southeast Asia.

"IDX also needs to create a special consulting team for IPOs. The large costs for IPOs are usually in financial, legal and auditing consultations. If the three components were given assistance by the government, then costit can be much cheaper," added Bhima.

Making the decision to be listed on the stock exchange ultimately comes back to the respective leaders of the company. Choosing registered requires a lot of consideration and preparation. After the IPO, there are obligations that need to be fulfilled regularly as part of GCG.

However, behind this complexity there are advantages to be gained, the company becomes easier to identify. Visibility is increased many times over, provoking business collaboration with various parties.

Overseas investors can easily search for companies on the Bloomberg portal. Just type the code ticker before deciding to buy shares of this public company.

So are you ready to go big because of the IPO or wait until it's big before the IPO?

Sign up for our

newsletter