Surge Increases The Initial Funding Ticket Size of Its Foster Startups

Now early-stage startups participating in the Surge accelerator program have the potential to record up to $3 million

After announcing initial managed fund for the Southeast Asia region worth $850 million (more than 12,5 trillion Rupiah), Sequoia India and Southeast Asia through its accelerator program Surge again strengthened their commitment by increasing funding for early-stage startups they foster. Previously they gave seed funding in the range of $1 million - $2 million, now increased to $3 million.

Even in the midst of a slowing market, Surge increased ticket sizes in order to provide founder wider runway and time to get product-market fit; as well as building a strong team before raising the next funding round. This is done by Surge to stay relevant for as many as possible founder, including those who are just starting out as well as those in the process of raising additional capital.

Participants in Surge 08 or later cohorts have the opportunity to get seed funding with the above ticket size. However, Surge also does not close the opportunity for startups in the pre-seed stage to obtain funds with a smaller nominal, for example $300 thousand to $500 thousand. In fact more than 20% of Surge startups were in the pre-launch stage when they joined forces.

To date, the Surge program has been held six times. Across six cohorts, Surge has partnered with 246 founder from 112 startups --- including 45 from Southeast Asia and 64 from India. Startups under the auspices of Surge have collectively raised more than $1,5 billion.

Rajan Anandan, Managing Director of Sequoia Capital India said, “As we expand Surge, we look forward to partnering with future startups that will transform Indonesia's ecosystem in various sectors. For the past three years, Surge has partnered with amazing startup from Indonesia, including Qoala, Lummo, Otoklix, Hangry, CoLearn, Durianpay, RaRa Delivery, Bobobox, Rukita and others.”

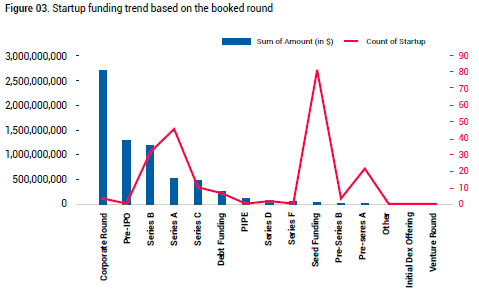

Trends in startup startup funding in Indonesia

Based on reports DSInnovate entitled "Startup Report 2021-2022Q1", the number of funding rounds increased from 113 in 2019 to 214 in 2021. Based on this report, early-stage funding is the most common round.

The high amount of seed funding also implies that there are still opportunities for a new generation of founders to create innovations to democratize certain aspects of the business.

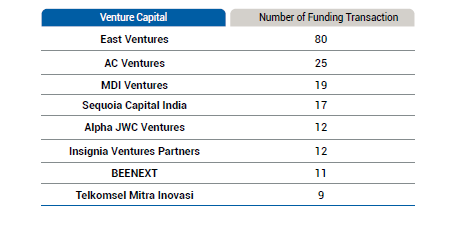

Meanwhile, from all funding rounds, there were around 341 institutional investors involved. This list is filled by each from Venture Capital (VC), Corporate Venture Capital (CVC), Limited Partners (LP), and corporations both locally and globally.

More Coverage:

In this list, East Venture is the VC with the most funding transactions, followed by AC Ventures and MDI Ventures. Sequoia Capital India itself is in the top five of this list with a total of 17 funding transactions. The following is a complete table of investors who channel the most investments in Indonesia.

Sign up for our

newsletter