LODI Logistics Business Penetration Strategy Through Partner Expansion

Cooperate with three companies to support its presence in five cities, namely Flexofast (Tangerang, Medan, Surabaya), Janio (Jakarta), and Kalla Logistics (Makassar)

LODI, startup fulfillment and last mile delivery, is still focused on expanding its location in its third year of operation, so that more consumers and sellers throughout Indonesia are served and feel the impact of the growth of the digital economy. This startup already operates in five cities with various warehousing partners, namely Flexofast (Tangerang, Medan, Surabaya), Janio (Jakarta), and Kalla Logistics (Makassar).

In an official statement, LODI CEO Yan Hendry Jauwena explained that the company cooperates with many partners who own warehouses and logistics companies in order to serve its many target consumers, namely SME entrepreneurs online from various business segments. The expansion to Makassar, he continued, is the latest information from companies that want to focus on meeting logistics needs in eastern Indonesia, namely Maluku, Sulawesi and Papua.

One of Kalla Group's supports through this partnership is to accommodate the transportation mode of trucks for cross-island needs in a short time by the navy owned by the Kalla Group. Not only that, Kalla Logistics provides warehouse for needs e-commerce fulfillment with an area of 2250 square meters which will be used by LODI in stages.

According to Yan, the support from the Kalla Group is very large for the company in its efforts to improve the quality of service in the future and help serve the growth of the digital economy in eastern Indonesia and Sulawesi.

“Kalla Group's involvement in this partnership includes transportation and logistics support for LODI. The involvement of both parties to work hand in hand to support each other can increase efficiency, both optimally and business optimization for all parties involved," said Yan.

LODI business development

LODI is a startup that adopts the concept of Cainiao, a logistics giant from China. So far, logistics players have always relied on heavy assets, such as having warehouses in various locations and their own fleet in running their business.

In fact, it is not necessarily the asset that has a high utility. When the warehouse is empty, it's always there overhead costs charged. So that fulfillment players are less able to compete with the digital era like today. The Cainiao concept with light assets and carrying a collaborative spirit with a supporting logistics ecosystem is considered appropriate to be adopted in Indonesia.

Contacted separately by DailySocial, Yan conveyed the blessing of partnership with partners fulfillment, now the company can reach more SME business owners who come from the fashion segment, household appliances, skincare, medical devices, health supplements, baby needs, and much more. Most of them sell through the platform marketplace.

All of these SME products are entrusted to the warehouse of LODI partners and the entire procurement process to delivery is handled directly by LODI. SMEs can also prioritize their focus on business development so that it continues to grow. There was no further mention of LODI's business growth during the pandemic.

He also said the need for procurement solutions during the pandemic is now the target of online SMEs to help develop their businesses more effectively, both in terms of time and cost. At the same time, to minimize errors that occur due to the large number of orders that come in from consumers.

“Surely LODI balances demand it with man power preparation and monitoring controls which becomes an SLA to increase productivity.”

Yan did not explain further in detail how the company's strategy going forward. He only mentioned that in order to become a dominant player in Indonesia, the company will continue to strengthen product and operational innovations that focus on higher customer satisfaction. Thus, their business can continue to grow so that they can enter into the coming era of commerce (futures commerce).

Regarding funding, Yan only said that the company continues to open up opportunities for other investors to join and support the development of LODI. Finally, the company obtained early-stage funding with the identity of the investor and an undisclosed nominal.

Logistics sector contracted

Although this sector is highlighted as promising in the midst of the fast pace of business E-commerce In Indonesia, according to the latest data released by BPS regarding economic growth in the first quarter of 2021, the logistics sector (warehousing and transportation support services; post and courier) contracted 13,71% yoy. This is due to restrictions on mobility in the midst of a pandemic.

More Coverage:

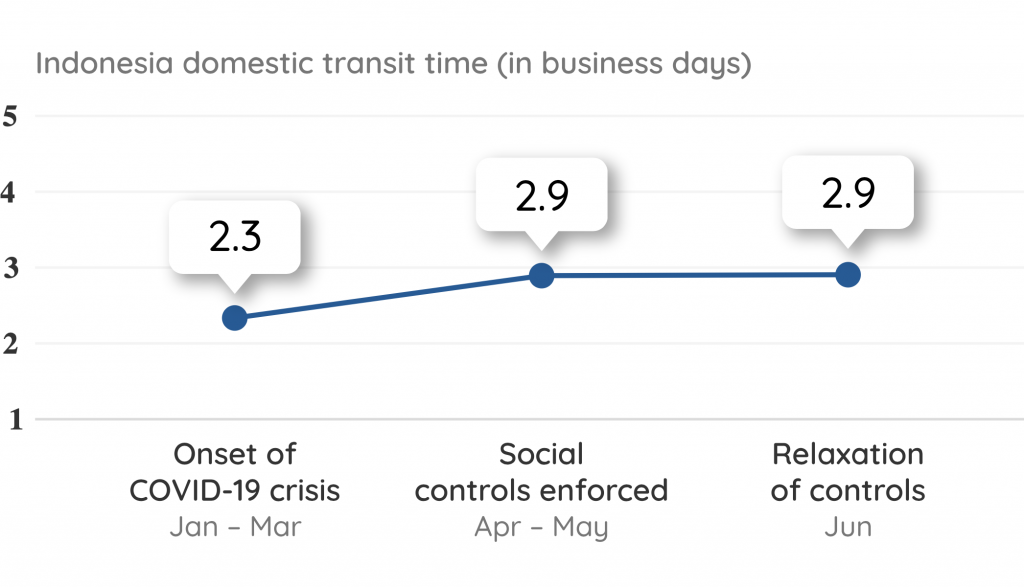

Obstacles related to these restrictions were also validated by Parcelmonitor which recorded an average 26% increase in transit time during the pandemic period. Logistics operators have not fully overcome the challenges amid the pandemic in 2020.

However, market optimism for a new era of logistics seems to be the driver of digitization in this sector. Evidently, during H1 2021, there were three logistics startups that received funding. Includes SiCepat (series B worth $170 million), Shipper (series B worth $63 million), and Andalin (series A with hidden value).

Sign up for our

newsletter