Corporate Venture Capital is the Right Way to Face Disruption

Most of the investment focus is on startups in the "growth stage"

In June 2010, the application UberCab launched in San Francisco to make it easier for people to order taxis. It didn't take long, the platform was popular throughout the local area, even though the service fees charged became more expensive. Users are willing to pay more for the efficiency gained.

Five months later the company secured $1,25 million in seed funding from a number of investors. The brand was changed to Uber because it accommodates transportation services that embrace drivers outside of taxis. Early February of the following year, Uber announced a series A funding of $11 million.

Steady with a valuation of $ 60 million, they formalize a presence in New York. The public is enthusiastic about the new service, even in the early stages of this region becoming Uber's largest market share. Some taxi companies began to call for strong resistance, questioning the legality of the business.

At the end of 2011, Uber secured series B funding worth $32 million, including from Jeff Bezos. International expansion began, Paris became the main target. Feedback from consumers, regarding price and availability, has led the company to release various product variants, including UberX for affordable service options.

Mid-2013, Uber expanded to India and Africa. Accompanied by series C funding worth $258 million. Company valuation reaches $3,76 billion, officially gets the title unicorn. Then in July 2016 they raised another $1,2 billion in new funding and brought the company up to valuation decacron $17 billion.

Long story short, with existing business dynamics including expansion, business streamlining and continued funding, in May 2019 they conducted an IPO on the NYSE with a market capitalization of $75,5 billion.

From this business journey, there are several things that can be underlined: (1) a fast growing business, (2) a disruptive business, (3) a business with fantastic value growth.

The terminology "disruption" is a scourge

Uber's business model was then widely replicated, including by Gojek by including local wisdom – in this case the motorbike taxi mode of transportation. After running the business in a semi-conventional way since 2011, on January 7 2015 they introduced their first application on the Android and iOS platforms. At that time it provided transportation, instant courier and shopping services.

Welcome to the future of GO-JEK! Download the GO-JEK mobile application on the App Store or Google Play http://t.co/rQm1ISvVS9pic.twitter.com/LoTgVY091S

— Gojek Indonesia (@gojekIndonesia) January 7, 2015

Similar to Uber, the services provided are in great demand. Traction has skyrocketed over time, as has financial support from investors. Likewise, regarding the issue of rejection, both by motorcycle taxi drivers and transportation companies, they also felt it. In fact, several times it received regulatory "pressure", because there was no legal umbrella that accommodated this business model, at that time.

That's just from ride hailing, in fact, various new platforms are still emerging (e-commerce, digital wallet, SaaS, online learning and so on) which tries to replace traditional business processes, has also received extraordinary response amidst the increasing number of smartphone users in Indonesia. Suddenly the term "disruption" became the main topic of discussion in various news reports, public discussions, and even scientific publications.

Many companies that have been running before feel the need to follow existing trends, so as not to be eliminated. In the end, the jargon "digital transformation" became widely campaigned. Business people flocked go-digital, trying to adopt the latest technology to accelerate business models. From the simplest things like creating social media accounts for marketing, to applying data science concepts to business.

Technology has an important role in disruption. Moreover, it already has the right medium to connect a service to its users, namely computing devices – including smartphones. If not through mobile apps, perhaps Uber's growth, Gojek, Tokopedia, Moka, Bridestory and other startups are not that fast.

Strategic partnerships through investment

Many large companies that were previously successful in market share have been driven into a frenzy by digital startups. For example, several shopping centers claimed to be empty of visitors - and some had reduced the number of outlets - after booming service E-commerce in Indonesia. The “laws of nature” in business seem to be starting to show results: either adapt or slowly die.

Some retailers are trying to change their approach, for example Matahari Department Store which finally released a portal E-commerce. Other shopping centers are starting to optimize application-based services, such as platform loyalty GetPlus at Grand Indonesia. His vision is on improving customer experience. So far sector consumer It is indeed those who seem to feel the impact of disruption the most.

There are really two choices, developing independently or collaborating with existing startups. Each has implications. First, if you choose to build a digital foundation independently, you must invest in various resources including infrastructure and experts. Meanwhile, for the second option, strategic partnerships could be a solution, and seem to be the most effective to adopt.

Changes towards the digital realm must be made quickly. The reason is that technology itself is developing very dynamically. While executives in corporations must remain focused on improving their main business commodities, they feel they do not have more time to experiment with creating digital solutions. Digital products that reach market fit requires a process that is not simple – you have to do research, market validation, etc.

Corporations can adjust the synergies that will be built with the business vision they run. For example, for companies in the financial sector, they can embrace appropriate fintech startups to support business development. Companies in the insurance sector can start collaborating with insurtech startups to increase their presence and ease of access to services for the public.

After finding a suitable startup and they have proven their product market fit, then cooperation is needed for more exclusive stages. One way is by providing investment – acquiring several percent share ownership – to the related startup. So if this strategic cooperation development initiative is of particular concern to the corporation, the formation of a venture capital sub-company can be carried out.

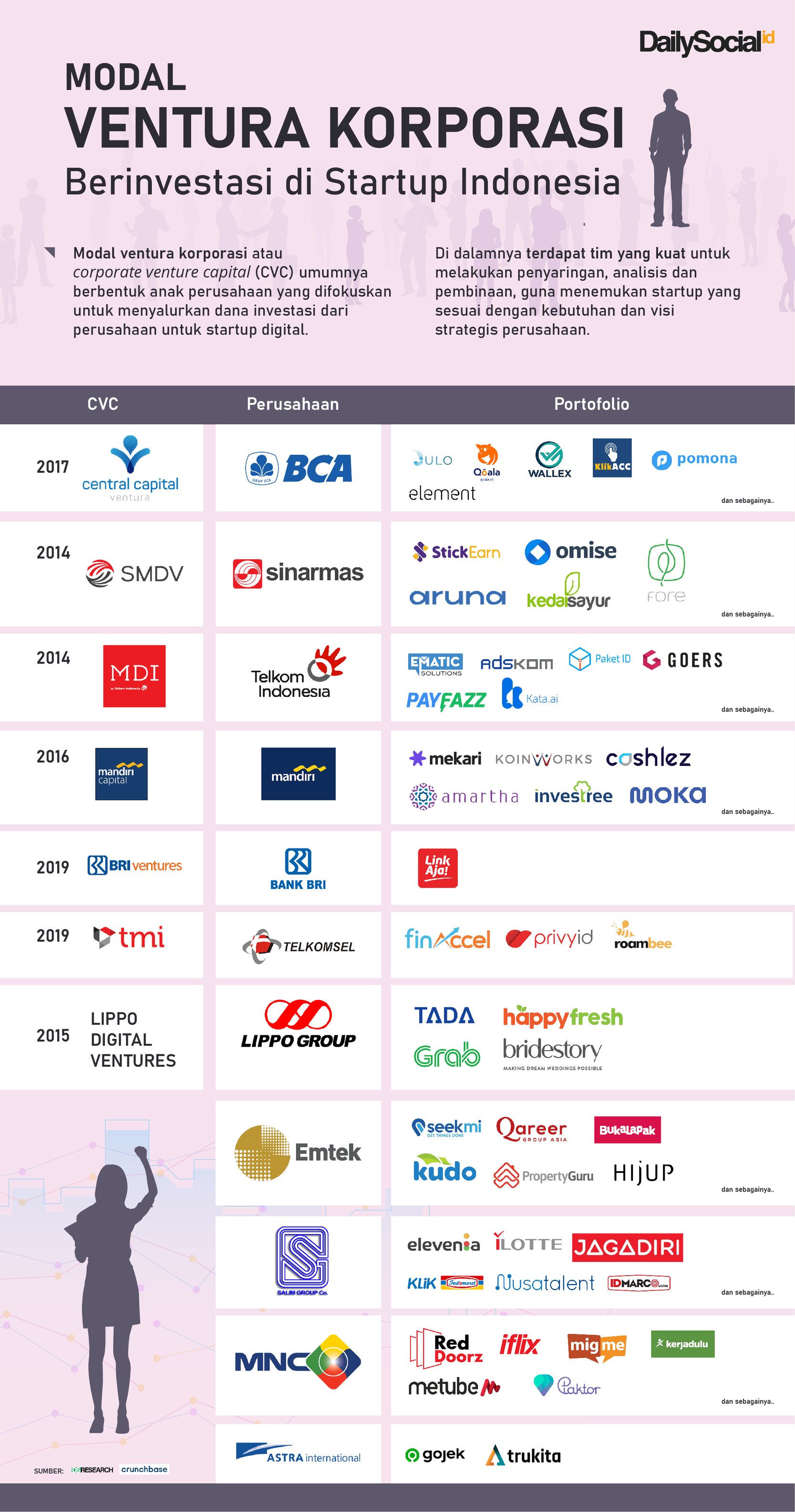

Corporate venture capital in Indonesia

Corporate venture capital or better known as corporate venture capital (CVC) generally takes the form of a separate business unit (subsidiary) which is focused on channeling company investment funds to startups. It has a strong team to carry out analysis and screening, in order to find startups that suit the company's needs.

The practice of forming CVCs is starting to become popular in Indonesia, along with the success that has been achieved – either in the form of strategic partnerships in the context of increasing business or exit (IPO or acquired at a higher valuation) as a mechanism for investors to gain financial benefits.

The investment focus is also easy to read, each of which explores sectors that have the potential to strengthen corporate lines. Take for example BCA's Central Capital Ventura, a portfolio targeted at startups that provides easy access to finance for consumers and businesses. The derivatives are quite diverse, from credit platforms, technology supporting financial businesses, to insurance. Likewise, Astra International focuses on startups that empower automotive products, around transportation and logistics.

More portion for growth stage startups

After previously debuting with funds under management of up to 3,5 trillion Rupiah. Recently, BRI has again injected additional capital worth 500 billion Rupiah into BRI Ventures. Apart from increasing the share ownership portion to 99,97%, it is hoped that it will be able to accelerate its subsidiary. Fantastic numbers for kick-off new venture capital business.

More Coverage:

Another CVC, Mandiri Capital Indonesia (MCI) has invested in 13 startups by the end of 2019. CEO Eddi Danusaputro said that this year they still have 50 billion Rupiah ammunition to invest in startups fintech other. Most recently they led the funding of a financial planning platform developer Halofina in the pre-series A round.

The large amount of value disbursed by corporations to CVC is not without reason. From existing funding trends, on average they invest in startups at the developing stage (growth stage). In this phase, startups are usually able to prove traction in the targeted market niche. As well as Telkomsel Mitra Innovation (TMI), which was only formed in the middle of last year, debuted investment in the series C round Kredivo.

Telkom Group took a more in-depth approach by establishing the Indigo Creative Nation integrated incubation and acceleration program. MDI Ventures was involved to fund startups that passed the program.

It is projected that there will be more and more CVCs

Even though they have not explicitly announced their involvement in investing in startups, several companies are reportedly also Limited Partners (LP). venture capital. Acting as an LP means they entrust the appointed party to channel funds to the right startup, instead of forming their own team or subsidiary to process investment from upstream to downstream.

It is believed that digital startups that successfully demonstrate competitive value in the market and support existing industries will attract the attention of more corporations to get involved in the ecosystem, especially forming CVCs. Apart from case studies from within the country, actually abroad, world-class companies have also stepped into the ecosystem.

The latest news is that several other state-owned companies are also interested in establishing subsidiaries in the venture capital sector. Bank BNI and Pegadaian are said to be currently finalizing investment strategies to strengthen the company's business lines.

Sign up for our

newsletter

Premium

Premium