The 2022 Startup Report Highlights Slowing Investment, Layoffs, and the Potential of the Green Sector

Summarizes the various highlights of the latest Startup Report 2022 report

DSInnovate is back in publishing its annual Startup Report 2022 with the title "Towards More Sustainable Startup Ecosystems in Indonesia". This report highlights a number of important events that have colored the dynamics of the Indonesian startup industry throughout 2022. One of them is the efficiency measure for the startup industry where as many as 20 startups have been recorded as carrying out layoffs last year. Here's the summary:

Industry turmoil to funding trends

According to the AsianNikkei report, funding transactions in Southeast Asia will slow down in 2022 compared to the previous year. This was triggered by the geopolitical situation which impacted investment in this region.

The uncertain economic situation made it difficult founder startups to seek capital to develop their business, unlike in 2021 where the total funding value skyrocketed to $25,75 billion.

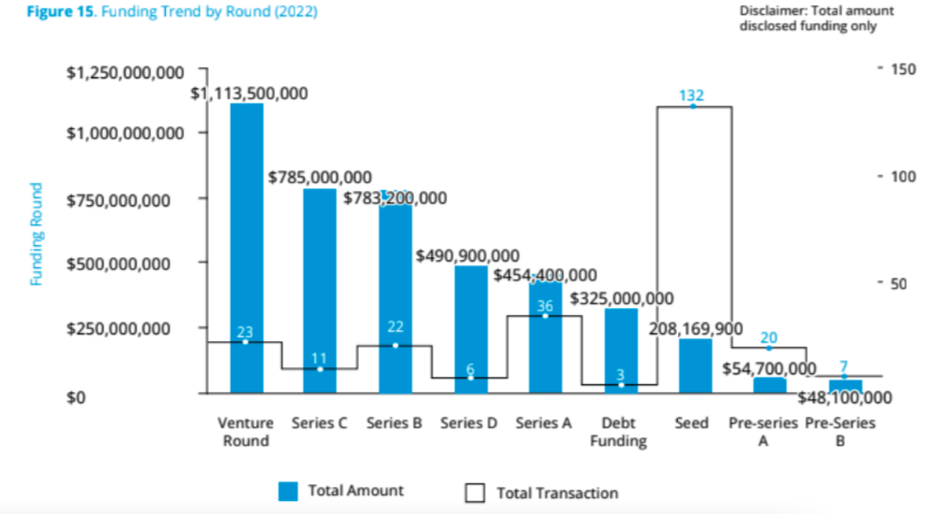

Based on this report, a total of $4,2 billion from 260 funding transactions will flow to the Indonesian startup industry throughout 2022. This amount is down from the previous year's $6,9 billion, although the number of transactions is lower by 214.

Break down by accumulated value, fintech became the sector with the largest funding, namely $ 1,71 billion, followed by OTA (Traveloka) of $ 300 million, and agritech $229,9 million. In terms of the number of funding transactions, sector fintech remained dominating with 29 transactions, followed agritech (15), and social commerce (11)

This report also found 34 actions mergers and acquisitions (M&A) or doubled from 2021. Most M&A came from the fintech sector, some of which were (1) Xendit and Bank Sahabat Sampoerna, (2) Komunal and BPR (Kediri), (3) FinAccel Teknologi and Bank Bisnis Internasional .

Apart from that, the e-Conomy SEA by Google, Bain & Company, and Temasek in 2022 actually shows a positive trend where Indonesia's digital economy is predicted to reach $ 77 billion in 2022, and reach $ 130 billion in 2025.

"Currently, we are in the middle of a new global economic cycle that requires us to make adjustments to risk management and valuation exit, and capital deployment. However, Indonesia's resilient economy and strong fundamentals have put us on a high growth trajectory, and we are excited to be a part of that," said East Ventures Co-Founder and Managing Partner. Willson Cuaca.

train 2023

This report also displays projected trends throughout 2023 in three selected sectors, namely greentech, healthtechand embedded finance.

1. GreenTech

DSInnovate sees significant growth in green startups in Indonesia over the past few years. This growth is in line with Indonesia's commitment to achieve Net Zero Emissions in 2060, the government is encouraging all stakeholders to encourage the development of innovation in the green and sustainable sector.

Based on the data collected, there are 39 startups that come from four major categories, among others food/trash/waste management, carbon print/credit, electric vehicles, and newenergy. In addition, DSInnovate sees the trend of the green sector in the country being reflected in increasing VC investment to startups in related sectors. There were 15 funding transactions announced in 2022, an increase from 5 transactions in 2021 and 2 transactions in 2020.

According to Southeast Asia's Green Economy 2022 research by Temasek and Bain & Company, currently investment flowing into Indonesia's green sector is still driven by corporations. Most of the investment has been disbursed by corporations for the development of renewable energy (EBT), while PE/VC has disbursed the most funding to the energy sector. mobility, solar, and sustainability.

"Based on my experience as angel investors in this area, it is difficult for investors to engage in funding regardless of the large capital required for startups to develop innovation and scale their business. Startups in the green sector usually take a long time to return compared to other technology startups. Policy and regulatory uncertainty affects the development of green innovation for early-stage startups. It's even difficult for VCs to predict investment returns accurately," said Jawara Ventures Co-Founder and Managing Partner Alfred Boediman.

2. Embedded finance

Sector fintech Indonesia has continued to grow in recent years, and has been in maturity level tall one. The potential is still great considering the population unbanked and underbanked in Indonesia is still very large, with a total accumulation of 90 million from the two segments.

In this report, DSInnovate observes that technological developments in the financial sector are no longer centered on the digital payment sector. After eras open finance and open banking (although relatively new), now a trend embedded finance began to develop in Indonesia.

Embedded finance enabling non-financial companies to integrate their financial services without the need to build infrastructure from scratch or apply for related service licenses. Embedded finance enabling every business to manage and offer financial services, from payment, debit, insurance, to investment, into its core services.

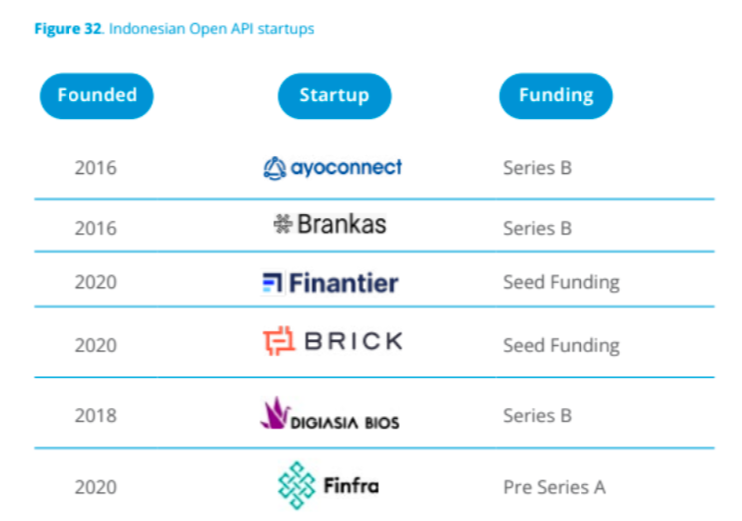

Currently, there are six Indonesian startups that are listed as developing services open finance and embedded finance, such as Ayoconnect and Digiasia Bios.

3. Healthtech

The Covid-19 pandemic has kept the healthcare industry in the spotlight for the last three years. This world health crisis has opened Indonesia's eyes about the role of digitalization in improving the health industry.

Obsolete problems, such as the high cost of medical treatment and the uneven distribution of health facilities, are trying to be overcome by various health innovations. In 2020, the Ministry of Health recorded that the ratio of doctors is only 03,8 per 1.000 population, while the ratio of hospital beds is around 1,2 per 1,000 population.

In the last two years, industry healthtech recorded an investment of $ 107,9 million of the total accumulated funding of $ 231,7 million obtained during the last eight years in this sector.

In this report, DSInnovate highlights how the Ministry of Health is taking a progressive step by publishing a health transformation roadmap for 2020-2024, showing the government's support for revolutionizing the country's health industry by involving various stakeholders.

The Satu Sehat platform, the main part of this transformation, will connect all health service data from upstream to downstream. The government has also issued policies that will facilitate the process of exchanging health data and developing technology in the health sector.

For more, download the Startup Report 2022 HERE.

Sign up for our

newsletter