Startup Insurtech Fuse Announces Series B Funding Raise

This round was led by GGV Capital with the involvement of East Ventures Growth, SMDV, Golden Gate Ventures, Heyokha Brothers, Emtek, and a number of other investors.

Startups insurtech Fuse today (09/8) announced the closing of series B funding. No investment amount was disclosed. The round was led by GGV Capital with the involvement of previous investors, including East Ventures Growth, SMDV, Golden Gate Ventures, Heyokha Brothers, Emtek, and a number of unidentified investors.

The fresh funds raised will be focused on developing their digital platform and continuing their expansion to other countries in Southeast Asia, outside of Indonesia and Vietnam. Previously, Fuse secured series A funding at the end of 2019, led by EV Growth.

Platform insurtech It was founded in 2017 by Andy Yeung and Ivan Sunandar. They claim to be a pioneer application that focuses on the agency model. This is considered relevant to conditions in Indonesia, as much as 97% of the population is still underinsured due to lack of trust in the current insurance system.

With this approach, the company also said it had been able to book Gross Written Premium (GWP) exceeds $50 million or equivalent to IDR720 billion in 2020 and confident enough to claim to be a platform insurtech largest in Indonesia [by transaction].

Fuse has also partnered with 30 insurance companies, presenting more than 300 products, including through the program employee benefits and integrated on the site E-commerce.

"We have always focused on product innovation and will continue to invest in developing platforms that make insurance accessible and affordable to everyone in Southeast Asia. A total of 7 insurance companies have chosen Fuse to be a strategic partner insurtech they are in Indonesia," said CEO Andy Yeung.

Market competition

Viewing the landscape insurtech in Indonesia currently Fuse's two closest competitors, in terms of business size, are PasarPolis and Qoala. With different metrics, PasarPolis said, as of August 2020 they had issued 70 million new policies every month. The total policies that were successfully released in 2019 reached 650 million policies in the countries they operate, namely Indonesia, Thailand and Vietnam.

PasarPolis earlier this year secured IDR 70 billion in funding from IFC, continuing to raise IDR 796 billion for the Series B round which was announced in September 2020. The startup is backed by several investors, including LeapFrog Investments, SBI Investment, Alpha JWC Ventures, Intudo Ventures, etc.

As for startups insurtech others available Qoala. Last April 2020 they booked a series A funding of 209 billion Rupiah led by MDI Ventures through the Centauri Fund. Also supporting several investors including Sequoia India, Flourish Ventures, Kookmin Bank Investments, Mirae Asset Venture Investment, Mirae Asset Sekuritas, Central Capital Ventura, SeedPlus, etc.

Since March 2020, the company claims to have been able to process more than 2 million policies per month, up from the previous 7.000 policies per month in March 2019.

Market potential

According to processed data DSInnovate in "Insurtech Report 2021", the GWP that has been recorded by the insurance industry in Indonesia has reached $20,8 billion in 2020. Life insurance dominates the figure with a percentage of 73,8%.

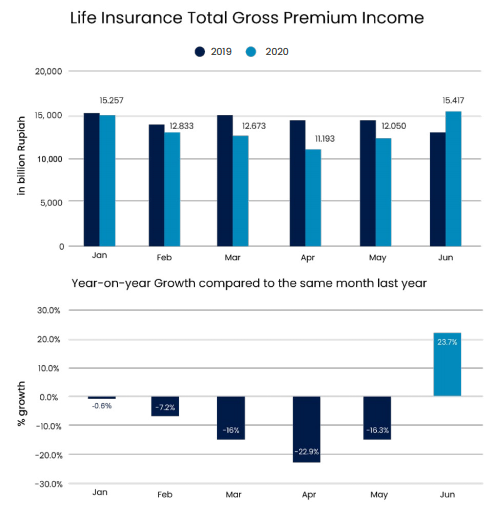

Even though it was affected by the pandemic at the beginning of its emergence in Indonesia, this sector was relatively able to recover quickly when viewed from the Gross Premium Income obtained.

Potency insurtech To democratize the insurance business in Indonesia is still very wide open, including in the context of attracting new users and educating the market. Still from the report above, from the survey cited there are several important factors that can encourage insurance adoption in Indonesia, in relation to digital services.

First, in terms of the claim process, it must make it easier (48% of respondents). Then the second one is related brand service providers who have to convince (39%). Then proceed with costs (37%) and benefits provided (11%).

Sign up for our

newsletter