Startup's "Cash Burn Rate" in Indonesia is Still Considered at a Reasonable Level

Venturra Capital Managing Partner Stefan Jung dissects the investment system of Southeast Asian startups at Echelon Indonesia 2016

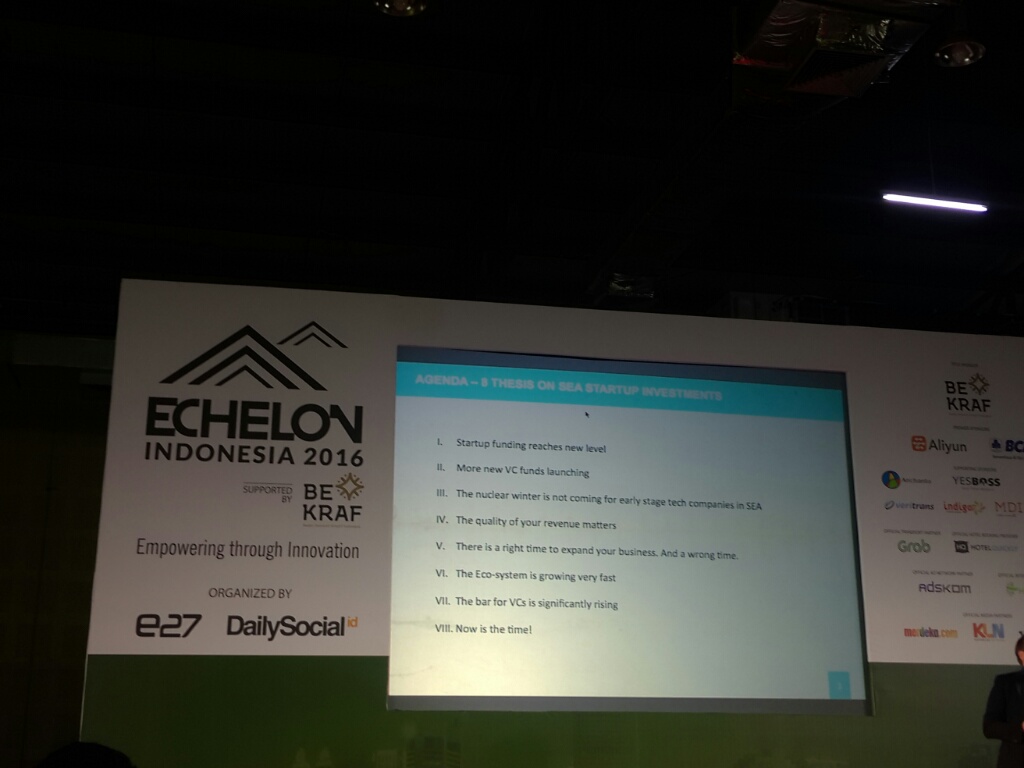

In his presentation at Echelon Indonesia 2016 discussing the development of the investment climate in the Southeast Asia region, Managing Partner of Venturra Capital, Stefan Jung said that investment in this region is still in a healthy level.

Factors that can be a positive signal are cash burn rate startups, which are typically used for subsidies or consumer acquisition costs, are still healthy. For example, office expenses are not excessive compared to income. Output from various startup this, according to Stefan's observation, is also still considered healthy.

Apart from the reason cash burn rate which is still at a normal level, Stefan's positive view is also supported by several factors, such as the existing funds have a fairly long commitment period (up to 8-10 years) and the amount startup those who fail or fail are still normal and not worrying.

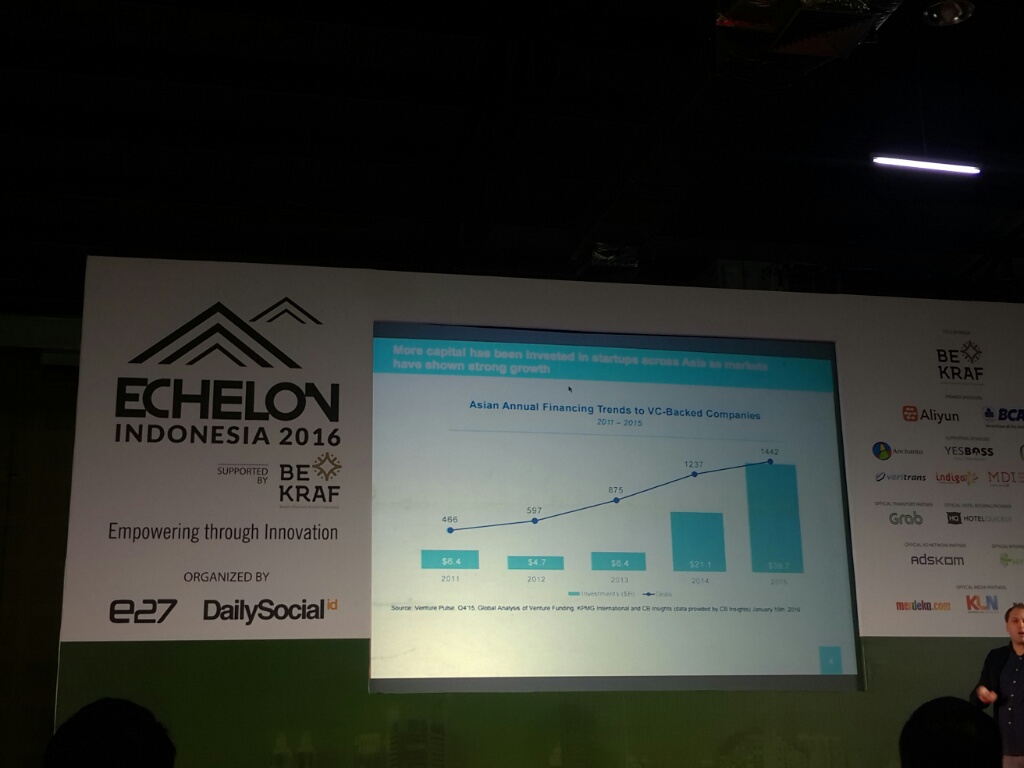

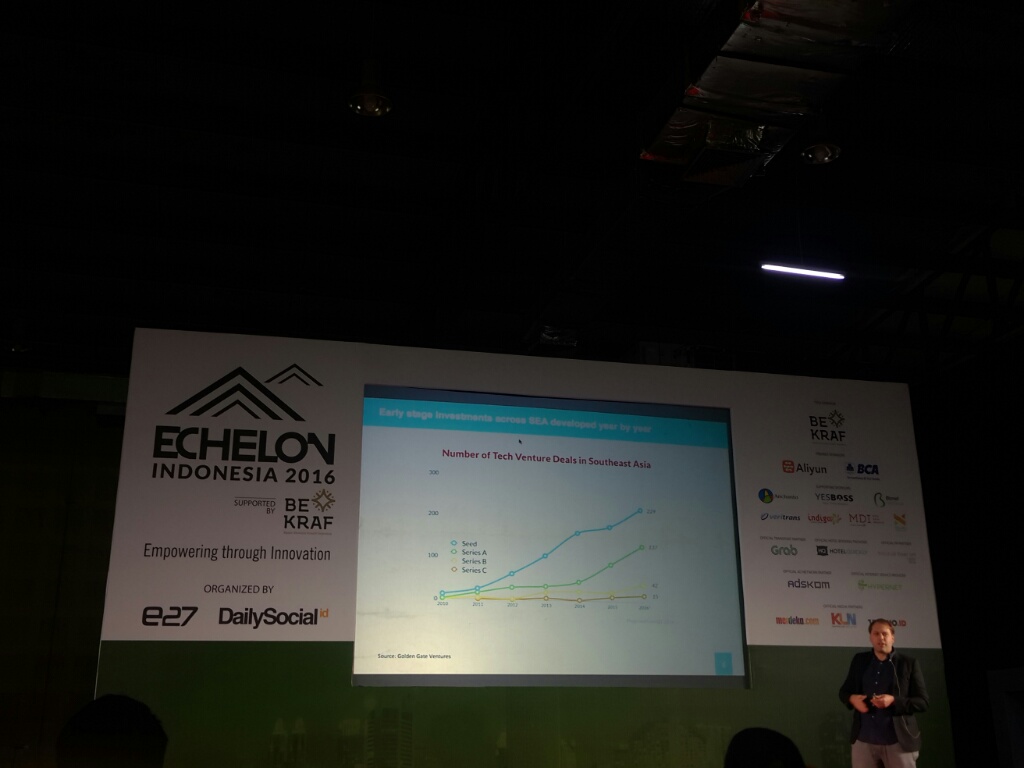

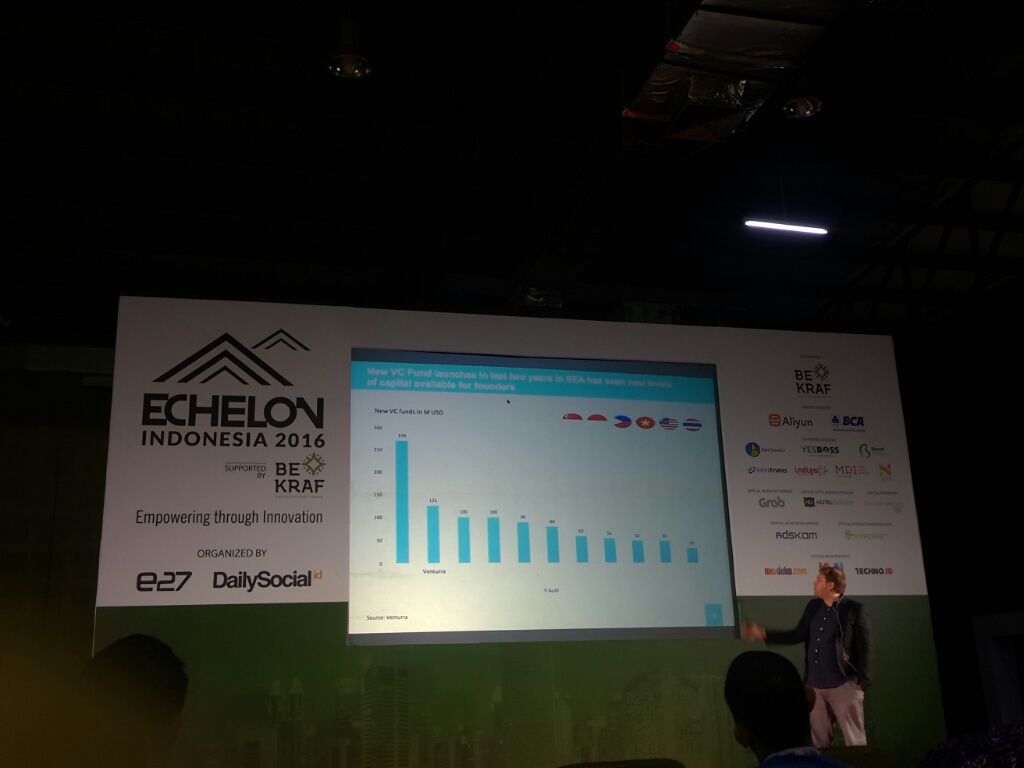

Using data, one of which is from Golden Gate Ventures, Stefan displays data that level startup in getting funding in the Southeast Asia region has reached a new level. It shows some examples funding which happened recently and many of them are of great value related to Indonesian startups, including Bukalapak, Grab, Lazada, Tokopedia, Traveloka, Gojek, and MatahariMall.

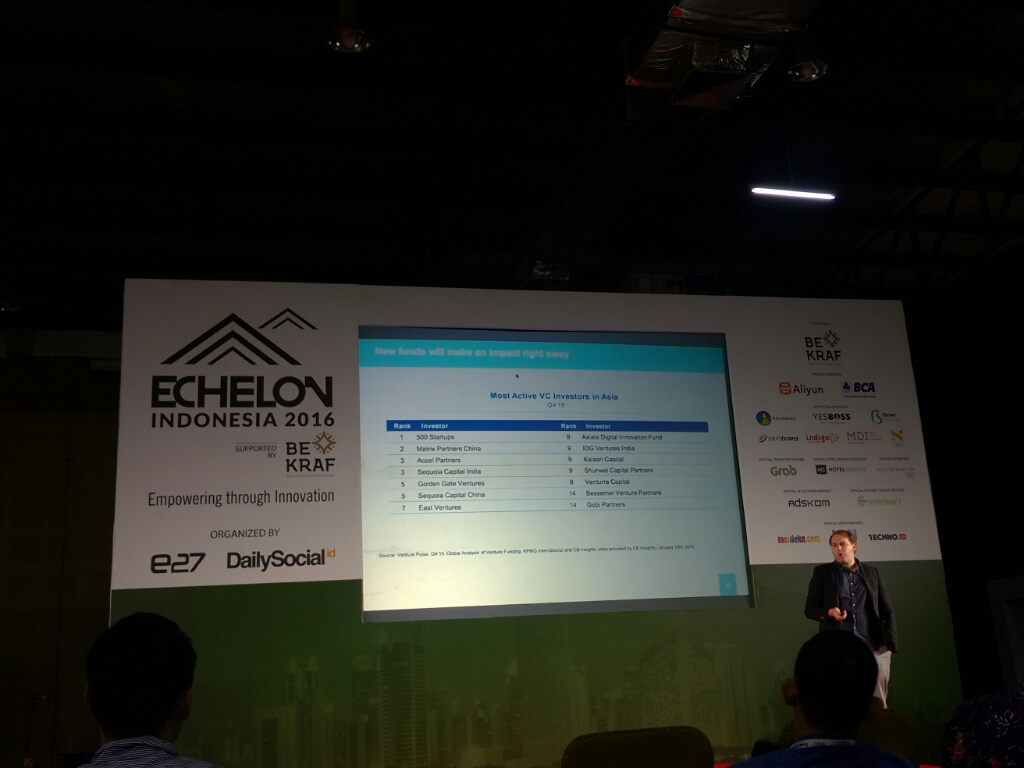

Stefan also features a short list of some of the most active VCs in Southeast Asia. Names like East Ventures, 500 Startups, Golden Gate Ventures are in there.

Although Stefan's opinion can be said to take a positive position in viewing the investment climate startup, but it also provides some notes for the ecosystem startup existing in Southeast Asia. One of them is quality revenue which must now be considered by startups in running their companies. Don't just focus on finding growth only, but the trend now must also pay attention to revenue due to the fundraising process in the next phase (late stage) will not be easy at first.

Myths about the startup ecosystem

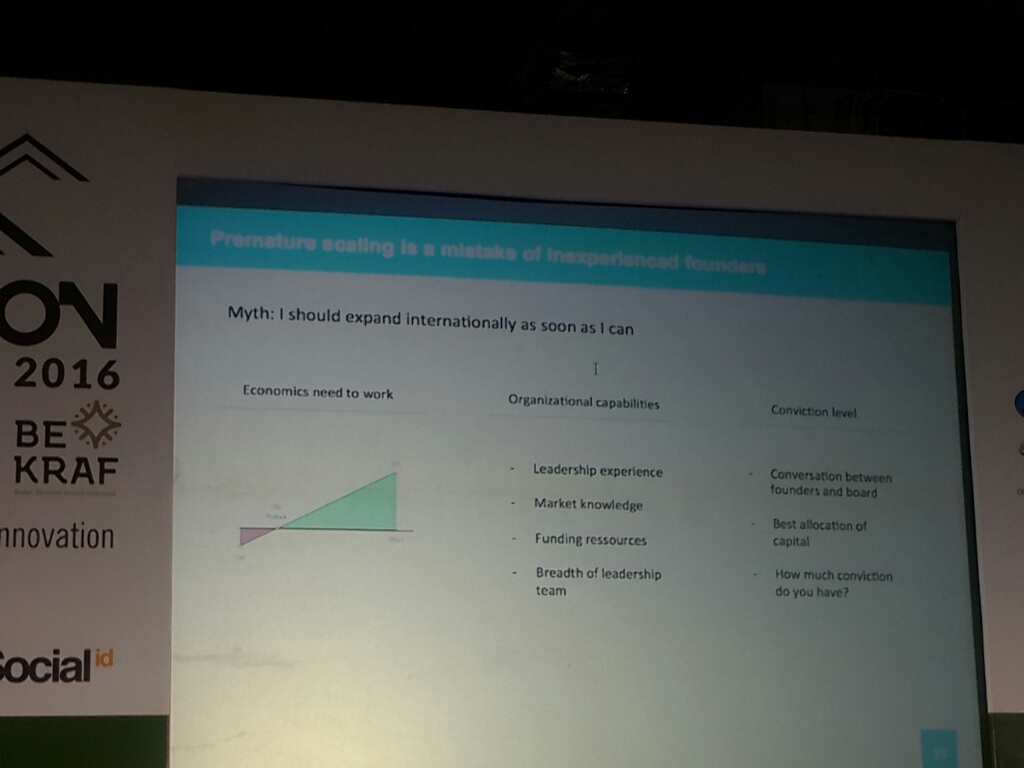

There are several myths that Stefan wants to break about ecosystems startup in Southeast Asia, one is about the "must" to expand into international markets as quickly as possible. Stefan believes that startups should weigh properly before deciding to expand. Deciding to expand abroad must take advantage of the right timing and be familiar with the business that is being undertaken.

There are three main factors that must be considered when expanding, namely economic value, organizational capability (eg: leadership, able to manage a local team when developing with other country teams, knowledge of the market to be targeted, ability funding to support expansion into new markets), and how confident are you when it comes to making the decision to expand to other countries.

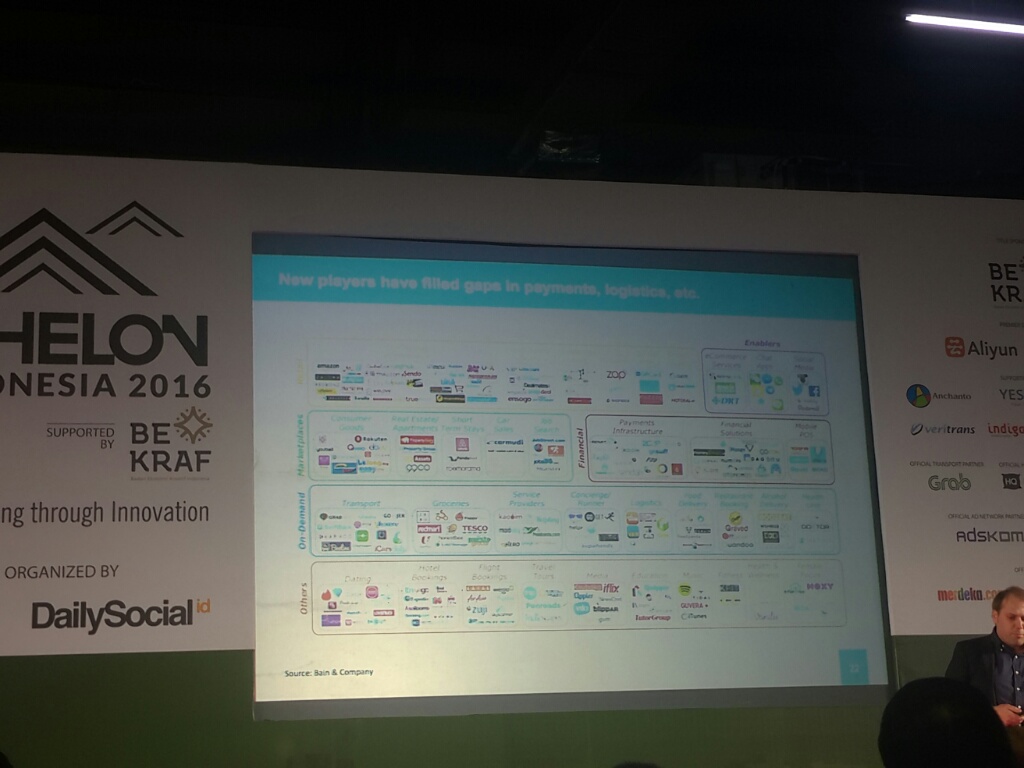

Another myth is the opinion about the unprepared ecosystem startup in Southeast Asia. Stefan explained that the ecosystem in the area is currently growing rapidly and is ready to support growth and development startup Some of the references that support this opinion include: talent capabilities in this area continue to grow, the emergence of many co-working, the presence of various accelerators and incubators and the last way related to the ecosystem startup more and more appear.

In general, Stefan has a positive view of the existing investment climate in Southeast Asia, including Indonesia. With growth as it is now, VCs as financiers must also grow and raise their limits to help startup. According to Stefan, now is the right time to enter and dive into the climate or ecosystem startup, especially for investors.

Sign up for our

newsletter