Gojek Immediately "Spin-Off" the Gopay Service from the Main Application [UPDATED]

The Gopay application has now started to be released separately in beta for selected users

Gopay, a proprietary electronic money service Gojek, will soon be available in the app itself aka spin off from the main application Gojek. In the initial phase, the Gopay version beta already available, but only opened to selected users.

When contacted DailySocial.id, GoTo Financial Head of Corporate Communications Alina Darmadi said that in accordance with GoTo Financial's vision of wanting to make GoPay a centralized service in financial management, the company is in the trial phase of the GoPay application for selected users.

"Our hope is that this trial will bring good results so that later the wider community can immediately use this application. During the trial phase, customers can continue to access GoPay services through the application. Gojek for the convenience and comfort of transactions," said Alina.

Separately in blog page, it was explained that Gopay Beta existed because Gopay was soon releasing its own application. "So that the application can suit real-life needs, we released Gopay Beta to get input from users," he wrote (02/12).

Furthermore, Gopay will send letter of invitation to selected users to download applications on the Play Store or App Store. The application will not be accessible unless signed in with e-mail the same as the address for receiving invitations from GoPay. The company will receive all input before it is officially released to the public.

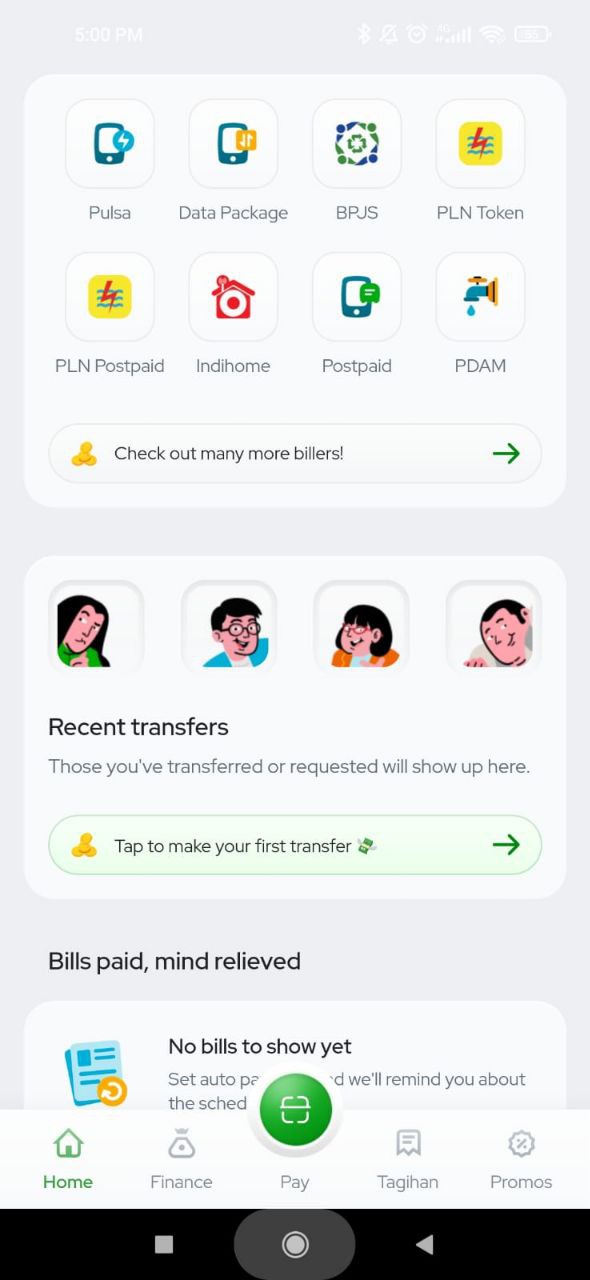

Under observation DailySocial.id, the Gopay application has enhanced features from before. Features such as money transfers to bank accounts, shopping via QRIS, are also available. Apart from that, there is the Billing feature to pay various bills and view transaction history.

Then the Finance feature which is directed at setting the method of source of funds for various transactions, is equipped with a recapitulation of all expenditures which are divided into several expenditure categories. Previously this capability was provided by Gopay via e-mail which are sent to consumers every month.

Next, there is the Promo feature which contains vouchers that can be purchased by consumers, the result of collaboration with various Gopay merchants and exchanged when shopping. Meanwhile, in the same column in the application Gojek, contains subscription packages that have beenbundling with various benefits from GoTo Group services and merchants for select users.

Research results

In the latest research released by InsightAsia titled “Consistency That Leads: 2023 E-Wallet Industry Outlook” shows that digital wallets are now the most preferred payment method for Indonesian digital society, compared to cash and bank transfers.

As many as 74% of respondents actively use digital wallets for various financial transactions. The rest chose cash (49%), bank transfer (24%), QRIS (21%), paylater (18%), debit card (17%), VA transfer (16%). This research involved 1.300 respondents spread across seven cities, including Greater Jakarta, Bandung, Medan, Makassar, Semarang, Palembang and Pekanbaru, taking place from 19-30 September 2022.

The research also shows Gopay as the platform that has consistently been used the most by consumers, since more than five years until now. Research shows that most digital wallet users have used Gopay (71%) and continue to use it faithfully to this day (58%).

OVO is in second place with 70% of respondents having used it and 53% have used it in the last three months. Then, DANA followed with 61% of respondents who had used it, but were not included in the top three usage categories in the last three months. Then there is ShopeePay which was used by 51% of respondents in the last three months, but was not included in the top three categories of having used it.

InsightAsia Research Director Olivia Samosir said, there are five main driving factors that have enabled digital wallet players to lead the market. Namely, it is safe to use and ensures that consumer balances are protected, easy and convenient to use in transactions, free of monthly usage limits and can be used to pay for daily needs to the fullest.

More Coverage:

"The ability to meet these needs makes a brand able to gain the highest trust from consumers," he said, as quoted from Investor.id.

-

*) We added a statement from GoTo Financial

Sign up for our

newsletter