Reading the Startup Direction of Rural Bank Acquisition (Part I)

Despite having limited business space, the digitalization of Rural Banks has the potential to be promising for startups

It seems quite dubious if young people today know BPR aka Rural Bank. They are now more familiar with the term digital bank because they are milling about on various digital platforms that they use every day. On average, this digital bank offers an easy process that is completely in the hands of the customer as a selling point.

However, this assumption was refuted by a mini survey that was held DailySocial through social media platforms. As many as 90% of respondents answered correctly that BPR stands for. Most are also able to distinguish commercial banks from rural banks, both in terms of scope of operations and business activities. As many as 61% of respondents know that BPRs can only operate in one province.

Furthermore, as many as 66% of respondents were able to correctly answer that the BPR's business activities were distributing business loans and collecting funds in the form of savings. Finally, as many as 68% of respondents were able to answer the difference between commercial banks and rural banks, namely that they are not allowed to conduct business activities in foreign currencies or provide check/giro and insurance services.

This survey of course does not represent the opinion of the majority of the young generation in Indonesia, it is only a perspective that was participated in by 39 respondents, most of whom were aged 25-35 years (66%) and the rest were aged under 25 years (31%).

The existence of BPR is regulated in the Banking Law (UU), namely Law no. 7 of 1992 concerning Banking as amended by Law no. 10 of 1998. This law states that banks that carry out business activities conventionally or based on Sharia Principles in their activities provide no services in payment traffic.

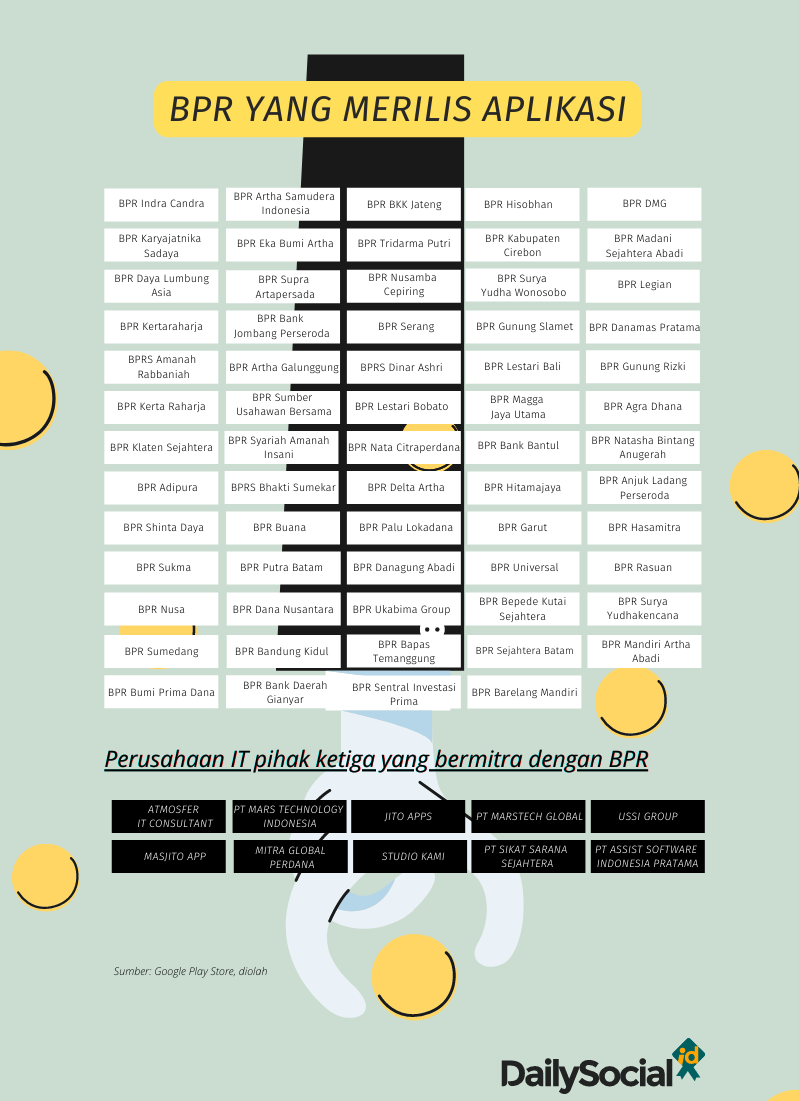

However, the frenzy of digitalization that has occurred recently has not been felt by the BPR industry. Only a handful of BPRs, which have above average assets, are able to utilize digital technology in their business processes. Under observation DailySocial, at least only 64 BPRs in Indonesia (see infographic) have released applications. The new feature is just to make work easier accounts officer in the field or for customers to pay PPOB (Payment Point Online Banking) bills.

However, this capability has not been able to attract younger generation customers to join. In order to survive in today's digital era, service and technology innovation is mandatory if BPR does not want to be eliminated from the banking business map. Unfortunately, not all BPRs have adequate digital infrastructure. Many BPRs have limited capital, making it difficult to build digital infrastructure which requires relatively high costs.

Already having to compete in the digital world, the road that BPR treads is becoming increasingly difficult day by day. The micro segment, which has been their main business area, continues to be eroded by the presence of various competitors. Resistance occurs, starting from commercial banks which have greater power than BPRs, LKMs (Microfinance Institutions), cooperatives, smart selling agents, to new competitors called fintech lending. Not to mention, the reduction in the KUR (People's Business Credit) interest rate to 6% certainly collides with the BPR business.

Even though business competition is very tight, these rural banks have advantages because of their different business characteristics. Locality and close emotional relationships with customers are an added value for BPR. Overcoming its weaknesses, while relying on its strengths, will make BPR's attractiveness even brighter. In this way, the function of BPR to advance the region and improve community welfare becomes greater.

BPR acquisition startup trends

Recently there has been an interesting phenomenon, namely the interest of fintech startups in acquiring BPR. From observation DailySocial, after ALAMI Group with BPRS Cempaka Al Amin which rebranding became Hijra Bank, then Xendit took shares in BPR Arthakelola Cahayatama and is now known as BPR Xen. Followed by Fazz Financial Group officials taking share ownership in BPR Sentral Mandiri and the full acquisition of BPR Prima Dadi Arta by Komunal, a startup peer to peer lending. All of these corporate actions do not reveal the transaction amount to the public.

Indeed, this number is only small, but this trend is in line with technology players starting to look for new business opportunities in the financing sector, which has the softest margins in the banking world. If explained, almost all commercial banks with small assets are preparing to be acquired by technology companies. Commercial banks and BPRs are currently both pressed for time by the OJK to meet minimum capital.

Capital regulations for BPR are contained in POJK No. 5 of 2015 concerning Minimum Capital Requirements and Minimum Core Capital Fulfillment. According to this regulation, BPRs are required to meet the minimum core capital set at IDR 3 billion in 2020 and IDR 6 billion by 2024 at the latest. In the midst of this tightness, technology companies have emerged with large capital to work on BPR.

According to data Infobank Research Bureau (birl), in 2020 it still exists around 700 BPRs have not met the capital requirement of IDR 6 billion. So, with the same assumptions, in this case the ROE per year is 20%, meaning that at the end of 2024 there will still be around 50% of BPRs that are unable to grow organically. If the owner does not increase capital, the options are merger, sale, or resigning to become a microfinance institution (LKM). It is estimated that there will be 300 to 400 BPRs that will be downgraded to become MFIs.

“Given the need for technological adaptation and limited capital and services, BPR has become attractive for fintech startups. They can develop banking services with digital services, but the capital is relatively small compared to acquiring general banking or creating a digital bank. "So fintech startups benefit from relatively small development capital," said Indef Economist Nailul Huda.

For startups, having a banking business means their market share will be wider, because there are services in BPR that they don't have. Startups can be more innovative in developing products, not just savings and credit distribution, but also integrating startup services into BPR.

“For example, for Xendit, you can expand services payment gatewayvia BPR. Or enter lending with a scheme p2p loans It can also be subject to various requirements, such as the BPR service radius. "The collaboration between BPR and fintech is still very dynamic."

Nailul's statement is true. The reason is, after reportedly acquiring BPR, now Xendit is continuing its steps by acquiring it Bank Sahabat Sampoerna shares, to smoothen his steps in digital banking. This application itself is still being tested internally and has a waiting list open. The initial features offered are 6% annual interest paid every day for savings, free admin and transfer fees, and ease of sending and receiving funds. The average offer offered by contemporary digital banks.

Not much information can be extracted from Xendit regarding this action. However, in Huda's view, this step is seen as Xendit's way of dividing its market segmentation. Weaknesses in BPR can be developed or implemented at Bank Sahabat Sampoerna. Geographically, the scope of BPR is limited, so Xendit definitely needs something bigger considering that they also already have a unicorn valuation.

“Yes, it could also be said to be a lab or stepping stone too. The problem is banking services at BPRs and commercial banks can "It's different, yes, so I think it's more about developing services with a wider reach in terms of demographics and services."

Referring to OJK data, BPR Xen (PT Bank Perkreditan Rakyat Xen) was previously named BPR Arthakelola Cahayatama which is located in Depok, West Java. Xendit Co-Founder Theresa Sandra Wijaya (Tessa Wijaya) entered as a shareholder in BPR Xen with ownership of 0,68% in June 2021. The majority shareholder is controlled by PT Indo Digital Raya (99,32%). Theresa increased her stake to 1% in December 2021.

Not much information can be obtained about PT Indo Digital Raya. However, it is certain that it is related to Xendit because it is located with Xendit's head office. Previously, the company had denied involvement with BPR Xen.

They admitted that they were still in the exploration stage of how this partnership could have a good impact on MSMEs.

Separately, the results of the interviews are published Convectus Law in November 2021 together with Mikiko Steven, Head of Consumer Solutions Xendit, may be able to provide an overview of Xendit's future direction in expanding its solutions in payment gateways in the banking arena by increasing its capabilities in Open API (Application Programming Interface).

He explained that the central bank has so far been striving towards a leaner digital banking space, while strengthening the role of fintech in supporting digital transactions. According to him, currently Bank Indonesia has grouped all payment service providers into three categories, reducing the number of licenses that operators previously had to have. The three categories are permit category one, permit category two, and permit category three.

These more detailed rules are contained in PBI Number 23 of 2021 concerning Payment Service Providers (PJP). The essence of this latest regulation is that PJP no longer has to worry about taking care of lots of permits. In processing permits, they are divided into three categories of permits, each of which has different paid-in capital provisions.

“For example, Xendit is in the second category, which allows us to provide products classified as account information services (AInS) and payments acquiring and initiation services (PIAS). "Previously, each of these products required a successful application before payment service providers could start providing them," explained Mikiko.

Apart from that, BI also announced that all banks must adopt a universal API for payments by 2025 which he believes will be game changer. “When Xendit first wanted to offer basic financial services in 2017, it was to help merchants accept digital payments. We had to approach many different banks. This meant we had to unify all their different banking APIs, which was time consuming and expensive.”

Driving the adoption of banking Open APIs should ensure that digital banking products can be rolled out to market more quickly and to a wider audience. According to him, digital banking removes logistical barriers for those outside urban areas and democratizes the banking process.

Meanwhile, the shares of BPR Sentral Mandiri are now controlled by two brothers Hendra Kwik (CEO of Fazz Financial Group) and Hendoko Kwik (Co-founder and CEO of Modal Rakyat). Both of them are recorded as having bought shares from the previous owner and control the shares with the composition: Hendra (79%), Hendoko (3,5%), and Ong Tek Tjan (17,5%). Ong is a former director of Bank Sahabat Sampoerna who is now a startup founder e-groceryleave me.

It is yet to be seen where BPR Sentral Mandiri will go under its new shareholders. The latest news is that UpBanx, a fintech platform for creators, will use a banking license for its operational activities. There has been no further updated information regarding this. UpBanx Management refused to answer questions DailySocial. UpBanx itself is affiliated with Fazz after obtaining pre-seed funding worth $5,2 million, which Hendra and Hendoko also participated in.

Hijra Bank's digitalization story

The concrete evidence so far that we can examine is Hijra Bank who have successfully transformed digitally. Co-founder and CEO of ALAMI Group Dima Djani is willing to share his experience in a joint interview DailySocial. One main point he emphasized was how the implementation of technology can become the main DNA at Hijra Bank. The transition process is carried out by placing NATURAL talent within the bank.

“Many banks use technology but don't understand it. Therefore, we update our human resources by placing NATURAL people to transfer knowledge. When we acquired BPRS Cempaka Al Amin, it already had a website and simple technology, then we updated it from that side tech stack, appearance mobile banking"said Dima.

Recruiting technology talent is the next step to support Hijra Bank. Interestingly, the company standardizes the process and training has also been equated with what has been carried out by the ALAMI technology team. “We invest in the best talent. Not only for the technology, but also for other staff to be qualified. Focusing on this foundation will make it easier for us to take our next development steps.”

Refreshing the identity and moving the office to a more strategic location from Ulujami to Pondok Indah also supports the company's efforts to form a new DNA. He realized change mindset digitalization is not easy. With the previous owners, this foundation had not been established at all because they had no direction in that direction. Just like BPR in general, it serves local needs.

"Moreover, there are capital increase regulations, plus the pandemic, the owner is having difficulty finding funding, also not making digital investments and the existing human resources are not qualified. The way of work and culture of the bank that we acquired has been run traditionally for quite a long time. This is our note on how to unite culture and mindset digital so you can run fast.”

Another important point that is also of concern is introducing Hijra Bank to the public. They also helped Branding NATURAL as a platform p2plending sharia which is able to increase public enthusiasm for the presence of digital BPRS. The BPR persona itself has so far been known as a very local market bank.

If this persona is added with digital elements, many people are guessing whether the form will be similar to a commercial bank or not. Thanks to the regulator's direction, Dima admitted that he was quite helped in its execution because the direction was correct and able to boost BPR into an institution that could move up in class and be able to compete. Plus the current supervision principal-based supervision, so it's not stiff anymore.

“From a regulatory perspective, it has been quite helpful. But the problem is more about HR. Manpower for tech developer It's hard to find them, not to mention the competition is quite tight."

Following existing regulations, Hijra Bank's main business will be accepting deposits and distributing financing to MSMEs, including connecting with the ALAMI Group ecosystem. In order to have better competitiveness, Hijra Bank is open to partnerships with other technology companies so they can provide additional financial products, such as top up balance e-wallet, PPOB, card issuance, including features regarding financial management.

"Pain points community regarding sharia finance itself, there are still many who have not yetSolve. We continuously evaluate things like that customer demands, what and how impact-his."

Consumers still need to wait until Hijra Bank is officially released. Dima said, his party is still doing it product-market fit and continue to carry out studies until finally they are sure to release it. "Hopefully it can be done second half this year. "

Communal Stories

Hendry Lieviant, Co-Founder and CEO of Komunal, admitted the steps acquisition of BPR Prima Dadi Arta is part of the company's big desire to make the daily operations of the BPR industry more efficient. Communal, with its position as a platform p2p loans, it is often difficult to get feedback from the OJK and the BPR industry every time they want to explain a new innovation.

"Before we had BPR, when we wanted to introduce innovation to OJK it [took a long time]. Our position is not as a BPR, but as a fintech [platform]. We have to convince many parties and cannot be forced. However, when the position becomes BPR, we can more easily present in front of the OJK and we can sharing to other BPRs too," he said when contacted DailySocial.

Menurut Bisnis.com, Komunal acquired 100% shares of BPR Prima Dadi Arta on behalf of its director and founder, namely Hendry Lieviant (34%), Rico Tedyono (33%), and Kendrick Winoto (33%). The three of them took over the ownership of BPR shares previously held by Peter Lumanpauw, Arthur Lumanpau, Elsye Susana, and Fendy with a total nominal share of IDR 2,7 billion.

Communal will make BPR Prima Dadi Arta a pilot BPR as well as an innovation lab. Later, if the company releases an innovation, this BPR will be the vehicle. If successful, it will be rolled out to the BPR industry through its ecosystem.

This area of digital innovation carried out by Komunal for BPR does not want to stray far from BPR's DNA as a specialist in the savings and loans and credit business. The addition of digital solutions is expected to make BPR grow efficiently, safely, and encourage people to put their funds in this type of bank.

“This so cycles. People want to save funds in BPR, the BPR will grow bigger, the local economy will be helped even more. We believe that in this area everything must work together. Fintech lending road, digital bank road. "In this way, financial inclusion will run much faster."

One of the implementations that will be carried out through BPR Prima Dadi Arta is e-bilyet. Hendry said that the issuance of bilyets was now irrelevant to developments in the digital era. Bilyet is a physical document to prove the validity of a deposit owned by a person is genuine.

For example, BPR in Bali must send physical bills to depositors located in Jakarta. Likewise, vice versa when depositors want to withdraw their funds. As a result, logistics costs must be borne by consumers. His party is currently applying for a licensing process for e-bilyets at the OJK.

“There are many other ways to solve the problem. But this activity has been carried out by BPR, which has been operating for decades. We want to break through e-bilyet innovation. Once we are successful at BPR Prima Arta Dadi, we want to invite others."

Komunal's first step in entering the BPR industry was through the DepositoBPR product. The spirit is connecting various BPRs and customers throughout Indonesia who want to open BPR Deposits online. This product was pioneered through Komunal's subsidiary (PT Komunal Finansial Indonesia), namely PT. Komunal Sejahtera Indonesia, which has been registered with the OJK as a provider of digital financial innovation (IKD).

BPRs that can collect third party funds through this product will be sorted first by Communal. One thing is certain, they must be registered with the Deposit Insurance Corporation (LPS) because every deposit on the platform must be guaranteed by LPS up to IDR 2 billion.

The various acquisitions and collaborations above have brought about changes in the BPR business landscape in various regions in line with the entry of various technology companies. BPRs will be increasingly exposed to technology and innovation in their business processes so that they are closer to customers and can compete with commercial banks.

Sign up for our

newsletter

Premium

Premium