Public Acceptance of Paid Virtual Services and Digital Payments

Even though there are many digital payment services, cash transactions are still the main priority for most people

Along with the increase in internet users to access various virtual services, many digital businesses have begun to adopt virtual ways of processing payments. The big question is, of course, whether the Indonesian people as consumers are used to or at least willing to use the virtual payment model. The classic issue still revolves around user trust in digital currencies. However, to prove this assumption, DailySocial trying to do a survey in collaboration with JakPat to find out user understanding smartphone in Indonesia against virtual goods and payment methods.

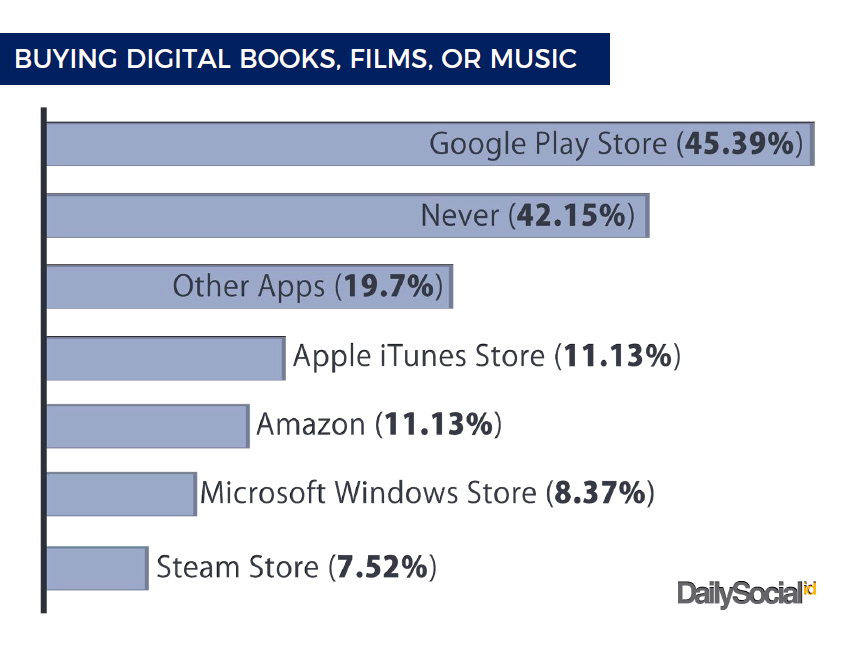

This survey involved 1051 respondents from all parts of Indonesia who used smartphone for daily activities. From the respondents' answers, several findings were obtained, first about the most commonly used virtual services. As many as 45,39% of respondents claimed to have made a purchase or payment for the Google Play Store, although the percentage was also almost equal to those who had never made a purchase at all, which was 42,15%. Interesting, the article is that for self-payment, there are actually many options to choose from, starting from cutting credit, voucher, or manual bank transfer.

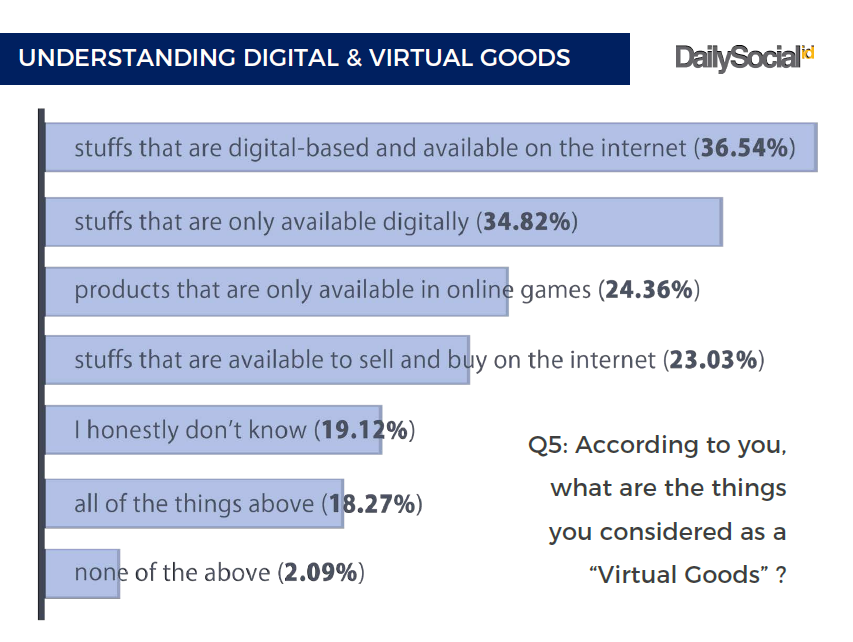

Then the survey also tried to explore people's understanding of virtual goods. In the survey, several options were given, on average defining it as a service that is accessed via the internet or in digital form. Another percentage also shows that the so-called virtual goods are known on average starting from the service games and apps commonly used.

Internet penetration and usage smartphone itself has always been predicted to be the fundamental basis for improvising digital services. One of them is the launch of a virtual transaction model that is carried out by various types of online services, the most of which are services on-demand and E-commerce. Its function is simply to accommodate a certain amount of money credit to a digital wallet service owned by the service provider. There are many advantages for businesses, one of which is user loyalty.

Currently there are several services with their respective characteristics. Of those, GO-PAY became the most widely used, followed by voucher Google Play and TokoCash. Unfortunately because there are issues around the license e-money, some services are suspended, including TokoCash, GrabPay, and BukaDompet. Because if the service has played transactions above 1 billion rupiah, it must have a permit from BI.

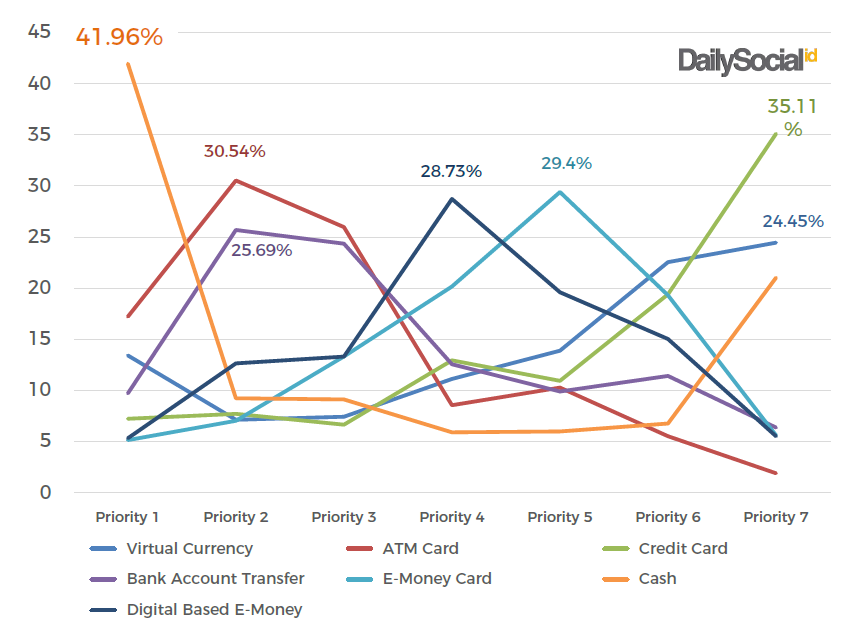

Then what about the current trend of society with regard to payment services. Still from the same respondents, most of them still place the cash or cash method cash in first place, followed by using an ATM or debit card. e-money, credit card and virtual currency still on the last priority.

This figure will certainly still fluctuate, considering that there are many innovations that service providers continue to intensify – including offering more advantages and other benefits, such as program reward.

In addition to the four findings above, there are many more survey results regarding public acceptance of virtual goods and payments. The full report can be downloaded for free at Virtual Goods and Digital Goods Survey 2017.

Sign up for our

newsletter