FMCG's B2B Platform Is in a Transitional Phase Towards an Integrated Digital Ecosystem

CELIOS predicts the potential growth of B2B business transactions in Indonesia will grow 25% this year

Digital transformation has brought about major changes in the B2B FMCG industry. In a study CELIOS conducted with WarehouseAda, it was stated that 60% of MSMEs in Indonesia had benefited from implementing digitization in their businesses, such as making it easier to find suppliers and reach customers.

Through a report titled “B2B FMCG Marketplace Indonesia Outlook 2023 Study,” it also confirms that the B2B FMCG ecosystem has developed more fully, in line with the readiness to adopt a digital approach by MSME players who are getting better. Starting from the increasing demand for POS services, financing, as well as the growth of MSMEs in the middle class, demonstrating the huge potential of Indonesia's B2B FMCG.

“As a provider of product distribution services starting from manufacturers, to sellers, to end users, B2B digital platforms will become a trend that spreads across various industries, including FMCG," wrote the study.

This study is expected to be a reference for supply chain business players in Indonesia in assessing the B2B business landscape, as well as setting the best business strategy to face economic challenges from the point of view of digital innovation in the B2B FMCG industry.

For the record, B2B FMCG is a new business model in B2B business development. Unlike B2B marketplace in general, B2B FMCG is more specific to sales activities carried out by one business or other companies specifically for FMCG products. The players are not only GudangAda, but also there Bukalapak Partner, Tokopedia Partners, GoToko, and Warung Pintar.

B2B user profile marketplace the majority are aged 25-35 years (41%). About half of stall owners have been in business for more than three years. Due to its large population, the island of Java remains the main location for most warungs. Jakarta and its satellite cities account for 26% of the total stall owners.

The majority of shop owners (38%) allocate IDR 1 million per week to restock goods. Then, as much as 27% spent IDR 1 million-IDR 2 million, and 12% spent IDR 2 million-IDR 3 million.

Study findings

- Research has found that the biggest challenges for MSMEs in developing post-pandemic businesses are competition with modern shops (36%), consumers defaulting on debt payments (31%), and unprofitable business locations (27%). This correlates with other findings, where there is an increasing need for simple digital solutions for speed and cost efficiency, payment flexibility, and wider market reach.

- The opportunity for B2C FMCG volume escalation in Indonesia in 2023 is still considered large in line with the business potential of Indonesian MSMEs, the growth of internet users, and government support in increasing public financial inclusion. CELIOS predicts the potential growth of B2B business transactions will grow 25% this year.

- The research results show that the digital B2B platform as a provider of distribution channels from producers, sellers to end-users will become a trend that spreads across various industries, including FMCG.

- This year, research shows various challenges in the development of the B2B industry in terms of low financial literacy, digital access gaps, and financing for MSMEs that must be watched out for by B2B FMCG players in Indonesia.

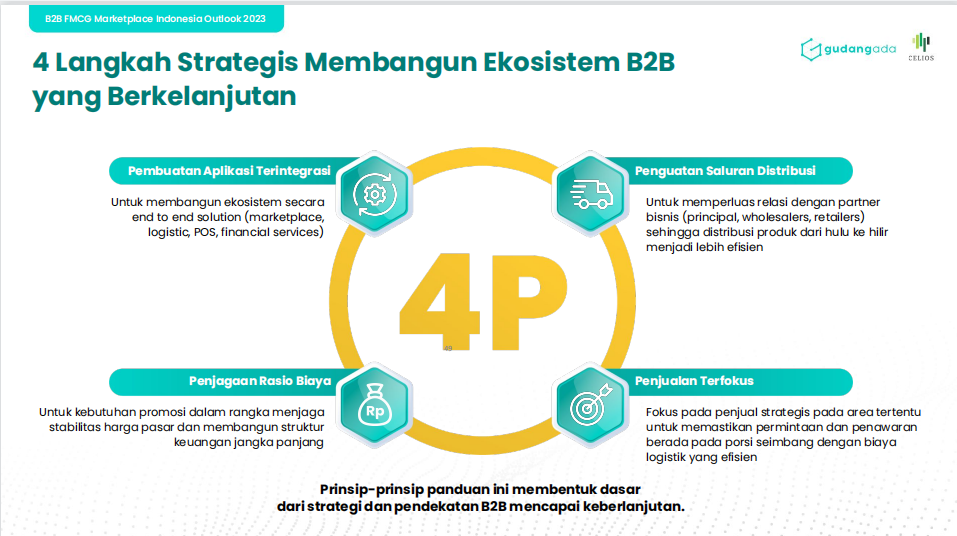

- There are guiding principles (4P Strategy) in the research aimed at B2B FMCG players to build a sustainable B2B ecosystem, including: creating integrated applications as a whole; distribution channel strengthening; sales focused on strategic sellers in certain areas; and maintenance of cost ratios for market price stability.

Director of the Center of Economic and Law Studies (CELIOS) Bhima Yudhistira said, to produce a more in-depth analysis this study was made using the literature study method with various sources, both primary and secondary and relevant previous studies. The results found that currently the B2B marketplace market in Indonesia is in a transitional period from phase 2 (customer process portal) to phase 3 (multi-channel infrastructure).

"The B2B transformation phase in Indonesia is currently in the transition from Phase 2 to Phase 3 where B2B service provider companies begin to develop additional services needed by MSME players in an integrated digital ecosystem," said Bhima.

He continued, "The presence of a digital B2B platform such as GudangAda can play an active role in accelerating this transition through a variety of digital business services that are integrated to all players in the B2B industry, from principals to MSME-level business people such as shop and shop owners."

More Coverage:

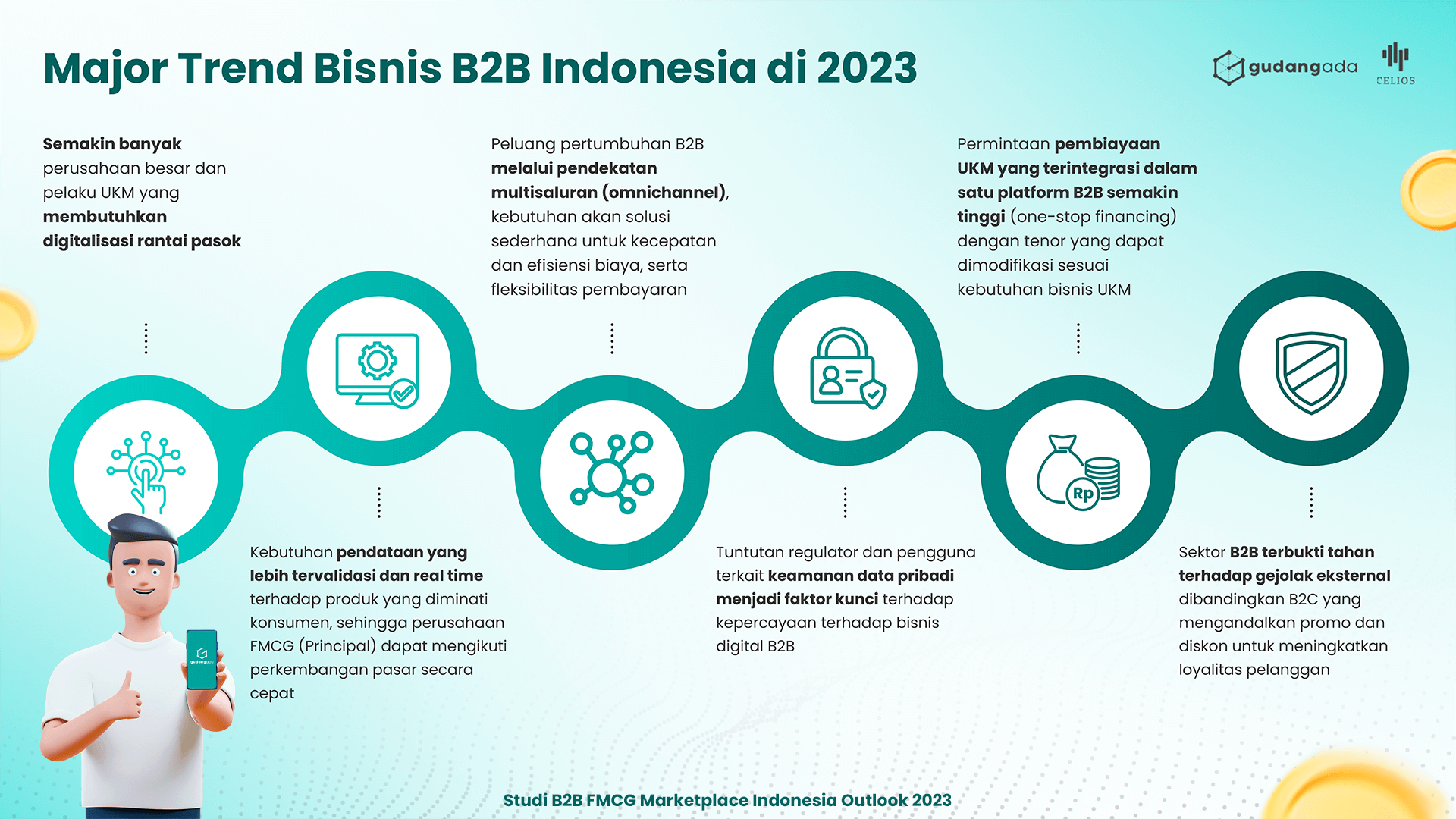

Trend predictions in 2023

- System requirements one-stop solution to speed up the data validation process realtime so that principals can follow market developments more quickly.

- Multi-channel approach (omnichannel) as one of the efforts for the B2B FMCG industry to grow more rapidly.

- The demand for personal data security is in line with the increasing number of business actors using B2B digital platforms.

- Request one-stop financing with a tenor that can be adjusted to the needs of SMEs

GudangAda's SVP Marketing & Corporate Affairs Yuanita Agata said, this year GudangAda will focus on strategic aspects to achieve the best position in navigating business competition. This is done by building a more efficient distribution channel to support the development of principal and business strategic sellers in strategic areas, prioritizing sustainability by creating healthy margin levels between principals and business partners.

“Then, focus on strategic buyers and seller by increasing partners' digital literacy in maximizing service features in the GudangAda application and providing safe access to productive credit for MSME business partners," concluded Yuanita.

Sign up for our

newsletter