AFPI Survey: 88 P2P Lending Provide Loan Relief Worth 237 Billion Rupiah During the Pandemic

The total number of incoming restructuring requests has reached IDR 1 trillion

The latest AFPI (Indonesian Joint Funding Fintech Association) internal survey regarding credit restructuring due to the pandemic re-shown. This time revealed that as many as 88 platforms received restructuring requests from borrowers. The number of loans that were successfully facilitated and approved Actioncalendar reached Rp237 billion from 674.068 accounts/transactions.

The survey was held on 9-14 May 2020 and was participated by 143 organizer platforms p2p loans as a respondent. Further elaborated, as many as 61,5% or 88 platforms received a request for restructuring from borrowers. Meanwhile, the remaining 38,5% or 55 platforms did not receive applications.

AFPI's Head of Public Relations and Institutions, Tumbur Pardede, explained that of the 88 platforms that reported, only 60 of them submitted information on the number of accounts and the total value of transactions. The other six platforms convey the total value of the transaction, and the remaining 14 platforms only convey the number of accounts.

"The total number of requests for restructuring reached 1,96 million accounts/transactions, the value reached Rp. 1,08 trillion, but what was approved by lenders was only Rp. 237 billion," he said at a press conference. online, Tuesday (2/6).

He emphasized, the organizer of the platform p2p loans different from the banking industry. The platform only brings together borrowers with lenders, while banks act directly as lenders.

Therefore, the platform is not authorized to provide loan restructuring without the approval of Actioncalendar. “The authority lies with the lender, but the operator can facilitate requests for restructuring requests for borrowers.”

In addition, the survey also shows the Pay Success Rate (TKB90). A total of 90 platforms stated that TKB90 was stable, 34 platforms decreased TKB90, and 6 platforms claimed that TKB90 had increased.

TKB90 is a level of credit quality in a platform. The higher and closer to level 100, the better. Based on OJK data as of March 2020, TKB90 industry p2p loans recorded at the level of 95,78%.

New requirements for permit application

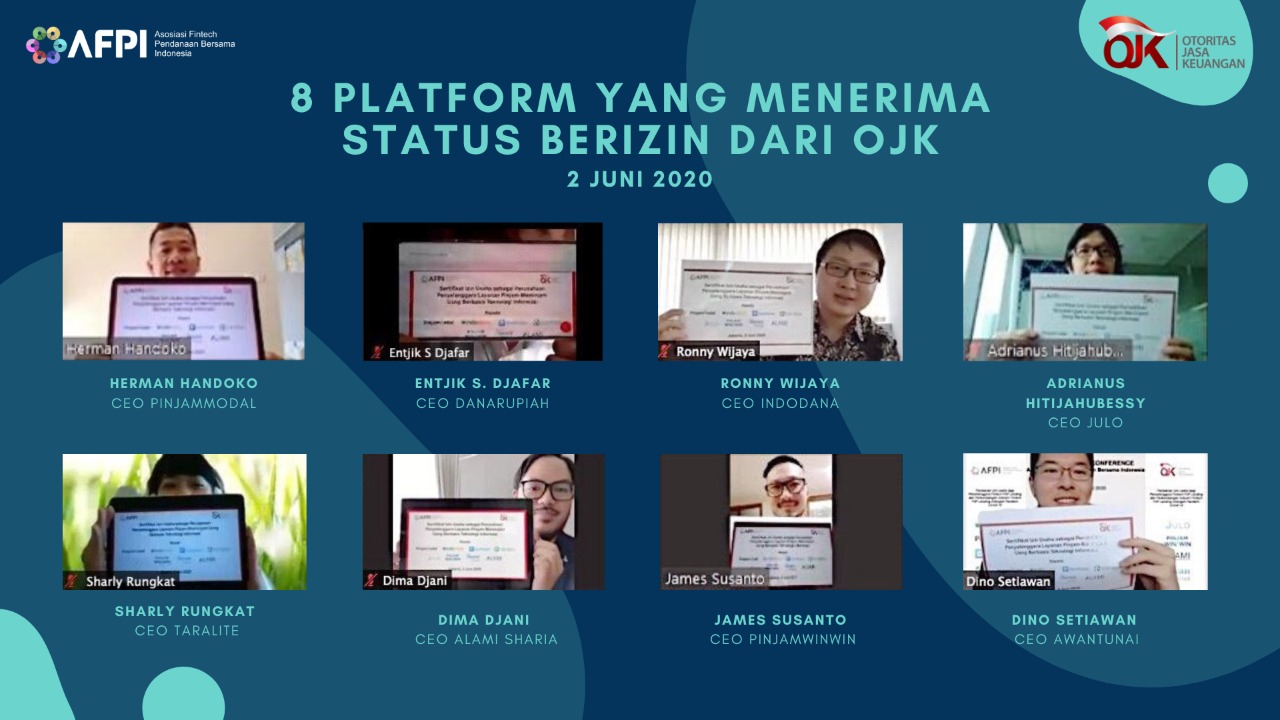

At the same time, AFPI announced eight platforms that had new business licenses from the OJK. They are Borrow Modal, Taralite, Danarupiah, Pinjamwinwin, Julo, Indodana, Awantunai, and Alami. The total platforms that have been licensed by the OJK have reached 33 platforms out of 161 AFPI members, the rest are still registered.

AFPI Daily Chair Kuseryansyah added, there are additional requirements that must be met by the platform when applying for a permit. Namely, having information system security in the form of ISO 27001 and has been integrated with the system Fintech Data Center (FDC). "This is requirement new ones for submissions last year, on batch never before," he said.

Integration with FDC is currently the main focus of associations in order to provide optimal impact to reduce the potential for fraud in the industry. Therefore, all members are encouraged to be integrated, including for platforms that are applying for permits.

In this regard, the association temporarily closed the registration process for new members some time ago. Kus said that there were 35 new players who were still on the waiting list and had not yet been processed by the association.

“Soon we will have a meeting to determine when it will open again. We are also currently conducting a joint study with OJK to see how much ideally p2p loans in Indonesia, the results will be out soon.”

More Coverage:

From the latest data from the OJK in April 2020, the accumulation of loan disbursements in the industry p2p loans as much as Rp106,06 trillion, up 186,54% yoy. Java Island dominates total loans of up to Rp90,88 trillion, the remaining Rp15,18 trillion comes from outside Java. Amount Actioncalendar recorded there are 647.993 and borrowers reached 24,77 million.

Kus also noted that the number of loans per month during these four months experienced an upward trend. The sectors that increased dramatically were financing for the health industry, such as pharmaceutical SMEs, drugs, and health support equipment. The same applies to sectors related to food distribution, agricultural products, and packaged foods.

Other sectors are telecommunications and ecosystem online which are increasingly used to support daily life and have the potential to develop along with the shift in people's consumption behavior.

Sign up for our

newsletter