A Year of Operation, Crypto Asset Marketplace Pintu Focus on Reaching Beginner Investors

Although the adoption of crypto assets continues to increase, Pintu considers that education and assistance are still needed, especially for novice investors

The skyrocketing popularity of crypto assets has attracted many novice investors to dive into this investment instrument. However, the increasing "hype" of crypto assets certainly carries risks. Having a concept that is not simple and has a high level of volatility, there are many things that need to be understood before deciding to enter the world cryptocurrency this.

Crypto assets are digital currencies that are used for virtual transactions on the internet network. There are secret passwords that are quite complex to protect and maintain the security of this digital currency.

Founder Pintu Jeth Soetoyo said, "Crypto is now a digital asset that is eyed by investors because it has the highest return and also cryptocurrencies such as Bitcoin are considered as store of value most reliable against the impending global recession. Its performance so far makes Bitcoin a more attractive asset choice for investors looking to diversify their asset holdings."

Even so, crypto assets exist as an alternative currency with a decentralized concept. In this concept, there is no sole proprietorship. Without a definite form and value, regulation is expected to be a solution.

The development of crypto assets in Indonesia

Cryptocurrency was declared legal as a commodity in Indonesia in February 2019, based on regulations issued by the Exchange Supervisory Agency (Bappebti) through Commodity Futures Trading Supervisory Agency Regulation Number 5 of 2019 concerning Technical Provisions for Organizing the Physical Market for Crypto Assets (Crypto Assets) on the Futures Exchange.

In these regulations, there is a licensing mechanism for para exchanging which trades crypto assets such as Bitcoin, Binance, Ethereum, Dogecoin and other tokens. At least 13 companies or entities have received registration marks from CoFTRA as potential crypto asset traders. Including Crypto Store, Indodax, and which last March completed a year of operating in Indonesia, Pintu.

Even though it is claimed that it can be used as a means of payment for virtual transactions, crypto assets still cannot be used as a legal means of payment in Indonesia. According to Law no. 7 of 2011 concerning Currency, the legal means of payment is the rupiah. However, crypto assets can still fulfill their other functions as investment and mining instruments.

There are more than 3,000 types of crypto assets circulating throughout the world, and there will be more in the future. Some types that are often used include Ethereum, Dogecoin, Ripple, Stellar and the most popular Bitcoin. Bappebti itself has published a list 229 crypto assets that can be traded in Indonesia.

Apart from that, crypto asset-based derivative products have also been widely circulated in the community, including DeFi, staking, and so on. Regarding this, Jeth stated, Pintu has accommodated DeFi coins. Every week the team always tries to present DeFi coins that are of interest to users, but it does not rule out the possibility that in the future the platform will also accommodate features such as staking.

Uncertainty about the end of the pandemic is said to increase public awareness of its importance investation to assets that have advantages on the hedging side. This also increases millennial investors' adoption and understanding of crypto assets. The recent actions of institutional investors who are increasingly buying Bitcoin in large amounts have also changed the positive stigma towards crypto. Bitcoin is now considered one of the world's major commodities with a market capitalization once exceeding $1 trillion.

High volatility and novice investors

Trading crypto assets is a high-risk activity due to high price volatility, so the crypto investor profile is usually someone who dares to take risks. It is important for people to understand that one crypto asset is not the same as another. Investors must ensure that the crypto assets they own have a high level of liquidity.

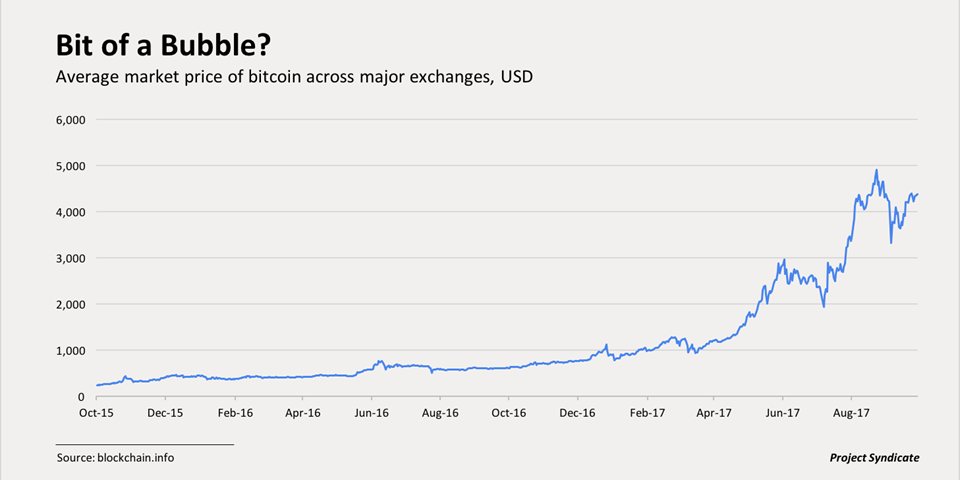

Reflect on situation 2017-2018 which had made the public quite "traumatized" with extreme volatility and uncertain intrinsic value, quite a few investors were reluctant to jump into the pool cryptocurrency. At the end of 2017, the price of Bitcoin almost touched US$20,000, before finally falling again below US$10,000 in mid-January 2018.

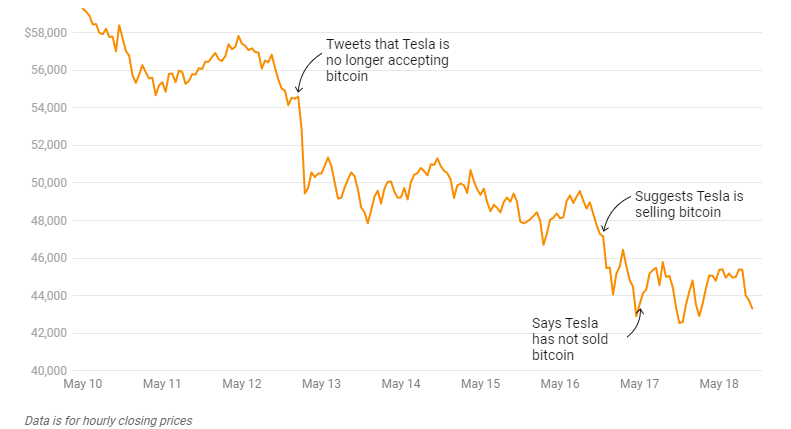

When Tesla announced the purchase of $1,5 billion in bitcoin on February 8, the world cryptocurrency It's hotly discussed again and its value has also increased. Investment activists and ordinary people flocked to try out this instrument.

However, seeing the price of Bitcoin gradually falling in the last month, questions arise again. Will history repeat itself?

Regarding price volatility and novice investors, Jeth said, "Investors must ensure fundamentals (such as background, technology, market capitalization, etc.) and what the characteristics of crypto are compared just because of FOMO. Investors must also choose one that suits their beginner profile and not never believed in promises of guaranteed profits."

In fact, among the many crypto assets with high volatility in circulation, there are those that are categorized stablecoin, because its value refers to other assets whose prices are stable, for example gold or the US dollar. Called stablecoin, because the price does not rise and fall quickly over a certain period of time.

Since its initial launch, Pintu focuses on easy and user-friendly mobile applications to encourage more and more novice investors who want to trade, send and store crypto assets. As an exchange that focuses on novice investors, Pintu offers education where everyone can learn about crypto.

"We also often hold webinars to provide education directly to the audience. We feel it is important to continue providing education about crypto and its price volatility," added Jeth.

Regarding Regulations

Reporting from Seconds Finance, Bitcoin transactions and other crypto asset commodities in Indonesia have reached IDR 1,7 trillion per day. The high interest in transactions in this sector has caused regulators to prepare bursa as a protective measure. This exchange focuses on protecting business actors so that relations between all parties can run well. Between traders, investors and other institutions it can be clear and safe.

See the case in Turki and in other countries that allow platform owners to "run away" with public funds, Jeth also commented, "The problem that occurs in Turkey is that the Turkish cryptocurrency market is not regulated, whereas in Indonesia crypto is a commodity whose trading is regulated by CoFTRA as the supervisor."

Bappebti is currently also said to be working on a custodial user mechanism for crypto asset traders for better security of its users' assets.

"In order to mitigate future problems, security is our priority as a crypto trading exchange. By prioritizing advanced technology and experienced developers, Pintu wants to provide a sense of security for its users," added Jeth.

Sign up for our

newsletter

Premium

Premium