Observing the Prospect of "Securities Crowdfunding" for Startup Ecosystems

There are four organizers who are applying for SCF permits

OJK's move to expand alternative funding for SMEs from equity crowdfunding (ECF) becomes crowdfunding securities (SCF) should be appreciated because the previous regulation had many holes that did not accommodate SMEs, the majority of which were not in the form of Limited Liability Companies.

The detailed rules are contained in POJK 57/2020 regarding Securities Offering Through Crowdfunding Services Based on Information Technology, replacing POJK 37/2018 which originally only regulates service through crowdfunding stock based and Islamic stocks.

This regulation, which contains 13 chapters and 92 articles, details the licensing, business activities, obligations and prohibitions, reporting, securities offering and trading practices, and sanctions.

This expansion does not necessarily eliminate the presence of ECF. Chairman Indonesian Crowdfunding Service Association (ALUDI) Reza Avesena, who is also the Co-Founder and CEO of Santara, emphasized that the ECF function still exists and remains an alternative that can be of interest to publishers and investors.

“With SCF, organizers can issue securities not only on a basis equity, but also debt or sukuk based. "It can be seen from Article 91," he explained to DailySocial.

Reza also explained that sukuk issuance now adopts what is implemented by the capital market regulator. The required instruments used by BEI for the issuance of sukuk, such as the role of the DPS (Sharia Supervisory Board) or ASPM (Capital Market Sharia Expert) recommended by the MUI DSN, the role of sharia custodian banks, and the role of KSEI as custodian.

Further in this SCF service loads some important points:

A. Offer period: 12 months (1 or several offers) B. Securities offered: Equity securities, debt securities and sukuk C. Offer value: Max IDR 10 billion D. Offer period (each offer): 45 day E. Offer is null and void: If the minimum funds are not met, the offer is null and void. F. Equity securities: It is prohibited to use more than 1 organizer. : The issuer can cancel the securities offering before the end of the offering period by paying a fine to the organizer

CORE Indonesia economist Yusuf Rendy Manilet said the presence of SCF was a positive step for the domestic capital market because it could increase the amount of funds raised from the capital market. Apart from that, SCF further deepens the variety of instruments available in the capital market because it is considered that there are still many financing instruments that have not been fully explored.

“This is a good thing, especially for the small and medium business sector which is often hampered by capital problems. "The impact will certainly be in line with the government's efforts to deepen domestic investor ownership," he explained as quoted from Bisnis.com.

Bank Permata VP Economist Josua Pardede has the same opinion. According to him, the emergence of SCF will have a positive impact on the capital market as demand for shares from domestic investors increases. This can be seen from the increasingly limited impact of incoming and outgoing foreign investors on stock movements.

"SCF will increase stock market deepening and encourage the empowerment and corporatization of SMEs," he said.

The initial story of ECF becoming SCF

Amvesindo Chairman Edward Chamdani explained that the OJK originally issued POJK 37/2018 because the regulator wanted to issue an ECF but did not yet understand what areas it was for. After publishing the POJK, the association provided input from the venture capital side, for example mandatory convertible (mandatory convertible bonds) are counted as equity. Meanwhile, in the capital market it is still considered a loan as long as it has not yet matured.

This difference in concept occurs because regulations in the capital market are more rigid because they relate to regulations in the Ministry of Law and Human Rights. Also, after POJK 37 was issued there were still holes which OJK finally filled in through POJK 57. He saw that OJK paid attention to input from Amvesindo that securities such as bonds or KIK participation units could be securitized.

"Instead of making a circular, OJK finally made POJK 57 which has the contents embedded with POJK 37. So securities instruments are more in nature open can be-through crowdfunding"Well, it's not just equity," he said when contacted DailySocial.

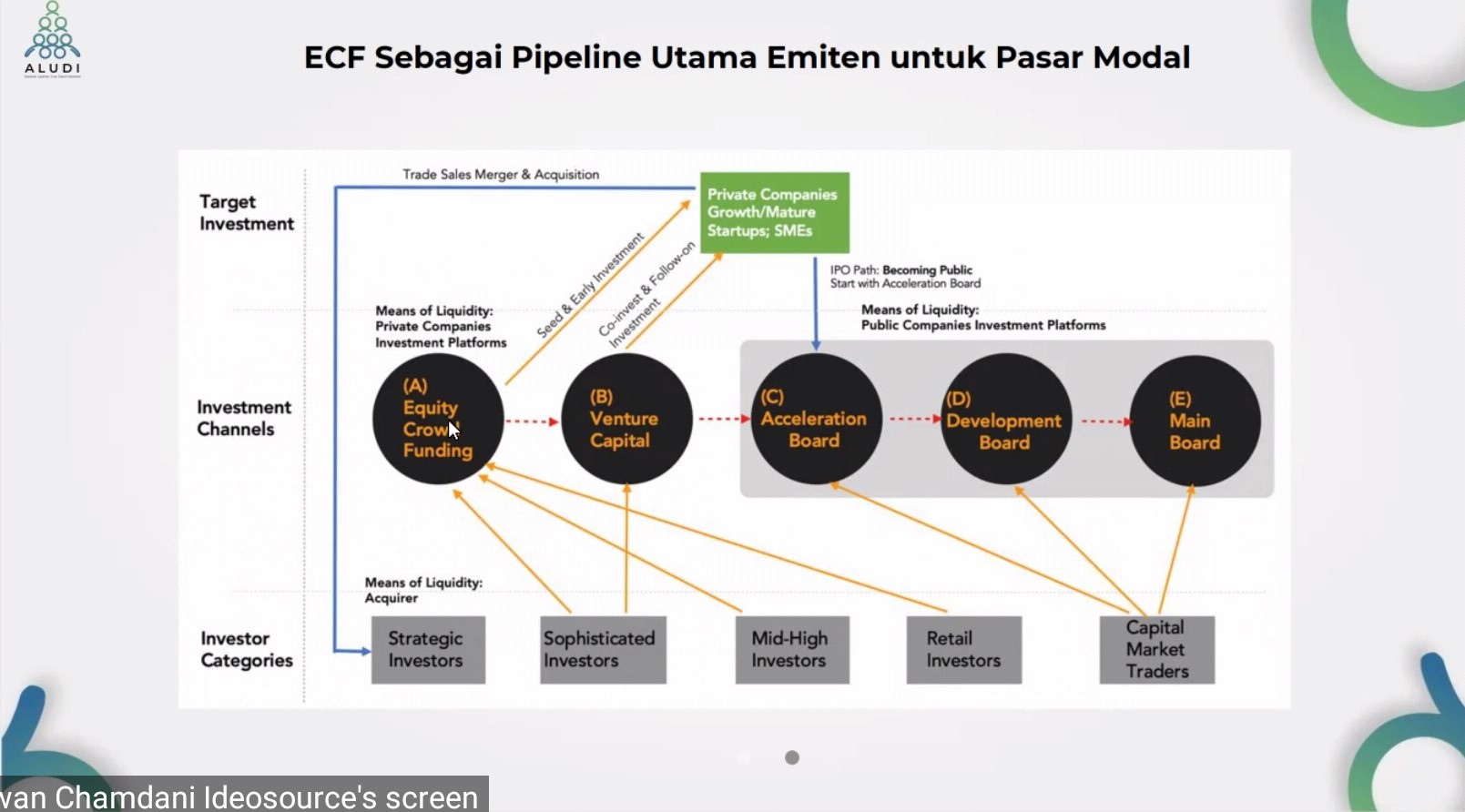

He continued, interestingly SCF could be a new breakthrough for the startup ecosystem because it could be an interesting medium for them angel investors, VC, or accelerator who want to work with SCF organizers and fund SMEs.

There are many possibilities that could occur, for example creating your own joint venture company that functions for pool of funds with more properties open to invest in companies that enter the SCF platform. Then the accelerator players are trained to move up in class so they can enter the acceleration board on the BEI. Can also angel investors or VCs who directly inject funds into these SMEs.

Venture capital that does not adhere growth mindset can also participate in funding. SME businesses that enter the SCF platform have been curated, not haphazard, and have stronger business fundamentals than most technology startups that are oriented towards a "burn money" strategy.

Oriented venture capital company growth mindset come in too. The misconception that VCs are only interested in entering technology startups can also be dispelled because they are starting to look at many sectors. These possibilities can occur because the scope of investors reached is much wider.

In terms of regulations, the OJK is much stricter for SCF players than p2p lending where fraudulent investments are still found because most players come from abroad and do not have representative offices in Indonesia. Here, the OJK does not apply the provisions for registered status, the organizer must have licensed status before he can operate.

The requirements that must be met to obtain permission are also no joke, not just understanding the business model, but must be ISO 27001 and audited by a committee which is one of the member on BEI. “Because this is a mini exchange for private investors so whether you like it or not, you have to strict from the beginning."

Upgrade to SCF

OJK noted that up to the end of last year, it had issued four organizing permits to four companies. They are Santara, Bizhare, Crowddana, and LandX. Cumulatively, these four companies have raised funds amounting to IDR 185 billion.

Meanwhile, OJK recorded that there are 16 prospective organizers who are still in the ECF licensing process and three prospective organizers in the SCF licensing process. Two of the three organizers in question are Santara and Bizhare. "It's in the final stage, we hope to release [the permit] this February," said Reza.

Santra has prepared a number of plans, for example for the issuance of sukuk, it has received recommendations related to TAS (Sharia Expert Team) from DSN MUI. However, even if the permit has been issued, the company has not immediately taken the SCF seriously this year because it chose to focus on issuing the ECF.

"Because at ECF the business model is already very mature internally. But that doesn't mean we won't issue sukuk, but it's more necessary for education market, audience first."

To DailySocial, Founder and CEO of Bizhare Heinrich Vincent said, the company chose to transform into SCF, not pivot, in order to develop its pre-existing business model.

"Of course it is aimed at making it easier for the public, especially SME business people, to obtain capital with a more diverse choice of schemes. "To be able to support Indonesia's economic development and open up wider job opportunities."

He continued, SME businesses in Bizshare which has received funding through the ECF scheme will continue to run and the company itself is creating innovations for this service product category by releasing Secondary Market services which will be released in early February 2021.

This service is a strategy to increase the liquidity of the issuer's shares issued, as well as one of the exit strategy for investors. In an official statement today (3/2), Heinrich explained the benefits of the Secondary Market for SME publishers themselves, namely to buy shares again (buyback) their shares in the Secondary Market, if there are investors who want to sell their shares.

In this way, the democratization of the financial services system will be realized mature such as the capital market, which was initially only accessible to the upper middle class, can now be accessed by SMEs throughout Indonesia. Investors can carry out request transactions (bid) and offer (offer) stock safely and conveniently.

“The Bizhare Secondary Market is opened for issuers that have been running for 1 year, registered with KSEI, and/or according to the resolutions of the GMS of Publishers. The Secondary Market will be opened every 6 months with the Secondary Market opening for 10 working days,” explained Vincent.

Vincent is optimistic that SCF will make it easier for SMEs to choose the type of funding that suits their preferences, whether shares, bonds or sukuk. In terms of requirements, this securities issuer is not only for PT entities, but also cooperatives, CVs, and so on.

"We will also continue to present stock offerings for a row of increasingly attractive and diverse SME businesses. Currently, Bizhare is opening funding for various businesses that can be invested starting from IDR 50 thousand per share. We are optimistic that many young people's business works can grow rapidly thanks to our services as SCF so that Indonesia's economy will grow even more extraordinary."

Bizhare targets that this year more than 200-300 SMEs can open funding through Bizhare. From the investor side, the total investment value is expected to grow between 5-10 times. This target will be achieved with company innovation not only through expanding services to SCF, but also plans to add other types of business besides SMEs and franchise, such as funding for technology startups.

“From the product side, we will soon launch a new feature, namely business profile, so that prospective publishers can more easily apply for funding and profile listingits in Bizhare. "Apart from that, we are launching an application for Android and iOS which is targeted for release this year."

Vincent continued, “There are various strategic collaborations with various parties which will be announced in the near future. "In terms of funding, we plan to open discussions with various investors and VCs to join in Series A funding at the end of 2021."

Needs massive education

The SCF market potential can be measured from the number of MSMEs which is estimated to reach 60 million. In order to pursue this potential, ALUDI has a lot of homework. Industry optimism needs to be accompanied by massive education from all stakeholders so that the ecosystem is much healthier because the opportunities in the future will be much broader.

Reza said that from the business side, SMEs need to improve financial literacy, integrity, legality and understanding of capital markets. Meanwhile, from the investor side, literacy regarding understanding investment risks also needs to be improved. Remember, each investment instrument has a different level of risk and level of understanding.

Another thing that needs to be improved is maintaining public trust and bridging the lack of talent in the financial industry. Edward also emphasized education for investors so as not to be misled because this investment instrument is still new, like shares but not as liquid as shares and the issuing company is relatively young.

"But this is interesting because it contributes to SMEs, they have a channel for raising funds that banks or other financial institutions cannot enter. This is a gap that can be exploited."

He hopes that if this instrument is increasingly popular with SMEs, the costs for listing securities at KSEI will be cheaper. Moreover, KSEI is currently promoting unscripted securities recording (scriptless) with system updates still underway.

“KSEI's potential can be patterned scriptless for private company menjadi breakthrough, but an issue cost this could overload the platform, this is something to pay attention to.”

From the perpetrator's side, Vincent said that every week the company prepares various programs to provide information about SCF online for investors. "We also actively collaborate with the seller community, starting from the MSME business community, marketplace sellers, and many others to educate business people in terms of strategies to develop their business through Bizhare funding," he concluded.

- Header photo: Depositphotos.com

Sign up for our

newsletter

Premium

Premium