Moduit Strategy to Increase Investment Penetration of Mutual Funds

Currently in the process of raising series A

Lately, online mutual fund players are increasingly popping up, considering that the penetration of this investment instrument is still minimally utilized by the public. Moduit comes with a slightly different approach, not only making it easier for consumers to invest. But committed to building its own industry by releasing a platform for investment advisors (financial advisors).

moduit was founded in early 2018 by Jeffry Lomanto and Charles Jap. They see there are important issues that prevent financial advisors from developing in the midst of technological advances. Advisors who also serve as marketers are faced with the challenge of expensive customer acquisition because the education process must be done individually.

In addition, the licensing administration process is complicated. Meanwhile, in terms of technology, IoT and system security are finished pain point. Customers have difficulty accessing their investment portfolio information, and are subject to large transaction fees.

"Jeffry and Charles met to create a solution so that everyone can invest easily and affordably. Moduit was founded with the vision of being an access gateway for Indonesians to be able to manage their wealth," said Moduit CMO Stefanus Adi Utomo to DailySocial.

In its business model, Moduit has two products that target different types of users, as well as differentiate them from other players. Namely, applications for customers and platforms for investment advisors. Both have been officially released.

The Moduit application has several advantages. Among other things, the product curation process uses the Moduit PRIME model, which consists of quantitative and qualitative criteria. As a result, customers will receive selected products available on the platform.

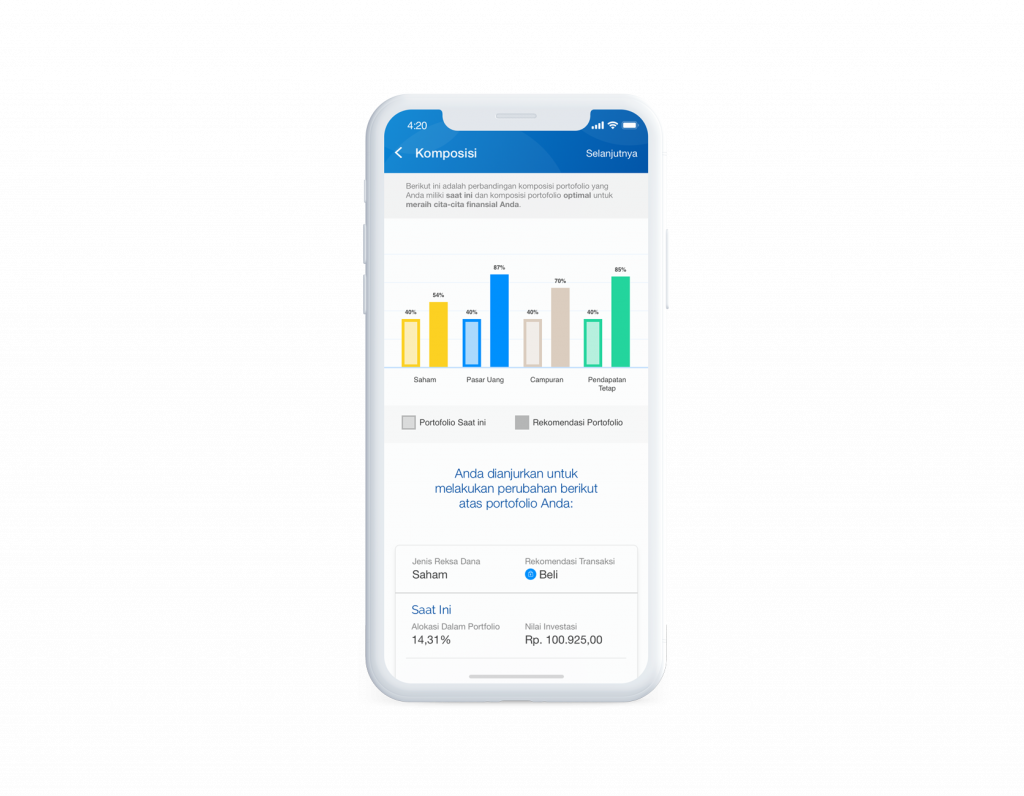

Next, the Moduit Navigator feature will guide customers to achieve their financial goals by recommending the appropriate investment portfolio, reminding them to invest regularly and rebalancing periodically.

"Then, there is easy access for customers because Moduit uses multiple data center and various supporting technologies such as OCR (Optical Character Recognition) at the time of registration and fingers/face scan When login."

As of October 2019, Moduit has collaborated with 15 investment managers, providing 66 selected mutual fund products. The application was released in March 2019. More than 20 thousand users downloaded both the iOS and Android versions.

"From the number of downloaders, the number of registered customers is more than 10 thousand customers with an average growth of 83% of managed funds per month since the launch date."

Investment advisory platform

Stephen explained, investment advisory platform this was actually only released in May 2019, after the company obtained an investment advisory license from the OJK. From this license, the company is equipped to provide more comprehensive solutions for customers.

The reason for the company to enter this segment is because there is an imbalance in the number of securities marketers with the growth of the capital market itself. Referring to OJK data, the number of licensed securities marketers in September 2019 only increased by 5,37% or 15.215 people from the previous 14.439 people. year to date.

This figure consists of WPE/Securities Representatives (WPPE/Broker-Dealer Representatives or WPEE/Deputy Underwriters); Investment Advisor; APERD/ Mutual Funds Selling Agent; and WMI/Deputy Investment Manager.

In fact, the growth of capital market investors and their managed funds is faster than that. The number of investors alone last year grew to 44,24% or 1,6 million people.

"Here there is a need for marketers how to stay competitive. They can use Moduit to market their well-selected mutual fund products."

To become an investment advisor at Moduit, there are a number of requirements that must be met. Individuals must register themselves as MAP (Moduit Advisory Partners) and assist client transactions through the platform.

Advisers who join, must have a valid license. Can choose, WPE (WPPE or WPEE); WAPERD; or WMI. "They are also required to have the expertise to use internet-based applications."

Advisors who join, he continued, will be supported by various facilities other than passive and active income. These include support for Moduit system infrastructure, such as CRM, Income Planner, Pipeline Management, and Scheduler; operational support, periodically there will be training programs, market updates, and the licensing process for marketers.

Android version of the application is available and iOS which advisors can download to start selling.

In addition, it does not give special preferences to targeted customers. Stefanus only said that there were segments of society who were busy, or needed consultation from experts who needed the role of this investment advisor. Which, this segment is not only closely related to wealthy customers.

"There are types of people who are hesitant to enter the capital market, so they need Chat to strengthen their judgment. There are also those who are busy, so it's less Update with the development of the capital market."

There are two types of profit sharing system for each customer who invests through a financial advisor. Direct income from transaction fees, the amount of which depends on the terms of each prospectus and monthly income from management fee.

It is claimed that the company currently has around 39 marketers who have joined.

Series A . funding targets and preparations

More Coverage:

One of Moduit's latest innovations is collaborating with GoPay as an additional payment method. It is hoped that the public will find it easier to invest in affordable mutual funds.

Next, the company will add payment options by the method virtual accounts which will launch next month. "We will continue to enrich features and modify processes to make it easier for customers to use the application."

Regarding funding, Stefanus said that his party is in the process of raising series A funds. It is hoped that it will be announced early next year.

Previously, the company had pocketed a number of funds with an undisclosed value from angel investors. Then, recently graduated as a participant in the Plug and Play Asia Pacific Batch 5 program.

"We have just joined the Plug and Play Asia Pacific Batch 5 program and are in progress fundraisingseries A," he concluded.

Sign up for our

newsletter