Moduit's Commitment to Live the Investment Advisory Profession with Technology

The mobile app will be unveiled later this month; in the middle of raising series A funding worth 41 billion Rupiah

The euphoria of the increase in the number of retail investors should actually be appreciated, because before digital technology came in, the numbers had stagnated at only hundreds of thousands of people for more than a decade. However, in the industry wealth management, there is a supporting ecosystem that helps retail investors recognize securities products, namely securities marketers whose numbers continue to decline because they have not been helped.

According to OJK statistics, the number of Mutual Fund Selling Agent Representatives (WAPERD) last year was 23.110 people, down 16,23% from the previous year's 27.586. Whereas last year the number of retail investors reached the range of 2,47 million from the previous 1,61 million investors.

Approach taken moduit as one of the players fintech di wealth management quite different. This startup is working on the potential of b2c to target retail investors, and b2b2c targeting securities marketers who want to reach investors with large investment nominals.

This strategy was taken because here the industry wealth management very fragmented. There are three main activities in it, educating clients by finding out their financial needs and what is it like. Not just doing KYC (Know Your Customer).

Then enter the second activity, namely financial planning to simulate the investment portfolio based on the data obtained during the first activity. Finally, go to the execution section to transact the activities in the second section.

"This last part requires an PI (Investment Advisor) license to administer, connect with custodians, KSEI (Indonesian Central Securities Depository) and the like. In Indonesia, startup players wealth management it's very fragmented, if we want end-to-end, "explained Moduit Founder & CEO Jeffry Lomanto to DailySocial.

Moduit has hooked 20 officially licensed marketers since the app was released on a limited basis last year. Interestingly, although small, these marketers contribute to the number of customers on Moduit, around 15-20% of the current total of 18 thousand customers. When viewed based on managed funds, the contribution reaches 90%.

"But we want both [b2c and b2b2c] to stay growth. What we like, because our business model is like this, passion The number of agents joining is getting higher, because they have easier access," added Moduit CMO Stefanus Adi Utomo.

"By month to month Our AUM grew by an average of 70%. Incomparison, for players who only rely on b2c, the increase is 40%. That's why this business model is interesting because there is a combination of ticket sizes and number of tickets," added Jeffrey.

The b2b2c application is equipped with Moduit system infrastructure support, such as CRM, Income Planner, Pipeline Management and Scheduler; operational support, regular training programs, market updates, and the licensing process for marketers.

For the time being, all transactions made through marketers have no commission taken by Moduit. The commissions set are still entirely based on an agreement between investors and marketers.

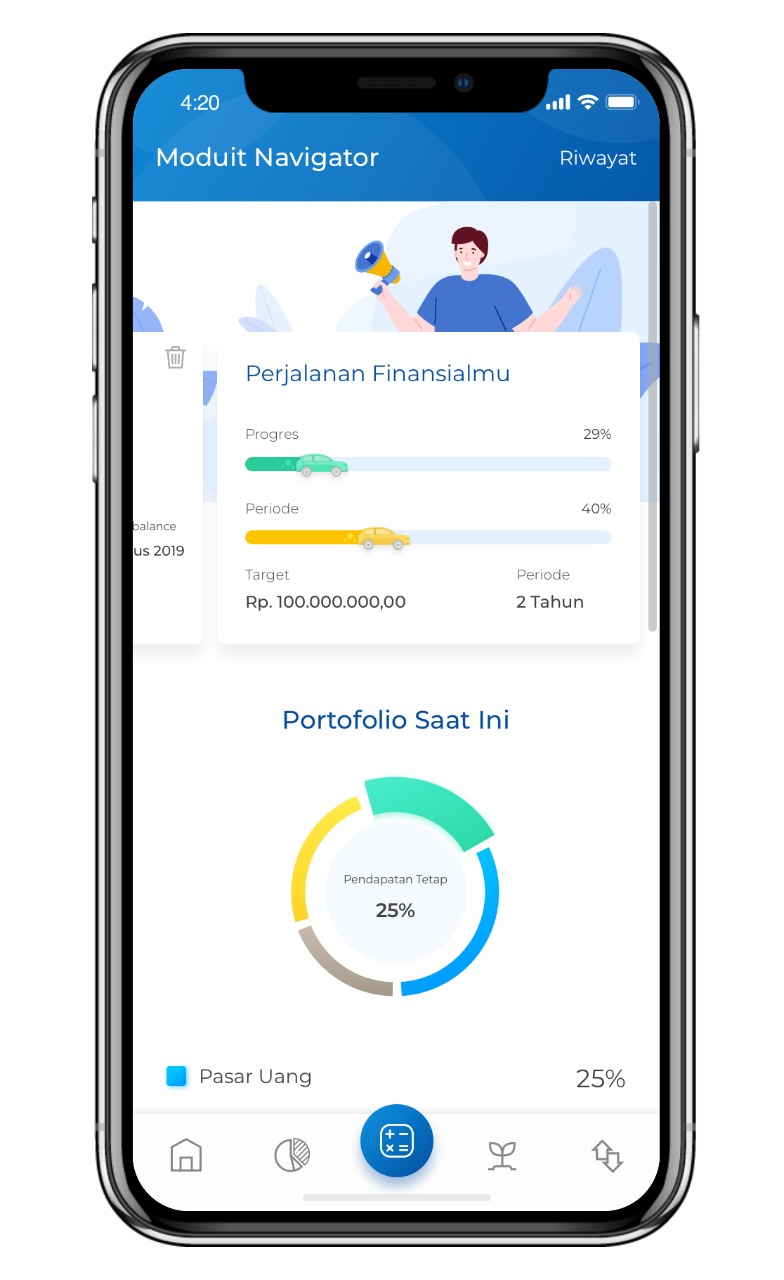

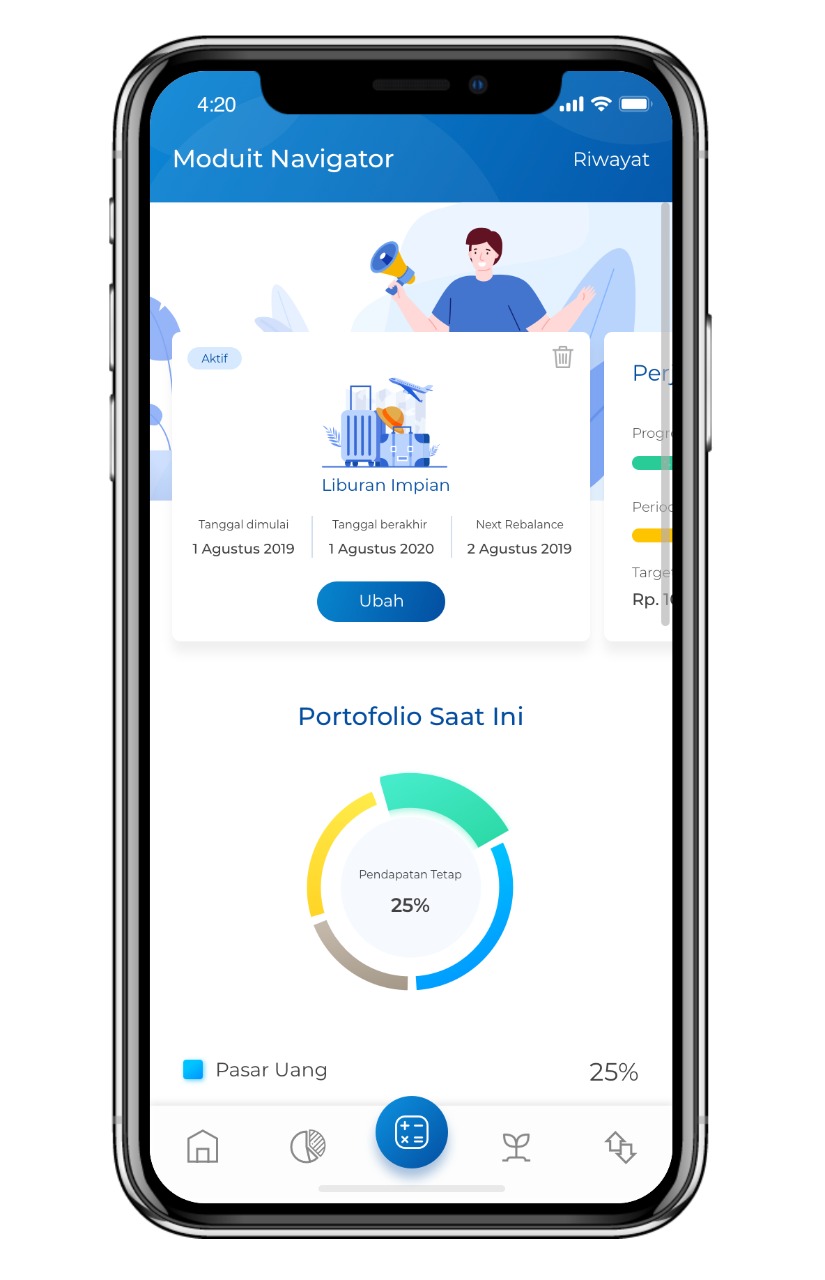

Latest feature development

Jeffry explained that since the last year, moduit released applications for b2c and b2b2c with the development of supporting features. In the financial industry, complicated payment systems are the main barrier that causes people to be reluctant to invest.

Therefore, the company provides two options. Namely transfer with e-wallet GoPay for transactions with small nominal starting from Rp. 10 thousand and virtual accounts to accommodate large nominal transactions between hundreds to billions of Rupiah.

"In the past, if you wanted big transactions, the customers themselves had to go to the bank for manual transfers virtual accountsSo if you buy three mutual fund products at once, just use one virtual accounts just. Later in-disperse automatically to purchased products."

Investors can monitor the performance of the products they buy through marketers through the b2c application. If you are interested in making changes or buying other products, it can be done independently or assisted by marketers.

The mutual fund products sold by investment managers (MI) are fully selected by Moduit with their own parameters to increase convenience for customers who are new to investment products. The filtering used uses the PRIME concept (Performance persistence, Risk ratio, Investment AUM per fund level, Management and Expense ratio).

Each of the five has qualitative and quantitative benchmarks that ensure that all mutual fund products onboard it is safe in terms of risk management both from internal and external conditions.

Currently, Moduit sells around 60 mutual fund products managed by 14 investment managers with a wide variety of products to cover all consumer needs.

"Our target is really direct user who have never used mutual funds. We try to protect them with pre-screening product. Now we have processed 31 investment managers, but new ones onboard in Moduit only 14 only. We position ourselves as specialized market."

He also revealed that this year he will increase additional features to make the consumer experience even better seamless pattern. The number of marketers is targeted to increase to 200 people. The overall increase is expected to be five to six times over the course of 2020.

In the future, the b2c application will be equipped with a search feature for marketers that suits their individual needs. The experience offered is more or less like a consumer looking for a doctor on the app Halodoc. The credibility rating, experience and price will appear.

More Coverage:

"We see the behavior of millennials today, they are used to learning and trying it themselves. From this side, they don't need it yet advisor because they don't have much money. But when the money is hundreds of millions, that's where the need is advisor appear. Well this will be in our next module."

As for the marketers themselves, the plan is to develop further selling securities products, so that they can not only sell mutual funds. The hope is that if possible, enter the next wealth management product such as insurance.

In addition to having an APERD license, Moduit also has an Investment Advisory (PI) license to develop its b2b2c business. With this license, it allows the company to sell all securities-based investment products.

"We are develop the next module with the addition of new products. From the features that already exist now, we are making sure the MVP can be accepted or not by the customer, if not, it must be calibrated because user journeys what we're after."

To support all of the above businesses, the company is currently in the series A fundraising stage with a need of US$3 million (approximately Rp41 billion). Jeffry targets to close next month.

Since Moduit was released in 2018, there were only five people on the team, including Jeffry and Charles Jap who held the position of CTO. Now the Moduit team has 28 people. The company also opened a special engineer office in Bandung.

Sign up for our

newsletter