Expecting “Unicorn” from Indonesian Cultivation Startups

The year 2021 is proof for agriculture and aquaculture startups, the quantity of funding continues to increase compared to previous years

Once underestimated, the agricultural sector in the digital startup ecosystem is now starting to show extraordinary potential. Even during the pandemic, some services related to the cultivation business are gaining tremendous traction.

According to a report entitled "Driving the Growth of Agritech Ecosystem in Indonesia" compiled by DSInnovate with Crowde, revealed a number of potentials and challenges in the agricultural industry in Indonesia. First, from the upstream side, namely the production system by farmers, as of 2018 there were around 33,4 million farmers throughout Indonesia. Second, of the total 4,5 million of them have access to the internet.

This finding is interesting, meaning that the development of broadband infrastructure that is continuously being accelerated by the government and accessibility to increasingly affordable internet access devices can be a good medium for the production sector to the upstream side to connect to the market. Startup agritech can also play an important role in providing education -- some have already done so, with the implication of opening up more efficient distribution channels for agricultural products.

Still from the same report, several fundamental problems experienced by the country's agricultural industry were revealed. Includes increasing productivity, access to capital, regeneration and market access. Productivity matters include fertilizer distribution and preventive steps that can be taken to maximize land potential based on weather conditions.

Walk in the same direction

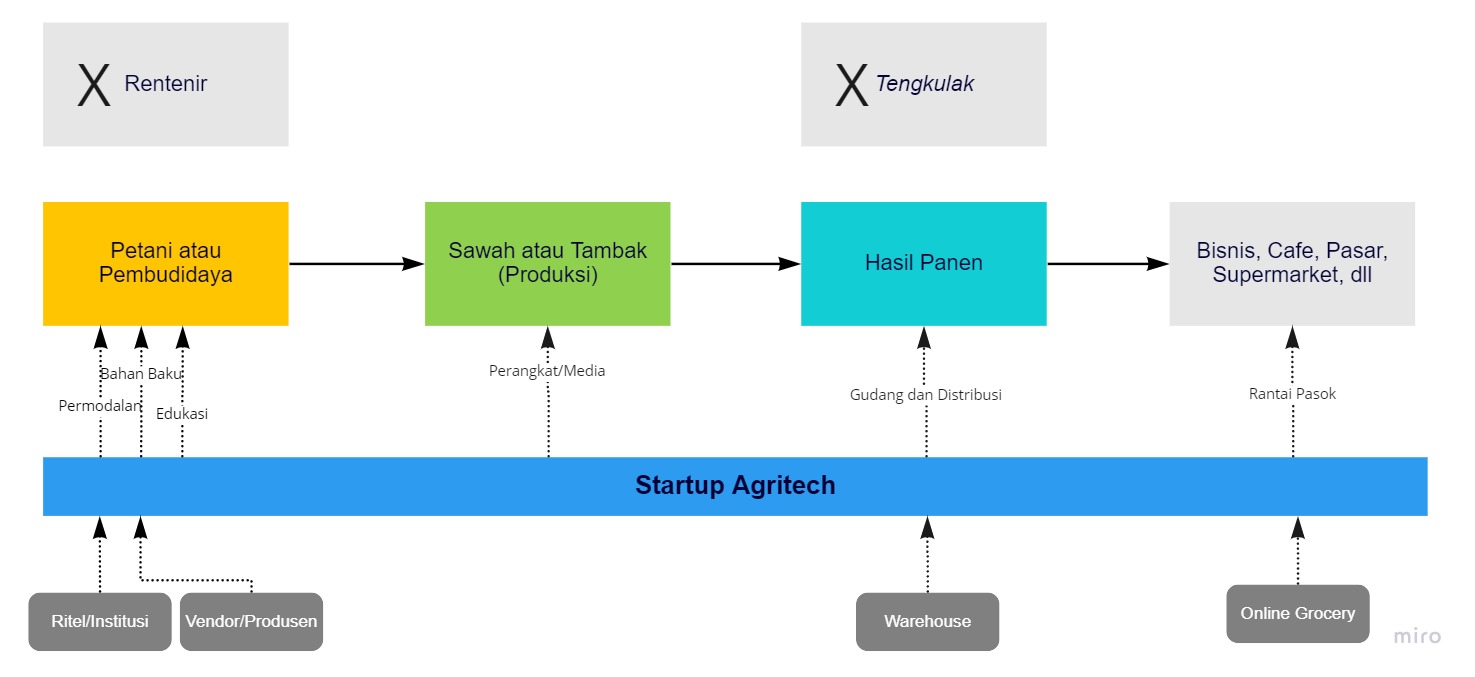

Starting from the root of the problem, founder trying to present efficient solutions to provide efficiency in agricultural business processes. From the existing business models so far, we have tried to map them into the solution map below.

There are quite valid reasons why startups ultimately choose to take an end-to-end approach. Namely providing efficiency in the overall process - including the variables of cost, time and product quality. The first step that must be taken is of course that platform owners need to educate and convince them that with the democratization of technology there is a lot of potential that can be gained. There are various methods, and what will be well received is a solution approach.

In an interview with Tanihub Co-Founder Ivan Arie Sustiawan one year after his business launched, he explained his role as a buying and selling intermediary. Each purchase transaction will be paid in advance by Tanihub to the seller based on the bill for delivery of food products to the buyer, and the buyer will pay the bill to TaniHub according to the payment terms and conditions agreed upon by both parties.

Most clients who buy are passing through marketplace Tanihub is a business owner who usually buys basic commodities in large quantities. The procurement process sometimes takes a long time to disburse funds to farmers. At this point the farmers are hesitant, if they sell quickly to middlemen they will get a cheaper price; while selling to businesses access is difficult and takes a long time. That's where Tanihub comes in.

Along with the acceptance of the business process, product escalation was carried out. With the certainty that their product will be absorbed by the platform, the startup offers funding (capital) to help expand production, even to packaging and logistics (warehouse) to handle the distribution process.

The fisheries sector is relatively the same

Targeting the cultivator segment who are already familiar with smartphones and the internet, eFishery presents an IoT-based automatic animal feeding solution with a guarantee of being more scalable and economical – impacting economic value. The education process is carried out by jointly assisting fish farmers to increase their production.

The reception was welcomed by them by adding more comprehensive services, starting capital services for equipment procurement (eFisheryFund) to product distribution channels (eFisheryFresh) collaborating with various applications online groceries.

The initial step always starts with a manual process. To strengthen education, the two startups even set up units at many points to handle transaction and production processes – as is known, farmers/cultivators are among the contributors to statistics. unbankable, direct transactions are a priority.

Investor support

2021 seems to be a blessing in itself for startups that deal with farmers/fish cultivators. Advanced funding is provided to help business and product expansion – some also to validate and penetrate services. In fact, up to this year, there have been several startups that have reached hundreds of millions of dollars in valuation from this segment.

Instead of being hampered, the pandemic has actually become a proving ground for cultivation startups. Moncer transactions are certainly one of the considerations why investors want to entrust their funds to investors founder The.

Statistics DailySocial noted, throughout the last 3 years funding to cultivation startups has been very minimal in quantity.

| Company | Last Funding | Year | Est. Valuation* |

| Tanihub | Seri B | 2021 | $218 million |

| Aruna | Serie A | 2021 | $103 million |

| eFisheries | Seri B | 2021 | $88 million |

| Vegetablebox | Seri B | 2021 | $45 million |

| Chilibeli | Serie A | 2020 | $31 million |

| Eden Farm | Pre-Series A | 2021 | not known |

| Fresh | Initial Funding | 2021 | not known |

| Dropezy | Initial Funding | 2021 | not known |

| Vegetable Shop | Initial Funding | 2019 | not known |

| Ethanee | not known | not known | not known |

*based on data input to the regulator

The range of investors supporting the funding is also quite convincing, because it involves local and global venture capitalists in a significant portion of certain funding rounds.

Local investors:

- MDI Ventures

- Intudo Ventures

- AC Ventures

- East Ventures

- Northstar

- BRI Ventures, and others.

More Coverage:

Global investors:

- Openspace Ventures

- Vertex Ventures

- Prosus Ventures

- 500 Startups

- Wavemaker Partners

- Sequoia Capital, etc.

Perhaps the cultivation sector currently has not generated significant GMV from the transactions entered into. But gradually, with comprehensive service penetration and an increasingly educated market, it is not impossible that agricultural applications (especially B2C) will become the new e-commerce to fulfill basic material needs. A hypothesis that investors believe in this vertical.

Head of Southeast Asia Investments Prosus Ventures Sachin Bhanot, when investing in Aruna, disclose, "Having built a strong supply chain and technology infrastructure with deep industry knowledge and expertise, we believe Aruna is uniquely positioned to serve the growing global demand for sustainable fisheries products, while supporting the livelihoods of local fishermen."

With investor confidence and the market getting better, it is not impossible that in the next few years we will welcome unicorn new to vertical agritech and aquatech.

- Header Image: Depositphotos.com

Sign up for our

newsletter

Premium

Premium