Reading BPR Acquisition Startup Directions (Part II)

Seeing how BPRs have been doing digitization so far, including solutions brought by digital platforms to help this process

This is a follow-up to first part

Reinforcement for the BPR Industry

Improving competitiveness in the BPR industry is a mandatory item so that they can survive. Communal Co-Founder and CEO Hendry Lieviant said, before the pandemic, many BPRs were complacent and didn't feel the need to digitize. In distributing credit, they can indeed take advantage of sources of funds from various parties. However, collecting third-party funds (savings and deposits) turned out to be difficult.

“This BPR needs to be more competitive but because the push for digitization is not felt urgent, so the impression will be later. But once the pandemic, they get stuck. This pandemic is a catalyst for change. So forced to change, otherwise you won't survive," he said.

This condition is true. Chairman of the Association of Indonesian Rural Banks (Perbarindo) Joko Suyanto said, four main points that pose challenges for the BPR industry in realizing digitization. First, the investment cost (Capex and Opex) is very high. Second, there are restrictions in regulations. Third, the various conditions of BPR/BPRS. Finally, the quality of IT HR is limited, including in its leadership.

In overcoming this issue, BPR officials usually use two general ways to enter the digital world. For BPRs with BPRKU 3 (core capital of more than Rp50 billion) the digitization program is carried out independently or in collaboration with third parties. However, BPRKU 1 (core capital less than Rp15 billion) and BPRKU 2 (core capital Rp15 billion - Rp50 billion) do so under a lease system or in cooperation with third parties.

"To realize digital transformation for the BPR and BPRS industries requires continuous struggle and the support of all existing stakeholders," said Joko.

Joko continued, “Perbarindo has collaborated with various strategic parties, both from banks, fintech industry players, as well as IT service providers. The program has been described in the BPR-BPRS Now development architecture. The hope is that with this architecture, it can become a reference in realizing digital transformation in BPR-BPRS throughout Indonesia, so that it can improve performance and competitiveness.”

Joko's statement also confirmed that many application development companies were invited to work with BPR to release digital applications on the Google Play Store (see infographic).

Partnering with a third party is indeed cheaper in terms of cost, but it backfires when the company wants to develop to more complex features, because it creates a high dependency. If you look closely, BPR applications aimed at retail customers, for example, do not have a striking differentiation and the UI/UX is very good template. So it's just "what's important to have".

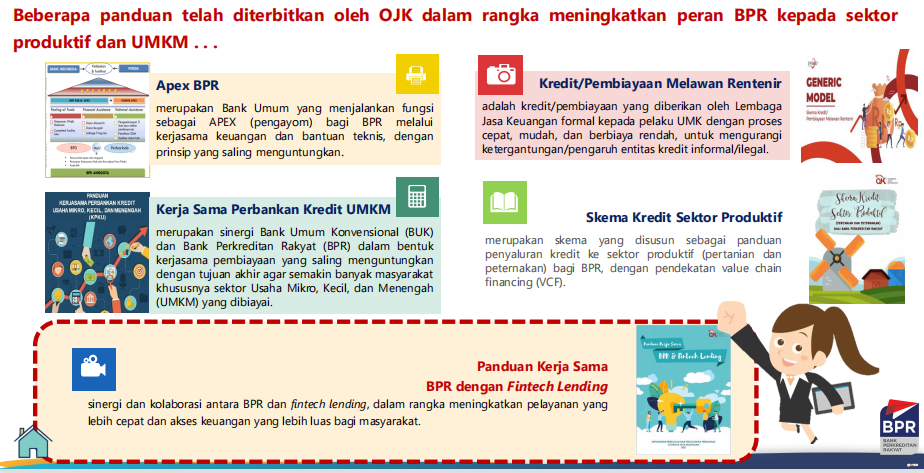

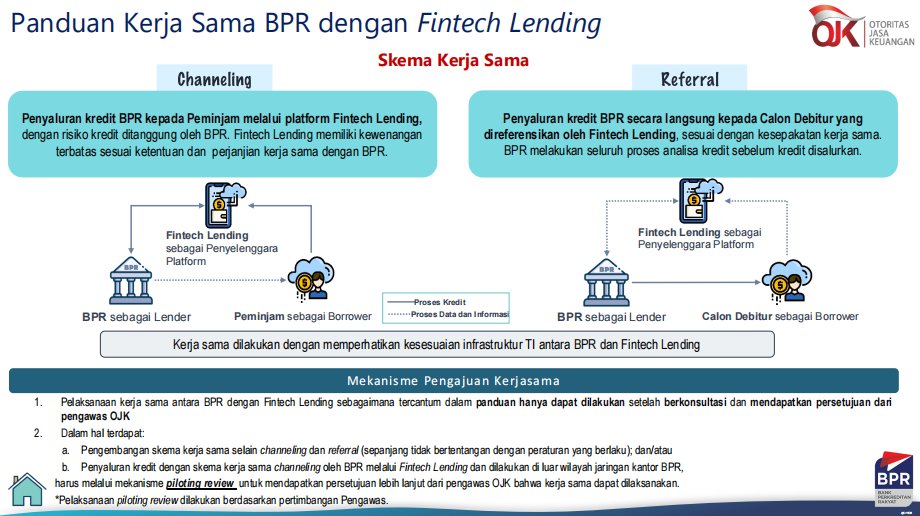

In order not to wither in the middle of the road, OJK has so far issued three stimuli. First, the technical instructions regarding the implementation of cooperation between BPR and fintech lending are contained in the Guidebook for Cooperation between BPR and Fintech Lending. Next, there is the Digital Transformation Acceleration Policy as set out in the 2021-2025 Indonesian Banking Development Roadmap, POJK Number 25 of 2021 concerning the Implementation of BPR and BPRS Products, and the acceleration of digitalization of the small-scale financial services sector through applications.

OJK's Executive Director of Banking Research and Regulation Anung Herlianto explained that the issuance of the Guide to Cooperation between BPR and fintech lending aims to improve faster services and wider access to finance for the public.

For BPRs, the benefits they get are expanding their target market, improving service quality, strengthening analysis of prospective debtors, and increasing adaptation of information technology and digitalization of the BPR industry. "As for fintech lending, it can be an alternative to additional funding sources, as well as strengthening monitoring of loan distribution to the regions," said Anung.

He continued, based on a survey conducted by the OJK after the issuance of the guidelines, as of January 2022, there were 60 BPRs that had started the exploration process and carried out loan distribution cooperation with 23 licensed fintech lenders.

"This number is expected to increase, along with the better implementation of the existing business model so that it can provide lessons for interested BPRs and meet the prudential requirements of the OJK."

Next, in the two POJKs issued specifically for BPRs, the point is to open the widest possible access for BPRs so that they can partner with various technology and banking companies to expand their solutions.

For example, from POJK No. 25 of 2021, the focus is on support for BPRs by utilizing technology, either through development in-house/mandiri (eg electronic banking services), as well as cooperation with commercial banks (eg virtual account services, e-KYC, QRIS, interbank transfers, and cardless ATMs), and fintech companies (eg. lending, payment, funding agent/deposit channeling, aggregators, and other IKD).

One example of the cooperation that has been established between commercial banks and rural banks has been implemented by Bank Danamon and Bank Permata which both take advantage of the presence of the Open API.

Bank Danamon cooperates with BPR Jatim for API Transfer and Danamon Virtual Account for all BPR Jatim and BPR Lestari customers. This allows BPR customers to make interbank transfers via ATMs or online applications and real-time, as well as receiving funds online through virtual accounts. The same initiative was also implemented by Bank Permata together with Perbarindo DKI Jaya and its surroundings.

BPR financial performance

According to OJK, as of September 2021, the number of BPRs and BPRSs reached 1.646 units, consisting of 1.481 BPRs and 165 BPRS. This figure is experiencing a shrinking trend. It was recorded that in 2016 there were 1.799 BPRs and BPRS, then in 2017 there were 1.786 units, in 2018 there were 1.764 units, in 2019 there were 1.709 units, and in 2020 there were 1.669 units.

Along with the consolidation action carried out, the number of BPRs and BPRS belonging to BPRKU 1 also experienced a decline. It was recorded that in the same period, the number of BPR and BPRS for BPRKU 1 was 1.138 units, or has decreased by 306 units from 2015. At the same time, the number of BPR and BPRS units classified as BPRKU 2 experienced growth, from the 2015 position of 158 units, to 272 units. until the end of the third quarter of 2021. Meanwhile, BPRs and BPRS classified as BPRKU 3 experienced an increase, from 35 units in 2016, to 71 units at the end of September 2021.

BPR assets (excluding BPRS) in December 2021 grew by 8,62% (yoy) from the previous 3,64%. BPR assets are centralized in Java (58,64%) with the largest portion located in Central Java and West Java, each with a share of 24,34% and 12,94%.

Deposits grew by 10,23% (yoy) to Rp117,01 trillion. The increase occurred in both components, both time deposits (69,35% portion) and savings deposits which grew by 10,56% and 9,47%, respectively. As with the distribution of assets, BPR deposits are still concentrated in Java (60,91%), followed by Sumatra (17,18%), Bali-Nusa Tenggara (13,09%) and others.

As for credit grew 5,24%. The distribution is dominated by non-business sectors (33,28%), wholesale and retail trade (21,23%), and households (12,91%). Spatially, the majority of BPR loans are in Java (59,06%), while the lowest credit is in Kalimantan (2,27%) of the total credit. This is in line with the majority of BPRs in Java (875 BPRs) while only 55 BPRs in Kalimantan.

During this period, BPR credit risk decreased slightly with the ratio of gross NPL and net NPL slightly improving, by 6,72% and 4,37%, respectively, from the previous year's 7,22% and 5,33%.

Fall in love with saving at BPR

One interesting thing about DPK, DailySocial.id had the opportunity to interview a loyal BPR customer who uses time deposits as a means of saving in the future.

That morning, Zelita was back skating in cyberspace before starting her activity, just to see how her friends were doing through the shared uploads. His dependence on social media is already so high, that's where he gets the latest information, whether it's promos, discounts, viral news, and others.

Even information about the hectic investment in crypto, stocks, he was also exposed and late following its development. More stories of people showing off a lot of profit through investing in an instant way, or in today's terms, flexing, thanks to investments in both asset classes. Rarely are people willing to share the story of how much money they lost. Maybe it has become a common thing, it is more fun to show off wealth in an instant way than the sad story.

However, he is not a group that wants to join in on trying such a trend. Since childhood, Zelita has seen firsthand how her parents struggle to set aside their salary for savings in a deposit at the BPR in her home environment in Tasikmalaya. Like the fruit is not far from the tree, he also continued this habit for his mini family.

"Incidentally, father had suggested to saving at BPR, from gue he's been working hard in college saving there. Actually he has a commercial bank account at BJB but just passing through. The problem is that all of his savings are placed in the BPR, even now.”

Coincidentally, Zelita's husband also works at BPR Artha Galunggung, the place where his father used to save deposits. As a result, she always asks her husband for help just to withdraw cash or just check the balance. Understandably, this BPR does not provide ATM. So if you want to deposit funds or withdraw cash, you have to come to the branch office. The application actually exists, but its function is only to check savings balances, mutations, and check deposit balances.

It's been almost a year since he started trying to save deposits at BPR. The reason is simple, because the interest offered is 6% or higher than commercial banks. Save funds in savings even the interest offered is also promising. Oia, the most important admin fee is cheap, only Rp. 3 thousand per month. The initial deposit is only Rp. 10 thousand.

“So every payday, immediately empty the account at the commercial bank, transfer the balance to the BPR. Because my husband works there, so please ask for help. If you don't have time, you can call the bank person to come to us." Zelita continued, "If the deposit is due, later the bank officer will call us to extend it. stop, just want to take the flowers, everything is possible."

The work system at BPR is famous for its pick-up and drop-off. Indiscriminately, even credit customers who also save at BPR, while selling tutug oncom, will definitely be visited every day. This is because, on average, daily business owners routinely set aside their money, either Rp. 100 thousand or above for savings. “When the officer came, he immediately printed his savings book at his shop. They brought mobile printerlike that. "

So close to customers, many refer to BPR as a market bank because of its locality and close emotional connection.

If you look at the deposit interest at Bank Mandiri in April, it was stable in the range of 2,25% to 2,5%. There, customers can save from under Rp. 100 million to above Rp. 5 billion. Meanwhile at BRI, the interest starts from 2% for short-term tenors, and 2,85% interest for long-term tenors of up to 36 months.

To maintain customer loyalty, BPR Artha Galunggung, according to Zelita, regularly holds a lottery program with prizes. With a point system, if a customer manages to collect a certain number of points, they are entitled to participate in the draw. The prizes range from gold bars, motorbikes, to cars.

“Even though in Tasikmalaya there are many commercial banks, such as Nobu Bank, Neo Commerce Bank, which have opened branches here. But still loyal to the BPR because the interest is higher, I don't dare to take a big investment various yes," said Zelita.

Birth of DepositoBPR

Just like Zelita's reason, Hendry Lieviant chose BPR because of its high deposit interest and guaranteed by LPS. At that time around 2019, the p2p lending startup he started, Communal, happened to have an advantage idle money that you want to deposit in the bank. His consideration was that he wanted a higher interest rate as well as being safe. After investigating further, it turned out that BPR was the answer he was looking for.

"But remember once that the process was complicated, a lot" paper work. Yes, we just live it. At that time it had not occurred at all to be made into a product. Instead, the idea started to emerge right during the pandemic," said Hendry.

He continued, the idea to take the BPR segment seriously was also supported by the condition that a number of BPRs had become Actioncalendar institutions in the Communal. They are quite helpful with the system channeling this. However, once a pandemic occurs, problems arise. They have difficulty collecting depositors. “There is no solution yet and we need help from fintech [platforms] to collecting deposits [from anywhere] because the regulation is allowed.”

For BPRs with mediocre capital, investing in building such a solution is certainly not an easy thing because it requires a fairly large investment. So, if each BPR came up with a similar solution, it would be inefficient. As a result, Communal moved to make DepositoBPR. So like marketplace which contains BPR-BPR for prospective depositors.

The total number of BPRs that have joined DepositoBPR has reached 110 BPRs. About 90% are in Java and Bali. The company will be more aggressive in attracting BPRs outside the two main islands so that more BPRs are helped. Communal claims that it has succeeded in channeling customer funds worth Rp500 billion to BPR partners who have worked together.

“Besides, BPR needs to be more competitive. Before the pandemic they realized that digitization was important, but that's okay. Until they are finally stuck in a pandemic, they have to change otherwise they can't survive. "

First time pilot projectOJK asked Communal to enter East Java for four months. The reason is because there are in fact the regions with the highest number of BPRs in Indonesia. The result is in line with expectations. Up to eight months since its launch, the number of DepositoBPR customers from East Java has reached 35% of the total. The rest, in Jakarta (10%), Bali (10%), and spread throughout Indonesia.

Around 70% of these customers are 35 years and over. This is an interesting fact. According to Hendry's analysis, this is because customers at that age are more aware of how to manage financial risk and cannot be fully placed at high risk. But the target of this DepositoBPR user is not only retail, but also corporates who want to save idle money-New.

"It's different from young people, who tend to be more daring in investing. Even though doing two diligence that is the first step in managing risk. We will often hold financial education related to this,” concluded Hendry.

Sign up for our

newsletter