Mekari Encourages MSMEs' Resilience Amid Economic Turmoil

At the same time, it describes the SMB Pulse Index research which highlights three trends related to the role of technology in strengthening MSME resilience

The annual Mekari Conference 2022 event was again held by a SaaS developer startup for the Mekari business. The mission this time is to invite MSME actors in Indonesia to stay active resilient in the midst of new economic turmoil.

Mekari Conference seeks to facilitate business owners who want to transform their business by connecting them to technology players, investors, financial experts and HRD, to the government sector.

"To remain resilient in the current situation, it is important for MSMEs to digital upskilling so they know how to adapt digitally. This also includes MSMEs in the unbanked to consider [the adoption of] fintech solutions," said Mekari COO Anthony Kosasih when met at the Mekari Conference press conference, Thursday (11/8).

Currently, Mekari offers a solution all-in-one under brandContact (Sales & support), Talent (HR), Flex (HR), Journal (Finance), and Klikpajak (tax). It claims to have served more than 600 thousand users and 35.000 businesses in more than 20 cities in Indonesia.

SMB Pulse Index

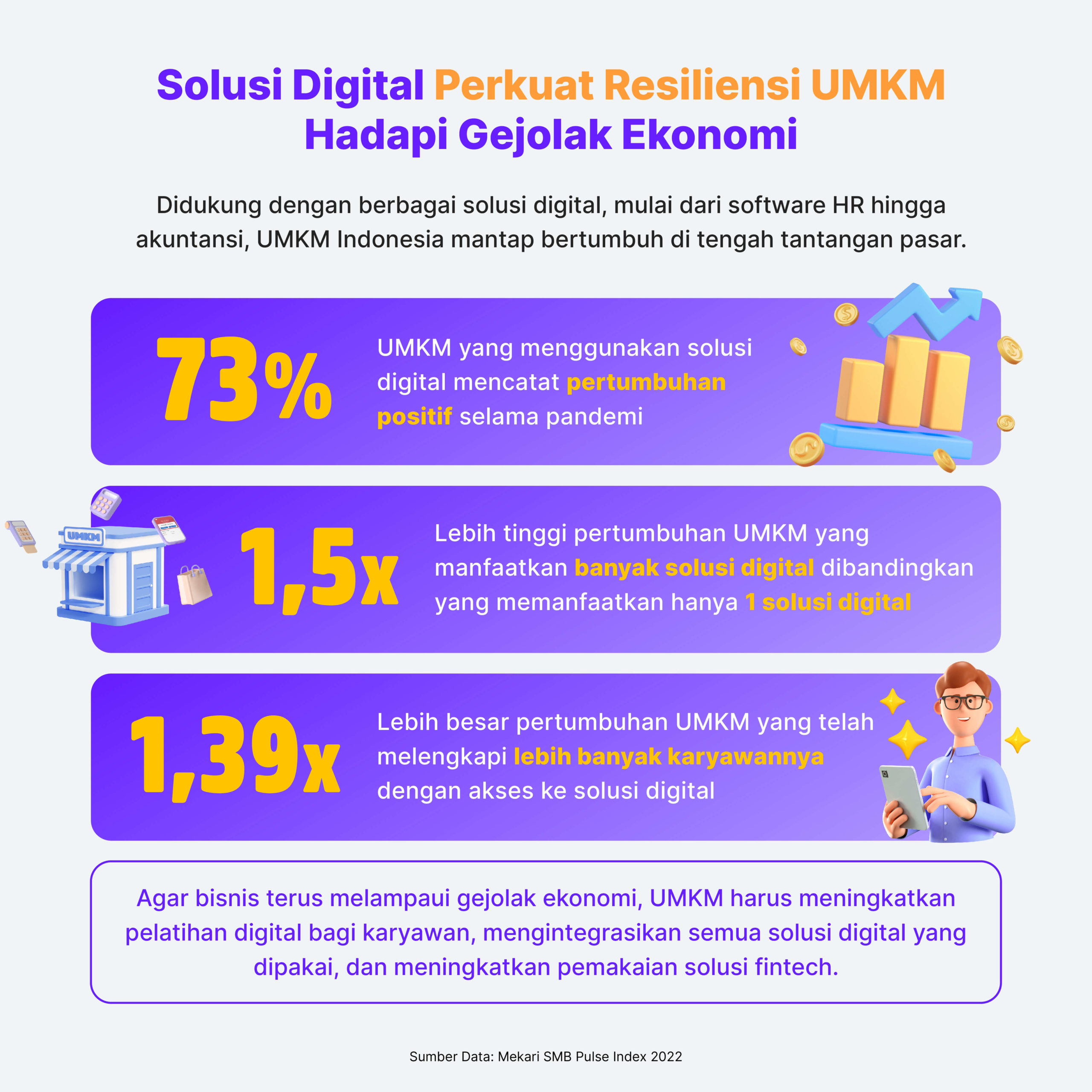

At this event, Mekari also presented her research entitled "SMB Pulse Index" which highlighted three trends related to the role of technology in strengthening MSME resilience in maintaining business growth during the pandemic.

First, as many as 73% of respondents from MSMEs who have go digital admitted that his business grew during the peak of the pandemic throughout 2021. Shifting shopping behavior to omnichannel or online is also said to have helped B2X MSMEs that have go digital return to the point of positive growth.

The second trend, the survey shows that MSMEs that use integrated digital solutions recorded growth of 1,5 times higher than MSMEs that only used one solution.

In addition, MSMEs that use various digital solutions (multi-tech adopters) in the B2B segment recorded growth of 1,54 times compared to B2B MSMEs which only used one solution (single-tech adopters). In the B2C segment, MSMEs multi-tech adopters recorded growth of 1,51 times compared to MSMEs single-tech adopters in a similar segment.

Meanwhile, the third trend shows that MSMEs are now adopting solutions cloud rated agile and scalable on a platform where these solutions can run aka become an integrated digital ecosystem.

Expansion fintech

Asked more about Mekari's expansion to services fintech, Anthony revealed that his party is currently preparing a business loan product (merchant financing). His party is still discussing with lending partners, both from banks and non-banks) to provide loans merchant financing.

For information, previously Mekari has entered into fintech services through Mekari Flex which is an Earned Wage Access (EWA) platform.

"[Product fintech prepared] isn't it lending related to consumers. If for merchant, currently still in the works. Example [use case] is working capital or supply chain financing. In the Journal, there will be some kind of add-ons, or it could be a new product," he said.

Based on monitoring DailySocial.id, the business loan service in question, has been introduced through brandMekari Capital. However, it seems that Mekari Capital has not officially launched yet. From the sources we have compiled, Mekari Capital offers business loans with approval within 1 day after the data is validated. Limit offered ranged from Rp100 million-Rp1 billion with a tenor of 1-12 months.

More Coverage:

"The realization will be gradual because we have to discuss with banks or non-bank institutions. How do we do it? make it available easily. Mekari users already Submit data to the platform, it's just a matter of how we process the data and they can Apply in a manner seamless pattern' he closed.

-

Disclosure: DailySocial.id is a media partner for Mekari Conference 2022

Sign up for our

newsletter