Measuring “Market Size” for Early Stage Startups

Using "top-down market sizing" and "bottom-up market sizing" methods

Know marketsize (market share) is important for startups to do before actually launching a product or service, even better before the development process is carried out. The goal is to find out potential users or profits that can later be obtained from selling these products. When doing pitching to investors, related statistics marketsize This is also one of the main explanations needed – for these investors regarding the projected ROI (Return on Investment) which can be obtained.

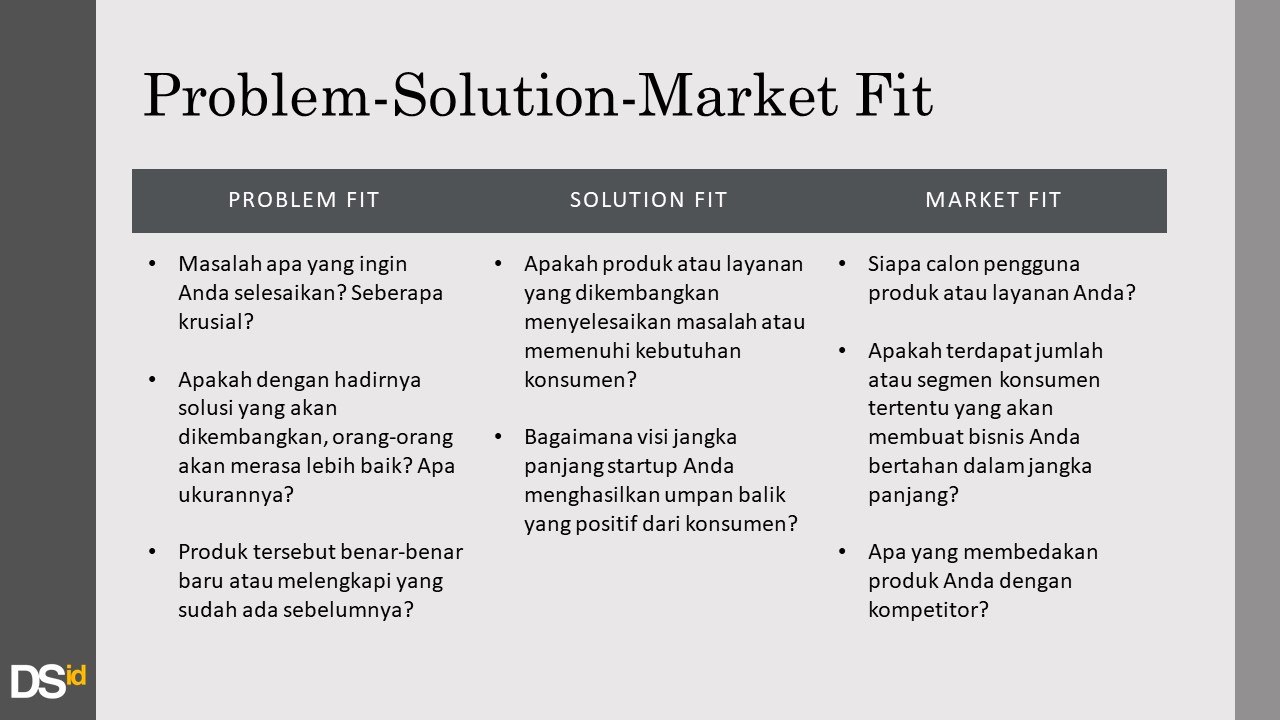

Before going into more detail about the methodology market size, Here, we will briefly review the things needed by early stage startups. In general, every startup must go through a phase called product-solution-market fit, namely to (1) validate that the product developed is really needed, (2) ensure that the solutions presented are efficient in solving problems, and (3) ensure that there are consumers who will make the business survive.

The following questions can be used as a reference founder to reassure him with the launch of his startup.

To define problem and solution, the approaches vary. One of them can use Business Model Canvas. Meanwhile to measure market, there is another method that can be followed by founder. The two most popular are Top Down Market Sizing and Bottom-Up Market Sizing.

Top Down Market Sizing

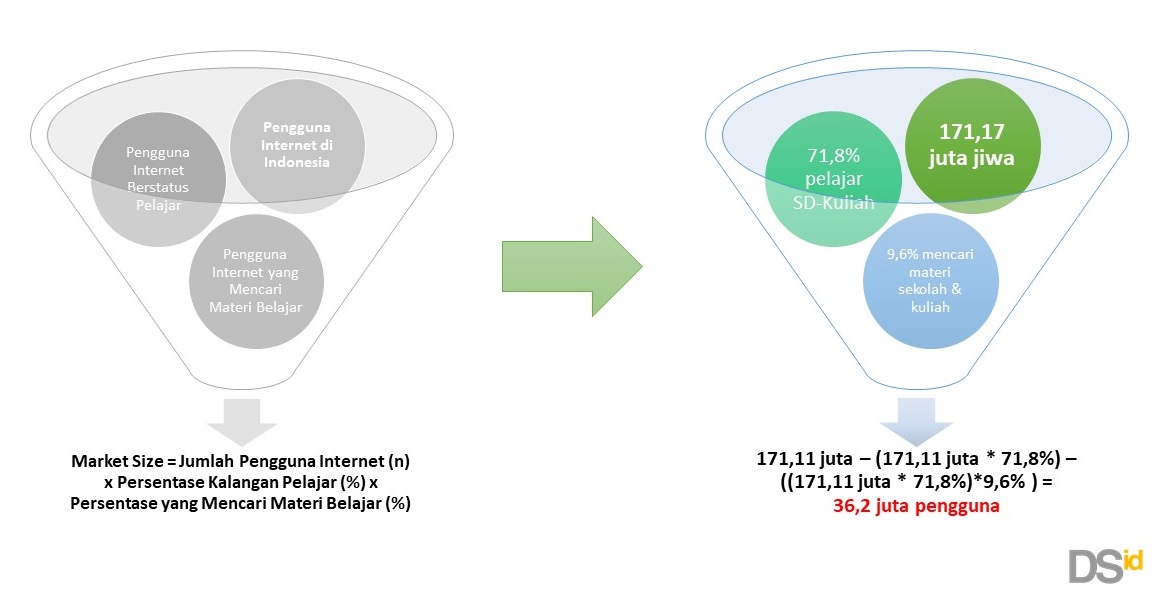

This mechanism is carried out by defining the market share of users universally. Then it is lowered into several levels using certain filtering attributes, until it reaches a narrowed estimate of the potential market. The following is an example of measuring marketsize for an online educational platform as a support for learning materials.

According to APJII, internet users in Indonesia as of 2018 amounted to 171,17 people. Since the product that will be launched by a startup is targeting students, it is necessary to find out what percentage of the total internet users are students – this data can be even smaller if the startup product targets a certain level of students, for example students. However, in this example, the percentage of students in general will be taken, so that 71,8% of internet users are students.

In this case study, the product that will be produced is an online platform that contains various digital teaching materials. From pre-existing data, it is undeniable that students do not use the internet to search for digital teaching materials. So it is necessary to look for more in-depth data, how many internet users from students who use it to find learning materials. From the data found (still from APJII) around 9,6% used it to find data about learning needs.

Then do the reduction in stages. From the general market share figure obtained (in this case internet users in Indonesia), it is reduced by the percentage who is among students, and reduced again by the percentage of students who use the internet to access learning materials. The result is marketsize that can be embraced with the startup product.

Bottom-Up Market Sizing

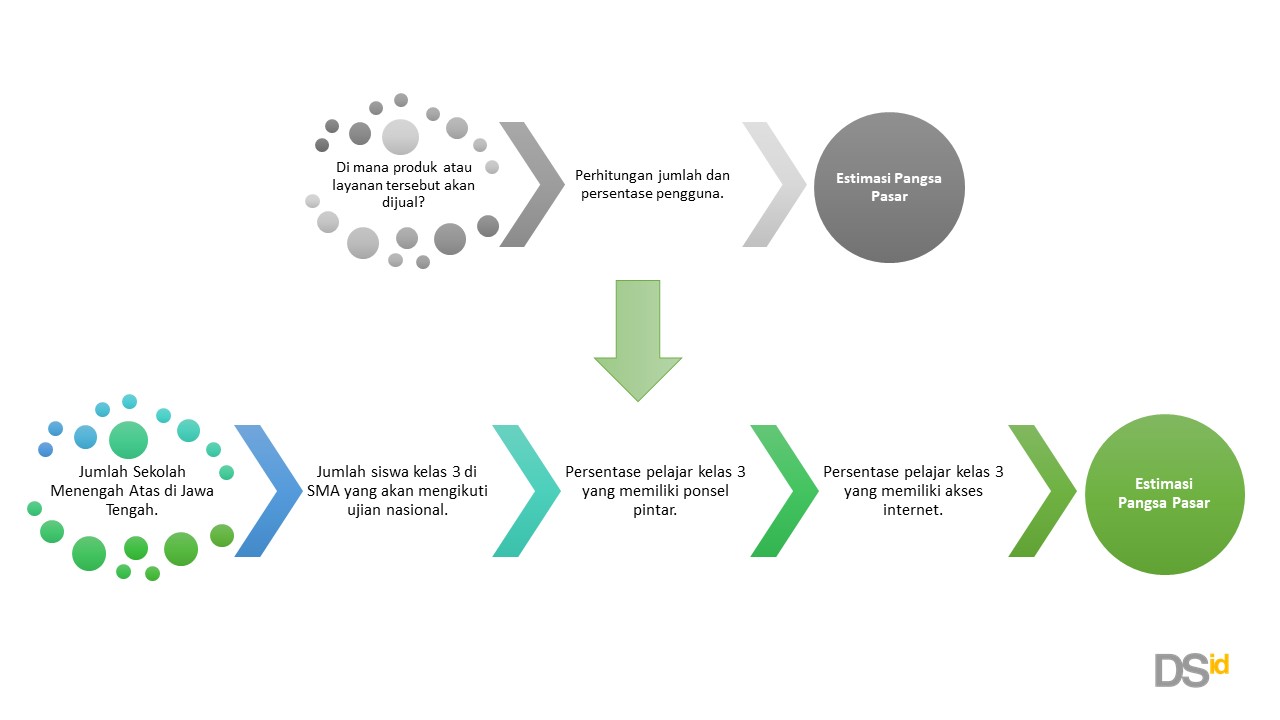

Contrary to the previous methodology, bottom-up begins by identifying specific customer segments. From there founder measure market share and projected growth. The calculation process starts from the most realistic scope –the mechanism bottom-up usually chosen because of limitations such as resources to reach the market. With the same case study as the example in the previous methodology, the following process is obtained.

The explanation of the above simulation is as follows. The online platform that contains study materials will target high school students who are preparing for the national exam. So founder can identify how many SMA in the area you want to target. From the number of schools, how many grade 3 students will take the exam. Then find out again how many students are already using smart phones and the internet.

The market estimate will tend to be less, however, because the scope is limited. The assumption is that when startup is in phase growth, they will reach a wider market share by expanding to other provinces and cities.

Which approach is suitable?

It can be said that the two methodologies above complement each other. In calculating market share there is the terminology "TAM-SAM-SOM". TAM is an acronym for Total Addressable Market, which is anyone who is expected to be reached with the product being developed. SAM stands for Segmented Addressable Market, which is the portion of TAM that is specifically targeted by startups. And SOM or Share of The Market, which is part of the SAM that has been achieved, users in the early stages of startup.

Methodology top-down market sizing very suitable for estimating TAM and SAM. Temporary bottom-up market sizing more likely to calculate SAM and SOM estimates.

Sign up for our

newsletter