MDI and Finch Capital Book First Funding Round for "Arise Fund" Worth 573 Billion Rupiah

Target to invest in 25 startups in Southeast Asia; there are at least 5 portfolios that are ready to be announced

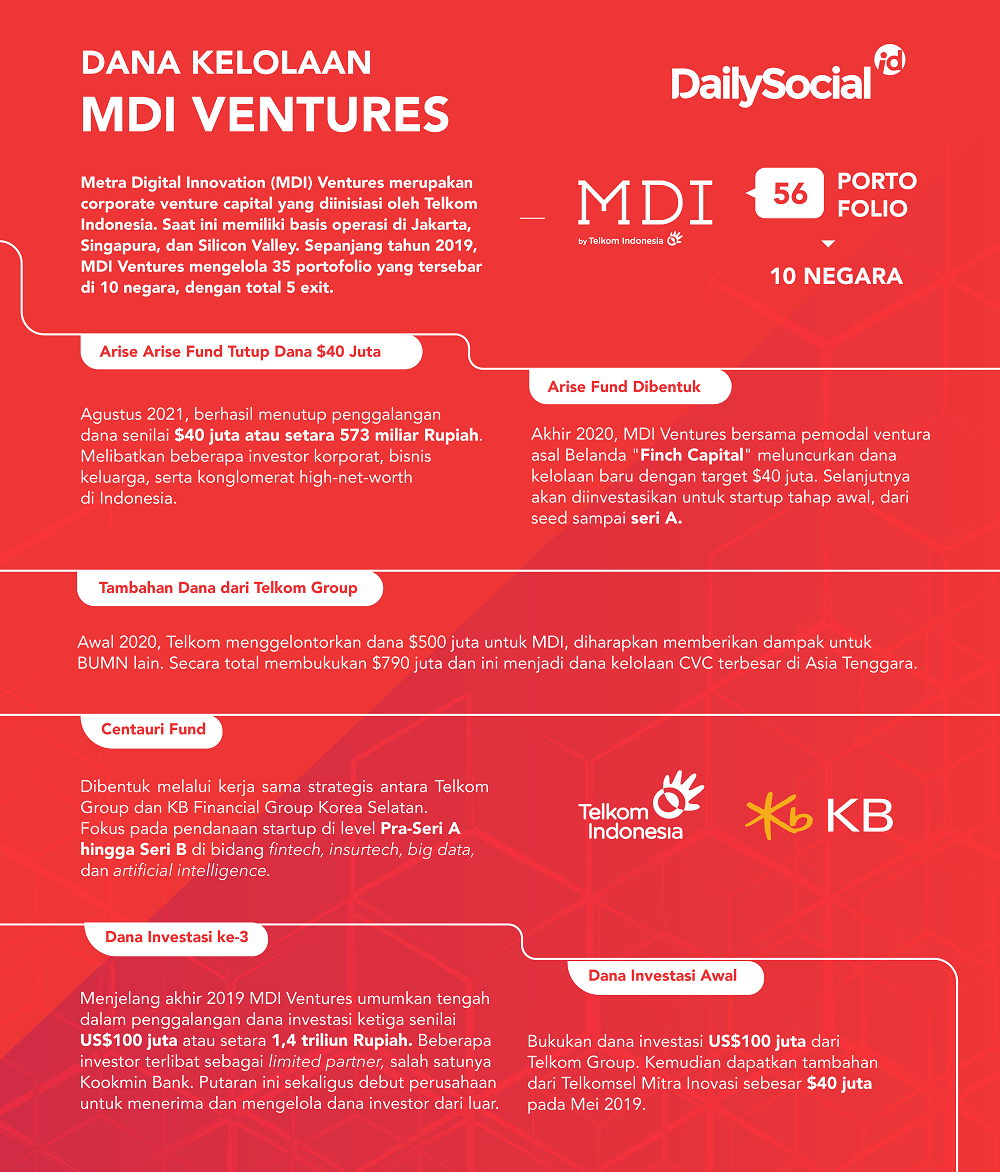

The investment vehicle of the collaboration between MDI Ventures and Finch Capital named "Arise Fund" succeeded in closing a fundraising debut worth $40 million or equivalent to 573 billion Rupiah. This round involved several corporate investors, family businesses, and conglomerates high-net-worth in Indonesia, including Metrodata Electronics.

This managed fund is targeted to reach 25 businesses that focus on building the technology industry in Southeast Asia, especially Indonesia. There are at least five portfolios that are ready to be announced at the end of this year. The agreement, which is currently in the finalization stage, revolves around the SaaS, B2B . sector commerce, agritech, and fintech.

Arise Fund Partner Aldi Adrian Hartanto revealed that despite the presence of many quality founders in the last decade, challenges arise from disproportionate capital allocation. This makes it difficult for entrepreneurs to secure capital in times of regional economic slowdown as it is today.

Introduced at the end of 2020, Arise focuses on investment post-seed and pre-series A with ticket sizes from $250.000 to $3 million per spin. In addition, the company also offers long-term capital, network to market strategically, as well as being directly involved with its portfolio.

Finch Capital's Managing Partner, Hans De Back also revealed, "We have seen many early stage companies struggling to access the right market, which is reflected in the lack of attractiveness [..] Our role is to solve this problem with strategy. to market through collaboration with our network of corporate partners such as Metrodata and portfolio companies. In this way, we can enable companies to grow faster and prepare them for series A funding."

Long term investment

In addition to providing access to partners to market Through its network of corporate LPs, the company also helps bridge asymmetric information related to validated business models, and empowers long-term capital through affiliated funds, including the Centauri Fund.

Aldi added, “Startups supported by Arise would ideally continue to receive investments from Centauri in the series A stage, MDI Ventures in the series B and later stages, and ultimately – in some cases – the potential to exit through acquisitions with Telkom Group as a potential buyer or IPO.”

In the Arise Fund affiliate network, one of the largest venture capitalists in Indonesia with total assets of US830+ million, MDI Ventures has had 56 portfolios spread across 10 countries and produced 5 exits. On its website, Finch Capital itself has 29 international portfolios to date.

More Coverage:

To drive long-term success, LP and Arise's strategic team are making a unique offer to its customers founder. Proactively, the company will look for world-class founder candidates, then jointly build the company, while continuing to explore problems that can create synergies within the company's circle.

In addition, startups that will receive investment from Arise also have the option to participate in the Telkom Indigo Nation incubation program. This opportunity is given to them to determine or ensure that the current business model is scalable and repeatable. The LPs involved also come from global technology networks and ecosystems in Europe, Asia and Silicon Valley.

Sign up for our

newsletter