Enter Bukalapak, Grab, and New Strategic Investors Assessed Can Accelerate Allo Bank's Digitization Mission

Allo Bank has officially announced its plans to conduct a limited public offering, releasing 10,04 billion shares worth IDR 4,8 trillion

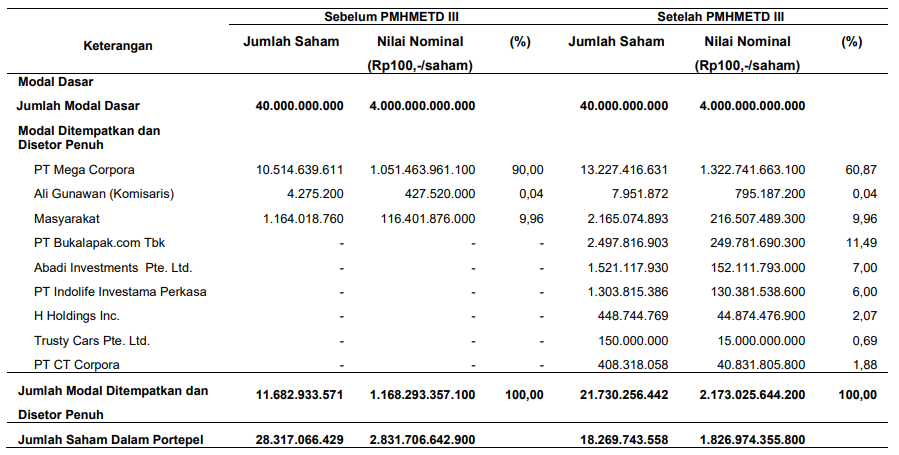

Allo Bank (IDX: "BBHI") has officially announced its plans to conduct a limited public offering or rights issue valued at Rp. 4,8 trillion, releasing 10,04 billion shares or equivalent to 86% of BBHI's total capital at Rp. 478 per share. In the disclosure, 6 companies took part as investors, including Bukalapak, Abadi Investments, Indolife Investama Perkasa, H Holdings, Trusty Cars, and CT Corpora.

Bukalapak itself acquired the highest percentage of shares in the action, which was equal to 11,49%. Abadi Investment itself is an entity owned by the Salim Group. Meanwhile, H Holdings indicated that the investment arm affiliated with Grab.

Sharpen the mission to become a digital bank

This corporate action is considered to sharpen Allo Bank's plan to transform its services into a digital bank. Especially with the inclusion of Bukalapak as one of the significant share grabbers. It is known that currently Bukalapak does not have or is strategically affiliated with digital bank operators – while its competitors already have, for example Tokopedia with Jago Bank or Shopee with SeaBank.

Precisely since June 2021, at this time Bank Harda Internasional has officially carried out rebranding become Allo Bank Indonesia. His passion is to provide integrated application solutions through Allo Apps, to meet user needs ranging from financial to entertainment. In its initial phase, the Allo application will be connected to various merchant and services in the CT Corpora ecosystem. However, until now the application has not been officially launched to the public.

On the regulatory side, mid last year OJK issued three new rules to support the banking industry to be more efficient, competitive, and adaptive to the needs of the community. One of the interesting points, the POJK for Commercial Banks emphasizes the definition of a digital bank, namely a bank that currently has digitized its products and services. (incumbent), or through the establishment of a new bank that immediately has the status of a comprehensive digital bank (full digital banking).

In addition, POJK 12 also redefined the grouping of banks based on core capital (KBMI), no longer using BUKU (commercial bank for business activities). This redefinition basically does not affect player performance Existing, because it does not reduce the scope of business activities. Precisely for small banks, KBMI is a smoothing plan for those who want to become a digital bank. In the previous rule in BUKU 1, they were not allowed to enter the digital realm. As long as they continue to adjust the minimum capital of IDR 3 trillion for the converted digital bank.

| Grouping | Core Capital |

| KBMI 1 | IDR 6 trillion |

| KBMI 2 | IDR 6 trillion to IDR 14 trillion |

| KBMI 3 | IDR 14 trillion to IDR 70 trillion |

| KBMI 4 | IDR 70 trillion |

| Digital Bank | Must have a minimum of one head office |

| Bank establishment | Minimum paid-up capital of IDR 10 trillion |

Previously, OJK noted that there were several banks in the process go-digital namely BRI Agroniaga, Bank Capital, Bank Harda Internasional, and Bank QNB Indonesia. Several other players such as KEB Hana, Digital BCA, Neo Commerce etc. have launched their services since last year.

Allo Bank Performance

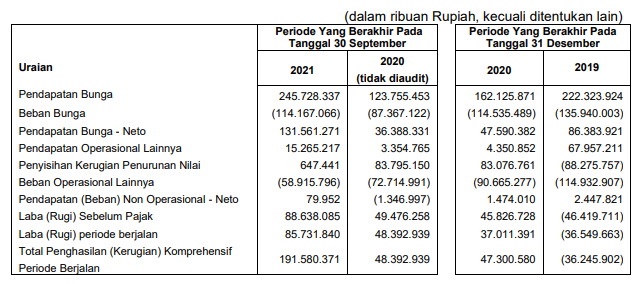

As of the end of Q3 2021, Allo Bank's total assets increased by 166,70% compared to last year, to Rp6,89 trillion. Supported by the increase in securities (355,17%) and credit (63,24%).

In the Q3 2021 period, the company posted a profit for the year of IDR 85,7 billion, an increase of 77,16% compared to the same period in the previous year. This growth was mainly due to an increase in profit before tax expense.

The income earned by Allo Bank reached Rp191,5 trillion, an increase of 295,88% compared to the same period last year. The growth was mainly due to unrealized gains from securities measured in other comprehensive income (available for sale) of Rp105,6 billion.

EMTEK has acquired Bank Fama

On the other hand, EMTEK (which cannot be separated when talking about Bukalapak and Grab), first do acquisition to Bank Fama. Through its subsidiary PT Elang Media Visitama (EMV), EMTEK will take over 93% or the equivalent of 9.089.503.800 shares owned by Bank Fama. Previously, there was widespread news that EMTEK and Grab in the midst of setting up a digital bank, these efforts were also supported by the recruitment of the former President Director of Bank CIMB Niaga Tigor M Siahaan. This bank is rumored to be integrated with various digital ecosystems, starting from commerce, online-to-offline (O2O), and digital payments.

In his statement, this corporate action became the entry point for the tycoon owned by Sariaatmadja to increase financial and banking literacy in the MSME sector. In addition, Bank Fama can also take advantage of EMV's financial strength, business network, products, and sectoral expertise.

Haven't started “Growth” mode yet

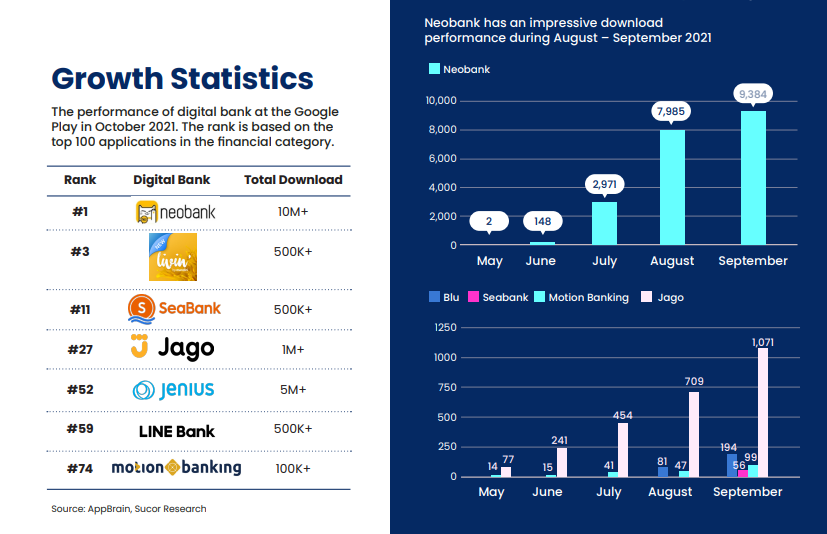

Compared to other banks that are in the same grouping, namely KBMI 2, and have ambitions to become the leading digital bank, Allo's financial position is still green. For example, compared to Neobank, which still lost Rp. 264,7 billion and Bank Jago to Rp. 32,9 billion in Q3 2021. Both of them are in the middle of pursuing rapid growth (growth) in the midst of the digital bank market which is still considered green.

It brings results. According to the data collected DSInnovate in the report"The Rise of Digital Banking in Indonesia", during the period of August-September 2021, both banks received the most dominant performance among other digital bank applications that have already launched. The "startup-style" style is implemented to increase adoption as well as traction to services – especially the main segment targeted is the productive age. (millennials).

More Coverage:

Trends that can be caught, one of the business models applied by digital bank players – in addition to being consumer banking—is to become a embedded services. Players are competing to present BaaS (Bank as a Services) products in the hope that they can be integrated with consumer applications with a large user base. It's no doubt that now each owner of consumer applications is holding their own digital bank one by one.

Enter Bukalapak and Grab clearly enhances Allo Bank's value proposition in this context. Therefore, the next homework is how product innovation can be accelerated so that Allo Bank's features and services can be immediately released and implemented to its strategic partners. The acceleration of product development is an important point, due to the fact that other players have gone one or two steps ahead in user acquisition and service integration with their respective partner ecosystems.

Strategic accuracy and innovation will ultimately be the key, whether Allo Bank is able to match the performance of existing players. Or on the contrary, failing to take advantage of the market growth momentum that is being explored by many parties.

Sign up for our

newsletter