VIDA Manifesto: Build Trust Business, Overcome Digital Signature Misperception

There are many misconceptions about digital signatures in society; VIDA Co-Founder and CEO Sati Rasuanto gave a detailed explanation

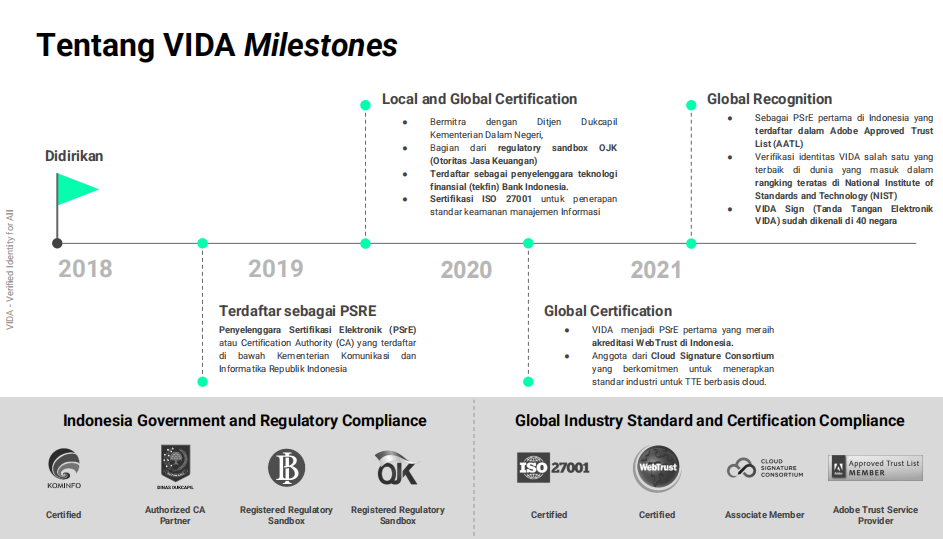

The adoption of digital signatures is increasingly felt when the pandemic comes. VIDA is one of the providers of electronic certification (PSrE) registered with the Ministry of Communication and Information, which has been established since 2018 by Niki Luhur, Sati Rasuanto, and Gajendran Kandasamy.

In Indonesia, players like VIDA take shelter under three regulators, namely Kemkominfo, OJK, and Bank Indonesia. The Ministry of Communication and Informatics regulates three recognition statuses for PSREs, namely registered, certified, and parent. VIDA is in the parental status (Rooted CA), together with D clear.id, Tilaka, and PrivyID. Meanwhile, at OJK and BI, they are registered under regulations regulatory sandbox.

Thus, legality and security aspects are highlighted values to build public trust, even though the solution is SaaS-based.

VIDA Service

In a joint interview DailySocial.id, Co-Founder and CEO of VIDA Sati Rasuanto explained that VIDA provides three series of solutions to help society face fundamental challenges in terms of digital transformation.

- VIDA Verify, an instant identity verification service to provide security and convenience at the same time. This solution uses top global biometric verification technology and official government data sources as a database for verification.

- VIDA Sign, a certified electronic signature solution that is legally recognized and recognized in more than 40 countries because VIDA has been listed on the Adobe Approved Trusted List (AATL).

- VIDA Pass, provides digital and physical access security to authenticate and authorize identity securely with biometric technology to provide convenience and high reliability.

These three solutions position VIDA as digital trust providers which provides solutions to the challenges faced by cyber security today, as well as greater value compared to similar players. “In addition to electronic certificate-based certified signature solutions, VIDA also provides solutions for access management, verification and identity authentication.”

VIDA solutions can be used for a variety of needs across industry verticals. I don't know if it's for consumer lending, e-commerce, e-money, hospital, insurance, P2P lending, to ride hailing.

He did not explain how many VIDA users there are currently. On its website it states, Grab, Gojek, Ciputra, Artotel, Ismaya Group, Ajaib, SiCepat, HappyFresh are a number of VIDA users. BGR Logistics is also among the VIDA users announced in June 2021.

In this collaboration, VIDA provides food stall verification and authentication technology solutions for BGR Logistics food stalls. The company helps with the process /customer registration becomes much faster and easier. The process is that stalls that will register via the application will be asked to provide several identity data, including Cooperative Identification Number (NIK), full name, date of birth and other required data.

After that, VIDA technology will verify the identity of the stall business owner against Dukcapil data. The data verification process is carried out automatically online with a high level of security, so that the resulting data is accurate and safely protected.

"To date, VIDA has provided digital identity authentication and certified electronic signature services to the MSME sector to increase the security of electronic transactions. "This results in more efficient business processes and supports the digital transformation of MSMEs in Indonesia," he said.

To support trust and compliance with regulations, VIDA has equipped itself with a series of certifications that are recognized nationally and globally. For example, ISO 27001 (international standard for information security management); accredited by the Webtrust Certificate Authority (to ensure the implementation of appropriate procedures in implementing the use of public key infrastructure and cryptography).

Then, Cloud Signature Consortium Associate Member (a global network of electronic signature/TTE based service providers cloud); and the Adobe Approved Trust List (AATL) (a list of registered TTEs that can be validated through Adobe).

One of the functions of ISO 27001 certification is that the data and information obtained during the electronic signature issuance process are then managed by a secure information system in accordance with international standards. The entire contents of the document are protected using cryptography, and can only be accessed by users through VIDA identity verification, namely the process of validating a person's identity based on trusted data sources.

VIDA uses biometric verification in the form of facial recognition, to validate identity. From the results of this verification, VIDA issues an electronic certificate (in accordance with Kominfo Regulation No. 11/2018 concerning Electronic Certification Organizers). With all these advantages, secure electronic signatures are a guaranteed and legally binding solution, making them very suitable for use in various types of electronic transactions.

Pre-series A funding

To support its business expansion, VIDA has just announced Pre-Series A . funding with undisclosed value led by Jungle Ventures, Alpha JWC Ventures, and Monk's Hill Ventures. Through this funding, the company will expand its presence in various sectors of the digital economy, including fintech, banking, insurance, health care and others.

There are no plans to expand overseas, although as an organization, the VIDA team is spread across three countries, India, Singapore and Indonesia.

Misperception of digital signatures

Both adoption and penetration of digital signatures in Indonesia still have a steep road ahead. Industrially, the quantity of users continues to grow, but in terms of quality, there are many things that need to be improved because misperceptions still occur.

Continuous education is homework and is the responsibility of all stakeholders because there are still misperceptions about digital signatures.

According to Article 54 Paragraph 1 PP82/2012 which is a derivative regulation from Law no. 11 of 2008 Article 12 concerning electronic information and transactions, electronic signatures are divided into two types, namely certified Electronic Signatures and uncertified Electronic Signatures. The first type is called a digital signature.

In terminology, digital signatures and electronic signatures are often considered the same. However, in reality there are significant differences. Basically, electronic signatures are not much different from wet signatures, only the physical form is different. One is electronic and the other is ink on paper.

On the other hand, digital signatures have more complex and unique features that go beyond simply representing an individual, but ensure authentication, integrity and irrefutability. Therefore, digital signatures are more widely used because they have legal force.

Sati explained further that many people still misinterpret digital signatures as scanned wet signatures. In fact, this signature format has no legal force, is not verified by the user, and has no guarantee of the authenticity of the signed document, so it is not a safe solution as a form of approval for the substance of a document.

“Just as wet signatures can only be used on paper documents, electronic signatures are valid for signing electronic documents. Just as wet signatures are only used on electronic documents, electronic signatures are valid for signing electronic documents."

The education process must be carried out continuously. The company collaborates with many parties through webinar and coaching clinic. The aim is not only for public understanding aware just about digital signatures, as well as technological developments in terms of identity verification, data protection and cyber security.

Certified electronic hand

He continued, in this digital economy era, society and the business world should quickly adapt and pay attention to issues of security and privacy of digital information and identity, including the use of certified electronic signatures (TTE). This TTE meets the highest legal standards, as well as being a solution for signing documents in a more efficient, cheaper and safer way.

There are four reasons why this is so; 1) TTE guarantees that the content of the document has not been changed after sending. With TTE, users can encrypt documents using public and private keys that only the user can access; 2) has legal validity; 3) use encrypted electronic certificates as a basis for validating identity; 4) reduce the risk of manipulation/modification of signed documents.

In practice in the field, by utilizing TTE, the registration, identification and verification process of potential users of financial technology services can be carried out in a short time and cost-effectively. The reason is, digital verification carried out using safe and reliable technology is the first step in various business activities and transactions, such as opening a bank account, upgrade Akuna e-money, approval of electronic agreements (employment contracts, agreements non-disclosure), and others.

"Apart from not having to incur administration, storage or courier costs, the presence of digital signatures encourages disbursement of funds as quickly as possible," he concluded.

Sign up for our

newsletter

Premium

Premium