LinkAja Expands Financial Products, Now Presents Services from Pegadaian

Pegadaian is one of the shareholders in LinkAja

Government-owned electronic money and digital wallet service LinkAja inaugurated a partnership with Pegadaian to provide easy access to financial services for consumers in second- and third-tier cities. Both Pegadaian and LinkAja have a strong presence in these locations.

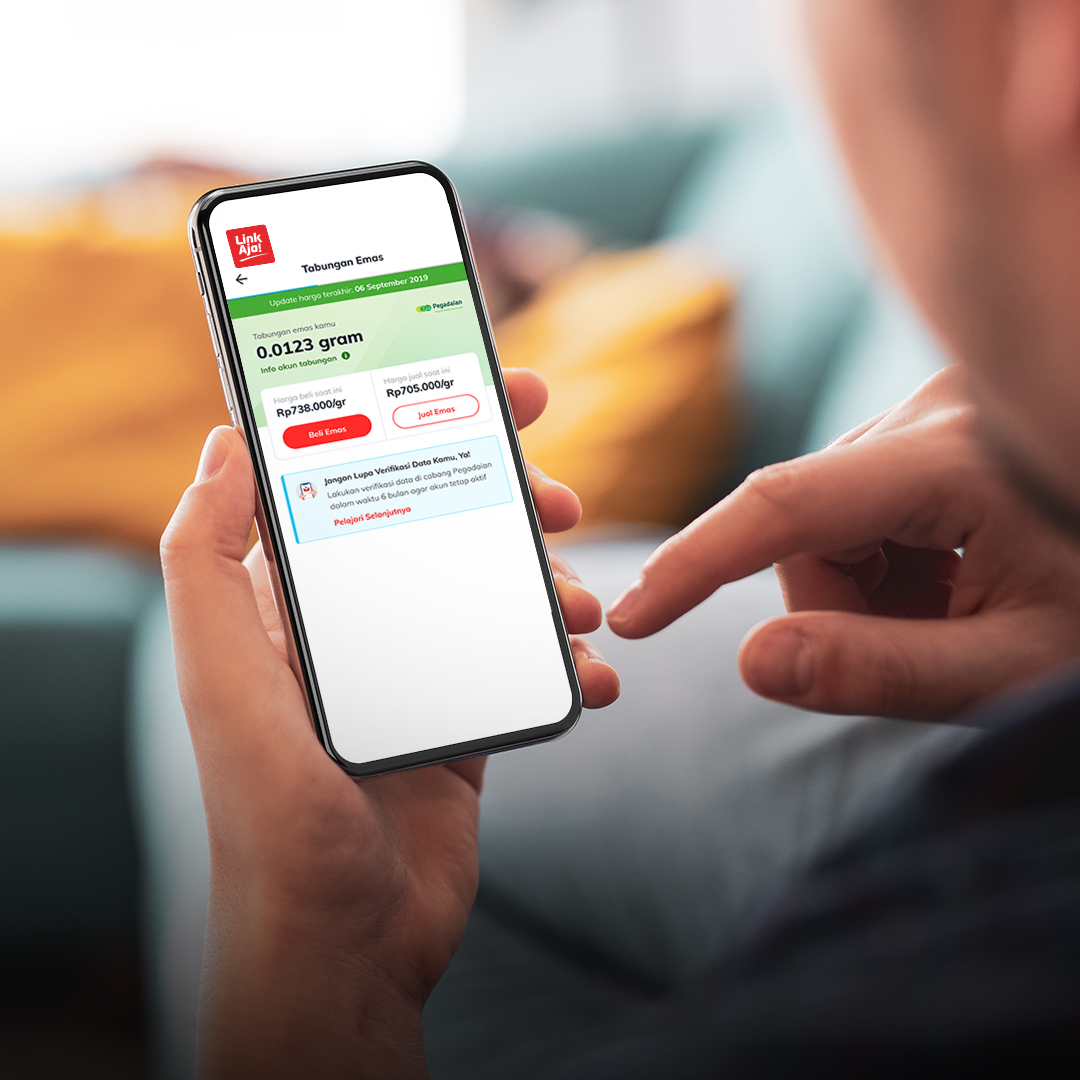

In the early stages, financial services from Pegadaian such as Gold Savings are present in LinkAja app for new opening and top up balances, Micro Installments such as motorized and multipurpose loans, Tabus Pawn, and Re-Pawning.

"We try to stay current and relevant to the needs of customers, whose applications trend is very large," said Director of IT and Digital Pegadaian Teguh Wahyono in a virtual press conference, Wednesday (24/2).

Expected attendance pawnshop service at LinkAja can boost digital transactions at Pegadaian. Teguh said last year this sector recorded more than 20 million digital transactions or grew more than 30%, contributed by the Digital Pegadaian application and Gold Savings service on various platform partners. E-commerce and e-wallet.

LinkAja's Marketing Director Edward Killian added, in building financial inclusion in tier two and three cities, you don't just need a payment solution like what LinkAja currently has, but you have to enter the next phase, which is introducing credible financial products.

Therefore, Pegadaian who is also a shareholder in LinkAja, continue to carry out business synergies so that more and more people have access to it.

Before being inaugurated to the public, he continued, it was claimed that the Pegadaian service was able to attract a positive response from LinkAja users. Edward, who is more often called Kiki, said that the installment payments amounted to billions of Rupiah, while the opening of savings accounts per week grew many times over.

“Gold savings with an initial deposit of IDR 10 and top up starting from IDR 5 from Pegadaian are relevant for the needs of users who come from the second and third tier middle class. They only need to use their LinkAja balance to make the transaction," said Kiki.

Expansion of financial products on LinkAja

Not only Pegadaian, LinkAja and its shareholders are also actively developing various financial product services in the application. One example is with Bank Mandiri providing the Online Account feature, enabling the opening of a new account, debit card activation, or Mandiri Online activation.

More Coverage:

In total, by the end of January 2021, LinkAja has had more than 65 million registered users, 70% of whom come from second- and third-tier cities. In addition, the application is used in more than 1 million merchant local and more than 349 thousand merchant nationwide, 233 modes of transportation, 674 traditional markets, more than 42 thousand digital donation partners, 5 thousand online marketplace.

Next, it provides payment for payments and purchases of daily necessities such as telecommunications credit, electricity tokens, household bills, BPJS contributions, to various other financial services such as purchasing mutual fund products, purchasing micro insurance products, transfers to all bank accounts and cash withdrawals without cards. .

In addition, LinkAja can also be used at more than one million transaction points for top-up and balance withdrawals, including ATMs, banking transfers, retail networks, to digital financial services.

Sign up for our

newsletter