Ayoconnect Finalizes Advanced Funding This Year

Continuation of Pre-Series B funding in mid-2020 led by BRI Ventures

Startups fintech API service provider Ayoconnect is finalizing further funding. Amount venture capital take part in it. some names angel investors famous also participated in this round.

According to the data we received, a impact investors and a state-owned CVC involved in this round of funding. In addition, some angel investors, including the former President's son, also participated. The person concerned is currently an advisor to the company.

Ayoconnect confirmed that this investment round is still in the finalization stage. It was stated that there had been no final decision regarding the involvement of these names and the amount of investment. The same thing was conveyed by one of the investors who was reportedly involved in the round.

Previous Pre-Series B funding announced in mid-2020, at the same time as rebranding company from Ayopop to Ayoconnect. BRI Ventures led the funding with the involvement of Kaku.com, Brama One Ventures, and previous investors, namely Finch Capital, Amand Ventures, Strive, and AC Ventures.

API based, product ecosystem open finance What Autoconnect provides is quite diverse. One of the most popular is the Digital Products API, enabling app developers to integrate payments into more than 3000 digital services (bill payment). Apart from that they provide APIs for various other needs, such as auto-billing, payment points, bulk-transaction, education payments, to property.

Not only managing transaction processes, Ayoconnect also offers an alternative credit scoring platform through the Insight feature.

Previously, Ayoconnect had also established partnerships specifically with Bank Mandiri (MCI parent) for the integration of Autobilling API services into Mandiri Power Bill. This solution allows Mandiri credit card users to automatically pay various bill transactions for more than 200 merchant of 8 product categories.

Penetrative thrust e-wallet

Services bill payments This is designed to make it easier for various types of applications to provide payment services such as PPOB or subscriptions, integration is included in e-commerce, fintech, to productivity applications for MSMEs. For business people, this is a pretty good channel to increase transaction turnover in applications and increase retention. Then for consumers, having the option to pay for basic needs (such as electricity, telephone etc.) on their favorite application will certainly make things easier.

High penetration e-wallet is allegedly a key factor in increasing adoption and use of services bill payments in the future. On the user experience side, payment methods with e-wallet is considered the easiest at the moment, especially when it is integrated directly into certain applications.

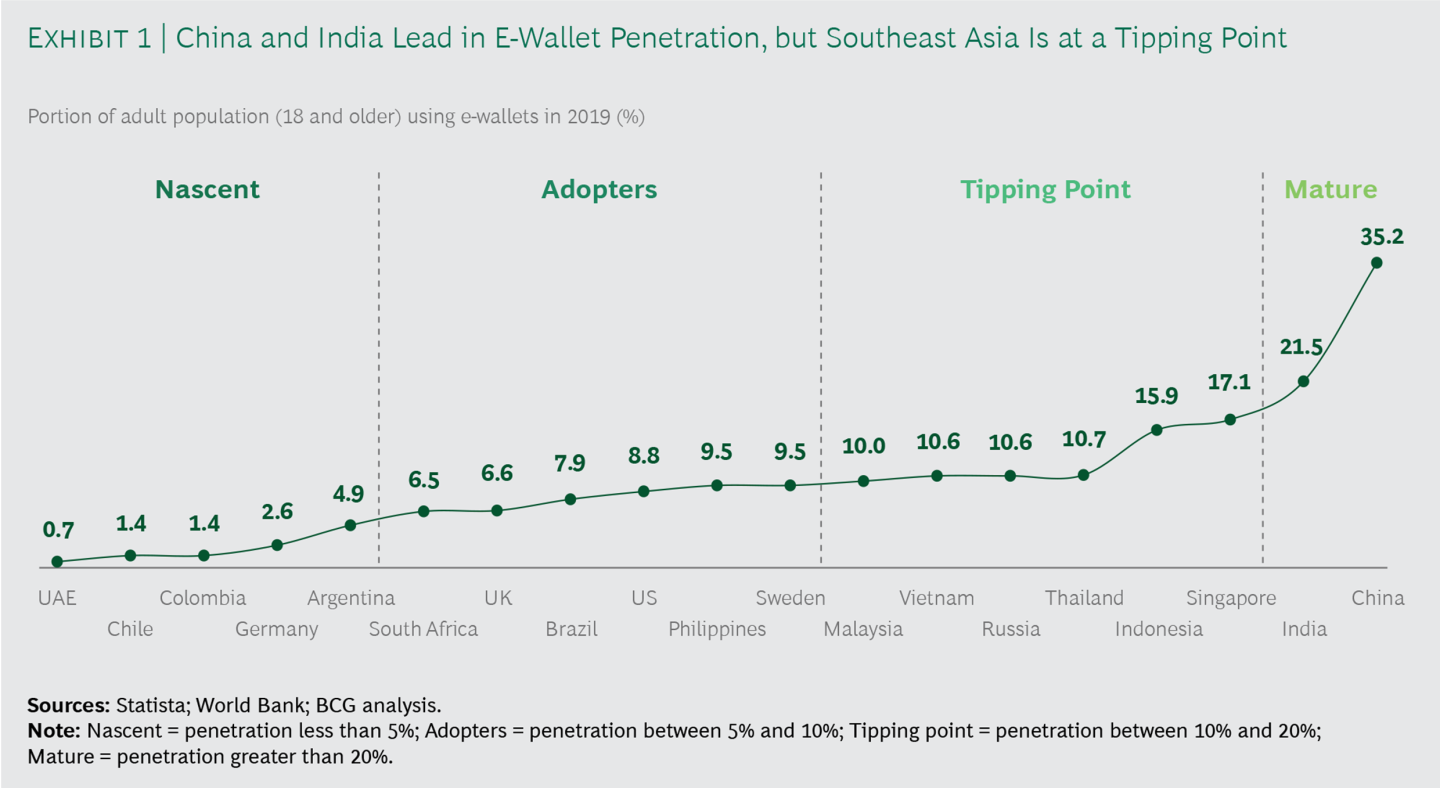

According to research results published by BCG in the middle of last year, penetration e-wallet in Indonesia itself has approached the level of maturity.

More Coverage:

Party Ayoconnect itself said that by December 2021 they are targeting growth of up to 10x compared to the previous year. Various efforts were made to increase traction, including by presenting bill payment aggregator. As of H1 2021, total transactions from their API network are claimed to have increased 600% from 80 integration partners.

Sign up for our

newsletter

Premium

Premium